Unlocking Homeownership: A Deep Dive into the 2024 VA Native American Direct Loan (NADL) Maximums, Benefits, and Considerations

For many veterans, the dream of homeownership is a cornerstone of their post-service life. The Department of Veterans Affairs (VA) offers a suite of home loan programs designed to make this dream a reality, providing significant advantages over conventional mortgages. Among these, the VA Native American Direct Loan (NADL) program stands out as a unique and invaluable resource specifically tailored for eligible Native American veterans seeking to purchase, construct, or improve homes on Federal Trust Land.

Unlike the more widely known VA home loan guarantee program, the NADL is a direct loan from the VA, meaning the VA itself acts as the lender. This distinction brings both unique benefits and specific considerations. As we step into 2024, understanding the maximum loan amounts, the comprehensive advantages, and the potential drawbacks of the NADL is crucial for any eligible veteran contemplating this path to homeownership. This article will delve into these aspects, offering a detailed review and a "purchase recommendation" for utilizing this powerful program.

Understanding the VA Native American Direct Loan (NADL) Program

Before discussing loan limits, it’s essential to grasp the core purpose and structure of the NADL program. Established to address the specific challenges faced by Native American veterans living on or desiring to live on tribal lands, the NADL program aims to provide access to safe and affordable housing where conventional financing options are often scarce or non-existent due to the unique nature of land ownership on reservations.

Key Features of the NADL:

- Target Audience: Native American veterans, or non-Native American veterans married to a Native American.

- Location: The property must be located on Federal Trust Land (tribal lands).

- Purpose: Loans can be used to:

- Purchase a home.

- Construct a home.

- Make improvements to an existing home.

- Refinance an existing NADL to lower the interest rate.

- Direct Loan: The VA is the lender, offering distinct advantages in terms of interest rates and terms.

The Maximum Loan Amount for a VA NADL in 2024

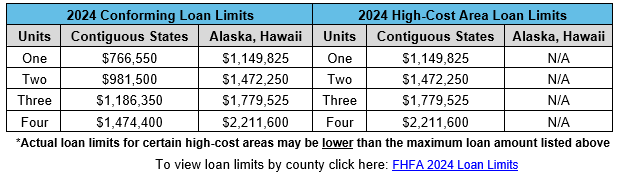

One of the most common questions regarding any home loan program concerns its maximum loan amount. For the VA NADL in 2024, the answer is somewhat nuanced compared to conventional loans with fixed caps. The VA NADL does not have a set, standalone maximum loan amount determined solely by the VA for all properties. Instead, the maximum amount for which a veteran can purchase a home with no down payment under the NADL program is tied directly to the county conforming loan limits established by the Federal Housing Finance Agency (FHFA) for Fannie Mae and Freddie Mac.

These conforming loan limits vary by county and are updated annually. For most of the United States in 2024, the baseline conforming loan limit for a single-unit property is $766,550. However, in designated "high-cost areas" (e.g., certain counties in California, New York, Hawaii, etc.), these limits can be significantly higher, potentially exceeding $1,149,825 for a single-unit property.

How this works for NADL:

- No Down Payment up to Conforming Limit: If the purchase price of the home on Federal Trust Land falls within the county’s conforming loan limit, an eligible veteran can typically finance 100% of the loan amount, requiring no down payment.

- Loans Above Conforming Limit: If a veteran wishes to purchase a home that exceeds their county’s conforming loan limit, they can still utilize the NADL program. However, they will be required to make a down payment for the amount that exceeds the conforming loan limit. The VA will guarantee a portion of the loan (typically 25% of the conforming limit), and the veteran pays the difference.

Example:

Let’s say a veteran is looking to purchase a home on tribal land in a county with a 2024 conforming loan limit of $766,550.

- If the home costs $700,000, the NADL can cover 100% of this, requiring no down payment.

- If the home costs $800,000, which is $33,450 above the conforming limit, the veteran would generally need to make a down payment of at least $33,450.

It’s crucial for veterans to check the specific conforming loan limits for the county where the tribal land is located. This information is publicly available on the FHFA website or can be obtained directly from the VA. The flexibility to go above the conforming limit (with a down payment) provides significant purchasing power, especially in areas where housing costs are high, while still leveraging the unique benefits of a VA loan.

Advantages (Pros) of the VA NADL Program

The NADL program offers a compelling suite of benefits that make it an exceptionally attractive option for its target demographic:

- No Down Payment (Up to Conforming Limits): This is perhaps the most significant advantage. For eligible veterans, the ability to purchase or build a home without needing to save for a substantial down payment removes a major barrier to homeownership.

- Competitive, Low-Interest Rates: As a direct loan from the VA, NADL interest rates are often lower than those offered by conventional lenders. The VA sets the interest rate, which is typically fixed for the life of the loan, providing stability and predictable monthly payments.

- No Private Mortgage Insurance (PMI): Unlike conventional loans with less than a 20% down payment, VA loans (including NADL) do not require private mortgage insurance. This saves veterans hundreds of dollars each month, significantly reducing their overall housing costs.

