Demystifying High-Cost Credit: A Comprehensive Review of the Tribal Loan Interest Calculator

In the often-turbulent waters of personal finance, many individuals find themselves in desperate need of quick access to funds. When traditional lending avenues are closed, or credit scores are prohibitive, alternative options emerge – among the most controversial and high-cost are tribal loans. These short-term, high-interest loans, offered by lenders operating under the umbrella of Native American tribal sovereignty, bypass state usury laws, leading to Annual Percentage Rates (APRs) that can soar into the triple digits.

Navigating the complexities and understanding the true cost of such loans is paramount, yet incredibly challenging for the average consumer. This is where a Tribal Loan Interest Calculator steps in, purporting to offer transparency in an opaque market. This comprehensive review delves into the utility, features, advantages, disadvantages, and ultimate value of such a calculator, providing a critical assessment for anyone considering or researching tribal lending.

Understanding the Landscape: Tribal Loans and Their Appeal (and Peril)

Before dissecting the calculator itself, it’s crucial to grasp the context of tribal loans. These are typically small-dollar, unsecured loans marketed as a quick fix for emergencies. They are offered by companies owned and operated by Native American tribes, or by third-party lenders in partnership with tribes, allowing them to claim tribal sovereign immunity and operate outside of state regulations that cap interest rates.

While they provide a lifeline for some, their exorbitant interest rates often trap borrowers in a cycle of debt. A $500 loan could easily accrue thousands of dollars in interest over its lifespan, with borrowers often paying far more than the principal amount. The lack of regulatory oversight means terms can be less transparent, and consumer protections fewer, making an informed decision all the more vital.

What is a Tribal Loan Interest Calculator?

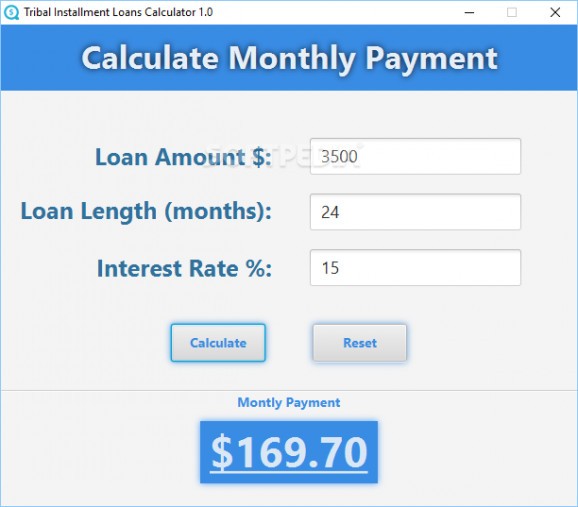

A Tribal Loan Interest Calculator is a digital tool, often found online or as a standalone application, designed to help potential borrowers understand the actual cost of a tribal loan. Unlike a simple interest calculator, it’s specifically tailored to account for the unique characteristics of these loans, which typically involve very high APRs and various repayment structures (often bi-weekly or monthly).

The core function of such a calculator is to translate complex interest rates and fees into easily digestible figures: the total cost of the loan, the total interest paid, and the specific amounts of each repayment. Given the high stakes involved with tribal loans, this tool isn’t just a convenience; it’s a critical component for financial literacy and risk assessment.

Key Features and Functionality

While specific calculators may vary, an effective Tribal Loan Interest Calculator typically includes the following features:

- Principal Amount Input: Allows the user to enter the initial loan amount they intend to borrow.

- Annual Percentage Rate (APR) Input: This is the most crucial input, representing the yearly cost of the loan, including all interest and fees. Given tribal loan APRs can range from 200% to over 1000%, accuracy here is vital.

- Loan Term Input: Users specify the duration of the loan, usually in weeks or months (e.g., 6 months, 24 weeks).

- Repayment Frequency Selection: Tribal loans often have varied repayment schedules. The calculator should allow users to select weekly, bi-weekly, or monthly payments.

- Total Interest Calculation: This output clearly shows the cumulative amount of interest the borrower will pay over the life of the loan. This figure is often shocking to first-time users.

- Total Repayment Amount: The sum of the principal borrowed plus the total interest, representing the full cost the borrower will incur.

- Individual Payment Amount: Provides the exact amount of each scheduled payment, aiding in budgeting.

- Amortization Schedule (Advanced Feature): Some calculators offer a detailed breakdown of each payment, showing how much goes towards principal and how much towards interest, and the remaining balance after each payment. This is incredibly valuable for understanding the payment structure.

- "What If" Scenarios: The ability to easily adjust inputs (APR, term, principal) to see how these changes impact the total cost, allowing for comparison of different loan offers or potential negotiation.

- Educational Resources/Warnings: Many responsible calculators will include disclaimers, warnings about the high cost of tribal loans, and suggestions for alternative financial solutions.

Advantages of Using a Tribal Loan Interest Calculator

The benefits of using such a calculator, particularly in the high-risk environment of tribal lending, are substantial:

- Unparalleled Transparency: Tribal loans are notorious for their complex and often obscure terms. A calculator cuts through the jargon, presenting the actual financial burden in clear, undeniable figures. This transparency is the calculator’s single most significant advantage.

- Informed Decision-Making: Armed with precise cost calculations, potential borrowers can make more informed decisions. They can weigh the immediate need for funds against the long-term financial strain, rather than being swayed solely by the promise of quick cash.

