Of course! Here is a 1200-word step-by-step guide on Understanding Tribal Lending Laws and Regulations, formatted as a professional tutorial.

Understanding Tribal Lending Laws and Regulations: A Professional Tutorial

Introduction: Navigating a Complex Regulatory Landscape

Tribal lending, a facet of the broader financial services industry, operates at the intricate intersection of federal, state, and sovereign tribal laws. For consumers, businesses, and legal professionals alike, understanding this unique regulatory environment is crucial, yet often challenging due to its evolving nature and the fundamental principle of tribal sovereignty.

This comprehensive guide aims to demystify tribal lending by providing a step-by-step framework for understanding its core legal underpinnings, operational models, and regulatory challenges. By the end of this tutorial, you will have a clearer grasp of the complexities involved, enabling more informed decision-making and a deeper appreciation for the nuances of this specialized sector.

Disclaimer: This guide provides general information for educational purposes and should not be construed as legal advice. For specific legal guidance, consult with a qualified attorney.

Step 1: Grasping the Foundation – Tribal Sovereignty

At the heart of tribal lending lies the concept of tribal sovereignty. Without a firm understanding of this principle, the entire regulatory framework becomes opaque.

What is Tribal Sovereignty?

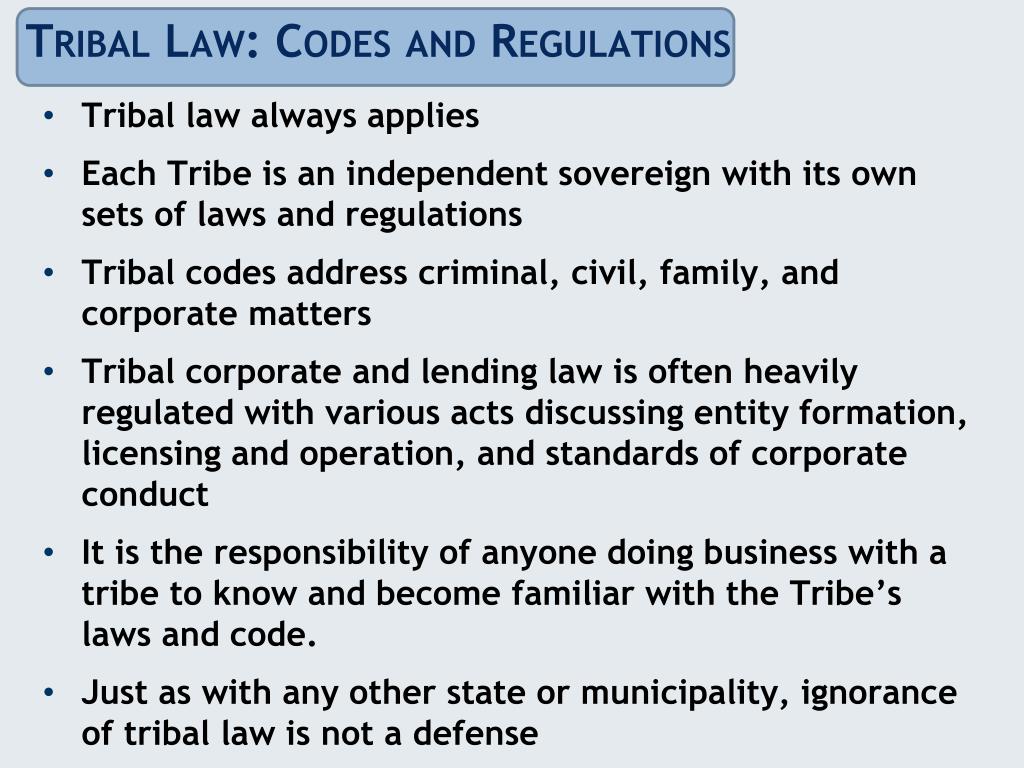

Native American tribes are recognized by the U.S. federal government as distinct, sovereign nations with inherent powers of self-governance. This sovereignty predates the formation of the United States and, while limited by federal law, it grants tribes the authority to:

- Form their own governments.

- Enact and enforce their own laws.

- Establish and regulate businesses, including lending operations, on tribal lands.

- Exempt themselves from state laws, often through the doctrine of sovereign immunity.

Impact on Lending:

Because of their sovereign status, tribal lending entities, when genuinely owned and operated by a tribe, often assert that they are not subject to state licensing requirements, interest rate caps (usury laws), or other state-specific financial regulations. This is the primary reason why tribal lenders can offer loans with interest rates that significantly exceed those permitted by state laws for non-tribal lenders.

Key Takeaway: Tribal sovereignty is the cornerstone. It allows tribal entities to operate under their own laws, potentially bypassing state regulations that govern traditional lenders.

Step 2: The Legal Framework – Where Federal and State Laws Intersect (or Clash)

While tribal sovereignty is paramount, it does not exist in a vacuum. Tribal lending operates within a broader legal landscape where federal and, to a more contested extent, state laws seek to assert influence.

