A Comprehensive Guide to Native American Loans and Assistance for Funeral Costs

The passing of a loved one is an emotionally devastating experience, often compounded by the significant and immediate financial burden of funeral and burial expenses. For Native American communities, these costs can be particularly challenging due to historical economic disparities, remote locations, and the desire to honor rich cultural traditions that may require specific ceremonies or practices. This guide aims to provide a professional, step-by-step overview of potential avenues for financial assistance, focusing on Native American-specific resources, federal programs, and other options available to help cover funeral costs.

Understanding the Unique Context

Before delving into financial solutions, it’s crucial to acknowledge the unique cultural, historical, and economic context surrounding Native American communities:

- Cultural Significance of Funerals: For many Native American tribes, funeral and burial rites are deeply spiritual and integral to cultural identity. They often involve specific ceremonies, gatherings, and traditions that require time, resources, and community involvement. Honoring these traditions is paramount.

- Economic Challenges: Generations of systemic issues, including land dispossession, forced assimilation, and limited economic development opportunities, have led to significant wealth disparities. Many Native American families face higher rates of poverty and unemployment, making unexpected funeral costs an even greater hardship.

- Sovereignty and Diversity: Each of the 574 federally recognized Native American tribes is a sovereign nation with its own distinct culture, governance, and resources. What is available from one tribe may differ significantly from another. Generalizations should be avoided, and direct tribal contact is always the first and most critical step.

- Remote Locations: Many tribal communities are located in rural or remote areas, which can limit access to mainstream financial services, affordable funeral homes, and transportation, potentially increasing overall costs.

Step 1: Immediate Actions and Information Gathering

The period immediately following a death is chaotic. Taking these initial steps can help streamline the process of seeking assistance.

-

Gather Essential Information:

- Deceased’s Information: Full legal name, date of birth, date of death, Social Security number, tribal enrollment number, veteran status (if applicable), last known address.

- Next of Kin Information: Your full name, relationship to the deceased, contact information.

- Financial Information: Any existing life insurance policies, bank accounts, or assets the deceased may have had.

- Funeral Home Estimate: Obtain a detailed itemized estimate from the chosen funeral home. This will be crucial for any application for assistance.

