Navigating the Path to Homeownership: Securing a Mortgage for a Modular Home on Reservation Property

The dream of homeownership is a universal aspiration, representing stability, security, and a place to build a future. For many individuals and families residing on Native American reservation lands, this dream is compounded by a desire to remain connected to their ancestral roots and community. The advent of modular homes offers an appealing solution for efficient and quality housing, but securing a mortgage for such a structure on reservation property presents a unique labyrinth of legal, financial, and administrative complexities. This article will delve into the intricate steps involved, explore the distinct advantages and disadvantages, and offer comprehensive recommendations for prospective homeowners embarking on this significant journey.

Introduction: A Unique Intersection of Housing and Land Tenure

Modular homes, built in sections in a factory and transported to the site for assembly, have gained popularity for their efficiency, quality control, and often lower costs compared to traditional stick-built homes. When placed on reservation property, however, these modern housing solutions meet a distinctive land tenure system. Reservation lands are often held in trust by the U.S. federal government for the benefit of Native American tribes or individual tribal members. This "trust status" means that the land cannot be bought or sold in the conventional sense, profoundly impacting how lenders view and collateralize a mortgage.

Securing a mortgage in this context is not a straightforward process. It requires a deep understanding of federal Indian law, tribal sovereignty, land lease agreements, and specialized lending programs designed to bridge the gap between conventional finance and the unique legal framework of reservation lands. This comprehensive review aims to demystify the process, empowering potential homeowners with the knowledge to navigate this challenging yet rewarding path.

Understanding the Landscape: Modular Homes and Reservation Land

Before diving into the mortgage process, it’s crucial to understand the two core components:

