Here is a 1200-word step-by-step guide on Indigenous Bad Credit Loans with Instant Funding, written in a professional tutorial style.

Navigating Indigenous Bad Credit Loans with Instant Funding: A Comprehensive Guide

Introduction

Access to traditional financial services can be a significant challenge for many Indigenous individuals across Canada, particularly those with a less-than-perfect credit history. Systemic barriers, geographical remoteness, and historical disadvantages have often limited opportunities for credit building and emergency funding. This guide aims to demystify "Indigenous Bad Credit Loans with Instant Funding," providing a professional, step-by-step approach to understanding, applying for, and responsibly managing these financial products.

This tutorial is designed for First Nations, Métis, and Inuit individuals who may have a low credit score but require urgent financial assistance. It will cover everything from assessing your needs to managing repayments, emphasizing responsible borrowing and long-term financial health.

Understanding the Landscape: Indigenous Bad Credit Loans

Before diving into the application process, it’s crucial to understand what these loans entail and why they exist.

What Are Indigenous Bad Credit Loans?

Indigenous Bad Credit Loans are financial products specifically designed to cater to the unique circumstances of Indigenous people in Canada, including First Nations, Métis, and Inuit individuals, who may have poor or no credit history. Traditional lenders often deny applications based solely on credit scores, leaving many without options during financial emergencies. These specialized loans offer a more flexible approach to eligibility, considering factors beyond just a credit score.

Why the Need for Specialized Loans?

The necessity for these loans stems from several factors:

- Systemic Barriers: Historical policies and ongoing systemic issues have created disparities in wealth and financial access for Indigenous communities.

- Geographical Remoteness: Many Indigenous communities are in remote or rural areas with limited access to physical bank branches or mainstream financial institutions.

- Credit History Challenges: Lack of prior access to credit, limited understanding of credit building, or past financial difficulties can result in low credit scores.

- Income Volatility: Employment opportunities can be less stable in some communities, leading to fluctuating incomes that traditional lenders view as risky.

- Cultural Sensitivity: Specialized lenders are often more attuned to the cultural nuances and community structures, offering more respectful and understanding service.

The "Instant Funding" Component

"Instant Funding" in this context refers to a streamlined application and approval process designed for rapid disbursement of funds. While "instant" rarely means seconds, it typically implies approval and fund transfer within 24 hours, often on the same business day. This speed is critical for individuals facing urgent financial needs, such as unexpected medical bills, emergency home repairs, or essential vehicle maintenance.

Key Features and Benefits

These loans offer several advantages for the target demographic:

- Accessibility Despite Bad Credit: The primary benefit is the ability to secure funding even with a low credit score, opening doors that traditional lenders have closed.

- Rapid Access to Funds: The "instant funding" aspect ensures that urgent financial needs can be addressed quickly.

- Potential for Credit Improvement: When managed responsibly and repaid on time, these loans can positively impact your credit score, helping you build a stronger financial future.

- Flexible Eligibility Criteria: Lenders often consider alternative forms of income (e.g., band employment, government benefits) and focus more on current ability to repay rather than solely on past credit history.

- Cultural Understanding: Many specialized lenders aim to provide services with a greater understanding and respect for Indigenous cultures and community structures.

Step-by-Step Guide: Securing an Indigenous Bad Credit Loan with Instant Funding

This section outlines the process from initial assessment to responsible repayment.

Step 1: Assess Your Needs and Eligibility

Before applying, honestly evaluate your financial situation and the purpose of the loan.

- Determine the Exact Amount Needed: Only borrow what is absolutely necessary. Over-borrowing can lead to increased debt and higher interest payments.

- Understand Your Repayment Capacity: Can you comfortably afford the monthly or bi-weekly repayments without straining your budget? Use a budget planner to assess your income versus expenses.

- Check Basic Eligibility: Most lenders require you to be:

- At least 18 or 19 years old (depending on provincial regulations).

- A Canadian resident or citizen.

- Have a stable source of income (employment, government benefits, band funding).

- Have an active bank account for fund disbursement and repayment.

- Reside in a province where the lender operates (some lenders cannot lend in Quebec, for example).

Step 2: Research and Choose a Reputable Lender

This is a critical step to avoid predatory lending practices. Look for lenders specializing in Indigenous loans or those with a strong track record of working with individuals with bad credit.

- Look for Transparency: A reputable lender will clearly outline all interest rates, fees, and repayment terms upfront. There should be no hidden costs.

- Read Reviews and Testimonials: Search online for reviews from other borrowers. Websites like Google Reviews, Trustpilot, or industry-specific forums can offer insights.

