Navigating Opportunity: A Comprehensive Review of USDA Rural Development Income Limits in Tribal Areas

In the pursuit of equitable development and sustainable communities, the United States Department of Agriculture (USDA) Rural Development programs stand as critical lifelines for many underserved populations. Among these, residents of tribal lands often face unique socio-economic challenges that underscore the importance of targeted assistance. This comprehensive review examines the "product" of USDA Rural Development income limits as they apply specifically to tribal areas, dissecting its features, evaluating its performance through a lens of advantages and disadvantages, and ultimately offering a recommendation for its utility.

Introduction: The Imperative of Rural Development in Tribal Communities

Tribal lands across the United States are vibrant communities, rich in culture and heritage, yet many contend with persistent issues of poverty, inadequate housing, and limited access to essential services. Historical disenfranchisement, remote locations, and complex land tenure systems often compound these challenges, making traditional financial pathways difficult to navigate. USDA Rural Development programs, designed to improve the economy and quality of life in rural America, offer a vital framework for addressing these disparities.

At the heart of eligibility for many of these programs are income limits – a crucial component that dictates who can access critical housing, community development, and business assistance. For tribal communities, understanding these limits, and the specific nuances of their application, is not just a bureaucratic exercise; it is the gateway to self-determination, improved living conditions, and economic revitalization. This review aims to demystify these income limits, presenting them as a "product" whose design and implementation significantly impact the lives of Native American families and the future of their sovereign nations.

The "Product" Under Review: USDA Rural Development Income Limits

The USDA Rural Development (RD) offers a suite of programs, broadly categorized into Housing, Community Facilities, and Business & Cooperative Services. While each program has its specific criteria, income limits are a foundational element for many, particularly those aimed at individual or family assistance.

Key Programs Where Income Limits Are Paramount:

- Single Family Housing Direct Loans (Section 502 Direct): This program provides low-interest loans to low and very low-income individuals and families to buy, build, or repair homes in rural areas. It’s often the program of last resort for those who cannot get conventional financing.

