Okay, here is a 1200-word product review article in English about the VA Native American Direct Loan (NADL) for first-time home buyers, covering its advantages, disadvantages, and a purchase recommendation.

Unlocking Homeownership: A Comprehensive Review of the VA Native American Direct Loan for First-Time Buyers

The dream of homeownership is a cornerstone of the American ideal, offering stability, equity, and a place to call one’s own. For many first-time buyers, however, this dream can feel distant, often hampered by the significant financial hurdles of down payments, closing costs, and stringent credit requirements. While various loan programs exist to ease this burden, one stands out for its unique focus and profound benefits for a specific demographic: the VA Native American Direct Loan (NADL).

Designed to help eligible Native American veterans purchase, construct, or improve homes on Native American trust lands, the VA NADL is more than just a loan; it’s a powerful pathway to homeownership that addresses specific challenges faced by this community. For first-time buyers who meet its unique criteria, the NADL can be an incredibly attractive, often life-changing, financial instrument. This comprehensive review will delve into the intricacies of the VA NADL, exploring its features, dissecting its advantages and disadvantages, and ultimately providing a well-rounded recommendation for first-time home buyers.

What is the VA Native American Direct Loan (NADL)?

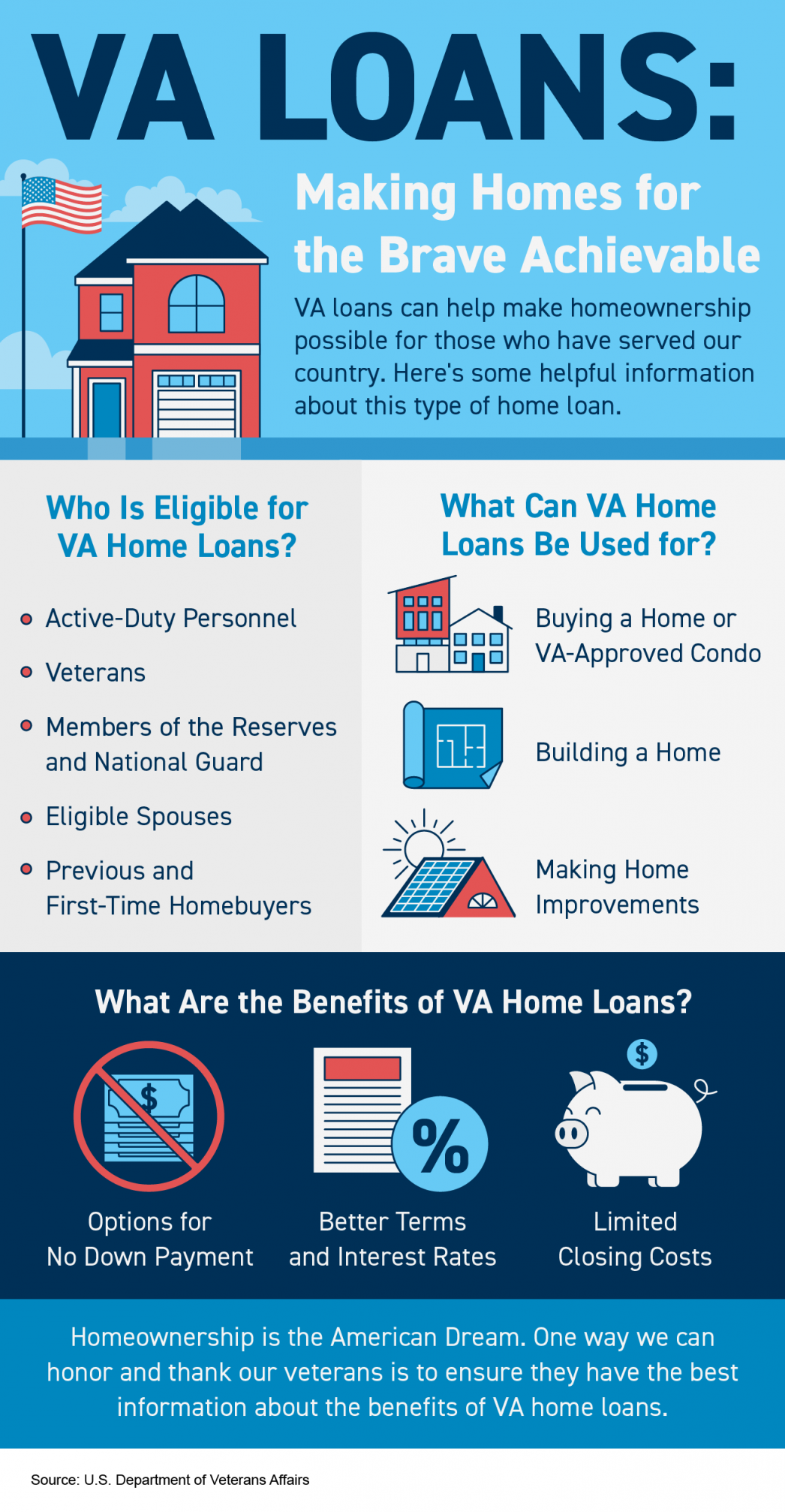

At its core, the VA Native American Direct Loan is a direct loan program administered by the Department of Veterans Affairs (VA). Unlike traditional VA-guaranteed loans, which are issued by private lenders and backed by the VA, the NADL is funded and serviced directly by the VA itself. This crucial distinction allows for greater flexibility and a more tailored approach to lending.

The primary purpose of the NADL is to help Native American veterans, or their eligible non-Native American spouses, obtain safe and sanitary housing on federally recognized trust or restricted lands. This addresses a significant historical challenge, as traditional lenders have often been hesitant or unable to lend on these unique land designations due to complex legal and jurisdictional issues. The NADL bridges this gap, making homeownership a reality where it might otherwise be impossible.

Key Features of the VA NADL:

- Direct Loan: Funded and serviced by the VA.

- Purpose: Purchase, construct, or improve a home; refinance an existing NADL; or refinance certain tribal housing loans.

- Eligibility (Veteran): Must be a Native American veteran (or non-Native American spouse of an eligible Native American veteran) who is eligible for VA home loan benefits and possesses a valid Certificate of Eligibility (COE).

- Eligibility (Land): The property must be located on Native American trust land or restricted land.

- Fixed Interest Rate: Offers stable, predictable monthly payments.

- No Down Payment: One of the most significant benefits for first-time buyers.

- No Private Mortgage Insurance (PMI): Eliminates a common additional monthly expense.

- Low Closing Costs: Often lower than conventional loans.

