The VA Native American Direct Loan (NADL) Maximum: A Comprehensive Review for Native American Veterans

Homeownership is a cornerstone of the American Dream, offering stability, a sense of belonging, and an opportunity to build generational wealth. However, for many Native American Veterans, achieving this dream on trust lands presents a unique set of challenges that conventional mortgage markets are ill-equipped to address. Enter the VA Native American Direct Loan (NADL) program – a vital resource designed to bridge this gap. This comprehensive review will delve into the intricacies of the VA NADL program, with a particular focus on its maximum loan amount, evaluating its strengths and weaknesses, and ultimately providing a recommendation on its efficacy as a financial tool.

Introduction: Bridging the Gap for Native American Veterans

The Department of Veterans Affairs (VA) established the Native American Direct Loan (NADL) program to help eligible Native American Veterans finance the purchase, construction, or improvement of homes on Federal Trust Land, or to refinance existing NADL loans. Unlike traditional VA loans, which are guaranteed by the VA but issued by private lenders, NADLs are direct loans made by the VA itself. This distinction is crucial, as it allows the VA to tailor the program to the unique legal and financial complexities of trust lands, where traditional collateral requirements and title issues often deter conventional lenders.

The core promise of the NADL program is to provide Native American Veterans with access to safe, affordable, and sustainable homeownership. A critical aspect of any loan program is its maximum lending capacity. Is the VA NADL maximum amount sufficient to meet the contemporary housing needs of Native American Veterans, or does it fall short in an era of rising construction costs and property values? This review aims to answer this question by examining how the maximum is determined, its practical implications, and the overall value proposition of the NADL program.

Understanding the VA NADL Program: Context is Key

Before dissecting the maximum loan amount, it’s essential to grasp the fundamental mechanics and purpose of the NADL program.

Eligibility: To qualify for a NADL, a Veteran must:

- Be a Native American (Native American, Alaska Native, or Pacific Islander).

- Be an eligible Veteran with VA home loan entitlement.

- Be creditworthy.

- Have a valid Certificate of Eligibility (COE).

- Occupy the home as their primary residence.

- Build or purchase a home on Federal Trust Land.

- Have the tribal organization participate in the NADL program through a Memorandum of Understanding (MOU) with the VA.

Purpose: NADLs can be used for:

- Purchasing a home.

- Constructing a home.

- Making home improvements.

- Refinancing an existing NADL to reduce the interest rate.

Key Features:

- Direct Loan: The VA is the lender.

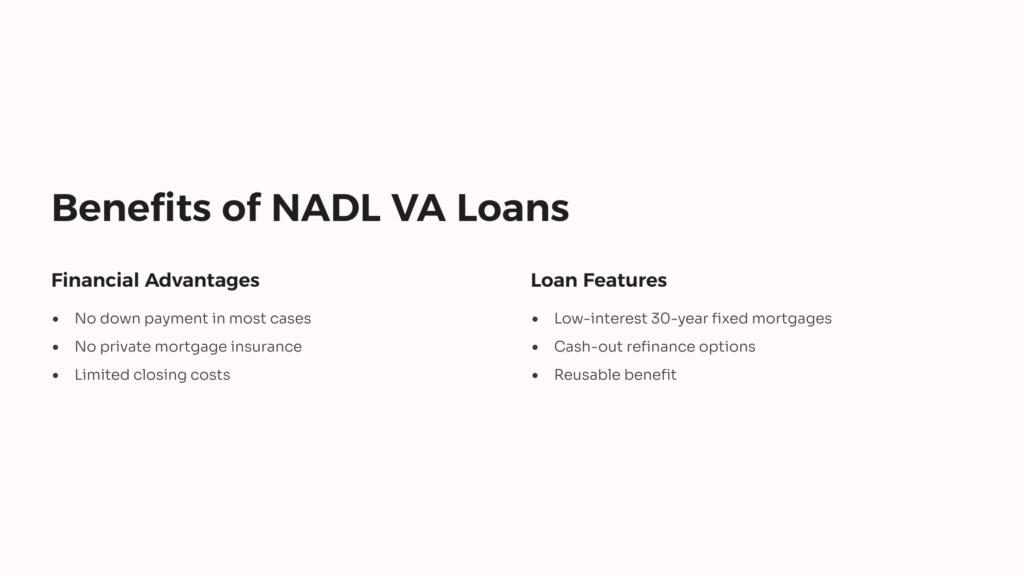

- Low Fixed Interest Rate: Competitive rates, often lower than conventional loans.

- No Down Payment: For eligible Veterans with full entitlement, no down payment is typically required.

- No Private Mortgage Insurance (PMI): Eliminates an additional monthly cost.

