Navigating the Path Home: A Comprehensive Review of the VA Native American Direct Loan (NADL) Program

For many of America’s veterans, the dream of homeownership is a cornerstone of their post-service life. The Department of Veterans Affairs (VA) offers an array of benefits to help achieve this, but for Native American veterans seeking to establish roots on Federal Trust Lands, a unique and profoundly impactful program exists: the Native American Direct Loan (NADL). This program, distinct from the more widely known VA home loan guarantee, provides a direct path to homeownership for eligible Native American veterans, offering a vital resource where conventional financing often falls short.

This comprehensive review will delve into the intricacies of the VA NADL program, exploring its core purpose, outlining the step-by-step application process, dissecting its numerous advantages and potential drawbacks, and ultimately offering a clear recommendation for those considering this unique and valuable benefit.

What is the VA Native American Direct Loan (NADL)?

The VA Native American Direct Loan (NADL) program is a direct home loan offered by the VA to eligible Native American veterans to purchase, construct, or improve homes on Federal Trust Land, or to refinance an existing NADL loan. Unlike the standard VA home loan, which guarantees a loan made by a private lender, the NADL program means the VA itself is the lender. This distinction is crucial because traditional lenders are often hesitant or unable to provide mortgages on Trust Land due to the unique legal status of the land, which is held in trust by the U.S. government for the benefit of Native American tribes or individuals.

The program was established to address this specific barrier, recognizing the sovereignty of tribal nations and the unique challenges faced by Native American veterans in securing housing on their ancestral lands. It aims to foster economic development, promote self-sufficiency, and provide a stable living environment for veterans and their families within their tribal communities.

Eligibility Criteria: Who Qualifies for NADL?

Before embarking on the application journey, it’s essential to understand the specific eligibility requirements for the NADL program:

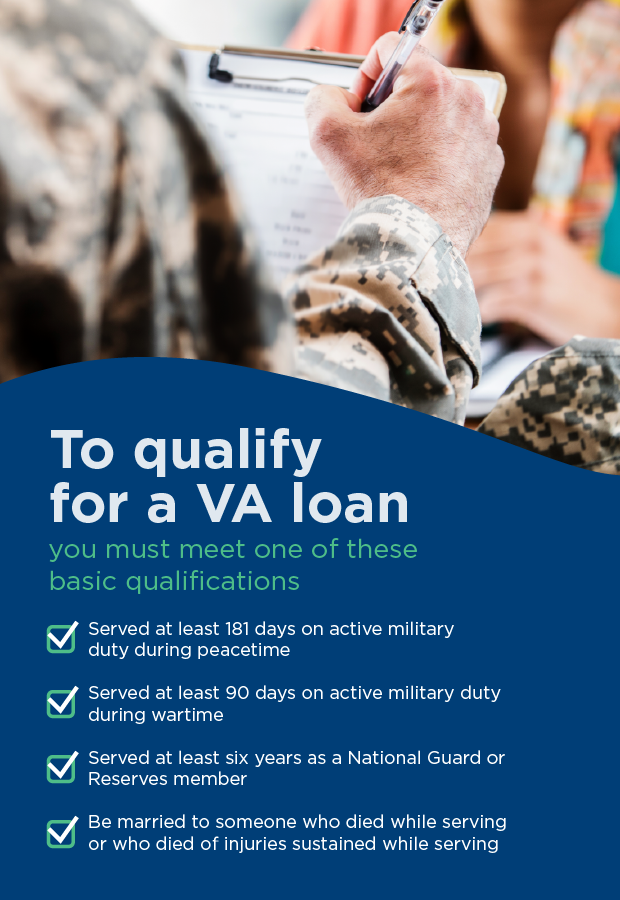

- Veteran Status: The applicant must be an eligible Native American veteran who has served in the U.S. military and meets the VA’s service requirements for a Certificate of Eligibility (COE). This typically includes active duty service during wartime or peacetime, National Guard, or Reserve service, with a discharge under other than dishonorable conditions.

- Native American Status: The veteran must be Native American, which means they are a member of a federally recognized tribe. This is a critical distinction, as state-recognized tribes or other indigenous groups may not qualify.

- Land Status: The property must be located on Federal Trust Land or individually allotted land. This is the cornerstone of the NADL program, as it’s designed specifically for this unique land tenure.

- Occupancy Requirement: The veteran must intend to personally occupy the home as their primary residence.

