Unlocking Homeownership: A Comprehensive Review of Low-Interest Home Loan Options for Native Americans in New Mexico

Homeownership represents more than just a roof over one’s head; it’s a cornerstone of wealth building, community stability, and generational legacy. For Native Americans in New Mexico, a state with a rich and vibrant Indigenous presence, the path to homeownership can be uniquely challenging yet profoundly rewarding. While historical inequities and complex land ownership structures have often created barriers, a range of specialized low-interest home loan options exists, specifically designed to empower Native American individuals and families to achieve their dream of owning a home.

This article functions as a comprehensive product review, dissecting these vital financial tools. We will explore the "features" (benefits), "drawbacks" (challenges), and ultimately provide "purchase recommendations" for those navigating the landscape of low-interest home loans for Native Americans in New Mexico.

The "Product Line-Up": Understanding the Low-Interest Options

Before delving into the pros and cons, let’s identify the primary "products" or loan programs available. These are not singular loans but rather a suite of options, often working in conjunction, that offer favorable terms, including lower interest rates, reduced down payments, and flexible underwriting criteria.

-

HUD Section 184 Indian Home Loan Guarantee Program:

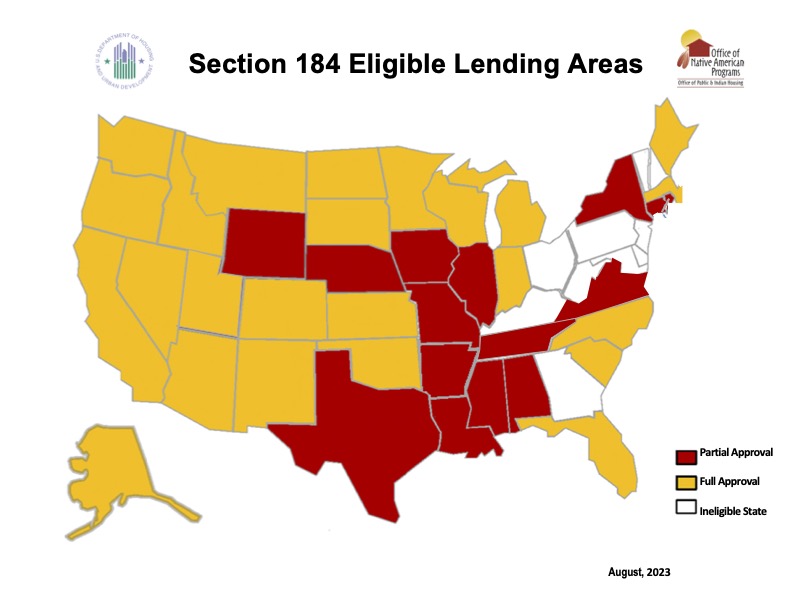

- Overview: This is arguably the most significant and widely recognized program. Administered by the U.S. Department of Housing and Urban Development (HUD), it guarantees loans made by private lenders to Native American individuals and tribes. Its unique feature is the ability to finance homes on trust lands, restricted lands, and fee simple lands.

- Key "Features": Low down payment (as low as 2.25% for loans over $50,000, 1.25% for loans under $50,000), flexible underwriting, ability to use tribal land as collateral, lower mortgage insurance premiums (MIP) than FHA, and streamlined processes designed for Native American applicants.

-

VA Native American Direct Loan (NADL) Program:

- Overview: Exclusively for eligible Native American veterans, the NADL program offers direct loans from the Department of Veterans Affairs (VA) to purchase, construct, or improve homes on Federal Trust Land.

- Key "Features": No down payment required, competitive fixed interest rates set by the VA, no private mortgage insurance (PMI), limited closing costs, and a focus on assisting veterans.

-

USDA Rural Development (RD) Home Loan Programs:

- Overview: While not exclusively for Native Americans, USDA RD programs (specifically the Section 502 Direct and Guaranteed Loan Programs) are highly relevant given the rural nature of many tribal lands and communities in New Mexico. They aim to help low- and moderate-income individuals purchase homes in eligible rural areas.

- Key "Features": The Guaranteed Loan program often requires no down payment, offers competitive fixed interest rates, and reduced mortgage insurance. The Direct Loan program offers even lower interest rates (as low as 1%) for very low-income applicants, sometimes with payment assistance.