- Assistance with Trust Land Issues: The VA works directly with tribal organizations and Veterans to navigate the unique challenges of trust land.

The existence of NADL underscores the VA’s commitment to ensuring all Veterans have access to housing benefits, regardless of their unique circumstances, particularly those tied to tribal sovereignty and trust land status.

The VA NADL Loan Maximum Amount: A Deep Dive

Unlike some loan programs with a fixed, static maximum, the VA NADL maximum amount is dynamic and tied to broader VA home loan policies. This is where clarity is paramount.

How the Maximum is Determined:

The VA NADL maximum amount is generally linked to the VA county loan limits for conventional VA loans. For Veterans with full entitlement, the VA does not impose a maximum loan amount. Instead, the amount a Veteran can borrow is limited only by:

- The appraised value of the property (the VA will not lend more than the home is worth).

- The Veteran’s ability to afford the monthly payments (based on income, credit, and debt-to-income ratio).

For Veterans with partial entitlement (meaning they’ve used some of their VA loan benefits before and not had them restored), the maximum loan amount will be limited by the county loan limit for the area where the property is located. These county limits are established annually by the Federal Housing Finance Agency (FHFA) and are the same limits used for conventional VA-guaranteed loans. For most of the United States, the 2024 VA loan limit for a single-family home is $766,550, but it can be significantly higher in high-cost areas.

Key Takeaways on the Maximum:

- No "Hard Cap" for Full Entitlement: This is a crucial distinction. If a Veteran has full entitlement, the VA can lend them the full appraised value of the home, regardless of how high that value might be, provided they qualify financially. This means the true maximum is often dictated by the property’s value and the Veteran’s income.

- County Limits for Partial Entitlement: For those with partial entitlement, the county limits serve as a practical ceiling for how much the VA will lend without a down payment.

- Appraisal is King: Regardless of entitlement, the loan amount can never exceed the VA-established appraised value of the property. This is a fundamental principle of responsible lending.

- What it Covers: The maximum amount covers the purchase price or construction cost, plus the VA funding fee (unless exempt), and certain allowable closing costs.

In essence, the VA NADL maximum is designed to be flexible and generally align with the market realities of the area, rather than being a one-size-fits-all fixed figure that might quickly become outdated or insufficient.

Advantages of the VA NADL Maximum Amount

When viewed through the lens of its intended purpose and the unique challenges it addresses, the VA NADL’s approach to loan maximums offers several significant advantages:

- Flexibility and Responsiveness to Market Values: By tying the maximum to county loan limits (for partial entitlement) and essentially removing a hard cap for full entitlement, the NADL program can adapt to varying housing costs across different regions. This prevents the program from being rendered ineffective in high-cost areas where a fixed, lower maximum would make homeownership unattainable.

- No Down Payment for Most: The ability to finance 100% of the home’s value (up to the appraised value) is a monumental benefit. For many Veterans, saving a substantial down payment can be the biggest hurdle to homeownership. This feature, enabled by the generous maximum, significantly lowers the barrier to entry.

- Comprehensive Coverage for Construction and Improvement: The NADL maximum is designed to cover not just existing home purchases but also the costs associated with new construction and substantial home improvements. Given the often-rural nature of trust lands, new construction or extensive renovation is frequently necessary, and the program’s capacity to fund these projects fully is a major plus.

- No Private Mortgage Insurance (PMI): While not directly related to the maximum amount, the absence of PMI is a significant cost-saving benefit that is common across all VA loans. This, combined with competitive interest rates, makes the overall monthly payment more affordable, allowing Veterans to qualify for potentially higher loan amounts than they might with conventional loans that require PMI.

- Direct VA Support and Expertise: The VA’s direct involvement in the NADL program means they are intimately familiar with the complexities of trust land and tribal legal frameworks. This specialized knowledge can streamline the process, reduce risks, and potentially facilitate higher loan amounts than private lenders might be willing to offer due to perceived risks.

- Empowerment of Native American Veterans: By providing a robust and flexible financing option, the NADL maximum empowers Native American Veterans to build or buy homes on their ancestral lands, fostering cultural continuity and economic self-sufficiency within their communities.

Disadvantages and Challenges Related to the VA NADL Maximum

Despite its numerous advantages, the VA NADL maximum, and the program itself, are not without their challenges:

- Appraisal Challenges on Trust Land: While the "no cap for full entitlement" sounds great, the actual loan amount is ultimately limited by the VA appraisal. Appraising homes on trust land can be notoriously difficult due to:

- Lack of comparable sales data (fewer transactions).

- Unique property rights (leaseholds rather than fee simple ownership).

