The Unseen Foundation: A Comprehensive Review of Property Surveys for Reservation Mortgages

The dream of land ownership, whether for future development, a personal retreat, or an investment, often begins with a "reservation mortgage." Unlike a standard residential mortgage that funds the purchase of an existing, well-defined home, a reservation mortgage typically involves raw land or property with an intent for future construction or significant alteration. In this unique financial landscape, where the collateral is often less tangible and more susceptible to unforeseen complications, one "product" stands out as absolutely indispensable: the comprehensive property survey.

This article will delve into the critical role of property surveys for reservation mortgages, exploring their multifaceted benefits, acknowledging their few drawbacks, and providing a robust recommendation for their procurement. We will argue that a property survey is not merely a bureaucratic requirement but a foundational investment that safeguards both the buyer’s aspirations and the lender’s security.

Understanding the Reservation Mortgage Landscape

A reservation mortgage, sometimes referred to as a land loan or construction-to-permanent loan (in its initial land acquisition phase), is fundamentally different from a conventional mortgage. When you finance an existing home, much of the due diligence around the property’s physical characteristics, boundaries, and encumbrances has likely been performed multiple times over its history. The property typically has clear access, established utility connections, and visible improvements.

With a reservation mortgage, you’re often dealing with:

- Undeveloped Land: Raw acreage, potentially without clear boundaries, existing utilities, or defined access.

- Future Intent: The value and usability of the property are often tied to future plans – building a home, developing a commercial site, or agricultural use.

- Increased Unknowns: Without existing structures, the property’s true dimensions, potential encumbrances, and suitability for its intended use are far less apparent.

These inherent uncertainties elevate the risk for both the borrower and the lender. The lender needs to be confident in the value and clear title of the collateral, while the borrower needs to ensure they are acquiring a property that meets their vision and won’t lead to costly surprises down the line. This is precisely where the property survey transforms from a suggestion into an absolute necessity.

