Okay, here is a 1200-word product review article in English about the VA Native American Direct Loan (NADL) down payment options, including its pros, cons, and a purchase recommendation.

The Path to Homeownership on Trust Land: A Deep Dive into VA Native American Direct Loan (NADL) Down Payment Options

For many, the dream of homeownership is a cornerstone of financial stability and personal well-being. However, for Native American veterans seeking to establish roots on ancestral trust lands, this dream often comes with unique complexities. The Department of Veterans Affairs (VA) Native American Direct Loan (NADL) program stands as a crucial bridge, offering a direct pathway to affordable home financing specifically designed for this demographic.

This article provides an in-depth review of the VA NADL program, focusing specifically on its down payment options. We will dissect the advantages and disadvantages of each approach, helping Native American veterans make informed decisions on their journey to homeownership on trust land.

Understanding the VA Native American Direct Loan (NADL)

Before delving into down payment specifics, it’s essential to understand the NADL program itself. Established in 1992, the VA NADL program is a direct loan from the VA (not a private lender) to eligible Native American veterans. Its primary purpose is to help these veterans purchase, construct, or improve homes on Native American trust lands, or to refinance an existing NADL loan.

Key Characteristics of NADL:

- Direct Loan: Unlike conventional VA loans, which are guaranteed by the VA but issued by private lenders, NADL is originated and funded directly by the VA.

- Purpose: To finance the purchase or construction of a home, or the improvement of an existing home, on trust lands. It can also be used to refinance an existing NADL.

- Trust Land Focus: This is the defining characteristic. The property must be located on Native American trust land, and the veteran must possess an eligible interest in the land (e.g., a tribal leasehold interest).

- Competitive Rates: NADL loans typically offer very competitive interest rates set by the VA.

- No Private Mortgage Insurance (PMI): Like all VA loans, NADL does not require PMI, regardless of the down payment amount, which can save borrowers hundreds of dollars per month.

The Down Payment Landscape: General Considerations

A down payment is the initial sum of money a homebuyer pays upfront towards the purchase of a property. Traditionally, larger down payments are seen as beneficial, as they:

- Reduce the Loan Amount: Less money borrowed means lower monthly payments and less interest paid over the life of the loan.

- Build Immediate Equity: A larger down payment means you own a larger percentage of your home from day one.

- Potentially Lower Interest Rates: Some lenders offer slightly better rates for borrowers with substantial down payments (though this is less relevant for NADL where rates are VA-set).

- Avoid PMI: For conventional loans, a down payment of less than 20% typically triggers Private Mortgage Insurance (PMI), an additional monthly cost. However, this is not applicable to any VA loan, including NADL, which is a significant advantage.

With the NADL program, the down payment options are quite straightforward, revolving around the choice to put nothing down or to voluntarily contribute a portion of the purchase price upfront.

VA NADL Down Payment Option 1: The Zero Down Payment Advantage

One of the most celebrated features of the VA loan program, extended to NADL, is the option for 100% financing, meaning no down payment is required. This is a monumental benefit, especially for veterans who may have limited savings or prefer to retain their cash reserves for other purposes.

Pros of Choosing Zero Down Payment:

- Unprecedented Accessibility: The most significant advantage is the removal of a major barrier to homeownership. Saving tens of thousands of dollars for a down payment can take years, making homeownership feel out of reach for many. Zero down payment makes the dream an immediate possibility.

- Preservation of Savings/Liquidity: Veterans can keep their hard-earned savings for emergencies, home repairs, furnishings, or other investments. This financial flexibility can be crucial, particularly when moving into a new home.

- Lower Upfront Costs: Beyond the down payment, there are closing costs associated with buying a home (appraisal fees, title insurance, recording fees, etc.). While some closing costs are still necessary, avoiding a down payment significantly reduces the total cash needed at closing.

- No Private Mortgage Insurance (PMI): This cannot be stressed enough. Unlike conventional loans where 0% down would incur hefty PMI, VA loans (including NADL) are exempt. This translates to substantial monthly savings for the entire loan term, making the 0% down option even more financially attractive than it appears on the surface.

- Faster Path to Homeownership: Without the need to save for a down payment, eligible veterans can move forward with their home purchase much sooner, allowing them to enjoy the stability and benefits of homeownership without delay.

Cons of Choosing Zero Down Payment:

- Higher Loan Amount: Borrowing 100% of the home’s value means your initial loan principal is higher. This will result in slightly higher monthly payments compared to making a down payment.

- Slower Equity Build-Up: Since you start with no equity from a down payment, it will take longer to build substantial equity in your home through principal payments alone. In a market downturn, this could mean owing more than your home is worth for a period.

- Higher Interest Paid Over Time: A larger principal balance, even with competitive interest rates, will accumulate more interest charges over the 30-year loan term.

