Unlocking Homeownership: A Comprehensive Guide to Qualifying for a No Down Payment Native American Home Loan

The dream of homeownership, a cornerstone of financial stability and generational wealth, can often feel out of reach for many, particularly due to the formidable barrier of a down payment. However, for eligible Native Americans, a powerful and often overlooked pathway exists: specialized home loan programs, most notably the HUD Section 184 Indian Home Loan Guarantee Program, which frequently offers the incredible advantage of a no or very low down payment.

This article delves deep into the intricacies of qualifying for such a loan, outlining the eligibility criteria, the application process, and a detailed examination of the advantages and disadvantages. By the end, you’ll have a clear understanding of whether this vital program is the right fit for your homeownership journey, along with practical recommendations to navigate the path successfully.

The Landscape of Native American Home Loans: More Than Just a Mortgage

Before diving into the specifics of qualification, it’s crucial to understand the philosophy behind these loans. The U.S. Department of Housing and Urban Development (HUD) Section 184 program was established in 1992 to address the unique housing challenges faced by Native American and Alaska Native communities. It recognizes historical disparities and aims to provide accessible, affordable home financing options for individuals, families, and tribal governments.

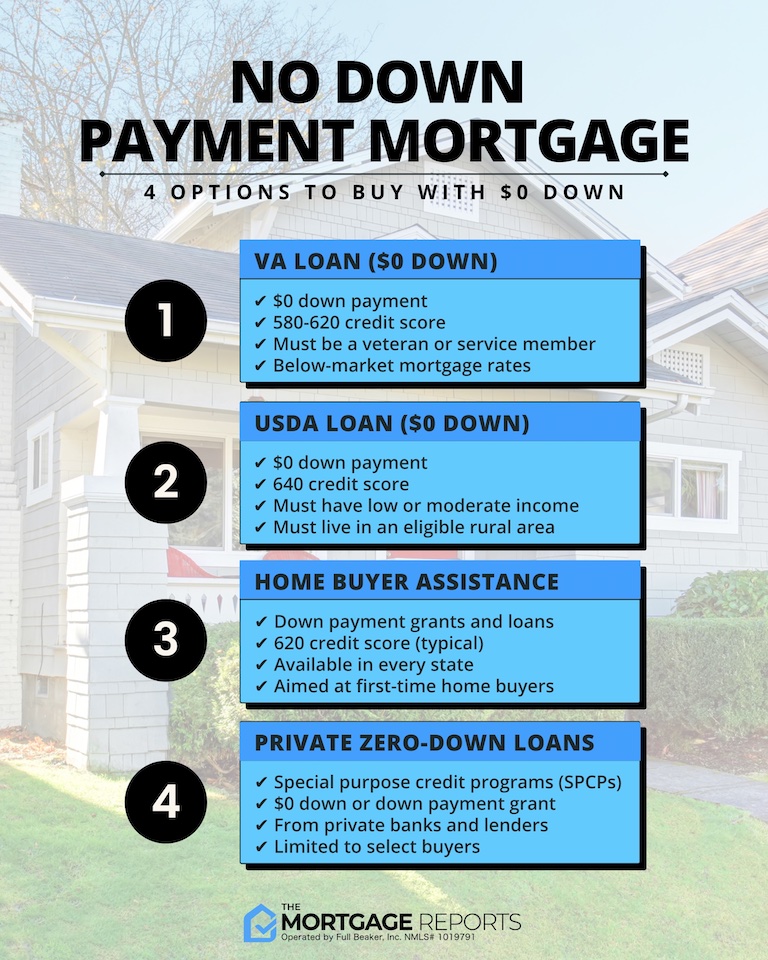

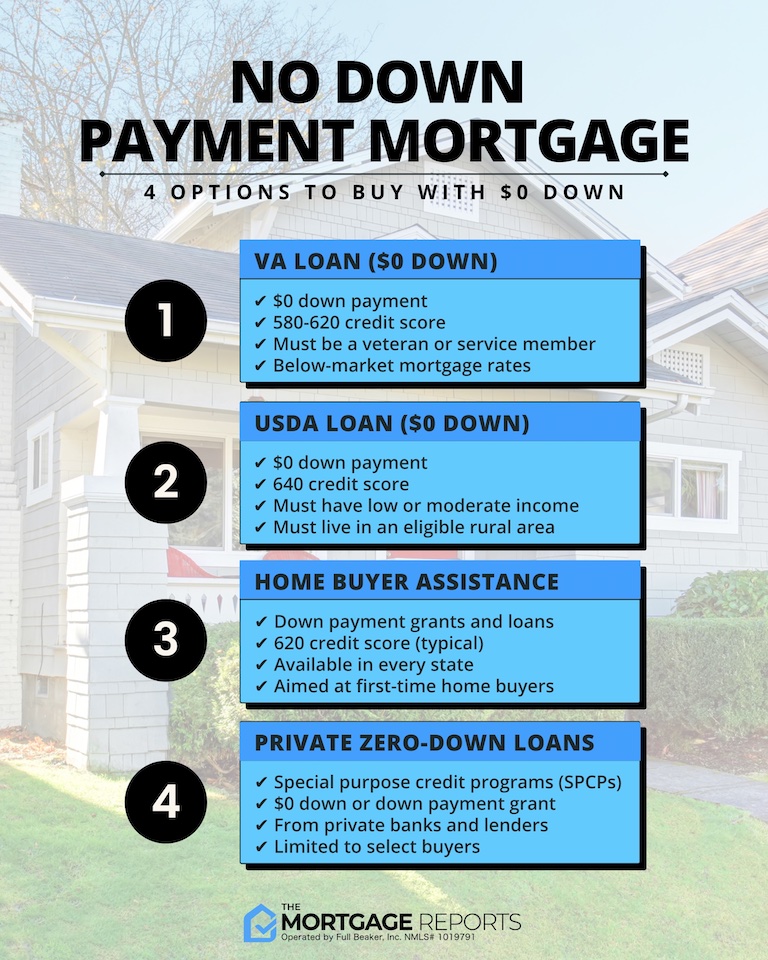

Unlike conventional loans, Section 184 is not a direct loan from HUD. Instead, HUD guarantees loans made by approved private lenders to eligible Native American borrowers. This guarantee significantly reduces the risk for lenders, making them more willing to offer favorable terms, including the highly sought-after low or no down payment option. While other programs like VA loans (for eligible Native American veterans) and USDA Rural Development loans might also be available, Section 184 remains the primary and most specifically tailored vehicle for Native American homeownership.

