Here is a 1200-word step-by-step guide in English on the USDA Native American Loan for Reservation Land, structured as a professional tutorial with clear headings.

USDA Native American Loan for Reservation Land: A Professional Step-by-Step Guide

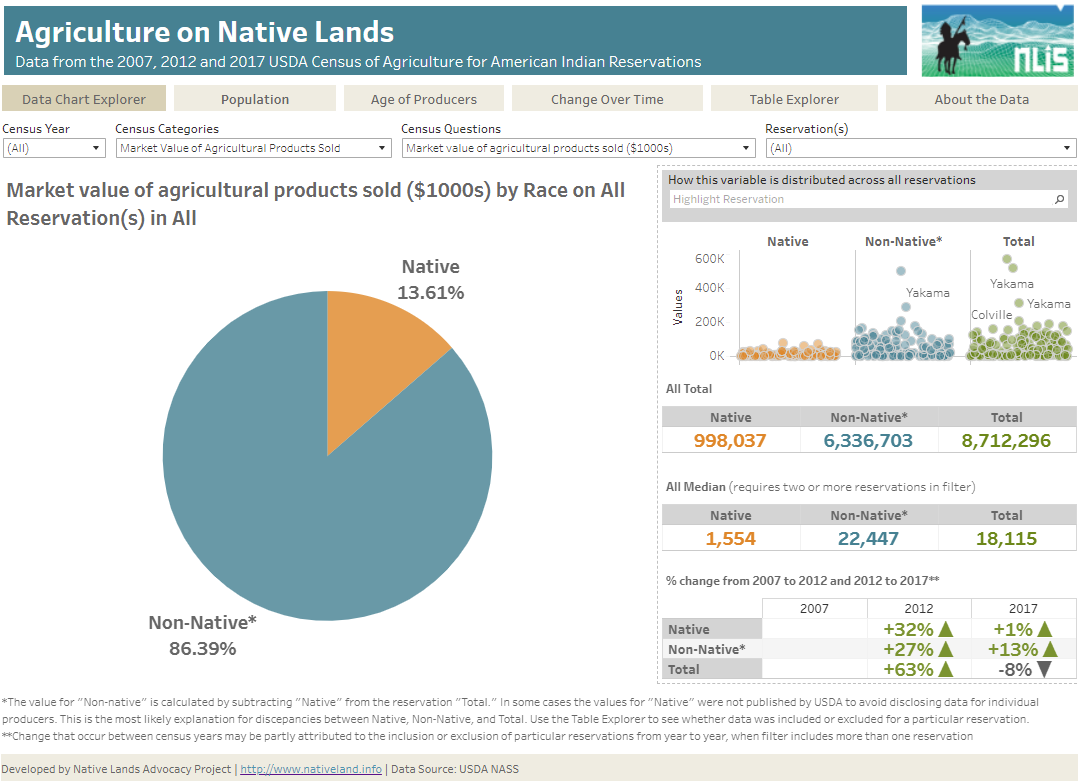

The United States Department of Agriculture (USDA), primarily through its Farm Service Agency (FSA), offers vital loan programs designed to support Native American individuals, Tribes, and Tribal entities in acquiring, developing, and operating on reservation and trust lands. These programs are crucial for fostering economic development, promoting agricultural sustainability, and preserving cultural heritage within Native American communities.

This comprehensive guide will walk you through the process of understanding and applying for USDA Native American loans for reservation land, offering a professional, step-by-step tutorial.

1. Understanding USDA’s Role in Native American Agriculture

The USDA recognizes the unique challenges and opportunities associated with land ownership and use on Native American reservations and trust lands. The primary goal of these loan programs is to overcome barriers to conventional financing, such as the unique legal status of trust land, and to provide access to capital for agricultural and related enterprises.

1.1 Key USDA Farm Service Agency (FSA) Loan Programs

While various USDA agencies offer support, the FSA is the primary provider of direct and guaranteed loans for land acquisition and farm operations. For Native Americans, specific considerations and programs are in place:

- Farm Ownership (FO) Loans (Direct and Guaranteed): These are the most common loans for purchasing, enlarging, or improving a farm. Native American individuals can apply for these loans, with special provisions for the unique legal status of reservation/trust land.

- Operating Loans (OL) (Direct and Guaranteed): These loans are for operating expenses, equipment, livestock, and other short-term needs.

- Native American Tribal Loan Program (NATLP): This specific program allows federally recognized Indian Tribes or Tribal entities to acquire land within their reservation or adjacent to it. The land can be used to establish or expand agricultural operations for the benefit of Tribal members. This program specifically addresses the complexities of financing land held in trust.

Crucial Distinction: While NATLP is specifically for Tribes/Tribal entities to acquire land (often trust land), individual Native Americans will typically apply for standard FSA FO or OL loans, but with specific allowances and processes for land held in trust or allotted status. This guide will cover both scenarios, with a focus on individual applicants navigating reservation land.