- Check for Licensing: Ensure the lender is licensed to operate in your province or territory.

- Inquire About Cultural Sensitivity: Some lenders specifically highlight their understanding of Indigenous communities.

- Compare Offers: Don’t settle for the first offer. Apply for pre-approval (if available) or compare the terms from 2-3 different lenders.

Step 3: Gather Required Documentation

Having all necessary documents ready will significantly speed up the application process. Typical documents include:

- Proof of Identity: Government-issued photo ID (Driver’s License, Provincial ID, Passport, Status Card).

- Proof of Income: Recent pay stubs (1-3 months), bank statements showing direct deposits, government benefit statements (e.g., CERB, EI, pension, disability), or a letter of employment from your band council.

- Proof of Residency: Utility bills, lease agreement, or a letter from your band council confirming your address.

- Bank Account Information: Void cheque or pre-authorized debit form to link your bank account for deposits and repayments.

Step 4: Complete the Application

Most applications for instant funding loans are done online, making them accessible from anywhere.

- Fill Out Accurately: Provide precise and honest information. Any discrepancies can delay or lead to the rejection of your application.

- Consent to Credit Check: Be prepared for a soft or hard credit check. Even with bad credit, lenders use this to verify identity and assess risk. Some specialized lenders might use alternative assessment methods.

- Submit Supporting Documents: Upload scanned copies or clear photos of your required documents as requested by the lender.

Step 5: Review the Loan Offer Carefully

Once approved, you will receive a loan offer. This is where you must exercise caution and diligence.

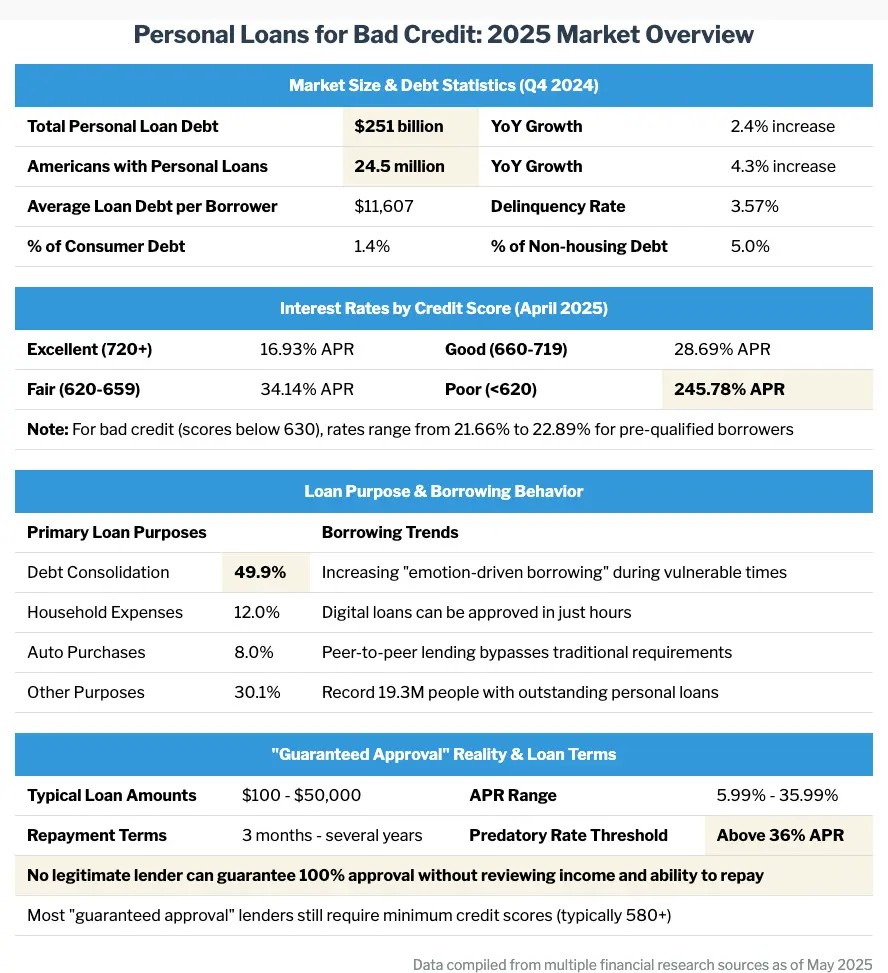

- Understand the Annual Percentage Rate (APR): This is the total cost of the loan, including interest and fees, expressed as a yearly rate. Bad credit loans typically have higher APRs than traditional loans.

