This guide aims to provide a comprehensive, professional, and step-by-step tutorial for Native American artisans and crafters seeking microloan financing to support and grow their creative enterprises. It addresses the unique context, challenges, and opportunities within Indigenous communities, offering a clear pathway to accessing capital.

Empowering Indigenous Creativity: A Professional Guide to Native American Microloans for Artisans and Crafters

Introduction

Indigenous art and craftsmanship are vital expressions of culture, heritage, and identity. From intricate beadwork and traditional pottery to contemporary painting and digital art, Native American artisans contribute significantly to the cultural fabric and economic well-being of their communities. However, accessing traditional financial services often presents significant barriers for these entrepreneurs, hindering their ability to scale their businesses, acquire necessary materials, or invest in marketing.

Native American microloans offer a crucial solution, providing accessible, culturally sensitive capital designed to meet the specific needs of Indigenous artists and crafters. This professional guide will walk you through the process, from understanding the unique landscape of Indigenous finance to successfully applying for and managing a microloan, empowering you to turn your artistic passion into a thriving, sustainable enterprise.

I. Understanding the Landscape: Why Native American Microloans?

Before delving into the application process, it’s essential to understand the unique financial ecosystem that makes Native American microloans so vital for artisans.

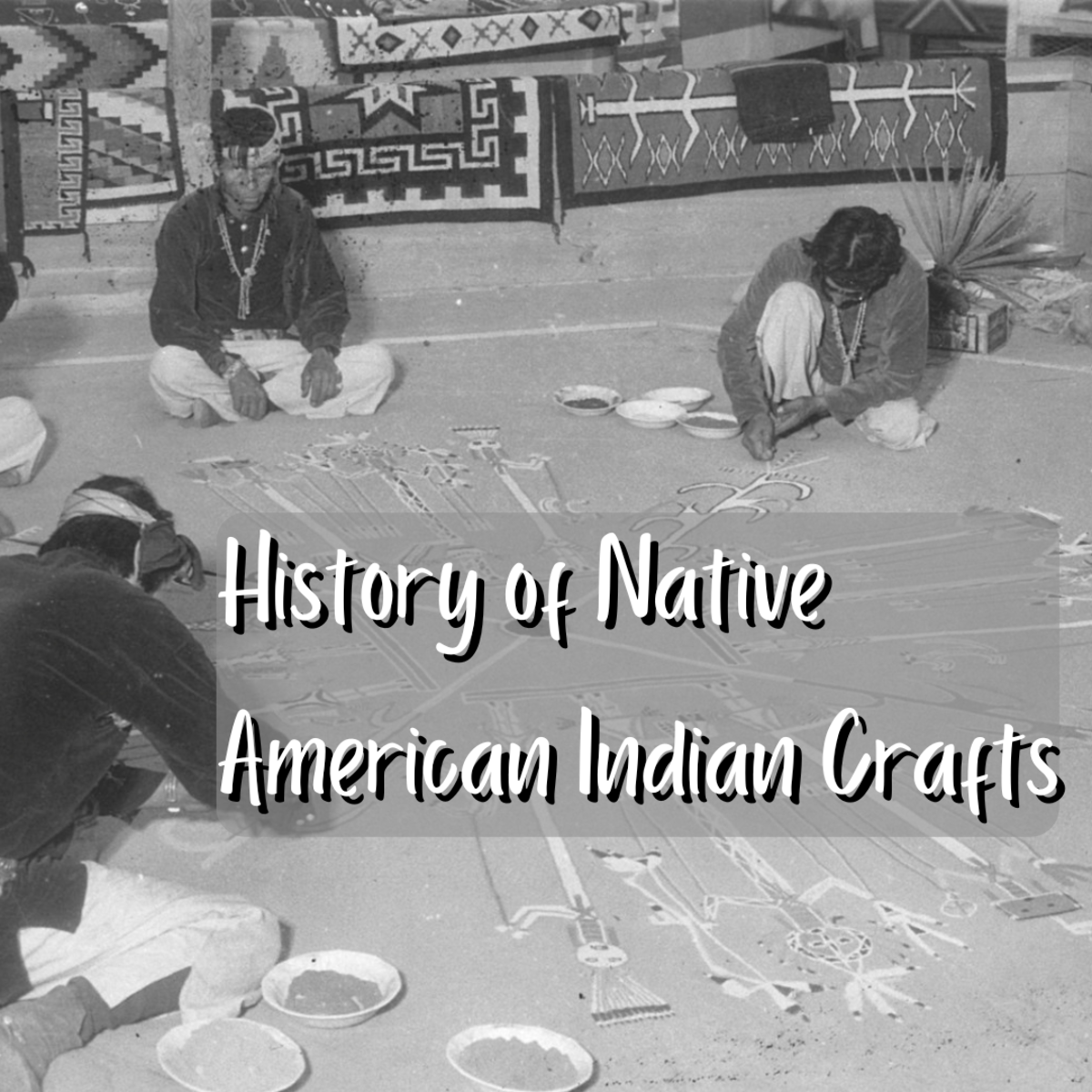

A. The Unique Value of Indigenous Art and Craft

Indigenous art is more than just a product; it often embodies generations of knowledge, storytelling, and cultural preservation. It represents a tangible link to heritage, making its production and dissemination profoundly significant. Supporting Indigenous artisans through tailored financial tools helps preserve these invaluable traditions while fostering economic self-sufficiency.

B. Barriers to Traditional Financing for Native Artisans

Many Native American artisans face systemic challenges when seeking capital from mainstream banks:

- Lack of Collateral: Traditional lenders often require significant collateral, which many artisans, especially those just starting, may not possess.

- Limited Credit History: Past financial circumstances or a lack of engagement with credit systems can result in a thin or non-existent credit file.

- Geographical Isolation: Many tribal lands are remote, limiting access to physical bank branches and financial advisors.

- Cultural Disconnect: Mainstream financial institutions may not understand the unique business models or cultural significance of Indigenous art.

- Informal Business Structures: Many artisans operate informally, making it difficult to present a traditional business case.

