Navigating the VA Native American Direct Loan (NADL): A Comprehensive Guide to Eligibility, Benefits, and Drawbacks

For many service members, the dream of homeownership is a cornerstone of their post-military life. The U.S. Department of Veterans Affairs (VA) home loan program has been instrumental in making this dream a reality for millions. However, for Native American veterans seeking to establish a home on tribal trust lands, unique challenges often arise. This is where the VA Native American Direct Loan (NADL) program steps in, offering a specialized pathway to homeownership that addresses these specific circumstances.

The NADL program is a direct loan from the VA (not a guarantee like other VA loans) designed to help eligible Native American veterans and their spouses purchase, construct, or improve homes on Native American trust lands. It’s a vital resource, acknowledging the distinct legal and financial frameworks that govern land on tribal reservations. This comprehensive review will delve into who qualifies for a VA NADL loan, explore its significant advantages and potential disadvantages, and offer a clear recommendation for those considering this unique opportunity.

Who Qualifies for a VA Native American Direct Loan (NADL)?

Qualifying for a VA NADL loan involves meeting a specific set of criteria that blend standard VA loan eligibility with conditions unique to tribal trust lands and Native American heritage. It’s a layered process designed to ensure the loan serves its intended purpose.

1. Veteran Eligibility:

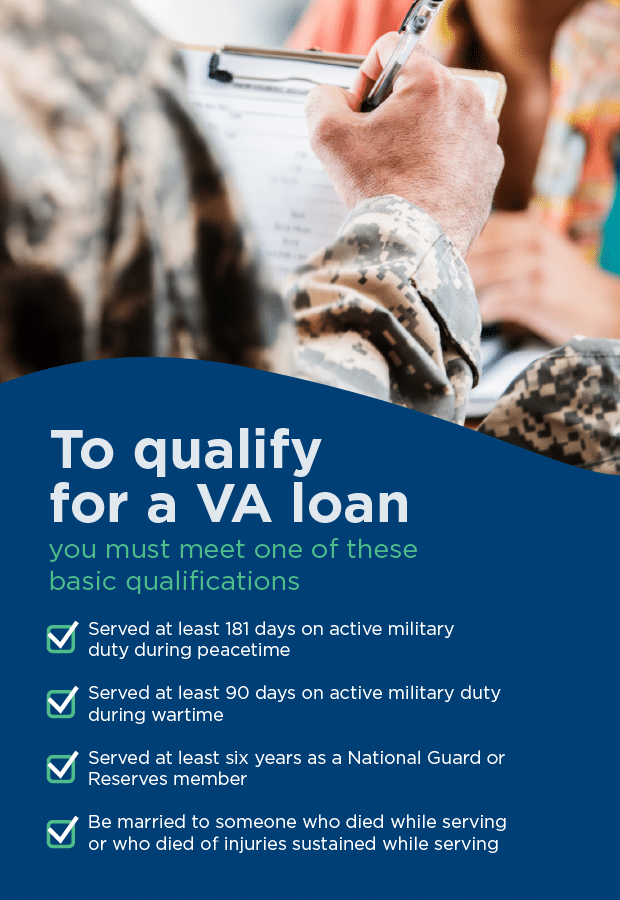

The foundational requirement is that the applicant must be an eligible veteran, or a qualifying spouse of an eligible veteran. This generally means meeting the service requirements for a VA home loan, which include:

- Service During Wartime Periods: Generally 90 continuous days of active service.

- Service During Peacetime Periods: Generally 181 continuous days of active service.

- Post-9/11 Service: Generally 90 continuous days of active service.

- Minimum of 6 Years in the National Guard or Reserves: For those who did not serve active duty.

- Honorable Discharge: All service must have been under honorable conditions.

A Certificate of Eligibility (COE) from the VA is required to confirm this eligibility. Spouses of deceased veterans (who died as a result of service or service-connected disabilities) or spouses of veterans who are permanently and totally disabled due to a service-connected disability may also qualify.

2. Native American Status:

This is the most distinctive requirement. The veteran (or the veteran’s spouse) must be Native American. Specifically, the VA defines this as:

- A member of a federally recognized Tribe. Proof of tribal enrollment or membership will be required.

- A Native Hawaiian. This includes individuals who are descendants of the aboriginal peoples who inhabited the Hawaiian Islands prior to 1778.

This criterion ensures the program directly benefits the community it was designed to serve.

3. Property Location on Native American Trust Land:

The NADL program is exclusively for homes on Native American trust land. This is a critical distinction from other VA loans, which are for homes on fee-simple (privately owned) land. Trust lands are parcels of land held in trust by the U.S. government for the benefit of Native American tribes or individual Native Americans. This unique land status means:

- Leasehold Interest: Rather than owning the land outright, the veteran will typically receive a leasehold interest in the property. The VA requires a valid and acceptable leasehold estate, generally for a term of 50 years (or more), that is recordable in the appropriate land records system.