-

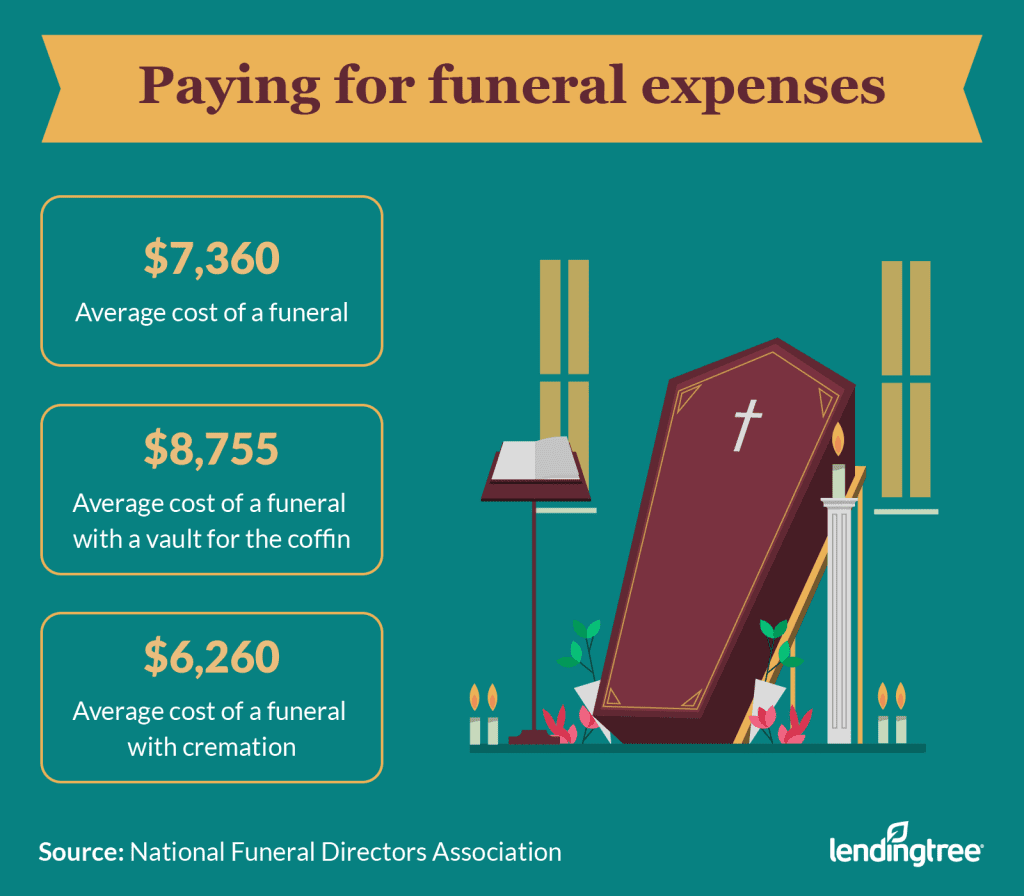

Understand Funeral Costs: Funeral expenses can vary widely but typically include:

- Basic Services Fee: Non-declinable fee for the funeral director’s services.

- Casket or Urn:

- Embalming and Other Preparation:

- Viewing and Funeral Service:

- Cremation or Burial Plot:

- Graveside Service:

- Transportation: Hearse, family travel.

- Death Certificates: Multiple copies are often needed.

- Headstone or Marker:

- Cultural Ceremony Costs: Depending on tribal traditions.

Step 2: Exploring Primary Avenues for Assistance

This section details the most relevant sources of financial aid, starting with those specifically tailored for Native American individuals.

A. Tribal Government and Social Services

This is almost always the first and most important point of contact for any Native American individual seeking assistance.

-

Contact Your Tribal Office/Social Services Department:

- Who to Contact: Reach out to the deceased’s (or your own) specific tribal government. Look for departments such as Social Services, Family Services, Human Services, Elder Services, or General Assistance.

- What to Ask For: Inquire about emergency financial assistance for funeral costs, burial programs, or any specific tribal funds allocated for such purposes. Many tribes have limited funds but prioritize assisting their enrolled members in times of need.

- Eligibility: Tribal programs are typically limited to enrolled tribal members. Be prepared to provide proof of enrollment.

- Documentation: You will likely need the death certificate, funeral home estimate, and proof of tribal enrollment.

- Referrals: Even if a tribe cannot provide direct financial aid, they may be able to refer you to other organizations, federal programs, or community resources.

-

Tribal Loan Programs:

- Some tribes operate their own financial institutions or have partnerships that offer small, low-interest loans to tribal members for various needs, including emergencies. These are distinct from commercial lenders and are often designed to be culturally sensitive and accessible.

- Inquire: Ask the tribal office if such a program exists.

- Terms: Understand the interest rates, repayment schedules, and eligibility requirements, which are often more favorable than commercial options.

B. Federal and State Assistance Programs

Several government programs, both federal and state, can provide assistance, though they may not be specifically "Native American loans."

-

Bureau of Indian Affairs (BIA) General Assistance:

- Purpose: The BIA’s General Assistance program is designed to provide financial aid to eligible needy Native Americans who reside in designated service areas and are not eligible for similar state, local, or tribal welfare programs. While primarily for basic living expenses, in some cases, emergency funds may be available or referrals made for critical needs like funeral costs.

- Contact: Locate your nearest BIA Agency or Regional Office.

- Eligibility: Must be an enrolled member of a federally recognized tribe, reside in a BIA service area, and meet financial need criteria.

- Limitations: Funds are often limited and vary by region. It’s not a direct funeral payment program but a potential pathway for general emergency aid.

-

Veterans Affairs (VA) Burial and Memorial Benefits:

- Eligibility: If the deceased was a veteran and received an honorable discharge, the VA provides significant burial and memorial benefits.

- Benefits: These can include a burial plot in a VA national cemetery, a headstone or marker, a Presidential Memorial Certificate, and potentially a monetary burial allowance.

- How to Apply: Contact the Department of Veterans Affairs (VA) directly or work with a funeral home experienced in VA claims. You will need the veteran’s discharge papers (DD-214).

-

Social Security Administration (SSA) Lump-Sum Death Payment:

- Eligibility: If the deceased worked long enough under Social Security, their surviving spouse or child may be eligible for a one-time lump-sum death payment of $255.

- Contact: Apply at your local Social Security office or online.

- Limitations: This is a small amount, but every bit helps.

-

State and Local Social Service Programs:

- Medicaid/Medical Assistance: In some states, if the deceased was receiving Medicaid or similar state-funded medical assistance, there may be provisions for burial or cremation assistance, particularly for individuals with no assets.