- Credit and Income: While the NADL program offers flexible underwriting, applicants must still demonstrate an acceptable credit history and sufficient income to meet the mortgage payments, along with other recurring debts. The VA will assess the veteran’s financial capacity to repay the loan.

- Tribal Housing Authority Approval: The tribal organization or housing authority must approve the veteran’s participation and agree to certain terms regarding the land lease or assignment. This tribal approval is a mandatory and unique step in the NADL process.

The Application Process: A Step-by-Step Guide to Securing Your NADL Loan

Applying for a VA NADL loan involves several distinct stages, requiring close coordination with the VA, your tribal housing authority, and potentially the Bureau of Indian Affairs (BIA). Here’s a detailed breakdown:

Step 1: Obtain Your Certificate of Eligibility (COE)

Your COE confirms to the VA that you meet the basic service requirements for a VA home loan benefit. You can obtain this online through the VA’s eBenefits portal, by mail using VA Form 26-1880, or through a VA-approved lender (though for NADL, you’ll apply directly to the VA, not a private lender). This is the foundational document for any VA loan benefit.

Step 2: Connect with Your Tribal Housing Authority

This is arguably the most critical and unique step for NADL. You must contact the housing authority or the appropriate tribal government office for the specific Federal Trust Land where you plan to purchase or build.

- Their Role: The tribal authority plays a pivotal role. They will:

- Verify your tribal membership and eligibility to live on the land.

- Approve your proposed housing plan (if building).

- Help facilitate the necessary land lease or assignment agreement.

- Provide essential counseling and support throughout the process.

- Why it’s Crucial: Without tribal approval and a land lease, the NADL loan cannot proceed. The tribal government’s consent is a testament to tribal sovereignty and a legal necessity for land use on Trust Land.

Step 3: Secure Your Land Lease or Assignment Agreement

Since Federal Trust Land cannot be owned outright by individuals, a long-term leasehold interest is required. This lease grants you the right to use the land for your home.

- Details: The lease must be for a period of at least 25 years, renewable, and acceptable to the VA. It typically involves a nominal rent or other agreed-upon terms with the tribe.

- BIA Involvement: The Bureau of Indian Affairs (BIA) may be involved in approving or recording these land leases, ensuring they comply with federal regulations governing Trust Land. Your tribal housing authority will guide you through this.

Step 4: Financial Preparation and Counseling

The VA will review your financial standing to ensure you can afford the loan.

- Credit Review: The VA will conduct a credit check. While not as stringent as some conventional loans, a reasonable credit history is expected.

- Income Verification: You’ll need to provide documentation of your income (pay stubs, tax returns, employment verification).

- Debt-to-Income Ratio (DTI): The VA will assess your DTI to determine if your income is sufficient to cover your new mortgage payment plus existing debts.

- Mandatory Counseling: The VA requires all NADL applicants to complete financial counseling, often provided by the tribal housing authority or a VA-approved counselor. This ensures you understand the responsibilities of homeownership and the terms of the loan.

Step 5: Apply Directly to the VA

Once you have your COE, tribal approval, and a plan for your land lease, you can formally apply for the NADL loan.

- Required Form: You’ll typically complete VA Form 26-0592, "Application for Native American Direct Loan."

- Documentation: You’ll submit a comprehensive package including your COE, tribal verification, land lease agreement, income and asset statements, credit reports, and details about the property (purchase agreement or construction plans).

- VA Processing: The VA will then process your application, underwrite the loan, and determine your eligibility for the loan amount requested. This involves a thorough review of all submitted documents and may include requests for additional information.

Step 6: Property Appraisal and Inspection

Just like other home loans, the VA requires an appraisal of the property to ensure its value supports the loan amount.

- VA Appraisal: A VA-assigned appraiser will assess the property’s market value, considering its unique location on Trust Land.

- Property Requirements: The property must meet VA Minimum Property Requirements (MPRs) to ensure it is safe, sanitary, and structurally sound. For new construction, plans must be approved.

Step 7: Loan Closing

If your application is approved and the property meets VA requirements, you’ll proceed to closing.

- Final Review: All documents, including the land lease, loan agreement, and any tribal specific agreements, will be finalized.

- Funding: The VA will disburse the loan funds.

- Recording: The land lease and loan documents will be recorded with the appropriate tribal and/or BIA offices.

Advantages (Pros) of the VA NADL Program

The VA NADL program offers significant benefits tailored to the specific needs of Native American veterans on Trust Land:

- No Down Payment Required: This is a major advantage, making homeownership accessible even without substantial savings for a down payment.