- Tribal Participation: The Native American Tribe must have a Memorandum of Understanding (MOU) with the VA. This MOU outlines the Tribe’s agreement to participate in the NADL program and details the procedures for land leases, tribal approvals, and other relevant processes. If a Tribe does not have an MOU with the VA, a NADL loan cannot be granted for land within that Tribe’s jurisdiction.

4. Occupancy Requirement:

The veteran must intend to occupy the property as their primary residence. The NADL loan is not for investment properties or secondary homes.

5. Creditworthiness and Income:

While VA loans are known for being more flexible than conventional loans regarding credit scores, applicants still need to demonstrate a reasonable credit history and sufficient income to meet their mortgage obligations. The VA will assess the veteran’s debt-to-income ratio and residual income to ensure they can comfortably afford the loan payments and other housing-related expenses.

6. Loan Purpose:

NADL loans can be used for several purposes:

- Purchasing a Home: Buying an existing home on trust land.

- Constructing a Home: Building a new home on trust land.

- Making Improvements: Renovating or improving an existing home on trust land.

- Refinancing an Existing NADL Loan: To obtain a lower interest rate or change loan terms.

In summary, a qualifying NADL applicant is a service-eligible Native American veteran (or their qualifying spouse) with good credit and sufficient income, seeking to purchase, build, or improve a primary residence on tribal trust land where their tribe has an active MOU with the VA.

Advantages of the VA Native American Direct Loan (NADL)

The NADL program offers a host of significant benefits tailored to the unique circumstances of homeownership on tribal lands, making it an incredibly valuable resource for eligible veterans.

1. No Down Payment Requirement: Like most VA loans, the NADL program typically requires no down payment. This is a massive advantage, especially for first-time homebuyers or those with limited savings, as it removes one of the largest financial barriers to homeownership.

2. No Private Mortgage Insurance (PMI): Unlike conventional loans with less than 20% down, NADL loans do not require private mortgage insurance (PMI). This translates to substantial monthly savings over the life of the loan, as PMI can add hundreds of dollars to a mortgage payment.

3. Competitive Interest Rates: NADL loans often come with highly competitive interest rates, typically lower than conventional loans. As a direct lender, the VA aims to provide affordable financing to veterans, ensuring they receive favorable terms.

4. Limited Closing Costs: The VA limits the types and amounts of closing costs that lenders can charge. While there is a VA funding fee (which can be financed into the loan), certain veterans, such as those with service-connected disabilities, are exempt from paying this fee.

5. Flexible Credit Requirements: While a reasonable credit history is necessary, VA loans, including NADL, are generally more forgiving than conventional mortgages when it comes to credit scores. This flexibility can open doors to homeownership for veterans who might not qualify for other loan types.

6. Exclusive Access to Homeownership on Trust Land: This is arguably the most significant advantage. The NADL program is specifically designed to facilitate homeownership on Native American trust lands, where conventional mortgage financing can be exceedingly difficult or impossible to obtain due to the unique legal status of the land (leasehold vs. fee-simple). It provides a crucial pathway for veterans to build or buy homes within their tribal communities.

7. Direct Loan from the VA: Unlike the VA’s guarantee program, the NADL is a direct loan. This means the VA is the lender, which can sometimes streamline the process and offer a more direct point of contact for assistance and guidance.

8. Opportunity for Construction and Improvements: The loan can be used not just for purchasing existing homes but also for new construction and significant home improvements, allowing veterans to build a home tailored to their needs or enhance an existing property.

9. VA Support and Oversight: As a direct VA program, borrowers benefit from the VA’s oversight and support. Should issues arise, veterans have a clear path to seek assistance from the VA, which is committed to helping them maintain their homes.

Disadvantages of the VA Native American Direct Loan (NADL)

While the NADL program offers unique and invaluable benefits, it also comes with specific limitations and potential drawbacks that applicants should carefully consider.

1. Limited to Native American Trust Land: The most significant restriction is that the loan can only be used for properties on Native American trust land. This means it is not an option for Native American veterans wishing to purchase a home off-reservation or on privately owned land within tribal boundaries. This geographical limitation significantly narrows its applicability.

2. Tribal Participation (MOU) Requirement: A NADL loan is only possible if the veteran’s tribe has an active Memorandum of Understanding (MOU) with the VA. If a tribe has not established this agreement, or if the agreement lapses, veterans within that tribe’s jurisdiction cannot access the NADL program. Establishing and maintaining these MOUs can be a complex and sometimes lengthy process, depending on tribal governance and resources.