- Variations in tribal legal codes and land use regulations.

- Remote locations that may deter appraisers.

These factors can lead to lower appraised values, effectively capping the loan amount below what a Veteran might need or what would be available in a conventional market.

- Perception vs. Reality of "No Cap": While technically true for full entitlement, the practical reality is that the appraisal and the Veteran’s income will always impose a limit. A Veteran might desire a $1 million home, but if it appraises for $700,000 or their income only supports a $500,000 loan, the "no cap" becomes less relevant.

- Geographic Limitations and MOU Requirements: The NADL program is only available where tribal lands exist and where the tribal government has signed a Memorandum of Understanding (MOU) with the VA. This geographical and administrative prerequisite can limit access for some eligible Veterans, regardless of the loan maximum.

- Potential for Slower Processing Times: Government programs, especially those dealing with unique land tenure systems, can sometimes experience longer processing times. The complexity of working with tribal governments, navigating leases, and securing necessary approvals can add delays, which might be frustrating for Veterans, even if the eventual loan amount is sufficient.

- Limited for Luxury or Niche Properties: While generous, the NADL is primarily designed for standard, primary residences. If a Veteran aims for a very large, custom-built luxury home on trust land in an exceptionally high-cost area, even the flexible maximum might be strained if the appraisal doesn’t support the high valuation or if the Veteran’s income cannot meet the payment requirements. The program is built for accessibility, not necessarily for ultra-high-end financing.

- Dependency on County Loan Limits for Partial Entitlement: For Veterans with partial entitlement, the dependency on county loan limits means they might face a ceiling that is insufficient in very high-cost areas if they cannot make a down payment to cover the difference.

Recommendation: Is the VA NADL Maximum "Enough"?

Considering the unique context and purpose of the VA NADL program, the answer to whether its maximum loan amount is "enough" is overwhelmingly yes, for the vast majority of eligible Native American Veterans.

The program’s design, which ties its lending capacity to the appraised value of the property and the Veteran’s financial qualifications (with no statutory limit for full entitlement and generous county limits for partial entitlement), makes it highly adaptable and competitive. It successfully addresses the primary financial barriers to homeownership on trust land: the lack of traditional collateral, the need for 100% financing, and the demand for low-cost, fixed-rate options.

The VA NADL is an excellent "purchase" (or option) for:

- Native American Veterans seeking to purchase or build a modest to upper-middle-class home on trust land. The current county loan limits and the absence of a cap for full entitlement ensure that most standard housing needs are well within reach.

- Veterans who need 100% financing. The no-down-payment feature is transformative, especially when combined with competitive rates and no PMI.

- Those prioritizing stability and affordability. The fixed interest rates and the VA’s direct lending oversight provide a secure and manageable financial pathway.

- Veterans who value the VA’s specialized support in navigating trust land complexities. The direct involvement of the VA can be invaluable in overcoming administrative hurdles.

However, Veterans should be aware of:

- The critical role of the appraisal. The true "maximum" will always be the appraised value, which can be challenging on trust lands. Veterans should manage expectations and ensure their construction or purchase plans align with realistic appraisal outcomes.

- The need for tribal cooperation. Ensure your tribal government has an MOU with the VA.

- Potential for extended timelines. Patience may be required due to the unique nature of the transactions.

Overall Assessment:

The VA NADL maximum amount is not just a number; it’s a testament to a program designed with flexibility and the unique needs of Native American Veterans in mind. By largely mirroring the generosity of conventional VA loans and removing hard caps for those with full entitlement, it ensures that financial constraints are minimized, allowing the focus to shift to the suitability of the property and the Veteran’s ability to sustain the loan. While challenges related to appraisals and the complexities of trust land remain, the program’s robust lending capacity effectively addresses the core financial hurdles.

Conclusion

The VA Native American Direct Loan program stands as a beacon of opportunity for eligible Native American Veterans. Its approach to the maximum loan amount – flexible, market-responsive, and uncapped for those with full entitlement – is a profound strength. It empowers Veterans to achieve the dream of homeownership on their ancestral lands without the prohibitive barriers often associated with traditional financing.

While the complexities of trust land and the appraisal process can present hurdles, these are inherent to the unique nature of the land and not a flaw in the loan maximum itself. For Native American Veterans looking to establish or improve a home on Federal Trust Land, the VA NADL program, with its generous and adaptable lending limits, remains an invaluable and highly recommended financial tool. It is a powerful instrument for fostering self-determination, cultural preservation, and economic stability within Native American communities, honoring the service and sacrifice of those who have served our nation. Veterans are encouraged to contact the VA directly to explore their eligibility and understand the full benefits of this critical program.