- Lower Closing Costs: The VA limits the fees that lenders can charge, which often translates to lower closing costs for the veteran. Some fees, like attorney fees or document preparation fees, can be covered by the seller.

- No Prepayment Penalties: Veterans have the freedom to pay off their loan early without incurring any penalties, offering financial flexibility.

- Financial Counseling and Support: The VA provides comprehensive financial counseling and support throughout the loan process, helping veterans understand their options and manage their finances effectively.

- Focus on Tribal Land Homeownership: The program is specifically designed to overcome the unique legal and financial challenges associated with homeownership on Federal Trust Land, where land is often held in trust by the federal government for the benefit of Native American tribes or individuals. This tailored approach is invaluable.

- Assumable Loans: VA loans are assumable, meaning a qualified buyer (who doesn’t necessarily have to be a veteran) can take over the existing mortgage, potentially making the home more attractive to future buyers if interest rates rise.

Disadvantages (Cons) of the VA NADL Program

While the NADL offers powerful benefits, it also comes with specific limitations and potential challenges that eligible veterans should be aware of:

- Limited Eligibility: The most significant drawback is its narrow eligibility criteria. It is exclusively for Native American veterans (or non-Native American veterans married to a Native American) and only for properties on Federal Trust Land. This excludes a vast majority of veterans.

- Geographic Restrictions (Federal Trust Land Only): The program is strictly limited to properties located on Federal Trust Land. This means veterans cannot use the NADL to purchase a home in a conventional subdivision or off-reservation.

- Complex Tribal Approval Process: Acquiring a NADL often involves navigating a dual approval process: the VA’s requirements and the specific requirements of the tribal government. This can include obtaining a Leasehold Interest on the land (as the land itself is typically not owned outright by the individual), which can be a lengthy and intricate process with varying rules across different tribes. This complexity can add significant time to the loan process.

- Property Requirements and Appraisals: Like all VA loans, properties financed through NADL must meet VA minimum property requirements (MPRs). Appraisals on tribal lands can sometimes be challenging due to unique construction styles, limited comparable sales data, and the need to value a leasehold interest rather than fee simple ownership.

- VA Funding Fee: Most veterans using the NADL will need to pay a VA funding fee, which is a percentage of the loan amount. This fee helps offset the cost of the program to taxpayers. However, veterans receiving VA disability compensation are exempt from this fee, as are Purple Heart recipients.

- Bureaucracy and Timelines: As a direct loan from a government agency, the process can sometimes be slower than working with a private lender, requiring patience and meticulous attention to detail from the veteran.

- Limited Lender Choice: Since the VA is the direct lender, veterans don’t have the option to shop around among multiple private lenders for the best rates and terms, as they would with a VA-guaranteed loan. While VA rates are generally competitive, there’s no room for negotiation.

- Loan Amount Tied to Conforming Limits: While the ability to go above the conforming limit with a down payment offers flexibility, the primary "no down payment" benefit is still capped by these limits. For very high-cost properties on tribal lands, a significant down payment might still be required.

Recommendation: Is the VA NADL the Right Choice for You?

The VA Native American Direct Loan program is not a universally applicable home loan, but for its specific target demographic, it is an unequivocally strong recommendation.

You should strongly consider the VA NADL if:

- You are an eligible Native American veteran (or a non-Native American veteran married to one).

- You intend to purchase, build, or improve a home on Federal Trust Land. This is the program’s core purpose and where its unique benefits truly shine.

- You prioritize a low-cost, no-down-payment option. The financial savings from zero down payment, no PMI, and competitive interest rates are substantial.

- You are comfortable navigating the tribal land lease and approval processes. While potentially complex, the benefits often outweigh the effort for those committed to living on tribal lands.

- You seek a stable, government-backed loan with veteran-centric support. The VA’s direct involvement offers a level of security and guidance not always found with private lenders.

- You value the cultural and community connection that comes with living on tribal lands, and the NADL helps facilitate this.

You might need to look for alternative options if:

- You do not meet the strict eligibility criteria (i.e., not a Native American veteran or not purchasing on Federal Trust Land). In this case, other VA loan programs or conventional loans would be more appropriate.

- You require an extremely fast closing process and are unwilling or unable to navigate potential delays from tribal approvals or VA bureaucracy.

- You wish to purchase a home significantly above the county conforming loan limits without making any down payment, as the NADL will require a down payment for the difference.

Conclusion

The 2024 VA Native American Direct Loan program remains an exceptional and vital resource for eligible Native American veterans. Its structure, which ties maximum no-down-payment limits to county conforming loan limits (with the flexibility to go higher with a down payment), offers significant purchasing power. The array of benefits—including no down payment, low interest rates, and no PMI—makes homeownership remarkably accessible.

However, its highly specific eligibility, geographic restrictions, and the inherent complexities of tribal land tenure and approval processes mean it’s not a program for everyone. For those it serves, the NADL is more than just a loan; it’s a bridge to stable housing, community connection, and the fulfillment of the American dream on ancestral lands.

Any eligible veteran considering the NADL should begin by contacting the VA directly and engaging with their specific tribal housing authority. Thorough research and proactive communication will be key to successfully navigating this powerful and purpose-driven path to homeownership.