A. Federal Laws and Agencies:

The U.S. Constitution’s Indian Commerce Clause grants Congress power over commerce with Indian tribes, forming the basis for federal oversight. Several federal laws and agencies play a role:

-

Consumer Financial Protection Bureau (CFPB): The CFPB is a federal agency tasked with protecting consumers in the financial marketplace. It asserts jurisdiction over all lenders, tribal or otherwise, when it comes to federal consumer protection laws. The CFPB primarily focuses on:

- Unfair, Deceptive, or Abusive Acts or Practices (UDAAP): Prohibiting predatory lending practices, misleading disclosures, or abusive collection tactics.

- Truth in Lending Act (TILA): Requiring clear disclosure of loan terms, annual percentage rates (APRs), and total costs.

- Equal Credit Opportunity Act (ECOA): Prohibiting discrimination in lending.

- Electronic Fund Transfer Act (EFTA): Regulating electronic payments and withdrawals.

-

Federal Trade Commission (FTC): The FTC also has authority to protect consumers from unfair or deceptive business practices, including those in lending. It often works in conjunction with the CFPB.

-

Other Federal Statutes:

- Gramm-Leach-Bliley Act (GLBA): Mandates privacy protections for consumer financial information.

- Fair Credit Reporting Act (FCRA): Regulates how consumer credit information is collected and used.

Important Nuance: While federal laws do apply to tribal lenders, enforcement can be complex due to sovereign immunity and the specific structure of the lending operation. Federal agencies often pursue enforcement actions against the non-tribal partners or individuals involved in allegedly illegal schemes.

B. State Laws and Jurisdiction:

This is where the most significant conflicts arise. States generally have strong consumer protection laws, including:

- Usury Laws: Limits on the maximum interest rates lenders can charge.

- Licensing Requirements: Mandates for lenders to obtain state licenses to operate within their borders.

- Collection Laws: Regulations governing how debts can be collected.

The Clash: Tribal lenders argue that state laws do not apply to them because of their sovereign status, particularly when the lending operation is physically located on tribal land and adheres to tribal law. States, conversely, argue that when a tribal lender offers loans to non-tribal members off tribal land (e.g., via the internet), they are engaging in commerce within the state’s jurisdiction and should be subject to state laws designed to protect state residents.

Key Takeaway: Federal consumer protection laws generally apply, but state laws, especially usury and licensing, are often contested. This creates a "gray area" of regulation.

Step 3: Understanding the Business Model – How Tribal Lending Works (and Why)

Tribal lending entities are often structured to leverage tribal sovereignty for economic development.

A. Motivation for Tribes:

- Economic Development: Lending operations provide a significant source of revenue for tribes, which can be used to fund essential services like healthcare, education, infrastructure, and housing, often in areas with limited economic opportunities.

- Self-Sufficiency: It offers a path towards greater financial independence from federal funding.

B. Operational Models:

- Direct Tribal Operation: The tribe itself, or an entity wholly owned and operated by the tribe, directly originates and services loans. These operations are typically structured under tribal law and adhere to tribal regulatory schemes.

- Tribal-Non-Tribal Partnerships: This is the most common and often most controversial model. A tribe partners with a non-tribal third-party lender or financial services company. The non-tribal entity typically provides the capital, marketing, technological infrastructure, and expertise, while the tribal entity provides the "face" of the operation, asserting sovereign immunity. These arrangements have led to accusations of "rent-a-tribe" schemes.

C. Target Market and Product:

Tribal lenders often target subprime borrowers – individuals with lower credit scores or limited access to traditional credit from banks. The products are typically:

- Short-term, small-dollar loans: Often marketed as payday loans or installment loans.

- High-interest rates: Justified by lenders due to the higher risk associated with subprime borrowers and the lack of state interest rate caps.

Key Takeaway: Tribal lending is an economic development tool for tribes, often leveraging partnerships and targeting specific borrower segments with high-interest, short-term products.

Step 4: Key Regulatory Challenges and Controversies

The unique structure of tribal lending has led to significant legal battles and regulatory scrutiny.

A. Sovereign Immunity Waivers:

While tribes enjoy sovereign immunity, they can waive it. Many tribal loan agreements include arbitration clauses which stipulate that any disputes must be resolved through tribal arbitration, not in state or federal courts. Some agreements also contain "sue-and-be-sued" clauses, but their scope can be limited. The effectiveness of these waivers and clauses is frequently challenged in court.

B. The "True Lender" Doctrine and "Rent-a-Tribe" Schemes:

Regulators and state attorneys general often scrutinize tribal-non-tribal partnerships under the "true lender" doctrine. This doctrine asks: Who is the actual lender, bearing the predominant economic interest and risks of the loan, regardless of whose name is on the paperwork?