Who Qualifies? Eligibility Criteria for the HUD Section 184 Loan

Qualifying for a Section 184 loan involves meeting specific criteria related to your tribal affiliation, financial standing, and the property itself.

1. Tribal Affiliation: The Cornerstone of Eligibility

This is the most fundamental requirement. To be eligible for a Section 184 loan, you must be:

- An enrolled member of a federally recognized American Indian tribe or an Alaska Native Village. This is non-negotiable. You will need to provide documentation of your tribal enrollment, such as a Certificate of Degree of Indian Blood (CDIB) card or a tribal enrollment card.

- The spouse of an enrolled member. If your spouse is an enrolled member, you can apply jointly, even if you are not tribally affiliated yourself.

It’s important to note that the program does not extend to members of state-recognized tribes or those with Native American ancestry who are not formally enrolled in a federally recognized tribe or Alaska Native Village.

2. Borrower Financial Requirements: Beyond Just a Score

While Section 184 offers more flexibility than conventional loans, lenders still assess your financial health to ensure you can responsibly manage a mortgage.

- Credit History: While a perfect credit score isn’t always required, lenders will review your credit report for a history of responsible borrowing and repayment. They often look at the overall picture rather than just a FICO score. Minor blemishes might be overlooked if they are isolated or have been resolved. Some lenders are also willing to consider non-traditional credit references (e.g., utility payments, rent history) if you have limited credit history.

- Income Stability: You must demonstrate a stable and verifiable income sufficient to cover your monthly mortgage payments, property taxes, insurance, and other housing-related expenses. Lenders typically look for a consistent employment history (usually two years) or reliable self-employment income.