- Maximum Loan Amount: Aligns with the conforming loan limits set by the Federal Housing Finance Agency (FHFA), which vary by county and are updated annually.

- Assumable: The loan can be assumed by another eligible Native American veteran.

Advantages of the VA NADL for First-Time Home Buyers

For first-time buyers, the VA NADL offers a compelling suite of benefits that directly address many of the common hurdles to homeownership:

-

Zero Down Payment: This is arguably the most impactful advantage. For many, saving up a 5%, 10%, or even 20% down payment is the single biggest obstacle to buying a home. The NADL eliminates this barrier entirely, allowing eligible veterans to purchase a home with no money down. This frees up capital for other necessities, such as moving costs, furniture, or an emergency fund, making the transition into homeownership much smoother.

-

Low, Fixed Interest Rates: The VA sets the interest rates for NADL loans, and they are typically very competitive, often below market rates. Furthermore, the fixed-rate nature ensures that the monthly principal and interest payments remain consistent over the life of the loan, providing budget stability and protection against rising interest rates. For a first-time buyer navigating a new financial commitment, this predictability is invaluable.

-

No Private Mortgage Insurance (PMI): Unlike conventional loans with less than a 20% down payment, NADL loans do not require PMI. This can save borrowers hundreds of dollars per month, significantly reducing the overall cost of homeownership and increasing buying power. Over the lifespan of the loan, these savings can amount to tens of thousands of dollars.

-

Lower Closing Costs: While there are still closing costs associated with the NADL, they are generally lower than those for conventional loans. The VA charges a funding fee (which can sometimes be waived for veterans with service-connected disabilities), but many of the typical lender fees found in private loans are absent. This further reduces the upfront financial burden on first-time buyers.

-

Access to Homeownership on Tribal Lands: This is the program’s most unique and vital advantage. For Native American veterans seeking to live on their ancestral lands, the NADL provides a critical financial tool where traditional mortgage options are often non-existent. It empowers tribal members to build equity and establish roots within their community, fostering economic development and cultural preservation.

-

VA Support and Counseling: As a direct VA program, borrowers have direct access to VA loan specialists who can provide guidance and support throughout the entire process. This personalized assistance can be a huge benefit for first-time buyers who may be unfamiliar with the complexities of real estate transactions.

-

Assumable Loan Feature: While not an immediate benefit for a first-time buyer, the assumable nature of the NADL adds long-term value. If the homeowner decides to sell their property in the future, another eligible Native American veteran can assume the existing loan’s terms and interest rate, which can be a significant selling point, especially in a rising interest rate environment.