- If a non-tribal entity is deemed the "true lender," courts may strip the tribal entity of sovereign immunity protections, thus subjecting the operation to state laws.

- A landmark case, Madden v. Midland Funding, LLC (2015, 2nd Circuit), significantly impacted the industry by ruling that a non-tribal assignee of a loan originated by a tribal entity could be subject to state usury laws, even if the original tribal lender was not. This case created a split among federal circuit courts and continues to influence litigation.

C. Enforcement Actions:

The CFPB and FTC have actively pursued enforcement actions against tribal lenders and their non-tribal partners, particularly for alleged UDAAP violations. These actions often target deceptive marketing, lack of proper disclosures, and unauthorized withdrawals from bank accounts.

Key Takeaway: Sovereign immunity is not absolute. The "true lender" doctrine and the Madden decision highlight ongoing efforts by states and federal agencies to regulate operations perceived as "rent-a-tribe" schemes.

Step 5: Consumer Protections and Recourse

For consumers engaging with tribal lenders, understanding their rights and potential avenues for recourse is vital.

A. Applicability of Federal Laws:

Remember that federal consumer protection laws (TILA, ECOA, UDAAP, GLBA, EFTA) generally apply. This means consumers are entitled to:

- Clear disclosure of loan terms and costs (APR, finance charges).

- Non-discriminatory lending practices.

- Protection against unfair, deceptive, or abusive acts.

- Privacy of financial information.

B. Arbitration Clauses:

Most tribal lending agreements include mandatory arbitration clauses. This means consumers often waive their right to sue in court or participate in class-action lawsuits, agreeing instead to resolve disputes through binding arbitration, typically governed by tribal law or a specified arbitration association.

C. Steps for Consumers:

- Read Carefully: Thoroughly review the loan agreement, paying close attention to interest rates, fees, repayment schedules, and dispute resolution clauses (arbitration).

- Verify Affiliation: Understand who the lender is (a tribal entity, a non-tribal partner, or both).

- Understand Recourse: Be aware that pursuing claims against a tribal entity directly in court can be challenging due to sovereign immunity.

- Contact Regulators: If you believe you’ve been subjected to unfair or deceptive practices, contact:

- The CFPB: File a complaint online.

- The FTC: Report fraud.

- Your State Attorney General’s Office: They may be able to investigate, especially if the lender is deemed subject to state law.

- Legal Aid/Consumer Attorneys: Seek specialized legal advice if you face difficulties.

Key Takeaway: Consumers have federal protections, but enforcing them against tribal entities can be difficult due to sovereign immunity and arbitration clauses. Proactive due diligence is essential.

Step 6: Due Diligence for Businesses and Investors

For businesses considering partnering with tribal lenders, or investors looking into the sector, rigorous due diligence is paramount.

A. Assess Legitimacy and Structure:

- True Tribal Ownership/Control: Verify that the tribal entity genuinely owns and controls the lending operation, and that the tribe receives a significant, direct economic benefit.

- Adherence to Tribal Law: Ensure the operation is fully compliant with all applicable tribal laws and regulations.

- Physical Presence: Does the lending operation have a substantive physical presence and operations on tribal lands?

B. Understand Regulatory Compliance Risk:

- Federal Compliance: Ensure robust compliance with all applicable federal consumer protection laws (TILA, ECOA, UDAAP, GLBA, FCRA).

- State Law Exposure: Critically assess the risk of being deemed subject to state laws (especially usury and licensing) under the "true lender" doctrine, particularly in light of Madden and subsequent case law. This requires a thorough jurisdictional analysis.

- CFPB/FTC Scrutiny: Prepare for potential scrutiny from federal regulators and have robust compliance management systems in place.

C. Evaluate Partnership Agreements:

- Clarity of Roles: Define clear roles, responsibilities, and financial arrangements between tribal and non-tribal partners.

- Indemnification: Understand indemnification clauses and liability allocation.

- Dispute Resolution: Review arbitration or dispute resolution mechanisms within the partnership.

D. Reputational Risk:

The tribal lending industry has faced negative press and regulatory crackdowns. Businesses and investors must assess the potential reputational risk associated with involvement in this sector.

Key Takeaway: For businesses and investors, thorough legal and operational due diligence is critical to mitigate regulatory, legal, and reputational risks.

Conclusion: An Evolving and Challenging Field

Understanding tribal lending laws and regulations requires a deep dive into the principles of tribal sovereignty, federal oversight, and the ongoing clash with state consumer protection efforts. It is a dynamic and constantly evolving area of law, shaped by court decisions, regulatory enforcement actions, and the continuous efforts of tribes to achieve economic self-determination.

For consumers, awareness and careful due diligence are their best defenses. For businesses and investors, a comprehensive understanding of the legal landscape and a commitment to ethical, compliant practices are essential for navigating this challenging, yet potentially rewarding, sector. As the industry matures, further clarity and potential legislative action may emerge, but for now, informed understanding remains the most powerful tool.