Navigating the Leasehold Labyrinth: How to Secure a Home Loan for Your Leasehold Property

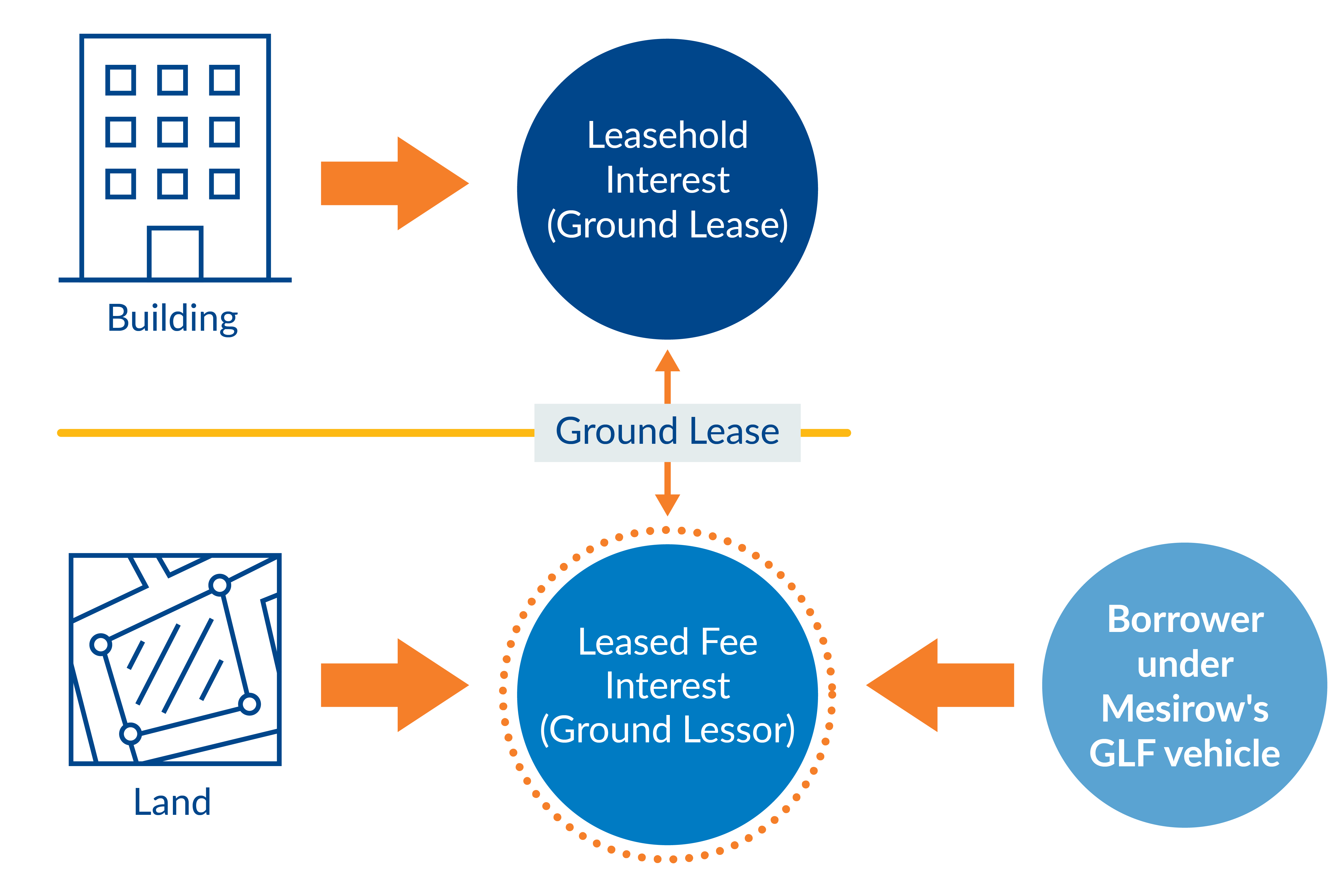

Owning a home is a cornerstone of the "great British dream," but the path to homeownership isn’t always straightforward. For many, especially those in urban areas, the reality involves purchasing a leasehold property. Unlike freehold, where you own the building and the land it sits on outright, leasehold means you own the property for a fixed period (the "term" of the lease) but not the land itself. The land, and often the building’s common parts, remain under the ownership of a freeholder.

While leasehold offers a gateway to property ownership for millions, it introduces complexities, particularly when it comes to securing a home loan. This comprehensive guide will demystify the process, highlight the advantages and disadvantages, and provide crucial recommendations for prospective leasehold buyers.

Understanding Leasehold: The Foundation

Before diving into mortgages, it’s vital to grasp the fundamentals of leasehold. You are essentially buying the right to occupy the property for a specified duration, as defined by a legal document called the lease.