-

New Mexico Mortgage Finance Authority (MFA) Programs:

- Overview: The state’s housing finance agency, MFA, offers various programs that can be combined with federal loans. These often include down payment and closing cost assistance, as well as competitive fixed-rate mortgages for first-time homebuyers or those purchasing in targeted areas.

- Key "Features": Can be layered with HUD 184, VA, or FHA loans. Offers 30-year fixed-rate mortgages, often with down payment assistance (DPA) grants or second mortgages that reduce out-of-pocket costs. Some programs are tailored for specific populations or geographic areas within New Mexico.

-

FHA Loans (Federal Housing Administration):

- Overview: Another widely accessible government-backed loan program, FHA loans are not specific to Native Americans but offer lower down payment requirements (as low as 3.5%) and more flexible credit guidelines compared to conventional loans. They can serve as a valuable option, especially when other specialized programs aren’t feasible or in conjunction with MFA DPA.

- Key "Features": Low down payment, more lenient credit score requirements, often easier to qualify for than conventional loans.

"Features" & "Performance": The Advantages of These Options

When reviewing these "products," their collective advantages present a compelling case for Native American homeownership in New Mexico:

- Access to Low-Interest Rates: The primary "feature" is the availability of competitive, often below-market, fixed interest rates. Government backing (HUD, VA, USDA, FHA) reduces risk for lenders, allowing them to offer more favorable terms to borrowers. This translates directly into lower monthly payments and significant savings over the life of the loan.

- Reduced Down Payment Requirements: Many of these programs dramatically lower or eliminate the down payment barrier. HUD 184 requires as little as 1.25-2.25%, VA NADL and USDA Guaranteed often require 0%, and FHA requires 3.5%. This is a critical advantage, as saving for a substantial down payment is often the biggest hurdle for aspiring homeowners.

- Flexible Underwriting & Credit Considerations: Recognizing unique financial situations, programs like HUD 184 often employ more flexible underwriting guidelines. This means lenders may consider non-traditional credit histories, tribal income, and other factors that might be overlooked by conventional lenders. This flexibility widens the eligibility pool.

- Addressing Trust Land Complexity: The HUD 184 and VA NADL programs are revolutionary in their ability to facilitate homeownership on Native American trust lands. This is a monumental advantage, as conventional lenders are typically unwilling or unable to lend on lands with complex title and jurisdictional issues. These programs navigate these challenges by working directly with tribal governments and BIA (Bureau of Indian Affairs) land offices.

- Lower Mortgage Insurance Premiums (MIP): HUD 184, for example, has lower annual mortgage insurance premiums than FHA loans, leading to further monthly savings for borrowers. VA NADL eliminates mortgage insurance entirely.

- Financial Education and Counseling: Many programs, or the organizations that administer them (like tribal housing authorities or non-profits), offer crucial homeownership counseling. This "product support" helps prepare borrowers for the responsibilities of homeownership, improving financial literacy and reducing default rates.

- Wealth Building and Generational Impact: Homeownership is a proven pathway to building equity and generational wealth. By providing accessible financing, these programs empower Native American families to accumulate assets, providing a foundation for future prosperity, education, and economic stability within their communities.

- Community Development and Self-Determination: Increased homeownership fosters stronger, more stable communities. It supports tribal self-determination by providing housing solutions that align with tribal values and needs, reducing reliance on external housing providers.

"Drawbacks" & "Challenges": Understanding the Limitations

No "product" is without its limitations, and these loan programs are no exception. Potential "buyers" should be aware of the following:

- Complexity and Paperwork: While designed to be accessible, navigating government-backed loan programs can be complex. There’s often more paperwork, specific forms, and multiple agencies involved (lender, HUD, VA, BIA, tribal government). This can be time-consuming and daunting without proper guidance.

- Limited Lender Participation: Not all mortgage lenders offer HUD 184 or VA NADL loans. While participation is growing, especially in states like New Mexico with large Native American populations, borrowers might need to search specifically for approved lenders, which can limit options and competitive shopping.

- Geographical Restrictions and Eligibility: USDA RD loans are limited to designated rural areas. VA NADL and HUD 184 on trust lands require specific agreements with tribal governments and BIA involvement, which can add layers of bureaucracy. Income limits apply to USDA RD and sometimes MFA programs, meaning higher-income individuals may not qualify.

- Appraisal Challenges: Appraising homes on tribal land can be challenging due to unique market dynamics, limited comparable sales, and cultural considerations. This can sometimes lead to delays or difficulties in meeting loan requirements.