1. Modular Homes: Efficiency Meets Quality

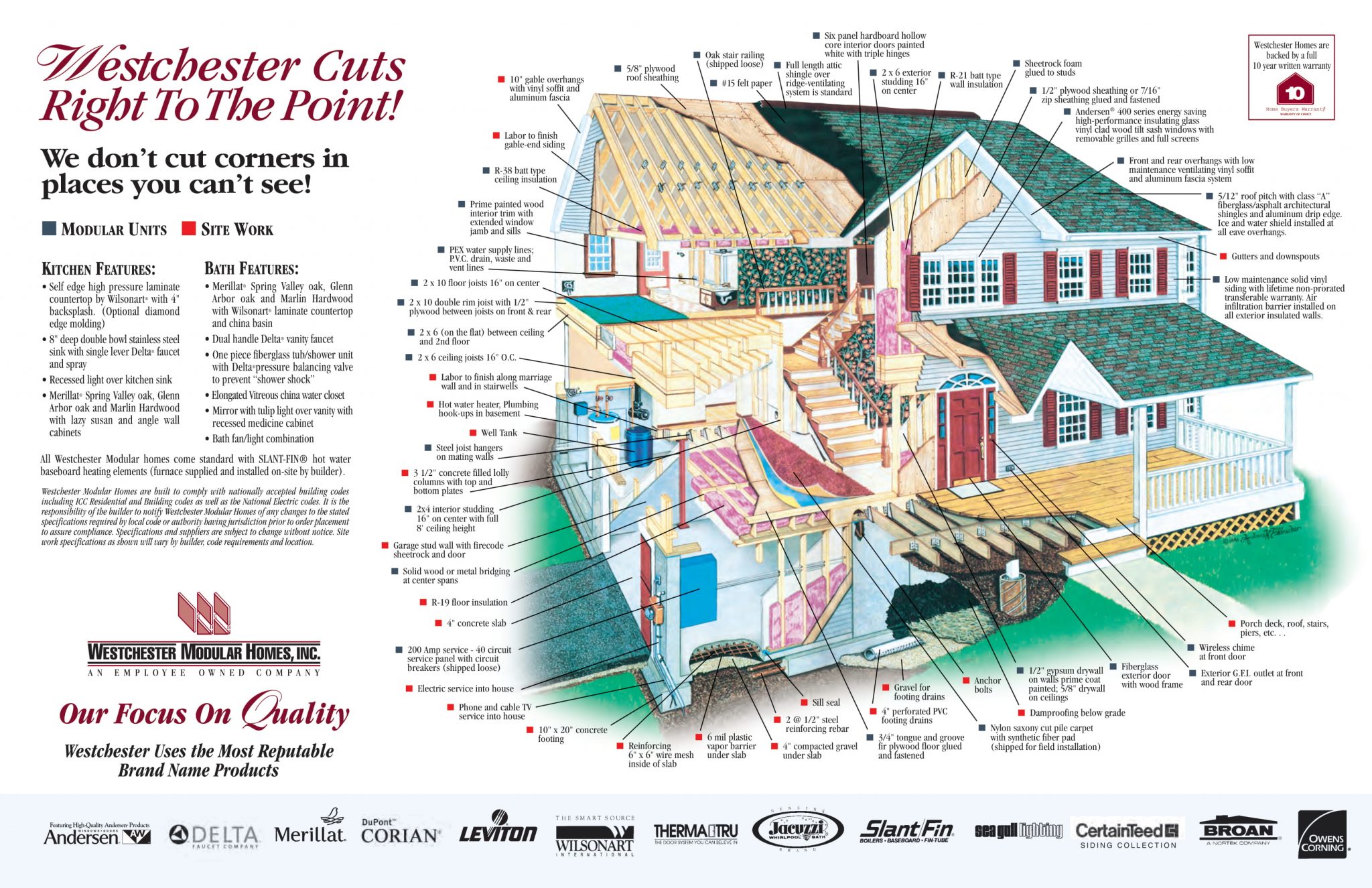

Modular homes are distinct from manufactured (mobile) homes. While both are factory-built, modular homes are constructed to the same state, local, and regional building codes as site-built homes. They are transported in sections, assembled on a permanent foundation, and become real property once affixed to the land.

Key Advantages:

- Efficiency & Speed: Factory production reduces construction time and avoids weather delays.

- Cost-Effectiveness: Often more affordable than comparable site-built homes due to economies of scale and reduced labor costs.

- Quality Control: Construction occurs in a controlled environment, leading to consistent quality and fewer defects.

- Design Flexibility: Wide range of designs and customization options available.

2. Reservation Property: A Unique Legal Framework

Reservation lands are held in a unique legal status, primarily as "trust land" or "restricted fee land."

- Trust Land: The U.S. government holds the legal title, but the beneficial ownership rests with the tribe or individual tribal members. This land cannot be mortgaged, alienated, or encumbered without federal approval.

- Restricted Fee Land: Owned by individual tribal members, but its sale or encumbrance is restricted and often requires federal approval.

The critical implication for mortgages is that a lender cannot place a lien directly on the land itself as collateral in the traditional way. Instead, financing relies on land lease agreements approved by the Bureau of Indian Affairs (BIA) and the tribe, which allow the homeowner to lease a parcel of trust land for a specific period (e.g., 25-50 years, often renewable) on which their home is built. The mortgage lien is then placed on the modular home and the leasehold interest, not the underlying land.

Steps to Securing a Mortgage on a Modular Home on Reservation Property

The process is multi-faceted and requires careful coordination between the homeowner, tribal government, BIA, and specialized lenders.

Step 1: Laying the Groundwork – Research and Preparation

- Engage with Tribal Housing Authority/Government: This is your first and most crucial step. Understand your tribe’s specific housing policies, land assignment procedures, and available resources. They can guide you on land allocation, necessary tribal resolutions, and local infrastructure availability (water, sewer, electricity).

- Secure a Land Assignment/Lease: You will need a formal land assignment or lease agreement from the tribe for the specific parcel where your modular home will be placed. This lease must be approved by the BIA and meet federal requirements to be considered mortgageable.

- Financial Readiness: Assess your credit score, income, and savings for a down payment and closing costs. Address any credit issues proactively.

- Choose a Modular Home Builder: Select a builder experienced with modular construction and, ideally, one with experience working on reservation lands. They should understand the specific permitting, transportation, and foundation requirements.

Step 2: Finding the Right Lender and Loan Program

This is often the most challenging step, as many conventional lenders are hesitant due to the complexities of trust land.

- HUD Section 184 Indian Home Loan Guarantee Program: This is by far the most significant and accessible program. Administered by the Office of Native American Programs (ONAP) within HUD, it provides a federal guarantee to lenders, reducing their risk and making loans on trust land viable. It covers both purchase and refinance, for new construction (including modular homes) and existing homes.

- Key Features: Low down payment, flexible credit requirements, competitive interest rates, and direct involvement with tribal governments and the BIA to facilitate land leases and approvals.

- VA Home Loan Program (for eligible Veterans): The Department of Veterans Affairs (VA) also offers a Native American Direct Loan (NADL) program for Native American veterans to purchase, construct, or improve homes on trust land. The VA acts as the direct lender, simplifying the process.

- USDA Rural Development Home Loans (Section 502 Direct/Guaranteed): For eligible low-income individuals in rural areas, USDA loans might be an option. However, their applicability to trust land can be more restrictive than HUD 184, often requiring specific agreements between USDA and the tribal government.

- Native Community Development Financial Institutions (CDFIs): These are mission-driven financial institutions that provide financial services to Native communities. Many specialize in Native American housing and can offer direct loans or assistance in navigating other programs.

- Conventional Lenders (Rare): While possible, it’s very difficult to secure a conventional mortgage for a modular home on trust land without a federal guarantee. Lenders typically require fee simple ownership for traditional collateral.

Step 3: Application and Underwriting

- Assemble Documentation: This will include standard financial documents (pay stubs, tax returns, bank statements) along with tribal enrollment verification, the BIA-approved land lease agreement, and modular home plans/specifications.

- Appraisal: An appraisal will be conducted on the modular home and the leasehold interest. Appraisers must be familiar with appraising homes on trust land, which can be challenging due to limited comparable sales.

- BIA and Tribal Approvals: The BIA must approve the land lease, the mortgage document, and often the utility easements. The tribal government will also need to approve the project according to their codes and regulations. This can be a time-consuming process.