C. The Role of Native Community Development Financial Institutions (CDFIs)

Native CDFIs are the cornerstone of Indigenous microfinance. These mission-driven financial institutions are dedicated to providing fair and responsible financial products and services to Native American communities. They are:

- Culturally Competent: Staff often have a deep understanding of tribal communities, traditions, and economic realities.

- Community-Focused: Their primary goal is community development and economic empowerment, not just profit.

- Flexible: They often offer more flexible terms, lower interest rates, and tailored products compared to traditional banks.

- Integrated with Technical Assistance: Many CDFIs couple loans with essential business training, mentorship, and financial literacy programs.

II. What Exactly Are Native American Microloans?

Microloans are small loans, typically ranging from a few hundred dollars up to $50,000, designed to support small businesses and entrepreneurs who may not qualify for traditional bank loans.

A. Definition and Purpose

For Native American artisans, microloans serve various purposes:

- Material Acquisition: Purchasing high-quality raw materials (beads, silver, clay, fabric, wood, paint, etc.).

- Tool and Equipment Investment: Acquiring specialized tools, kilns, looms, sewing machines, or digital design software.

- Studio Space Rental or Improvement: Securing a dedicated workspace.

- Marketing and Sales: Funding for website development, photography, market fees, or travel to art shows.

- Working Capital: Covering day-to-day operational expenses.

- Capacity Building: Investing in training, workshops, or apprenticeships.

B. Key Characteristics

- Lower Loan Amounts: Tailored for small-scale needs.

- Flexible Repayment Terms: Often structured to align with an artisan’s seasonal sales cycles or project timelines.

- Lower Interest Rates: Generally more affordable than predatory lenders.

- Technical Assistance (TA): Crucially, these loans are often paired with business support services, a key differentiator from traditional loans.

C. How They Differ from Grants

It’s vital to remember that microloans are loans, not grants. They must be repaid with interest. While grants offer non-repayable funds, loans build credit history, foster financial discipline, and are more widely available for business development.

III. Identifying Potential Microloan Providers

Finding the right lender is a critical first step. Focus your search on institutions specifically serving Indigenous communities.

A. Native Community Development Financial Institutions (CDFIs)

This is your primary resource. Organizations like Oweesta Corporation and Native CDFI Network provide directories and support for local Native CDFIs across the country. Research CDFIs serving your specific tribal nation or geographic region. Examples include:

- Tribal CDFIs: Operated by or for a specific tribe.