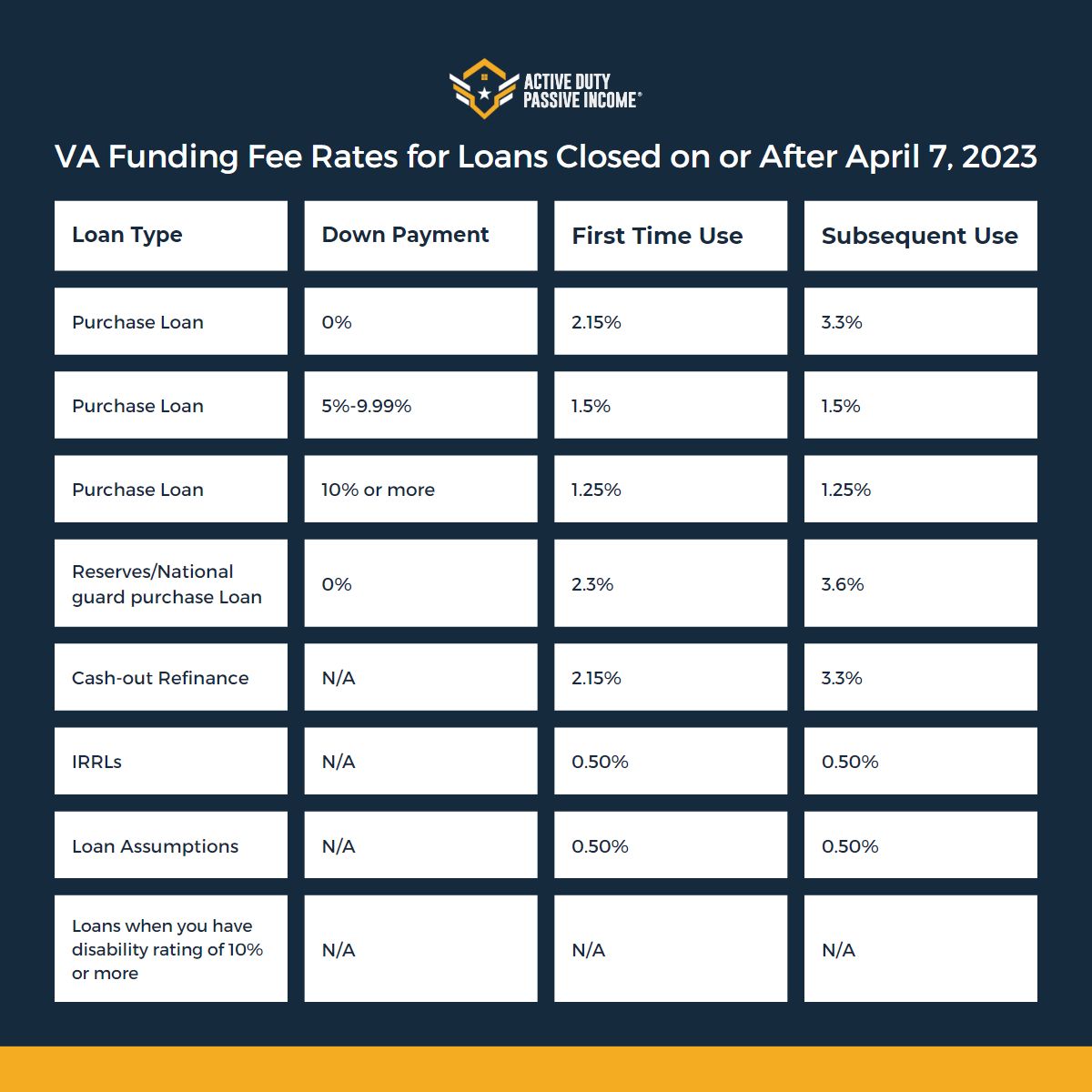

- Potentially Higher Funding Fee: While not a down payment itself, the VA Funding Fee is a one-time fee paid directly to the VA to help offset the cost of the program. For first-time users, the funding fee for 0% down is generally higher than if a down payment is made (e.g., 2.15% vs. 1.50% for 5% down). Veterans receiving VA compensation for service-connected disabilities are exempt from the funding fee.

VA NADL Down Payment Option 2: Making a Voluntary Down Payment

While 0% down is a powerful benefit, NADL recipients are absolutely permitted to make a down payment if they choose. There are compelling reasons why a veteran might opt to put money down, even when it’s not required.

Pros of Making a Voluntary Down Payment:

- Lower Monthly Payments: A larger down payment directly reduces the loan amount, leading to lower principal and interest payments each month. This can significantly improve monthly cash flow and financial comfort.

- Reduced Total Interest Paid: By borrowing less, you reduce the total amount of interest accrued over the life of the loan, saving you a substantial sum in the long run.

- Immediate Equity: A down payment instantly creates equity in your home, providing a financial cushion and a stronger starting position for wealth building. This equity can be leveraged later for home improvements or other financial needs (though equity on trust land can be more complex to leverage than on fee simple land).

- Lower VA Funding Fee: For those who are not exempt, making a down payment can reduce the VA Funding Fee. For instance, putting down 5% can lower the funding fee from 2.15% to 1.50% (for first-time users). This reduction can translate to thousands of dollars saved upfront.

- Enhanced Financial Security: Starting with a lower loan balance and higher equity can provide greater peace of mind and financial security, especially in uncertain economic times.