- Environmental Review: Federal programs often require environmental reviews for new construction on trust land.

Step 4: Closing

Once all approvals are in place and underwriting is complete, the loan will close. This involves signing the mortgage documents, the BIA-approved lease, and other legal instruments. The lender will then disburse funds to the modular home builder and any other relevant parties.

Advantages (Pros) of Securing a Mortgage for a Modular Home on Reservation Property

- Achieving Homeownership on Ancestral Land: This is perhaps the most significant advantage, allowing tribal members to live and build equity within their community and on their traditional lands, fostering cultural continuity and family stability.

- Affordability and Efficiency: Modular homes offer a cost-effective and quicker route to homeownership compared to traditional stick-built homes, which is crucial in areas where housing shortages or high construction costs prevail.

- Quality and Customization: Modern modular homes are built to high standards and offer significant design flexibility, allowing homeowners to personalize their living space.

- Economic Development: New housing construction stimulates local economies, creating jobs and supporting tribal businesses.

- Access to Specialized Financing: Programs like HUD 184 and VA NADL are specifically designed to overcome the unique challenges of trust land, providing accessible and affordable financing options that wouldn’t otherwise exist.

- Community Building: Homeownership strengthens communities, encourages civic engagement, and provides a stable foundation for families.

Disadvantages (Cons) and Challenges

- Complexity of Land Tenure: The primary hurdle is the trust status of the land. Lenders cannot easily foreclose on trust land, making it inherently riskier without federal guarantees. This leads to limited lender participation.

- Extended Timelines: The multiple layers of approval (lender, tribal, BIA) for land leases, environmental reviews, and mortgage documents can significantly prolong the closing process, often taking many months.

- Limited Lender Pool: Despite programs like HUD 184, the number of lenders actively participating and truly understanding the nuances of trust land lending remains relatively small, limiting options for borrowers.

- Appraisal Challenges: Finding comparable sales for homes on leasehold trust land can be difficult, potentially impacting the appraised value and loan amount. Appraisers must be experienced in this niche market.

- Infrastructure Issues: Some reservation areas may lack adequate infrastructure (roads, water, sewer, utilities), increasing development costs and potentially delaying construction or limiting financing options.

- Resale Value and Market: The resale market for homes on trust land can be smaller and more complex than on fee simple land, potentially affecting the home’s long-term value and future liquidity. The leasehold interest may also diminish in value as its term shortens.

- Leasehold vs. Fee Simple: While providing homeownership, it’s crucial for borrowers to understand they are acquiring an interest in the structure and a leasehold interest in the land, not outright ownership of the land itself. This can be a psychological and financial distinction.

- Tribal-Specific Regulations: Each tribe may have its own specific codes, ordinances, and requirements for housing development, adding another layer of complexity.

Recommendations for Prospective Buyers

Navigating this complex landscape requires patience, persistence, and proactive engagement. Here are key recommendations:

- Start Early and Be Patient: This process is not quick. Begin researching and engaging with tribal authorities well in advance of your desired move-in date.

- Connect with Your Tribal Housing Authority (TTHA) Immediately: The TTHA is your most valuable resource. They can provide information on land assignments, tribal housing codes, local resources, and connect you with experienced lenders and builders.

- Prioritize HUD Section 184 or VA Native American Direct Loan (if eligible): These programs are specifically designed for this scenario and offer the most viable path to financing. Seek out lenders who are active and experienced with these programs.

- Understand Your Land Lease Thoroughly: Before signing, ensure you fully comprehend the terms, duration, renewal options, and any responsibilities or restrictions outlined in the BIA-approved lease agreement. Consider seeking independent legal counsel.

- Maintain Excellent Financial Records and Credit: While programs like HUD 184 offer flexibility, a strong financial profile will always make the process smoother and potentially lead to better terms.

- Work with Experienced Professionals: Seek out modular home builders, real estate agents (if applicable for existing homes), appraisers, and legal counsel who have specific experience working on reservation lands and with federal Indian housing programs.

- Advocate for Infrastructure Development: If your chosen parcel lacks essential infrastructure, engage with your tribal government to explore options for utility extensions or community development projects.

- Educate Yourself Continuously: The more you understand the legal and financial intricacies, the better equipped you will be to ask informed questions and make sound decisions.

- Build Relationships: Foster good relationships with your tribal government officials, BIA representatives, and your chosen lender. Open communication is key to resolving issues efficiently.

Conclusion

Securing a mortgage for a modular home on reservation property is undeniably a challenging endeavor, marked by unique legal frameworks and administrative hurdles. However, it is a profoundly rewarding one, offering tribal members the opportunity to achieve the dream of modern homeownership while strengthening their connection to family, community, and ancestral lands.

By understanding the distinct nature of modular homes and reservation land, leveraging specialized federal programs like HUD Section 184, and meticulously following the outlined steps, prospective homeowners can navigate this complex path. While the journey demands patience and diligence, the culmination in a quality, affordable home on sacred ground makes every effort worthwhile, contributing to individual prosperity and the vibrant future of Native American communities.