- Regional Native CDFIs: Serving multiple tribes or a broader Indigenous population in a defined area.

B. Tribal Economic Development Offices

Many tribal governments have economic development departments that offer direct loans, loan guarantees, or can connect you with preferred lending partners.

C. Non-Profit Organizations with an Indigenous Focus

Some non-profits dedicated to Indigenous economic development or arts may offer microloan programs or provide referrals to partner lenders.

D. Small Business Administration (SBA) Microloan Program

While not exclusively Indigenous, the SBA’s Microloan Program works with intermediary lenders (often CDFIs) to provide small loans. A Native CDFI might be an SBA intermediary, so inquire about this possibility.

IV. The Step-by-Step Application Process: A Professional Tutorial

Securing a microloan requires careful preparation and a clear understanding of your business needs. Follow these steps meticulously.

Step 1: Self-Assessment and Business Concept Refinement

Before approaching any lender, thoroughly understand your artistic business.

- Define Your Art/Craft: What do you create? What makes it unique?

- Identify Your Market: Who are your customers? Where do they buy your work (online, galleries, markets)?

- Assess Your Needs: Why do you need a loan? Be specific. (e.g., "$2,000 for a new pottery wheel," "$500 for website development," "$1,500 for materials for the upcoming market season").

- Set Clear Goals: What will this loan enable you to achieve? (e.g., "Increase production by 25%," "Expand into online sales," "Exhibit at three new art shows").

Step 2: Develop a Comprehensive Business Plan

Even for a microloan, a well-structured business plan is essential. It demonstrates your seriousness and understanding of your enterprise. Many Native CDFIs offer assistance in developing these plans.

- Executive Summary: Briefly summarize your business, mission, and loan request.

- Company Description: Detail your business structure (sole proprietorship, LLC), mission, vision, and values (especially cultural significance).

- Products & Services: Describe your art/craft, its production process, and any unique selling propositions. Include photos.

- Market Analysis: Who are your target customers? Who are your competitors? What is the demand for your work?

- Marketing & Sales Strategy: How will you reach customers? (online, art fairs, galleries, social media).

- Management Team: Your background, skills, and any relevant experience.

- Operations Plan: How will you produce your art? What is your workspace like?

- Financial Projections: This is crucial. Include:

- Startup Costs: If applicable, list everything you need to start.

- Current Financials: If existing, profit & loss statements, balance sheet.

- Projected Income Statement: Forecast your sales and expenses for the next 1-3 years.

- Cash Flow Projections: Show how money will move in and out of your business.

- Loan Request & Use of Funds: Clearly state the loan amount and exactly how you will spend it.

- Repayment Plan: How will you generate the income to repay the loan?

Step 3: Gather Necessary Documentation

Lenders will require various documents to verify your identity, tribal affiliation, and financial standing.

- Personal Identification: Driver’s license, state ID.

- Tribal Enrollment Verification: Your tribal ID or official documentation.

- Proof of Residency: Utility bills, lease agreement.

- Business Registration (if applicable): LLC documents, DBA (Doing Business As) registration.

- Personal Financial Statements: List of assets (bank accounts, property) and liabilities (debts, credit cards).

- Personal Tax Returns: Usually for the last 2-3 years.

- Business Financial Statements: If your business is already operating, provide income statements, balance sheets, and cash flow statements.

- Bank Statements: Personal and business (if separate) for the last 6-12 months.

- Resume/CV: Highlighting your artistic background and any business experience.

- Art Portfolio: High-quality images of your work, demonstrating your skill and market readiness.

Step 4: Research and Select a Lender

Don’t just apply to the first lender you find.

- Eligibility: Confirm you meet their specific criteria (e.g., tribal affiliation, geographic area, business type).

- Loan Terms: Compare interest rates, repayment periods, and any fees.

- Technical Assistance: Does the lender offer business coaching, workshops, or mentorship? This is a significant added value.

- Reputation: Speak to other artisans who have worked with them.

Step 5: Prepare and Submit Your Application

- Complete All Sections: Ensure every field is filled out accurately and completely.

- Clarity and Conciseness: Present your information clearly.

- Honesty: Provide truthful information.

- Review: Double-check for any errors or omissions before submission.