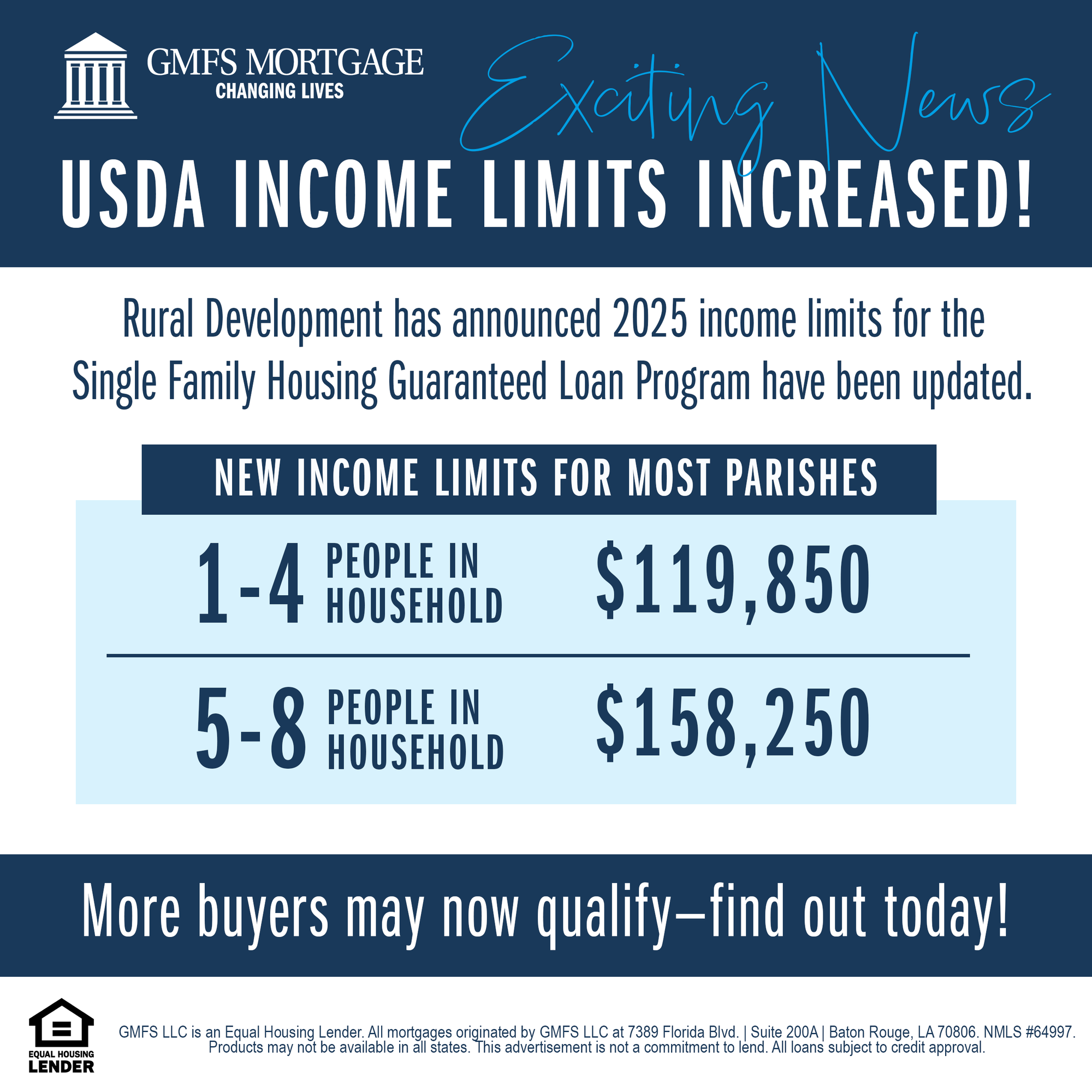

- Single Family Housing Guaranteed Loans (Section 502 Guaranteed): This program allows approved lenders to offer 100% financing to moderate-income borrowers, with the USDA guaranteeing a portion of the loan.

- Home Repair Loans and Grants (Section 504): Offers loans to very low-income homeowners to repair, improve, or modernize their homes, or grants to elderly very low-income homeowners to remove health and safety hazards.

- Multi-Family Housing Programs: While primarily for developers, the tenants in these properties must often meet specific income limits to qualify for reduced rents.

Understanding the Income Limit Calculation:

The "product" of income limits itself is not a static number but a dynamic calculation based on several factors:

- Median Household Income (MHI): The primary determinant is the adjusted median household income for the county or metropolitan statistical area (MSA) in which the property is located.

- Income Categories: USDA RD typically categorizes income into:

- Very Low Income (VLI): Generally, 50% of the area’s MHI.

- Low Income (LI): Generally, 80% of the area’s MHI.

- Moderate Income: For the Guaranteed Loan program, this can go up to 115% of the area’s MHI.

- Family Size Adjustments: Crucially, these limits are adjusted upwards for larger families. A family of four will have a higher income limit than a single individual. This ensures that the limits accurately reflect the financial needs of households with more dependents.