Disadvantages of the VA NADL for First-Time Home Buyers

Despite its many benefits, the VA NADL is not without its limitations and challenges. First-time buyers must be aware of these potential drawbacks:

-

Strict Eligibility Requirements: The most significant limitation is its highly specific eligibility. Only Native American veterans (or their non-Native American spouses) who are VA home loan eligible can apply, and the property must be on federally recognized trust or restricted land. This narrow focus means the program is not available to the vast majority of first-time home buyers.

-

Geographic and Property Restrictions: The requirement for the property to be on trust land severely limits where a veteran can use this loan. It’s not applicable to homes on fee simple land or land outside of tribal jurisdiction. Furthermore, the NADL typically finances single-family homes, often excluding multi-unit properties or certain manufactured homes, which could limit choices.

-

Bureaucracy and Processing Time: As a government-administered direct loan, the NADL process can sometimes be more complex and take longer than a conventional loan from a private lender. The involvement of multiple entities (VA, tribal housing authorities, Bureau of Indian Affairs) can lead to additional paperwork and extended processing times. This requires patience and proactive follow-up from the borrower.

-

Appraisal Challenges on Tribal Land: Appraising homes on tribal trust land can be more challenging than on fee simple land. Unique land tenure systems, lack of comparable sales data, and differing property rights can make it difficult to establish market value, potentially leading to delays or appraisals that don’t fully align with perceived value.

-

Tribal Approval and Leaseholds: Acquiring a NADL often requires obtaining approval from the tribal government, including a leasehold agreement for the land. This adds an additional layer of administrative hurdles and can involve navigating tribal laws and regulations, which vary significantly between tribes.

-

Limited Loan Amounts: While the NADL loan limits generally align with conforming loan limits, they might still be insufficient for purchasing larger or more expensive homes in certain high-cost areas, even on tribal lands. This could force buyers to scale back their homeownership aspirations or seek alternative financing.

-

Less Lender Flexibility: Unlike private lenders who might offer a wider range of loan products, interest rate structures, or be more flexible with underwriting guidelines in certain situations, the VA NADL is a standardized program with less room for negotiation or customization.

Purchase Recommendation for First-Time Home Buyers

For eligible first-time home buyers, the VA Native American Direct Loan is an unequivocally powerful and highly recommended pathway to homeownership. Its unique combination of zero down payment, low fixed interest rates, and the absence of PMI makes it one of the most financially advantageous loan programs available. For Native American veterans who aspire to live and build equity on their ancestral lands, the NADL is often the only viable and affordable option.

Who should strongly consider the VA NADL?

- Native American veterans (or their eligible non-Native American spouses) with a valid COE.

- Individuals specifically looking to purchase, build, or improve a home on federally recognized trust or restricted tribal land.

- First-time buyers with limited savings for a down payment and closing costs.

- Those who value predictable monthly payments and long-term financial stability.

- Veterans who are prepared to navigate a potentially more intricate application process and work closely with tribal authorities.

However, it is crucial to approach the NADL with thorough due diligence:

- Confirm Eligibility: The very first step is to confirm both your veteran status eligibility and the eligibility of the specific land where you intend to purchase or build.

- Engage Early with the VA: Contact the VA directly to understand the latest program details, interest rates, and application requirements.

- Consult Tribal Housing Authorities: Work closely with your tribal housing authority or government to understand their specific requirements for leasehold agreements and housing on tribal land. They can be invaluable resources.

- Be Patient and Persistent: Understand that the process may take longer than a conventional loan. Be prepared for extensive documentation and follow-up.

- Financial Counseling: Utilize the VA’s financial counseling services to ensure you are fully prepared for the responsibilities of homeownership.

When might alternatives be considered?

If you do not meet the strict veteran or land eligibility criteria, or if the property you desire is not on tribal trust land, the NADL is not an option. In such cases, other VA loan programs (if you’re a veteran), FHA loans, or conventional loans with down payment assistance programs would be more appropriate. If the complexities of the NADL process feel overwhelming, and you have access to other affordable loan options, those might be considered, though it’s rare to find a program with the same level of financial benefits for this specific demographic.

Conclusion

The VA Native American Direct Loan stands as a testament to targeted support, offering a unique and powerful opportunity for Native American veterans to achieve the dream of homeownership on their traditional lands. Its unparalleled financial benefits, particularly the zero down payment and low fixed interest rates, position it as an exceptional product for eligible first-time buyers. While the specific eligibility and procedural complexities demand patience and thorough preparation, for those who meet the criteria, the NADL is not just a loan – it’s a vital tool for community building, economic empowerment, and securing a lasting legacy for veterans and their families. For Native American veterans looking to lay down roots on trust land, exploring the VA NADL is not just recommended; it’s essential.