The Indispensable Role of Property Surveys

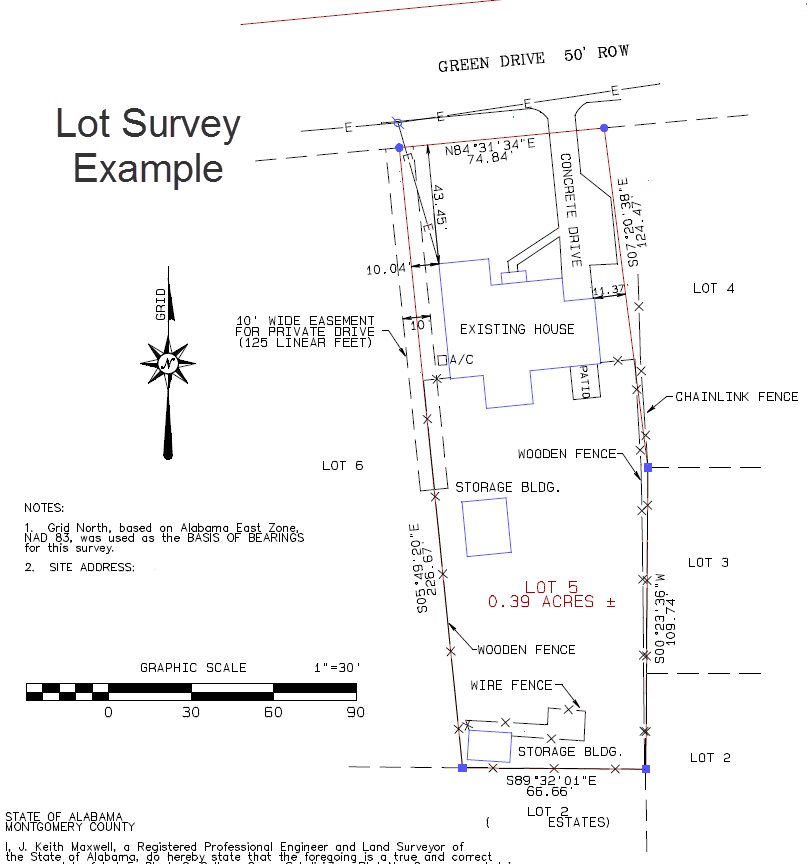

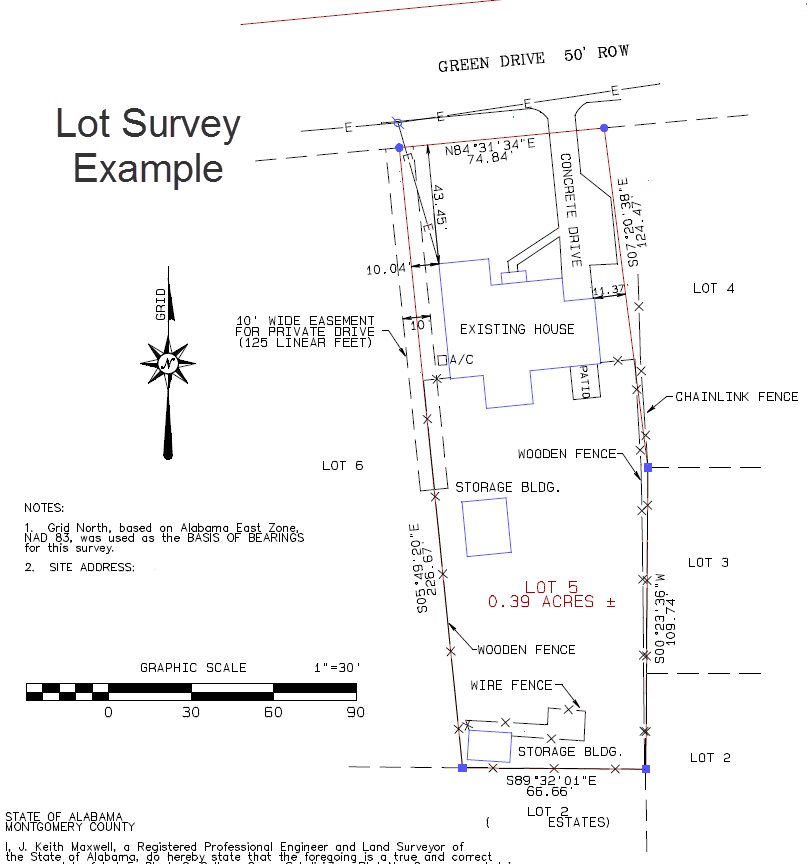

A property survey, performed by a licensed land surveyor, is a detailed document that precisely delineates the boundaries of a parcel of land, identifies existing improvements, and notes any easements, encroachments, or other features that could affect the property’s use or value. For reservation mortgages, the gold standard is often an ALTA/NSPS Land Title Survey, which is designed to meet the specific requirements of lenders and title insurers, offering a highly detailed and comprehensive view of the property.

Here are the key features and components typically included in a comprehensive survey relevant to reservation mortgages:

- Precise Boundary Delineation: The most fundamental aspect, establishing the exact legal limits of the property using monuments, markers, and legal descriptions. This is crucial for understanding what you own.

- Identification of Easements: These are rights held by others to use a portion of your property for a specific purpose (e.g., utility lines, access roads, drainage). A survey reveals their location, dimensions, and type, which can significantly impact future development or use.

- Discovery of Encroachments: A survey will identify if any part of a neighboring property (like a fence, building, or driveway) extends onto your land, or vice-versa. Unresolved encroachments can lead to costly legal disputes.

- Location of Improvements: Even on undeveloped land, there might be old structures, remnants of previous use, or natural features like significant trees or water bodies. The survey maps these out.

- Access and Adjacency to Public Roads: Confirms legal and physical access to public roadways, a critical factor for any property and a common concern for land parcels.

- Zoning and Land Use Designations: While not directly mapped by the surveyor, the survey often includes information about the property’s zoning classification and any known land use restrictions, which dictates what can and cannot be built.

- Flood Zone Determinations: Identifies if any part of the property lies within a designated flood hazard area, impacting insurance costs and buildability.

- Utilities and Servitudes: Locates existing utility lines (water, sewer, gas, electric) and their associated easements, indicating where services might be available or how future connections can be made.

- Topography and Contours: Often included (or as an add-on) for reservation mortgages, especially when planning construction, showing elevation changes across the property.

- Title Exceptions: The survey works in conjunction with the title commitment, providing a visual representation of the exceptions listed in the title report, such as specific easements or rights-of-way.

Benefits (Kelebihan) of a Property Survey for Reservation Mortgages

The investment in a property survey for a reservation mortgage yields a multitude of benefits for all parties involved:

For the Buyer/Borrower:

- Peace of Mind and Informed Decision-Making: This is paramount. A survey removes ambiguity, allowing the buyer to understand precisely what they are purchasing. There are no "hidden" boundary issues, unknown easements, or surprising encroachments.

- Avoidance of Costly Disputes: Boundary disputes with neighbors can be emotionally draining and financially ruinous. A clear, legally defensible survey acts as a preventative measure.

- Ensured Usability and Development Potential: For land intended for future construction, the survey confirms setbacks, buildable areas, and access points, ensuring the buyer’s vision is physically feasible and compliant with local regulations.

- Accurate Budgeting and Planning: Knowing the exact location of utilities, flood zones, and easements allows for more accurate planning of infrastructure, construction, and associated costs, preventing expensive mid-project changes.

- Protection Against Fraud or Misrepresentation: A survey independently verifies the property’s characteristics, protecting the buyer from unintentional errors or deliberate misrepresentation by sellers.

- Maximizing Property Value: By clearly defining the property and resolving potential issues upfront, the survey enhances the long-term value and marketability of the land.

- Compliance with Lender Requirements: Most lenders for reservation mortgages will require a survey, particularly an ALTA/NSPS survey, as a condition for financing. Having one facilitates the loan process.

For the Lender:

- Risk Mitigation and Collateral Validation: The survey provides a precise understanding of the collateral’s boundaries, size, and any encumbrances, allowing the lender to accurately assess risk and ensure the property’s value.