- Debt-to-Income (DTI) Ratio: This ratio compares your total monthly debt payments (including the new mortgage) to your gross monthly income. While specific thresholds can vary by lender, Section 184 generally allows for slightly higher DTI ratios than conventional loans, recognizing potential income fluctuations or unique financial structures within Native communities. However, a lower DTI always strengthens your application.

- Cash Reserves: While a no-down-payment option exists, having some cash reserves can be beneficial for closing costs, initial home maintenance, or simply demonstrating financial prudence.

3. Property Requirements: Where You Can Buy

Section 184 loans can be used to purchase, construct, or rehabilitate homes located in eligible areas.

- Location: The property must be located within an approved tribal area or an area designated by HUD as eligible for Section 184 loans. This includes:

- Indian Reservations and Trust Lands: This is a unique and critical aspect of Section 184. The program is specifically designed to facilitate homeownership on these lands, which often have complex land tenure systems (e.g., leases instead of fee simple ownership).

- Designated Areas Off-Reservation: Many areas outside of reservations, but within specific geographic regions where federally recognized tribes are located, are also eligible. Your lender can confirm if a specific property’s location qualifies.

- Property Type: The loan can be used for various property types, including:

- Existing single-family homes

- New construction (including modular and manufactured homes on permanent foundations)

- Rehabilitation of existing homes

- Purchase and rehabilitation loans

- Refinancing existing mortgages

- Appraisal and Condition: The property must undergo an appraisal by a HUD-approved appraiser to ensure its value supports the loan amount. It must also meet HUD’s minimum property standards for safety, security, and soundness.

The Qualification Journey: A Step-by-Step Guide

Once you understand the basic eligibility, here’s a general roadmap to securing your Section 184 loan:

- Educate Yourself: Start by thoroughly researching the program. HUD’s official website is an excellent resource, and many tribal housing authorities offer guidance.

- Find an Approved Lender: Not all mortgage lenders offer Section 184 loans. You’ll need to find one that is approved by HUD to originate these specific loans. HUD maintains a list of approved lenders, and your tribal housing authority can often provide recommendations.

- Pre-Qualification/Pre-Approval: This initial step involves providing basic financial information to a lender to get an estimate of how much you might be able to borrow. Pre-approval, which involves a more thorough review of your finances, is even better as it demonstrates to sellers that you are a serious and qualified buyer.

- Gather Documentation: Your lender will require a substantial amount of paperwork, including:

- Proof of tribal enrollment (e.g., tribal ID, CDIB)

- Income verification (pay stubs, W-2s, tax returns for the past two years)

- Bank statements

- Credit report authorization

- Documentation of any other assets or debts

- Property Search and Offer: With your pre-approval in hand, you can confidently search for a home within the eligible areas. Once you find one, make an offer.

- Underwriting and Appraisal: After your offer is accepted, the lender’s underwriter will thoroughly review all your financial documents and the property appraisal to ensure everything meets Section 184 guidelines. If the property is on tribal trust land, there might be additional steps involving tribal approval or lease agreements.

- Closing: Once all conditions are met, you’ll sign the final loan documents and become a homeowner!

The Advantages: Why These Loans Are a Game-Changer

The HUD Section 184 program offers several significant benefits that make homeownership more attainable for Native Americans:

- No or Very Low Down Payment: This is perhaps the most compelling advantage. While a conventional loan often requires 3-20% down, Section 184 allows for as little as 1.25% down payment on loans with a loan-to-value (LTV) ratio above 80%, and a zero down payment option is often available for loans up to 100% LTV. This preserves cash for other important needs like moving expenses, furniture, or an emergency fund.

- Flexible Credit Requirements: As mentioned, Section 184 lenders often take a more holistic view of credit history, making it more accessible for individuals who might not have a lengthy credit history or who have experienced past financial challenges.

- Lower Mortgage Insurance (MI): Unlike conventional loans where Private Mortgage Insurance (PMI) can be a significant ongoing cost until 20% equity is reached, Section 184 has a one-time up-front guarantee fee (typically 1.5% of the loan amount, which can be financed into the loan) and an annual premium (currently 0.25% of the remaining principal balance). These rates are often lower than FHA or conventional PMI, reducing monthly payments.