- Budgeting and Financial Planning: Knowing the exact amount of each payment and the total cost allows borrowers to integrate these figures into their personal budget. This helps prevent missed payments and further financial distress, which can lead to even higher fees.

- Avoidance of "Sticker Shock": Many borrowers only realize the true cost of a high-interest loan after they’ve committed. The calculator provides this "sticker shock" upfront, allowing them to reconsider before signing any agreement.

- Empowerment of the Borrower: In a financial transaction where the power dynamic often favors the lender, a calculator empowers the borrower with knowledge. It allows them to understand what they are signing up for, reducing the likelihood of being exploited.

- Comparative Analysis: For individuals considering multiple tribal loan offers, the calculator provides a standardized tool to compare the true costs side-by-side, helping them identify the "least bad" option if they feel they have no other recourse.

- Educational Value: Beyond immediate calculations, the tool serves as a practical lesson in compound interest and the devastating effects of high APRs. It highlights why even small loans can become massive debts.

- Accessibility and Convenience: Most calculators are free, online, and easy to use, making them readily available to anyone with an internet connection.

Disadvantages and Limitations

While invaluable, a Tribal Loan Interest Calculator is not a panacea and comes with its own set of disadvantages and limitations:

- It Doesn’t Solve the Underlying Problem: The most significant drawback is that the calculator merely illuminates the problem; it doesn’t solve it. It shows the high cost but doesn’t reduce it or offer alternatives. Borrowers still face the difficult choice of accepting an expensive loan or going without funds.

- Reliance on Accurate User Input: The calculator’s accuracy is entirely dependent on the user entering correct information, especially the APR. Lenders might present interest rates in different ways, or bury fees, making it difficult for users to find the true APR to input.

- May Not Account for All Fees: While APR is designed to encompass all costs, some tribal lenders might have hidden fees, late payment penalties, rollover fees, or other charges that might not be easily integrated into a standard calculator’s formula or clearly disclosed in the loan offer’s initial presentation.

- Can Potentially Normalize High Interest: By simply presenting the figures without strong ethical warnings, there’s a subtle risk that some users might normalize triple-digit APRs as "just how it is," rather than recognizing them as predatory.

- No Substitute for Financial Advice: The calculator is a tool, not a financial advisor. It cannot assess a borrower’s overall financial situation, suggest better alternatives, or offer guidance on debt management.

- Variations in Calculator Quality: Not all calculators are created equal. Some may be poorly designed, have limited features, or even contain calculation errors, leading to misleading results.

- Does Not Address Legal or Ethical Concerns: The calculator is purely mathematical. It cannot inform users about the legal standing of tribal loans in their state, the implications of tribal sovereignty, or the ethical debates surrounding this form of lending.

- Psychological Impact: Seeing the true, often staggering, cost of a tribal loan can be incredibly disheartening and anxiety-inducing, especially for individuals already in a vulnerable financial position. While necessary, this can be a difficult truth to confront.

Who Should Use This Calculator?

A Tribal Loan Interest Calculator is an essential tool for several groups:

- Prospective Borrowers: Anyone considering taking out a tribal loan absolutely must use this calculator to understand the full financial commitment before signing any agreement.

- Financial Counselors and Advisors: Professionals guiding clients through financial hardship can use this tool to illustrate the real costs of high-interest loans and help clients explore less damaging alternatives.

- Researchers and Journalists: Those studying the impact of predatory lending can utilize the calculator to model scenarios and demonstrate the financial burden on borrowers.

- Advocates for Consumer Protection: Groups working to highlight the dangers of high-cost credit can use the calculator as an educational instrument.

Recommendation and Conclusion

The Tribal Loan Interest Calculator, despite its limitations, emerges as an indispensable tool in the treacherous landscape of high-cost tribal lending. It serves as a beacon of transparency, illuminating the often-obscured financial realities of these loans.

Recommendation:

We strongly recommend that any individual contemplating a tribal loan utilize a reputable Tribal Loan Interest Calculator before committing to any agreement. This is not a tool to be purchased, but rather a vital resource to be accessed and thoroughly used.

However, this recommendation comes with a critical caveat: the calculator should be viewed as a first line of defense, not a solution. Its primary purpose is to inform, to prevent you from entering a debt trap blindly. It is crucial to remember that understanding the high cost is only the first step. The calculator cannot mitigate the inherent risks, the potential for a debt cycle, or the ethical dilemmas surrounding tribal loans.

Therefore, our ultimate recommendation is twofold:

- Use the Tribal Loan Interest Calculator meticulously to grasp the true, often alarming, cost of any proposed loan.

- Simultaneously, exhaust all other possible financial avenues before resorting to a tribal loan. Explore options like credit counseling, community assistance programs, loans from credit unions, or even negotiating with creditors. The calculator will vividly demonstrate why these alternatives are almost always superior.

In conclusion, the Tribal Loan Interest Calculator is a powerful instrument for financial literacy and consumer protection. It empowers individuals with the knowledge to navigate a complex and perilous financial product. While it cannot magically transform a bad loan into a good one, it provides the clarity needed to make the most informed decision possible, and ideally, to reconsider tribal loans altogether in favor of more sustainable and affordable solutions. It’s a necessary tool for survival in a market designed to profit from desperation.