2. Eligibility Criteria: Who Can Apply?

Eligibility for USDA Native American loans is multifaceted, combining general FSA requirements with specific criteria for Native American applicants and the unique nature of reservation land.

2.1 General FSA Loan Eligibility

- Citizenship: U.S. citizen or legal resident alien.

- Legal Capacity: Must have the legal capacity to incur the loan obligation.

- Credit History: A satisfactory credit history, demonstrating repayment ability.

- Farm Experience: Must have sufficient education, training, or experience in farming or ranching.

- Inability to Obtain Commercial Credit: Applicants must be unable to obtain sufficient credit elsewhere at reasonable rates and terms to meet their actual needs.

- Farm Plan: Must demonstrate the ability to develop and implement a viable farm plan.

2.2 Specific Native American Criteria

- Tribal Affiliation: For individual applicants seeking to finance land on a reservation or trust land, membership in a federally recognized Indian Tribe is typically required.

- For NATLP: The applicant must be a federally recognized Indian Tribe or Tribal entity.

3. Eligible Loan Purposes

USDA loans for Native Americans on reservation land can be used for a variety of purposes:

- Land Acquisition: Purchasing farmland, including allotted or trust land interests from other Native American landowners.

- Farm Enlargement: Expanding existing farm operations by acquiring additional land.

- Farm Improvements: Constructing, repairing, or improving farm buildings, dwellings, or other essential structures.

- Soil and Water Conservation: Implementing practices to conserve natural resources on the land.

- Operating Expenses: (Through Operating Loans) Purchasing livestock, equipment, seed, fertilizer, and other necessary inputs.

- Refinancing Debt: Under specific circumstances, existing farm-related debt can be refinanced.

- For NATLP: Acquiring land to establish, maintain, or enlarge a farm for members of the Tribe.

4. Step-by-Step Guide to Applying for a USDA Native American Loan

Navigating the application process requires careful preparation and understanding of the unique aspects of reservation land.

Step 1: Initial Consultation and Research

Action: Contact your local FSA office.

- Purpose: This is the most crucial first step. FSA staff are experts in their programs and can provide tailored advice based on your specific situation, tribal affiliation, and the nature of the land (e.g., trust, allotted, fee simple within a reservation).

- What to Discuss:

- Your eligibility for direct vs. guaranteed loans.

- The specific type of loan that best suits your needs (FO, OL, NATLP).

- The unique requirements for financing reservation or trust land, especially regarding collateral.

- The current interest rates and loan terms.

- Any specific tribal regulations or agreements that might impact the process.

- Gather Information: Request a checklist of required documents and forms.

Step 2: Preparing Your Application Package

Action: Compile all necessary personal, financial, and land-related documentation.

- Personal Information:

- Proof of identity (e.g., driver’s license, tribal ID).

- Proof of U.S. citizenship or legal residency.

- Documentation of tribal affiliation (e.g., CIB – Certificate of Indian Blood, Tribal enrollment card).

- Financial Documentation:

- Detailed personal financial statement (assets, liabilities, net worth).

- Income tax returns for the past three years.

- Credit report (FSA will usually pull this, but having an understanding of yours is beneficial).

- Balance sheets and income statements for any existing farm operation.

- Farm/Business Plan:

- A comprehensive plan outlining your agricultural operation, including production practices, marketing strategies, projected income, and expenses. This demonstrates the viability of your enterprise.

- For land acquisition, detail how the land will be utilized.

- Land Documentation (Crucial for Reservation/Trust Land):

- Bureau of Indian Affairs (BIA) Documents: This is where the process differs significantly. You will need:

- Title Status Report (TSR): A document from the BIA that outlines the legal ownership, trust status, and any encumbrances on the land.

- Trust Patent/Allotment Documents: Proof that the land is held in trust by the U.S. government for the benefit of the individual or Tribe.

- Purchase Agreement/Lease Agreement: If acquiring land, a draft or finalized agreement outlining the terms of sale or lease.

- BIA Approvals: Any necessary BIA approvals for the land transaction (e.g., approval for a lease, sale of trust land interest).

- Appraisal: An independent appraisal of the land’s value will be required. This can be complex for trust land due to market comparables and restrictions.

- Bureau of Indian Affairs (BIA) Documents: This is where the process differs significantly. You will need:

Step 3: Formal Application Submission

Action: Complete and submit all required FSA forms and your compiled documentation.

- FSA Forms: Your local FSA office will provide specific forms, which may include:

- FSA-2001 (Request for Farm Operating Loan) or FSA-2002 (Request for Farm Ownership Loan)

- FSA-2004 (Application for Farm Loan Assistance)

- FSA-2006 (Certification of No Federal Delinquent Debt)

- Various certifications and authorizations.

- Completeness: Ensure all forms are accurately filled out and all supporting documents are attached. Incomplete applications can cause significant delays.

Step 4: The Review and Underwriting Process

Action: FSA reviews your application, financial viability, and the unique aspects of the land.