Key Players:

- Leaseholder (Lessee): You, the homeowner, who owns the lease.

- Freeholder (Lessor): The owner of the land and the building’s structure, who grants the lease.

- Managing Agent: Often appointed by the freeholder to manage the building’s common areas, maintenance, and service charge collection.

The lease document is paramount. It outlines the rights and responsibilities of both the leaseholder and the freeholder, covering aspects like ground rent, service charges, maintenance obligations, and permitted alterations.

The Core Challenge: Securing a Home Loan for Leasehold Property

Lenders view leasehold properties through a specific risk lens. Their primary concern is that their investment (your mortgage) remains secure throughout the loan term. Several factors unique to leasehold can impact their willingness to lend:

1. Lease Length: The Absolute Priority

This is arguably the most critical factor. Lenders typically require a lease to extend significantly beyond the mortgage term.

- Minimum Thresholds: Most lenders require a minimum of 80 years remaining on the lease at the time of purchase. Some may go down to 70-75 years, but this significantly restricts your lender choice.

- The 80-Year Rule: Leases below 80 years are problematic because the cost of extending the lease increases significantly once it drops below this threshold. This makes the property less attractive to future buyers and harder to re-mortgage, posing a risk to the lender.

- Ideal Lease Length: For optimal choice and peace of mind, aim for a lease with 90, 100, or even 125+ years remaining.

2. Ground Rent: Not Just a Nominal Fee Anymore

Historically, ground rent was a token payment. However, in recent years, some leases included clauses allowing ground rent to double every 10 or 20 years, leading to "onerous" ground rents that can become unaffordable.

- Lender Concerns: Lenders are wary of high or escalating ground rents because they can impact your affordability (as they are considered an ongoing cost) and make the property difficult to sell.

- Leasehold Reform (Ground Rent) Act 2022: For new residential leases granted after June 30, 2022 (with some exceptions), ground rent is limited to a "peppercorn" (i.e., zero financial value). However, this doesn’t apply to existing leases.

- What Lenders Look For: Many lenders now have specific criteria regarding ground rent. They may reject applications if the ground rent exceeds a certain percentage of the property value (e.g., 0.1%) or if it’s considered disproportionately high. They will also scrutinize clauses for excessive increases.

3. Service Charges and Reserve Funds: Transparency and History

Service charges cover the costs of maintaining and insuring the building’s common parts (roof, exterior walls, hallways, gardens, etc.).

- Lender Requirements: Lenders want to see transparent and reasonable service charges. They’ll ask for a history of service charge payments to identify any sudden spikes or disputes.

- Reserve Funds (Sinking Funds): A well-managed building will often have a reserve fund to cover major works (e.g., roof replacement, lift repair). Lenders prefer properties with healthy reserve funds, as it indicates future costs are being planned for, reducing the risk of a huge, unexpected bill for leaseholders.

- "Major Works": The prospect of large, unexpected bills for major works (e.g., cladding remediation) is a significant concern for lenders, especially post-Grenfell. They will want assurance that such costs are manageable or covered.

4. The Freeholder and Managing Agent: Reputation Matters

Lenders, and you, want to know that the freeholder and their appointed managing agent are reputable, responsive, and financially sound.

- Bad Management: Poorly managed buildings can lead to disputes, neglect, and depreciation, all of which impact the property’s value and the lender’s security.

- Due Diligence: Your solicitor will conduct enquiries with the freeholder/managing agent to assess their track record.

5. Other Lease Covenants and Restrictions

The lease might contain various clauses that could affect the property’s value or your ability to enjoy it.

- Restrictions: These could include limits on pets, sub-letting, or making alterations. While usually not deal-breakers for mortgages, they can influence your decision.

- Right to Assign: The lease must allow you to sell or transfer your leasehold interest. This is fundamental for a lender.

The Process of Securing a Home Loan for Leasehold

The steps are broadly similar to a freehold purchase, but with heightened emphasis on specific areas:

- Pre-Application Due Diligence (Your Homework): Before you even speak to a lender, understand the basics of the leasehold property you’re interested in. Ask the estate agent for the lease length, ground rent, and latest service charge figures.

- Engage a Specialist Mortgage Broker: This is crucial for leasehold. A broker who understands the nuances of leasehold criteria will know which lenders are more flexible and which ones to avoid based on the specifics of your lease. They can save you significant time and frustration.

- Lender Application: Once you’ve chosen a lender and submitted your application, they will conduct their initial checks based on the information provided.

- Valuation: The lender will instruct a surveyor to value the property. The surveyor will assess the property’s market value, taking into account the lease terms, lease length, ground rent, service charges, and overall condition of the building. Any red flags here can lead to a down-valuation or rejection.