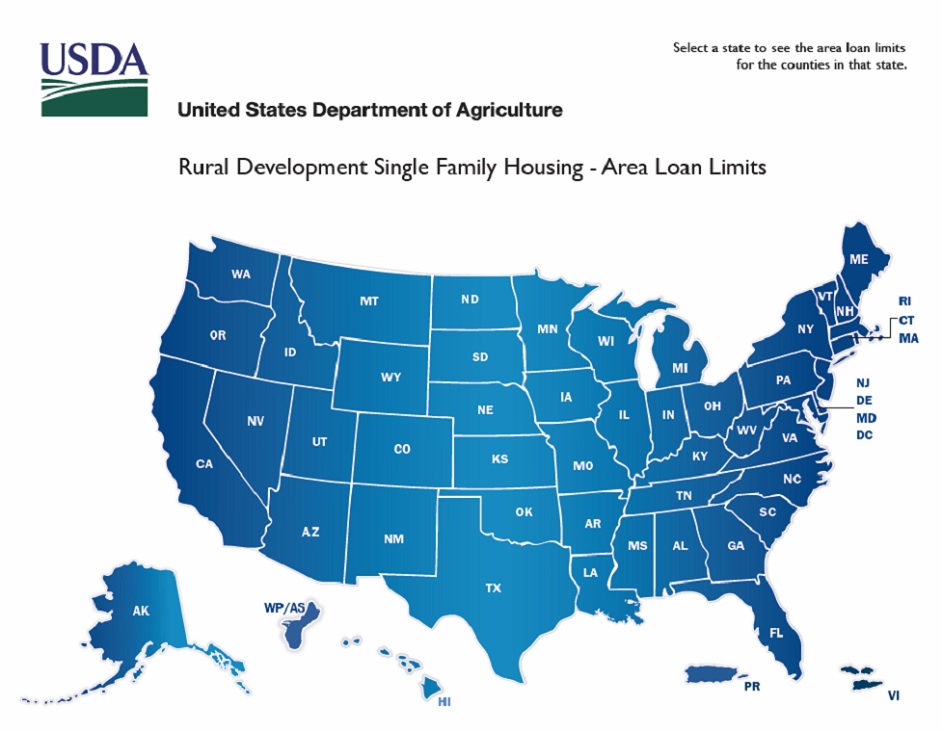

- Geographic Variation: Income limits vary significantly from one location to another, reflecting the cost of living in different regions. What qualifies as "low income" in a high-cost area like a coastal California county will be vastly different from a rural county in Oklahoma.

The Tribal Area Nuance:

For tribal lands, the application of these income limits carries specific considerations:

- Designated Rural Areas: Almost all tribal lands and reservations are automatically considered "rural" by USDA RD, thus qualifying for the programs.

- Data Challenges: While the principle of using MHI applies, accurately determining the MHI for a reservation can be complex. Reservations may span multiple counties, or be in very remote areas where standard census data might not fully capture the economic realities. USDA RD often uses the non-metropolitan MHI for the state or a specific MHI calculation for the tribal area if it results in higher, more favorable limits for residents.

- Eligibility Website: The USDA RD eligibility website (eligibility.sc.egov.usda.gov) is the definitive source. Users can input a specific address (or a nearby address on the reservation) to determine the income limits for the various programs in that precise location. This "tool" is an integral part of the "product" being reviewed.

Advantages (Pros) of USDA RD Income Limits in Tribal Areas:

- Targeted Assistance: The primary advantage is that these limits ensure resources are directed precisely to those who need them most – low and very low-income individuals and families within tribal communities. This prevents the "product" from being diluted by those who could access conventional financing.

- Flexibility for Larger Families: The adjustment for family size is a significant benefit, especially in many tribal communities where multi-generational households are common. This feature acknowledges the increased financial burden of larger families, allowing more of them to qualify.

- Gateway to Homeownership: For many tribal members, the 0% down payment and low-interest rates offered by the Section 502 Direct Loan, made possible by meeting the income limits, represent the only viable path to homeownership. This fosters wealth building and stability.

- Support for Economic Development: By providing housing, the income limits indirectly support local economies. Housing stability allows individuals to pursue employment, and construction activity generates jobs and stimulates local businesses.

- Adaptability to Local Economies: While challenging, the reliance on local MHI means the income limits are theoretically responsive to the specific economic conditions of a given region, including tribal lands. This prevents a one-size-fits-all approach that might be unsuitable.

- Addressing Historical Disparities: By intentionally lowering financial barriers, these programs, through their income limits, act as a tool to address historical inequities and provide opportunities for communities that have been systematically underserved.

Disadvantages (Cons) of USDA RD Income Limits in Tribal Areas:

- The "Income Cliff" Effect: One of the most significant drawbacks is the "income cliff." A family earning just a few dollars above the maximum limit can be entirely disqualified, even if they are still struggling financially. This can lead to frustration and a sense of unfairness, as the difference between qualifying and not qualifying can be arbitrary.

- Complexity and Awareness: Navigating the USDA RD programs and understanding the specific income limits can be complex for individuals, especially in communities with limited access to financial literacy resources. A lack of awareness about the existence and nuances of these limits often means eligible families miss out.

- Dynamic Nature and Uncertainty: Because income limits are based on MHI, they can change annually. While this reflects economic shifts, it can create uncertainty for applicants and program administrators, requiring constant verification.