- Credit Score Hurdles (Even with Flexibility): While more flexible, these programs still require a demonstrable ability to repay. Borrowers with very low credit scores or significant debt may still face challenges, even if the guidelines are less stringent than conventional loans. Financial readiness is still paramount.

- Mortgage Insurance (for some programs): While HUD 184 has lower MIP than FHA, it still requires mortgage insurance. FHA loans also require MIP, which can increase the overall cost of the loan, especially for those who can’t eliminate it later.

- Bureaucracy and Delays: The involvement of multiple government agencies (HUD, VA, BIA) and tribal governments can sometimes lead to longer processing times compared to conventional loans. Patience and persistent follow-up are often required.

- Awareness and Education Gap: Despite their benefits, many Native Americans in New Mexico may not be fully aware of these specialized loan programs or how to access them. There’s often a need for greater outreach and financial literacy within communities.

"Purchase Recommendations": Who Should "Buy" What?

For Native Americans in New Mexico considering homeownership, the "purchase recommendation" is clear: explore these options rigorously. Do not assume traditional financing is your only path. Here’s a breakdown of who should consider which "product":

-

For Veterans on Trust Land: VA Native American Direct Loan (NADL) is your first and strongest consideration. The no down payment, competitive fixed rates, and no PMI are unparalleled. If you are an eligible veteran and plan to live on trust land, prioritize this program.

-

For Individuals/Families on Trust Land (Non-Veterans) or Near Tribal Communities: HUD Section 184 Indian Home Loan Guarantee Program is your primary target. Its design specifically addresses the complexities of tribal land and offers excellent terms. Seek out lenders approved for HUD 184.

-

For Low-to-Moderate Income Individuals/Families in Rural New Mexico: USDA Rural Development Loans are a powerful option, especially the Guaranteed Loan (0% down payment) or the Direct Loan (very low interest rates for very low income). Check the USDA eligibility map for your desired location.

-

For First-Time Homebuyers or Those Needing Down Payment Assistance (DPA): New Mexico Mortgage Finance Authority (MFA) Programs should be investigated, particularly their DPA options. MFA programs can often be combined with HUD 184, FHA, or VA loans, significantly reducing upfront costs. This is often the "layering" strategy that makes homeownership truly affordable.

-

For Broader Accessibility with Lower Down Payment: FHA Loans are a solid general-purpose option if other specialized programs aren’t a perfect fit or if you prefer a wider selection of lenders. They offer a good balance of accessibility and favorable terms compared to conventional loans.

General Recommendations for All "Buyers":

- Seek Out Specialized Lenders: Don’t just walk into any bank. Actively search for lenders in New Mexico with experience in HUD 184, VA NADL, and USDA loans. Many tribal housing authorities or non-profits can provide lists of approved lenders.

- Engage in Homeownership Counseling: Before even looking at homes, participate in a homeownership counseling program. Organizations like Native Community Finance or local housing authorities offer invaluable guidance on budgeting, credit repair, understanding loan terms, and the responsibilities of homeownership. This is your essential "user manual."

- Understand All Costs: While interest rates are low, remember to factor in closing costs, appraisal fees, potential mortgage insurance, and ongoing home maintenance. Get a full breakdown of all expenses.

- Build or Improve Your Credit: Even with flexible underwriting, a healthier credit profile will always result in better terms and easier qualification. Work on reducing debt and ensuring timely payments.

- Be Patient and Persistent: The process can be lengthy, especially with trust land transactions. Be prepared for a thorough review and maintain open communication with your lender, tribal housing authority, and any involved government agencies.

- Utilize Tribal Resources: Many tribal nations in New Mexico have their own housing departments, housing authorities, or financial literacy programs that can offer direct assistance, education, and connections to relevant loan officers.

Conclusion

The dream of homeownership for Native Americans in New Mexico is more attainable than ever, thanks to a robust suite of low-interest home loan options. These "products" – HUD 184, VA NADL, USDA RD, MFA, and FHA – are not merely financial instruments; they are pathways to building equity, strengthening communities, and securing a brighter future.

While challenges like complexity and limited lender awareness exist, the benefits of lower interest rates, reduced down payments, and culturally sensitive underwriting far outweigh them. For those ready to embark on this journey, the recommendation is clear: do your research, seek expert guidance from specialized lenders and housing counselors, and leverage the unique advantages these programs offer. By doing so, Native American families in New Mexico can transform the dream of homeownership into a tangible, lasting reality, enriching both their lives and the vibrant tapestry of their ancestral lands.