- Low-Interest Rates: NADL loans typically offer competitive, often below-market, fixed interest rates, which can lead to significant savings over the life of the loan.

- No Private Mortgage Insurance (PMI): Unlike conventional loans with less than 20% down, NADL loans do not require PMI, further reducing the monthly housing cost.

- Flexible Underwriting: The VA generally employs more flexible underwriting standards than traditional lenders, taking into account unique financial situations and tribal economies.

- Direct Loan from the VA: The VA is the lender, eliminating the need to find a private lender willing to lend on Trust Land, which is often a major hurdle.

- Reduced Closing Costs: While some closing costs are still involved, the VA limits what the veteran can be charged, and often some fees are covered by the VA or can be negotiated.

- Focus on Trust Lands: It’s specifically designed to overcome the legal and financial challenges of lending on Federal Trust Lands, providing a solution where few others exist.

- Can be Used for Multiple Purposes: NADL can fund the purchase of an existing home, new construction, home improvements, or even refinancing an existing NADL loan.

- Financial Counseling: The mandatory counseling helps veterans prepare for the responsibilities of homeownership and understand their loan terms.

Potential Drawbacks (Cons) of the VA NADL Program

Despite its many benefits, the NADL program also has certain limitations and complexities:

- Limited to Federal Trust Lands: This is the most significant limitation. If the veteran wishes to buy a home off Trust Land, or on state-recognized tribal land, the NADL program is not applicable. They would need to pursue a standard VA-guaranteed loan.

- Tribal Approval is Mandatory: While essential for sovereignty, obtaining tribal approval and navigating tribal regulations can add layers of complexity and potentially extend processing times.

- Complex Land Lease Agreements: Understanding and securing a long-term land lease, which may involve the BIA, can be intricate and unfamiliar territory for many.

- Potentially Longer Processing Times: Due to the multiple parties involved (VA, tribal government, BIA) and the unique nature of Trust Land, the NADL application process can sometimes take longer than a conventional or even a standard VA-guaranteed loan.

- Less Common, Less Awareness: Compared to standard VA loans, NADL is less widely known, which can sometimes lead to fewer resources or less experienced staff at various stages of the process.

- Specific Occupancy Requirement: The veteran must occupy the home as their primary residence, which restricts using it for investment properties or secondary homes.

- Only for Native American Veterans: While not a drawback for eligible individuals, it’s a specific targeting that excludes non-Native American veterans from this particular program.

Is the VA NADL Loan Right for You? A Recommendation

The VA Native American Direct Loan program is not just a financial product; it’s a powerful tool for self-determination and community building for eligible Native American veterans.

Recommendation: The VA NADL loan is an unequivocally excellent and often indispensable option for eligible Native American veterans who seek to purchase, build, or improve a home on Federal Trust Land.

Who it’s ideal for:

- Native American veterans who are members of federally recognized tribes.

- Veterans who wish to live on Federal Trust Land within their tribal community.

- Those who might struggle to secure conventional financing due to the unique land tenure.

- Veterans seeking competitive interest rates, no down payment, and no PMI.

When to consider alternatives:

- If you are a veteran but not Native American, this program is not for you. You should explore the standard VA Home Loan Guaranty program.

- If you are a Native American veteran but wish to purchase a home off Federal Trust Land, the standard VA Home Loan Guaranty program (through a private lender) would be the appropriate choice.

- If you are unwilling or unable to navigate the tribal approval and land lease process, the complexities might make it less appealing, though the benefits often outweigh these hurdles.

Crucial Considerations Before Applying:

- Engage Your Tribal Housing Authority Early: This is paramount. They are your primary resource and guide through the tribal-specific requirements.

- Understand the Land Lease: Fully comprehend the terms of your land lease or assignment, as this is fundamental to your homeownership on Trust Land.

- Be Prepared for Documentation: Gather all necessary documents for your COE, tribal verification, income, and credit.

- Patience and Persistence: The process can be detailed and may take time. Maintaining open communication with the VA and your tribal contacts is key.

In conclusion, the VA Native American Direct Loan is a uniquely tailored benefit that addresses a critical need within Native American communities. For eligible veterans, it represents a profound opportunity to build or own a home on their ancestral lands, free from many of the financial barriers that would otherwise exist. While the application process requires diligence and collaboration with tribal authorities, the advantages – including no down payment, low-interest rates, and direct VA lending – make it an invaluable pathway to homeownership. For those who meet the criteria, the VA NADL program is not just a loan; it’s a testament to service, sovereignty, and the enduring dream of a place to call home.