3. Leasehold Interest vs. Fee-Simple Ownership: When purchasing a home on trust land, the veteran typically acquires a leasehold interest in the land, rather than outright fee-simple ownership. While this leasehold can be for an extended period (e.g., 50 years), it’s not the same as owning the land outright. This can introduce complexities regarding property rights, future resale, and potential restrictions imposed by the lease or tribal law.

4. Potentially Slower and More Complex Process: The unique nature of trust land and tribal governance can add layers of complexity and time to the loan process. Obtaining tribal approvals, navigating land leases, and coordinating between the VA and tribal authorities can make the NADL application and closing process longer than a conventional VA home loan.

5. Limited Lender Availability: Because the NADL is a direct loan from the VA, applicants work directly with the VA, not through private lenders. While this can be an advantage in some respects, it means veterans cannot shop around for different lenders or take advantage of specific lender promotions that might be available for other VA-guaranteed loans.

6. Property Valuation and Construction Challenges: Valuing properties on trust land can be more challenging due to fewer comparable sales and unique land tenure systems. For new construction, navigating tribal building codes, infrastructure development, and securing qualified contractors familiar with building on trust land can present additional hurdles.

7. VA Funding Fee (Unless Exempt): While there’s no PMI, the NADL does carry a VA funding fee, which helps offset the cost of the program. This fee, typically a percentage of the loan amount, can be financed into the loan, but it still adds to the total cost unless the veteran is exempt (e.g., due to a service-connected disability).

8. Potential for Tribal Laws to Impact Homeownership: While the VA strives for consistency, tribal laws and regulations can sometimes add additional layers of requirements or restrictions on homeownership, improvements, or property transfer on trust lands, which applicants must understand and adhere to.

Recommendation: Is the VA Native American Direct Loan Right for You?

The VA Native American Direct Loan is a highly specialized and incredibly valuable program, but it’s not for every veteran. The decision to pursue an NADL should be based on a clear understanding of its unique benefits and limitations, and a careful assessment of one’s personal circumstances and goals.

Who the NADL is Highly Recommended For:

- Native American Veterans Seeking to Live on Tribal Trust Land: If your dream is to establish a home, build new, or significantly improve an existing property on your tribal trust land, the NADL is likely your best, and often only, viable path to affordable homeownership. It directly addresses the unique challenges of financing on these lands.

- Veterans Whose Tribe Has an Active MOU with the VA: If your tribe is an active participant in the NADL program, and you meet the veteran and Native American eligibility criteria, this loan offers unparalleled advantages like no down payment, no PMI, and competitive rates.

- Those Seeking a Direct, Supportive Loan Program: As a direct loan from the VA, applicants can benefit from the VA’s direct support and commitment to veteran homeownership, potentially offering a more guided process.

Who Should Consider Alternatives or Proceed with Caution:

- Native American Veterans Seeking Off-Reservation or Fee-Simple Land: If you wish to purchase a home off tribal trust land, or on fee-simple land within tribal boundaries, the NADL is not the appropriate loan. You would instead pursue a standard VA-guaranteed loan or other conventional financing options.

- Veterans Whose Tribe Does Not Have an MOU with the VA: Unfortunately, if your tribe does not participate in the NADL program, this loan is not an option for you, even if you meet all other eligibility criteria. You would need to explore other financing avenues or work with your tribe to potentially establish an MOU.

- Those Prioritizing Absolute Simplicity and Speed: While the VA strives for efficiency, the inherent complexities of tribal land tenure and the need for tribal coordination can sometimes make the NADL process longer and more intricate than a standard VA loan.

Steps for Consideration:

- Confirm Veteran Eligibility: Obtain your Certificate of Eligibility (COE) from the VA.

- Verify Native American Status: Ensure you meet the VA’s definition of Native American and have proof of tribal enrollment.

- Check Tribal Participation: Contact your tribal housing authority or the VA to confirm if your tribe has an active Memorandum of Understanding (MOU) with the VA for the NADL program. This is a crucial step.

- Understand Land Lease Terms: Familiarize yourself with the specifics of obtaining a leasehold interest on your tribal land and any associated tribal laws or regulations.

- Assess Your Financial Readiness: Review your credit history and income to ensure you meet the VA’s creditworthiness requirements.

- Contact the VA Directly: Once you’ve completed the preliminary checks, reach out to the VA’s NADL program office. They can provide detailed guidance, answer specific questions, and help you navigate the application process.

In conclusion, the VA Native American Direct Loan is a powerful, purpose-built tool designed to empower Native American veterans to achieve homeownership on their ancestral lands. While it comes with specific requirements and unique considerations, its benefits—particularly the absence of a down payment and PMI, competitive rates, and the ability to finance homes on trust land—make it an indispensable resource for those who qualify. For eligible veterans whose dream home lies within their tribal community, the NADL program offers a bridge to that future, providing a tangible return on their service and a foundation for generations to come.