- Competitive Interest Rates: Because the loans are guaranteed by HUD, lenders perceive less risk, often resulting in competitive, fixed interest rates that can be below market averages. Fixed rates provide stability and predictability in monthly payments.

- On- and Off-Reservation Land Options: The program is uniquely designed to address the complexities of land ownership on tribal trust lands, making homeownership possible in areas where conventional financing is difficult or impossible. It also extends to eligible off-reservation areas.

- Cultural Sensitivity: Lenders approved for Section 184 loans are often more familiar with the unique circumstances and cultural nuances of Native American communities, potentially leading to a more understanding and streamlined process.

- Wealth Building and Community Impact: By facilitating homeownership, the program directly contributes to wealth building within Native communities, fostering stability, and supporting local economies.

Navigating the Challenges: Potential Drawbacks

While immensely beneficial, it’s also important to be aware of potential challenges and limitations associated with Section 184 loans:

- Specific Eligibility Restrictions: The requirement of being an enrolled member of a federally recognized tribe is strict. This means many individuals with Native American ancestry may not qualify if they are not formally enrolled.

- Limited Lender Pool: While the number of approved lenders is growing, it’s still significantly smaller than the pool of conventional mortgage lenders. This might require more effort to find a lender in your area and could limit your options for shopping around for the absolute best rate.

- Property Restrictions and Complexity on Trust Land: While a major advantage, financing on tribal trust land can also be complex. It often involves tribal lease agreements, approvals from the Bureau of Indian Affairs (BIA), and unique title processes, which can add layers of paperwork and potentially extend the closing timeline compared to fee simple land.

- Educational Curve for Borrowers and Lenders: Both borrowers and some lenders may require a learning curve to fully understand the specific nuances of the Section 184 program, particularly regarding trust land transactions.

- Appraisal Process Complexity: Appraisals on tribal lands can sometimes be more challenging due to a lack of comparable sales data, potentially leading to longer appraisal times or requiring appraisers with specialized knowledge.

- Still a Debt Obligation: Despite the favorable terms, a mortgage is a significant long-term financial commitment. Borrowers must be prepared for the responsibilities of homeownership, including ongoing maintenance, property taxes, and insurance.

Recommendations and Best Practices

For those considering a no down payment Native American home loan, here are crucial recommendations:

- Start Early with Education: The more you understand the Section 184 program, its requirements, and its process, the smoother your journey will be. Utilize resources from HUD, tribal housing authorities, and approved lenders.

- Prioritize Credit Health: While flexible, a stronger credit history will always result in better loan terms and a smoother approval process. Work on paying bills on time, reducing debt, and monitoring your credit report.

- Budget Diligently: Beyond the mortgage payment, factor in property taxes, homeowner’s insurance, utilities, and potential maintenance costs. Even with a no down payment loan, having some savings for these initial expenses is wise.

- Choose the Right Lender: Seek out lenders with extensive experience in originating Section 184 loans, especially those familiar with your specific tribal community or region. Their expertise can be invaluable in navigating the unique aspects of the program.

- Seek Housing Counseling: Many tribal housing programs and non-profit organizations offer free or low-cost housing counseling. These counselors can help you assess your financial situation, understand the loan process, and prepare for homeownership.

- Be Patient and Persistent: The process, especially on trust land, can sometimes take longer than a conventional loan. Patience, clear communication with your lender, and proactive submission of documents will be key.

Conclusion: A Path to Empowered Homeownership

The HUD Section 184 Indian Home Loan Guarantee Program represents a vital and powerful tool for Native Americans seeking to achieve the dream of homeownership. Its unique structure, offering no or very low down payments, flexible credit requirements, and the ability to finance homes on tribal trust lands, addresses historical barriers and creates unparalleled opportunities.

While the specific eligibility criteria and potential complexities, particularly around trust land, require diligent preparation and a thorough understanding, the advantages far outweigh the drawbacks for qualified individuals. By educating yourself, preparing your finances, and partnering with experienced lenders and counselors, you can unlock this incredible resource and lay down roots in a home of your own, fostering stability, building equity, and strengthening your community for generations to come. The path to homeownership is within reach; it’s time to take the first step.