- Clear Title Insurance Coverage: Title insurance policies rely heavily on surveys to define the property accurately and to identify exceptions to coverage (e.g., unrecorded easements found by the survey). This protects the lender’s interest.

- Legal Defensibility: In the event of a default or dispute, a comprehensive survey provides clear, legally recognized documentation of the property’s extent and features, protecting the lender’s investment.

- Compliance and Due Diligence: The survey demonstrates that the lender has performed appropriate due diligence, meeting industry standards and regulatory requirements.

For Title Insurers:

- Reduced Claims Exposure: By identifying potential title issues (like unrecorded easements or encroachments) before policy issuance, surveys significantly reduce the likelihood of future claims against the title policy.

- Accurate Exception Listing: The survey allows title insurers to accurately list specific exceptions to coverage, providing clarity to all parties regarding what is and isn’t covered.

Drawbacks (Kekurangan) of a Property Survey

While overwhelmingly beneficial, property surveys do come with a few considerations:

- Cost: This is often the primary concern. A comprehensive ALTA/NSPS survey for a larger or more complex parcel of land can be significantly more expensive than a basic boundary survey for a residential lot, ranging from hundreds to several thousands of dollars, depending on the size, location, and complexity of the property.

- Time Commitment: Conducting a thorough survey takes time. This includes research, fieldwork, and drafting. Depending on the surveyor’s workload and the property’s characteristics, it can add several weeks to the closing timeline, potentially delaying the reservation mortgage process.

- Potential for Unforeseen Issues: While a benefit in the long run, the survey might uncover unexpected problems such as undisclosed easements, significant encroachments, or zoning restrictions that could complicate or even derail the purchase. Addressing these issues can add further cost and delay.

- Finding a Qualified Surveyor: Not all surveyors are equal. Finding a reputable, experienced, and licensed surveyor who understands the specific requirements of an ALTA/NSPS survey for a reservation mortgage can sometimes be a challenge, particularly in rural areas.

- Obsolescence: While a survey provides a snapshot in time, property characteristics can change. New improvements, altered boundaries (e.g., due to eminent domain), or updated zoning laws can render an older survey less accurate or incomplete over time.

Recommendation (Rekomendasi Pembelian)

For anyone considering a reservation mortgage, the recommendation is unequivocal: A comprehensive property survey, ideally an ALTA/NSPS Land Title Survey, is an absolutely essential investment. It is not an optional extra but a foundational component of sound due diligence.

When to Get One:

Procure the survey as early as possible in the transaction process, ideally after the purchase agreement is signed but before the financing is fully committed. This allows ample time for the survey to be completed, for any discovered issues to be addressed, and for the lender and title company to review it thoroughly.

Choosing the Right Surveyor:

This is critical to ensuring the quality and accuracy of the survey. Consider the following:

- Licensing and Insurance: Ensure the surveyor is licensed in your state and carries professional liability insurance (Errors and Omissions).

- Experience: Choose a surveyor with extensive experience in the type of property you are purchasing (e.g., large acreage, commercial development, rural land) and with ALTA/NSPS surveys.

- Local Knowledge: A surveyor familiar with local regulations, historical records, and geological conditions can be invaluable.

- References and Reputation: Ask for references and check online reviews.

- Clear Scope of Work: Ensure the surveyor clearly understands the requirements of your reservation mortgage lender and the specific add-ons (Table A items for ALTA surveys) that are needed. Get a detailed quote outlining all services.

- Communication: Choose a surveyor who communicates clearly and promptly, explaining complex findings in an understandable manner.

What to Look For in the Survey Report:

- Clarity and Legibility: The plat should be easy to read, with clear labels and accurate measurements.

- Completeness: Ensure all required elements for an ALTA/NSPS survey are included, along with any specific Table A items requested by your lender or title company.

- Detailed Notes: The report should include detailed notes explaining any discrepancies, easements, encroachments, or other significant findings.

- Professional Seal: The survey must be signed and sealed by the licensed surveyor.

Cost-Benefit Analysis:

While the upfront cost of a comprehensive survey might seem substantial, it pales in comparison to the potential expenses and headaches of discovering boundary disputes, unbuildable areas, or unrecorded easements after closing. Legal fees, construction delays, re-design costs, or even property value depreciation can quickly dwarf the initial survey expense. View the survey as an insurance policy and a blueprint for your future plans, not just a line item on a closing statement.

Conclusion

For reservation mortgages, where the promise of future value is tied to the unknown characteristics of the land itself, the property survey is the bedrock upon which secure ownership is built. It acts as an independent verifier, a risk mitigator, and a crucial planning tool. While it demands an upfront investment of time and money, its benefits – peace of mind, protection from disputes, assurance of usability, and facilitation of lending – far outweigh the drawbacks. By meticulously defining the unseen foundation of your future property, a comprehensive survey empowers you to transform the dream of land ownership into a tangible, secure, and well-understood reality. It is, without question, the most vital purchase recommendation for anyone embarking on the journey of a reservation mortgage.