- General Assistance/Emergency Relief: Many states and counties have local social service departments that offer emergency financial aid to low-income residents, regardless of tribal affiliation.

- Contact: Research your specific state and county’s Department of Social Services or Human Services.

C. Non-Profit Organizations and Community Support

-

Native American Non-Profits:

- Several non-profit organizations focus on supporting Native American communities. Some may offer emergency financial assistance or have specific funds for funeral costs.

- Research: Search online for "Native American non-profits funeral assistance" or inquire with your tribal office for local recommendations. Examples might include local Native American centers or specific foundations.

-

Religious Organizations:

- Local churches, spiritual centers, or other religious institutions within the community (Native American churches, interfaith groups) sometimes have benevolent funds or can organize community support for grieving families.

-

Crowdfunding and Community Fundraisers:

- Platforms like GoFundMe or similar services can be effective ways to raise money from friends, family, and the wider community.

- Community Events: Organizing traditional community fundraisers (e.g., bake sales, dinners, cultural events) can also rally support and provide financial aid while strengthening community bonds.

Step 3: Considering Commercial Loan Options (with Caution)

While not ideal, commercial loans might be considered as a last resort if all other avenues have been exhausted. Proceed with extreme caution, as these options often come with high interest rates and can lead to significant debt.

-

Personal Loans from Banks or Credit Unions:

- Pros: Generally lower interest rates than payday loans, structured repayment.

- Cons: Requires a good credit score and stable income, which may be a barrier for many. Approval can take time.

- Recommendation: Prioritize credit unions, especially those that may have community development financial institution (CDFI) certification or a mission to serve underserved communities, as they often have more flexible terms and a focus on member well-being.

-

Short-Term/Payday Loans:

- Pros: Quick access to funds.

- Cons: EXTREMELY HIGH INTEREST RATES (often 300-700% APR or more). These are predatory and can trap borrowers in a cycle of debt. AVOID THESE WHENEVER POSSIBLE.

- Warning: Many tribal lending entities operate outside state regulations, offering high-interest loans. While some are legitimate tribal enterprises, others are less scrupulous. Research thoroughly and understand all terms before engaging.

-

Credit Cards:

- Pros: Immediate access to funds if you have available credit.

- Cons: High interest rates if not paid off quickly, adding to long-term debt.

Step 4: The Application Process and Best Practices

Once you’ve identified potential sources of aid, streamline your application.

- Prepare All Documentation: Have physical and digital copies of the death certificate, tribal enrollment card, veteran discharge papers (DD-214), funeral home estimate, income verification, and any other requested documents ready.

- Contact Agencies Promptly: Time is of the essence. Many programs have application deadlines or limited funds.

- Be Thorough and Honest: Complete all forms accurately and provide truthful information.

- Follow Up: Don’t hesitate to follow up on your applications. Be persistent but polite.

- Seek Guidance: If possible, enlist the help of a trusted family member, community leader, or social worker to navigate the process.

- Budget and Repay (if applicable): If you secure a loan, understand the repayment terms fully and create a realistic budget to ensure you can meet your obligations.

Step 5: Important Considerations and Long-Term Planning

- Cultural Sensitivity: When interacting with non-Native organizations or funeral homes, gently educate them on any specific cultural needs or preferences your family may have for the funeral arrangements.

- Beware of Scams: Unfortunately, times of grief can attract scammers. Be wary of unsolicited offers for loans or funeral services that seem too good to be true, or those that pressure you into quick decisions. Always verify the legitimacy of any organization.

- Explore All Options: Do not rely on a single source of assistance. Cast a wide net and apply to multiple programs if eligible.

- Community Support: Lean on your community. Beyond financial aid, emotional and practical support from family, friends, and tribal members is invaluable.

- Future Planning: Once the immediate crisis has passed, consider discussing funeral pre-planning and pre-payment options with family members. Life insurance policies or dedicated savings can significantly ease the burden for future generations. Many tribes also offer workshops or resources on financial literacy and planning.

Conclusion

Navigating the financial complexities of funeral costs for Native American families requires a sensitive, informed, and proactive approach. By prioritizing contact with tribal governments, exploring federal and state programs, leveraging non-profit support, and exercising extreme caution with commercial loans, families can find the necessary resources to honor their loved ones with dignity and respect. Remember that each tribe is unique, and direct communication with your specific tribal office is the most crucial first step in this challenging journey. Seek support, ask questions, and be persistent – you are not alone in this process.