- Legal Conveyancing (Crucial for Leasehold): Your solicitor’s role is magnified with leasehold. They will:

- Thoroughly review the lease document.

- Conduct enquiries with the freeholder/managing agent.

- Check for any upcoming major works, disputes, or historical issues.

- Advise you on all clauses, costs, and responsibilities.

- Ensure the lease meets the lender’s specific requirements.

- If the lease is too short, your solicitor will guide you through the process of extending it, often before or concurrently with the purchase, which can be complex.

Advantages of Leasehold Ownership

Despite the complexities, leasehold offers several benefits:

- Potentially Lower Initial Cost: Leasehold flats, especially, can sometimes be more affordable than equivalent freehold houses, making them an accessible entry point into the property market.

- Reduced Maintenance Burden (for common parts): As the freeholder or managing agent is responsible for the upkeep of the building’s structure and common areas, you’re generally freed from arranging and overseeing these tasks.

- Shared Costs: The cost of maintaining the overall building (e.g., roof repairs, communal cleaning, building insurance) is shared among all leaseholders through service charges, which can be more economical than bearing the full cost yourself in a freehold property.

- Access to Desirable Locations: Many properties in prime urban locations (city centres, popular neighbourhoods) are leasehold, offering opportunities to live where freehold is scarce or prohibitively expensive.

Disadvantages of Leasehold Ownership

The downsides are often the source of lender scrutiny and buyer caution:

- Ongoing Costs: You’re subject to ground rent and service charges, which are additional to your mortgage payments and council tax. These can increase over time.

- Lack of Control: You have less control over the building’s management, maintenance decisions, and any major works. Disputes with freeholders or managing agents can be stressful and costly.

- Depreciating Asset: Unlike freehold, a leasehold property’s value theoretically depreciates as the lease term shortens.

- Lease Extension Costs & Complexity: Extending a lease can be a lengthy, complex, and expensive process, especially once it falls below 80 years. This cost often needs to be factored into your long-term financial planning.

- Potential for Disputes: Conflicts can arise over service charge increases, quality of maintenance, or refusal of permission for alterations.

- "Onerous" Lease Clauses: Unfair ground rent clauses or restrictive covenants can significantly devalue a property and make it very difficult to sell or mortgage.

- Difficulty Selling: A short lease or problematic lease terms will severely impact your ability to sell the property in the future.

Recommendations for Purchase

To navigate the leasehold landscape successfully, thorough preparation and expert advice are paramount:

- Read the Lease Thoroughly (with Legal Guidance): Never proceed without your solicitor meticulously explaining every clause, cost, and covenant in the lease. This is your most important document.

- Prioritise Lease Length: As a golden rule, aim for properties with at least 90-100 years remaining on the lease. If it’s shorter, factor in the cost and complexity of a lease extension immediately.

- Scrutinise Ground Rent and Service Charges:

- Ground Rent: Understand how it’s calculated and how it might increase. Avoid properties with rapidly escalating or "doubling" ground rent clauses.

- Service Charge: Request a history of service charge payments for the last 3-5 years. Inquire about any planned major works and the status of the reserve fund.

- Research the Freeholder and Managing Agent: Ask your solicitor to make extensive enquiries. Look for evidence of good management, transparency, and responsiveness. Online reviews or local forums might offer insights.

- Engage a Specialist Mortgage Broker: Their expertise in leasehold lending criteria is invaluable. They can match you with suitable lenders and pre-empt potential issues.

- Choose an Experienced Conveyancing Solicitor: Select a solicitor with a proven track record in leasehold conveyancing. Their due diligence is your primary safeguard.

- Plan for the Future: Consider the cost of a future lease extension and how it might impact your finances. Think about the property’s resale potential if the lease is allowed to shorten significantly.

- Consider Collective Enfranchisement or Right to Manage: For apartment blocks, there are legal routes for leaseholders to collectively buy the freehold (collective enfranchisement) or take over the management of the building (Right to Manage). If these are possibilities, discuss them with your solicitor.

Conclusion

Securing a home loan for a leasehold property is undoubtedly more complex than for a freehold equivalent. It demands a heightened level of due diligence, a keen eye for detail, and the indispensable guidance of specialist professionals. While leasehold offers a viable path to homeownership, particularly in sought-after areas, prospective buyers must enter with their eyes wide open.

By understanding the intricacies of lease length, ground rent, service charges, and the roles of the freeholder and managing agent, you can mitigate risks. With the right team – a knowledgeable mortgage broker and a meticulous conveyancing solicitor – you can confidently navigate the leasehold labyrinth and secure your home loan, transforming the dream of homeownership into a tangible reality.