- Follow Instructions: Adhere to the lender’s preferred submission method (online portal, email, mail).

Step 6: The Interview and Follow-Up

Lenders may request an interview to discuss your business plan and personal qualifications.

- Be Prepared: Be ready to articulate your business vision, financial needs, and repayment strategy.

- Ask Questions: This is your opportunity to clarify any terms or understand the support services available.

- Respond Promptly: If the lender requests additional information or clarification, provide it quickly.

Step 7: Loan Approval and Agreement

If approved, you will receive a loan agreement.

- Read Carefully: Understand all terms and conditions, including interest rate, repayment schedule, fees, and any collateral requirements.

- Seek Clarification: If anything is unclear, ask the lender to explain it thoroughly. Consider having a trusted advisor review it.

- Sign Once Understood: Only sign when you are fully comfortable with the terms.

Step 8: Loan Disbursement and Utilization

Once the agreement is signed, the funds will be disbursed.

- Use Funds as Intended: Crucially, use the loan money exactly as outlined in your business plan and loan application. This builds trust and sets you up for future financing.

- Track Expenses: Keep meticulous records of how the funds are spent.

V. Beyond the Loan: Sustaining Your Artistic Enterprise

Receiving a microloan is a significant achievement, but sustained success requires ongoing effort.

A. Repayment Discipline

- On-Time Payments: Make every payment on time. This builds a positive credit history and strengthens your relationship with the lender.

- Communication: If you anticipate difficulty making a payment, contact your lender immediately. They may be able to work with you on a temporary adjustment.

B. Technical Assistance and Mentorship

- Engage with Your Lender: Take advantage of any business coaching, workshops, or mentorship programs offered by the CDFI. These resources are invaluable.

- Seek External Mentors: Connect with experienced Indigenous artists or business owners.

C. Financial Literacy and Business Management

- Record Keeping: Maintain accurate records of all income and expenses.

- Budgeting: Regularly review and update your business budget.

- Pricing Strategy: Ensure your pricing covers costs, reflects your skill, and generates profit.

D. Marketing and Sales Strategies

- Online Presence: Develop a professional website or e-commerce platform.

- Social Media: Use platforms like Instagram, Facebook, and TikTok to showcase your work and connect with customers.

- Art Markets and Galleries: Participate in local, regional, and national Indigenous art markets and seek representation in galleries.

E. Networking within the Indigenous Arts Community

Connect with fellow artists, participate in cultural events, and support the broader Indigenous arts ecosystem. This can lead to collaborations, shared resources, and new opportunities.

VI. Benefits of Native American Microloans for Artisans

- Access to Capital: Overcomes barriers to traditional financing.

- Business Growth: Enables investment in materials, equipment, and marketing.

- Cultural Preservation: Supports the continuation and innovation of traditional arts.

- Economic Empowerment: Fosters self-sufficiency and generates income for individuals and communities.

- Credit Building: Establishes a positive credit history, opening doors for future financing.

- Tailored Support: Often comes with valuable business guidance and mentorship.

VII. Key Considerations and Potential Challenges

- Repayment Responsibility: A loan is a serious financial commitment.

- Business Management Skills: Requires discipline in finances, marketing, and production.

- Market Fluctuations: The art market can be unpredictable; have a contingency plan.

- Eligibility Criteria: Ensure you meet all specific requirements of the chosen lender.

- Time Commitment: The application process and ongoing business management require dedication.

VIII. Strategies for Success

- Develop a Robust Business Plan: This is your roadmap.

- Practice Financial Discipline: Manage your money wisely, both personally and professionally.

- Seek Mentorship: Learn from those who have walked a similar path.

- Embrace Technology: Utilize online tools for marketing, sales, and record-keeping.

- Network Extensively: Build relationships within your community and the art world.

- Stay Persistent: The journey of entrepreneurship has its ups and downs; resilience is key.

Conclusion

Native American microloans are more than just financial products; they are powerful tools for cultural revitalization, economic empowerment, and artistic growth within Indigenous communities. By understanding the landscape, meticulously preparing your application, and committing to sound business practices, you can leverage these resources to elevate your art, sustain your craft, and contribute to the vibrant legacy of Indigenous creativity. This guide provides the framework; your passion and dedication will forge the path to success. Start your journey today, and empower your artistic vision.