- Scrutinize All Fees: Look for origination fees, administration fees, late payment fees, or any other charges.

- Review Repayment Schedule: Understand the frequency (weekly, bi-weekly, monthly) and exact amounts of each payment. Ensure it aligns with your income cycle.

- Total Cost of Loan: Calculate the total amount you will pay back over the life of the loan. Is it manageable?

- Ask Questions: If anything is unclear, contact the lender for clarification before signing. Do not sign if you are unsure or uncomfortable with any terms.

Step 6: Receive Your Funds

Upon accepting the loan offer, the lender will initiate the fund transfer.

- Direct Deposit: Funds are typically deposited directly into your bank account via e-transfer or direct deposit.

- Speed: As mentioned, "instant funding" usually means within 24 hours, often on the same business day, especially if you apply during business hours.

Step 7: Manage Repayments Responsibly

This is the most crucial step for maintaining financial health and improving your credit score.

- Prioritize Payments: Make loan payments a priority in your budget. Missing payments can incur late fees and negatively impact your credit score.

- Set Up Automatic Payments: This helps ensure you never miss a payment deadline.

- Communicate with Your Lender: If you anticipate difficulty making a payment, contact your lender immediately. They may be able to offer solutions or adjust your payment plan temporarily.

- Keep Records: Maintain records of all payments made and correspondence with your lender.

Important Considerations Before Applying

While these loans offer a vital lifeline, it’s essential to approach them with a full understanding of their implications.

- High Interest Rates: Loans for bad credit often come with significantly higher interest rates than conventional loans due to the perceived higher risk for the lender.

- Risk of Debt Cycle: If not managed responsibly, taking out high-interest loans can lead to a cycle of debt, where you borrow more to pay off existing loans.

- Predatory Lenders: Be wary of lenders who guarantee approval without any checks, demand upfront fees, or pressure you into signing without reviewing terms.

- Impact on Credit Score: While timely repayments can help your credit, defaulting on these loans can severely damage it further.

- Explore Alternatives: Before committing, consider all other options:

- Community Programs: Many Indigenous communities or organizations offer financial assistance, grants, or micro-loan programs.

- Credit Counselling: Non-profit credit counseling services can help you manage debt and explore alternatives.

- Family or Friends: If possible, borrowing from trusted individuals can be a lower-cost option.

- Emergency Funds: If you have an existing emergency fund, use that first.

Pros and Cons of Indigenous Bad Credit Loans with Instant Funding

Pros:

- Accessibility: Provides access to credit for those with poor credit histories.

- Speed: Quick approval and funding for urgent needs.

- Convenience: Often fully online application process.

- Credit Building Potential: Can help improve credit score with responsible repayment.

- Addresses Specific Needs: Tailored for the unique financial circumstances of Indigenous individuals.

Cons:

- High Cost: Generally come with higher interest rates and fees.

- Risk of Debt: Potential to fall into a debt cycle if not managed carefully.

- Shorter Repayment Terms: Can lead to higher individual payment amounts.

- Scam Potential: Higher risk of encountering predatory lenders, requiring diligent research.

Beyond the Loan: Building Financial Health

Securing an Indigenous Bad Credit Loan with Instant Funding can provide temporary relief, but it’s also an opportunity to start building a stronger financial foundation for the long term.

- Create a Realistic Budget: Track your income and expenses to understand where your money goes.

- Build an Emergency Fund: Start saving a small amount regularly to create a buffer for future unexpected expenses, reducing reliance on high-interest loans.

- Improve Your Credit Score:

- Pay all bills on time.

- Keep credit utilization low (if you have credit cards).

- Regularly check your credit report for errors.

- Consider a secured credit card or credit builder loan if appropriate.

- Seek Financial Literacy Resources: Many Indigenous organizations and government programs offer free financial education workshops and resources.

Conclusion

Indigenous Bad Credit Loans with Instant Funding serve a critical need, offering a pathway to financial support for individuals who might otherwise be excluded from mainstream lending. By following this comprehensive guide – from careful assessment and diligent research to responsible repayment and long-term financial planning – you can leverage these loans effectively. Remember, while quick access to funds is beneficial, understanding the terms, managing your debt, and working towards improved financial health are paramount. Approach these loans as a tool for short-term relief and a stepping stone toward a more secure financial future.

Disclaimer

This guide provides general information and is not intended as financial advice. The availability, terms, and conditions of loans can vary significantly. Always conduct your own thorough research, read all loan agreements carefully, and consider consulting with a qualified financial advisor before making any financial decisions.