Cons of Making a Voluntary Down Payment:

- Requires Upfront Cash: The most obvious drawback is that it necessitates having a significant sum of money readily available, which might deplete savings or delay the home purchase.

- Reduced Liquidity: Tying up a large amount of cash in a down payment means that money is no longer readily accessible for emergencies or other investments.

- Opportunity Cost: The money used for a down payment could potentially be invested elsewhere, yielding a higher return. However, this carries its own risks and is dependent on individual financial strategies.

The VA Funding Fee: An Important Consideration

While not a down payment, the VA Funding Fee is a critical upfront cost to understand. It’s a one-time fee paid by the veteran to the VA to help keep the loan program running for future generations of veterans. The amount of the funding fee varies based on:

- Loan Type: Purchase, refinance, construction.

- Veteran’s Service History: First-time use vs. subsequent use.

- Down Payment Amount: As mentioned, a higher down payment can reduce the funding fee percentage.

- Disability Status: Veterans receiving VA compensation for a service-connected disability, or those who would be entitled to compensation but for receiving retirement pay, are exempt from paying the funding fee. This is a huge financial benefit.

It’s crucial for every veteran to check their eligibility for funding fee exemption, as it can save thousands of dollars regardless of the down payment choice.

Pros of the VA NADL Program (Overall)

Beyond down payment flexibility, the NADL program offers a suite of benefits that make it an exceptional option:

- Competitive, Fixed Interest Rates: VA-set rates are often lower than conventional mortgages, and they are typically fixed, providing predictable monthly payments.

- No PMI: A substantial long-term saving.

- Limited Closing Costs: The VA limits what costs veterans can be charged, and some costs can be rolled into the loan or negotiated with the seller.

- Financial Counseling: The VA offers robust support and counseling throughout the loan process.

- Reusability: NADL benefits can be used multiple times, provided the previous loan is paid off.

- Tailored for Trust Lands: It’s the only federal loan program specifically designed to address the unique legal and administrative complexities of financing homes on Native American trust lands.

Cons of the VA NADL Program (Overall)

While powerful, NADL does have specific limitations:

- Geographic Restriction: Strictly limited to homes on Native American trust lands, which can limit housing choices.

- Leasehold Estate: Homes on trust lands are typically subject to a leasehold interest rather than fee simple ownership. This means the veteran owns the home, but leases the land from the tribe or individual allottee. This can affect future resale potential or leveraging equity.

- Direct Loan Process: Being a direct loan from the VA means the application process can sometimes be slower or less flexible than working with a private lender who might offer more diverse products or faster turnarounds.

- Tribal Participation: The program requires cooperation from tribal governments to establish the necessary lease agreements and administrative structures. Not all tribes may have the necessary agreements in place.

- Eligibility Requirements: Beyond veteran status and Native American heritage, applicants must meet VA’s credit, income, and debt-to-income ratio requirements.

Purchase Recommendation: When to Choose Which Down Payment Option

The VA NADL program is a highly specialized and incredibly valuable tool for eligible Native American veterans. The decision of whether to make a down payment largely depends on your personal financial situation and goals.

Choose the Zero Down Payment Option if:

- You have limited liquid savings: Don’t deplete your emergency fund or go into debt to make a down payment.

- You prefer to retain cash for other needs: Home repairs, furnishings, or other investments.

- You value immediate homeownership: Without the delay of saving for a down payment.

- You are comfortable with slightly higher monthly payments in exchange for no upfront cash.

Choose to Make a Voluntary Down Payment if:

- You have ample savings that won’t compromise your financial security.

- You prioritize lower monthly payments and reduced total interest costs.

- You want to build equity faster.

- You are not exempt from the VA Funding Fee and wish to reduce it.

Overall Recommendation:

For eligible Native American veterans seeking homeownership on trust land, the VA NADL program is an unequivocal recommendation. It is a unique, powerful, and often the only viable path to affordable home financing in this specific context. The zero-down payment option is a significant benefit that should be seriously considered, especially given the absence of PMI.

However, successful utilization of NADL requires:

- Early Engagement with the VA: Contact the VA Home Loan program directly to understand eligibility and the application process.

- Understanding Tribal Regulations: Familiarize yourself with your tribe’s specific land lease policies and any additional requirements.

- Thorough Financial Planning: Assess your budget, income, and long-term financial goals to determine if a down payment is feasible or beneficial for your situation.

- Patience and Due Diligence: The process for NADL, given its direct nature and the complexities of trust land, can sometimes be more involved.

Conclusion

The VA Native American Direct Loan (NADL) program is more than just a loan; it’s a testament to the commitment to supporting Native American veterans in achieving the dream of homeownership on their ancestral lands. The flexibility of down payment options, particularly the zero-down feature coupled with no PMI, makes it an exceptionally attractive and accessible program.

By carefully weighing the pros and cons of both the zero-down and voluntary down payment approaches, and understanding the overall benefits and challenges of the NADL program, Native American veterans can confidently navigate their path to a stable and secure future in a home they can call their own on trust land. This program is a vital resource, and any eligible veteran should explore it thoroughly as their primary option for home financing.