- Underestimation of "Rural" Cost of Living: While tribal lands are rural, the cost of building or renovating homes in remote areas can be surprisingly high due to transportation costs for materials and limited skilled labor. The MHI-based limits, while adjusted, might not always fully capture these specific "rural premium" costs, making it difficult for some to afford even an RD-funded home.

- Data Inconsistencies for Tribal Lands: As mentioned, accurate MHI data for specific tribal lands can be challenging to obtain or might not fully represent the unique economic dynamics. This could lead to limits that are either too restrictive or, in rare cases, not low enough to capture the most vulnerable.

- Interaction with Land Tenure Issues: While not directly an "income limit" issue, the complexity of land ownership on reservations (trust land, allotted land, fee simple) can make securing loans challenging, even if income limits are met. Lenders (even USDA RD) prefer easily collateralized property, and the unique legal status of trust land requires specific agreements (e.g., Leasehold Mortgages, Tribal Resolution of Consent) that add layers of bureaucracy and can deter applicants. This significantly impacts the "usability" of the income limits product.

- Application Burden and Processing Time: Meeting the income limits is just one hurdle. The application process itself can be lengthy and require extensive documentation, which can be a significant barrier for applicants with limited time, resources, or digital access.

Recommendation: The Verdict on USDA RD Income Limits for Tribal Areas

As a "product," the USDA Rural Development income limits for tribal areas are highly recommended, but with crucial caveats regarding implementation and user experience.

For Whom Is This Product Recommended?

- Low and Very Low-Income Tribal Members: This product is indispensable for individuals and families on tribal lands who struggle to find affordable, safe, and adequate housing through conventional means.

- Tribal Housing Authorities and Governments: For these entities, understanding and leveraging these income limits is critical for developing and managing housing programs that benefit their communities.

- Non-Profit Organizations and Community Developers: Groups working to improve housing and infrastructure in tribal areas should consider these income limits a foundational tool for project planning and funding applications.

Why the Strong Recommendation (with caveats)?

The core value proposition of these income limits is their ability to precisely target and deliver life-changing housing and development assistance to communities that need it most. Without these established criteria, the efficacy of USDA RD’s mission would be severely compromised. They embody an intentional effort to level the playing field and address systemic disadvantages.

However, the "user experience" of this "product" is far from seamless. The complexities surrounding awareness, application, and the persistent challenges of land tenure on reservations significantly dilute its immediate impact.

Recommendations for "Purchase" and Improved "User Experience":

- Proactive Outreach and Education: USDA RD, in partnership with tribal governments and housing authorities, must intensify efforts to educate tribal members about program availability and the nuances of income limits. Simplified guides, workshops, and culturally sensitive outreach are essential.

- Capacity Building: Invest in training for tribal housing authorities and community development staff to navigate the application process, understand the specific income calculations for their areas, and assist their members.

- Streamlined Application Processes: While income verification is necessary, exploring ways to simplify documentation requirements and accelerate processing times would significantly improve accessibility.

- Addressing Land Tenure Systematically: USDA RD, in collaboration with the Bureau of Indian Affairs (BIA) and tribal nations, needs to continue developing innovative solutions and standardized agreements for securing financing on trust lands. This is perhaps the single biggest hurdle that affects the utility of meeting income limits.

- Flexible Interpretation and Advocacy: While rules are rules, there may be instances where a slightly more flexible interpretation of MHI data for highly remote or unique tribal economies could ensure the spirit of the law is upheld, not just the letter.

- Increased Funding: Ultimately, even with perfect eligibility, programs are limited by funding. Continued advocacy for robust appropriations for USDA RD programs, especially those benefiting tribal communities, is crucial.

Conclusion: A Path Forward for Self-Sufficiency

The USDA Rural Development income limits, when applied to tribal areas, represent a powerful, albeit imperfect, mechanism for fostering self-sufficiency and improving the quality of life. While the "product" itself – the calculated income thresholds – is sound in its intent to target need, its full potential is often hampered by systemic challenges inherent in serving sovereign nations with unique historical contexts.

For tribal communities, understanding these limits is the first step toward unlocking vital resources. For USDA RD, continuous refinement of the "product’s" delivery, coupled with robust partnerships and a deep appreciation for tribal sovereignty, will ensure that these programs truly serve as engines of opportunity and progress, building stronger, healthier, and more resilient Native American communities for generations to come.