- Loan Officer Review: An FSA loan officer will meticulously review your application, farm plan, financial statements, and credit history.

- Financial Analysis: FSA assesses your ability to repay the loan based on projected farm income and other sources.

- Farm Visit: The loan officer may conduct a site visit to assess the land and proposed operation.

- Collateral Assessment: This is a critical stage, especially for reservation/trust land. FSA will determine what assets can be used as security for the loan.

Step 5: Navigating Collateral for Trust Land

Action: Work with FSA and BIA to establish acceptable security for the loan.

- The Challenge: Trust land cannot typically be directly mortgaged or foreclosed upon by a non-Native entity because it is held in trust by the U.S. government. This often poses a barrier to conventional lenders.

- FSA’s Solutions (for individuals): FSA has provisions to work around this. Acceptable forms of security can include:

- Assignment of Income: An assignment of income generated from the farm operation on the trust land (e.g., proceeds from crop sales, livestock sales).

- Leasehold Interests: If you have a long-term lease on trust land, the leasehold interest itself might be used as collateral.

- Other Acceptable Collateral: Other non-trust assets you own (e.g., equipment, livestock, fee-simple land not in trust) can serve as collateral.

- BIA Subordination (less common for individuals): In some specific cases, the BIA may agree to subordinate its interest to the FSA, allowing FSA to take a lien, but this is highly complex and usually involves Tribal entities or specific programs.

- For NATLP (Tribes/Tribal Entities): Under NATLP, the Tribe can use the acquired land as security, with the BIA acting as the lien holder or consenting to a lien on the leasehold interest or the land itself, provided it remains in trust status.

Key Point: This step often requires close coordination between the applicant, FSA, and the BIA to ensure all legal requirements are met and acceptable collateral is established.

Step 6: Loan Approval and Closing

Action: If approved, you will proceed to the loan closing.

- Loan Agreement: You will receive a loan agreement outlining all terms, conditions, repayment schedules, and security requirements. Review this carefully.

- Closing: The loan closing process involves signing all legal documents. For reservation land, this often involves the BIA’s participation to ensure the transaction complies with federal trust land regulations.

- Fund Disbursement: Once closed, the loan funds will be disbursed according to the agreed-upon terms (e.g., directly to the seller of land, to you for operating expenses).

Step 7: Post-Loan Management

Action: Manage your loan responsibly and maintain communication with FSA.

- Record Keeping: Keep meticulous records of your farm operations, income, and expenses.

- Repayment: Make timely loan payments according to your schedule.

- Communication: Maintain open communication with your FSA loan officer, especially if you anticipate any challenges in repayment or changes to your farm plan. FSA offers loan servicing options for borrowers facing difficulties.

- Compliance: Adhere to any environmental or other compliance requirements associated with your loan.

5. Unique Considerations for Reservation and Trust Land

Beyond the application process, understanding the unique legal and administrative landscape of reservation land is paramount.

- Trust Status: Land held in trust means the legal title is with the U.S. government for the benefit of an individual Native American or a Tribe. This limits alienation, encumbrance, and taxation.

- BIA Involvement: The Bureau of Indian Affairs (BIA) plays a significant role in approving land transactions, verifying titles, and ensuring compliance with federal Indian law. Their involvement is critical for any land-related loan.

- Fractionalized Ownership: Many parcels of trust land have multiple heirs, leading to complex fractionalized ownership. Acquiring land often requires dealing with numerous individual owners.

- Jurisdictional Complexity: Operating on reservation land involves navigating federal, tribal, and sometimes state laws, which can be intricate.

- Cultural Sensitivity: Be mindful of the cultural significance of land to Native American communities and approach transactions with respect.

6. Tips for a Successful Application

- Start Early: The process can be lengthy, especially with BIA involvement.

- Be Organized: Have all your documents ready and well-organized.

- Develop a Strong Farm Plan: A clear, realistic, and well-researched farm plan is essential for demonstrating viability.

- Understand Trust Land: Educate yourself thoroughly on the specifics of trust land, allotted land, and BIA processes.

- Seek Professional Advice: Consider consulting with tribal legal counsel, financial advisors, or agricultural extension services familiar with reservation land.

- Maintain Communication: Regular and open communication with your FSA loan officer is key.

- Patience: The process can be complex and may require patience and persistence.

Conclusion: Building a Sustainable Future

USDA Native American loan programs for reservation land represent a powerful tool for economic self-sufficiency, agricultural development, and cultural preservation within Native American communities. While the process involves unique challenges, particularly concerning the legal status of trust land, the FSA is committed to working with applicants to navigate these complexities.

By following this professional step-by-step guide, meticulously preparing your application, and proactively engaging with your local FSA office and the BIA, you can significantly increase your chances of securing the financing needed to realize your agricultural goals on reservation land. This investment not only benefits individual farmers and ranchers but also contributes to the long-term sustainability and prosperity of Native American nations.