This guide aims to provide a comprehensive, professional understanding of how Native American sovereign loans work. It delves into the unique legal, economic, and regulatory landscape that defines this complex sector, offering a step-by-step breakdown of its foundational principles, operational mechanisms, and the ongoing debates surrounding it.

How Do Native American Sovereign Loans Work? A Professional Tutorial

1. Introduction: Understanding the Unique Landscape

Native American sovereign loans represent a distinctive and often controversial segment of the financial industry. Unlike conventional loans regulated primarily by state or federal laws, these financial products operate under the unique jurisdiction of federally recognized Native American tribes. This tutorial will demystify the mechanisms behind these loans, explaining the critical role of tribal sovereignty, the operational models of tribal lending entities, the regulatory environment, and the implications for both lenders and consumers.

2. The Foundation: Understanding Tribal Sovereignty

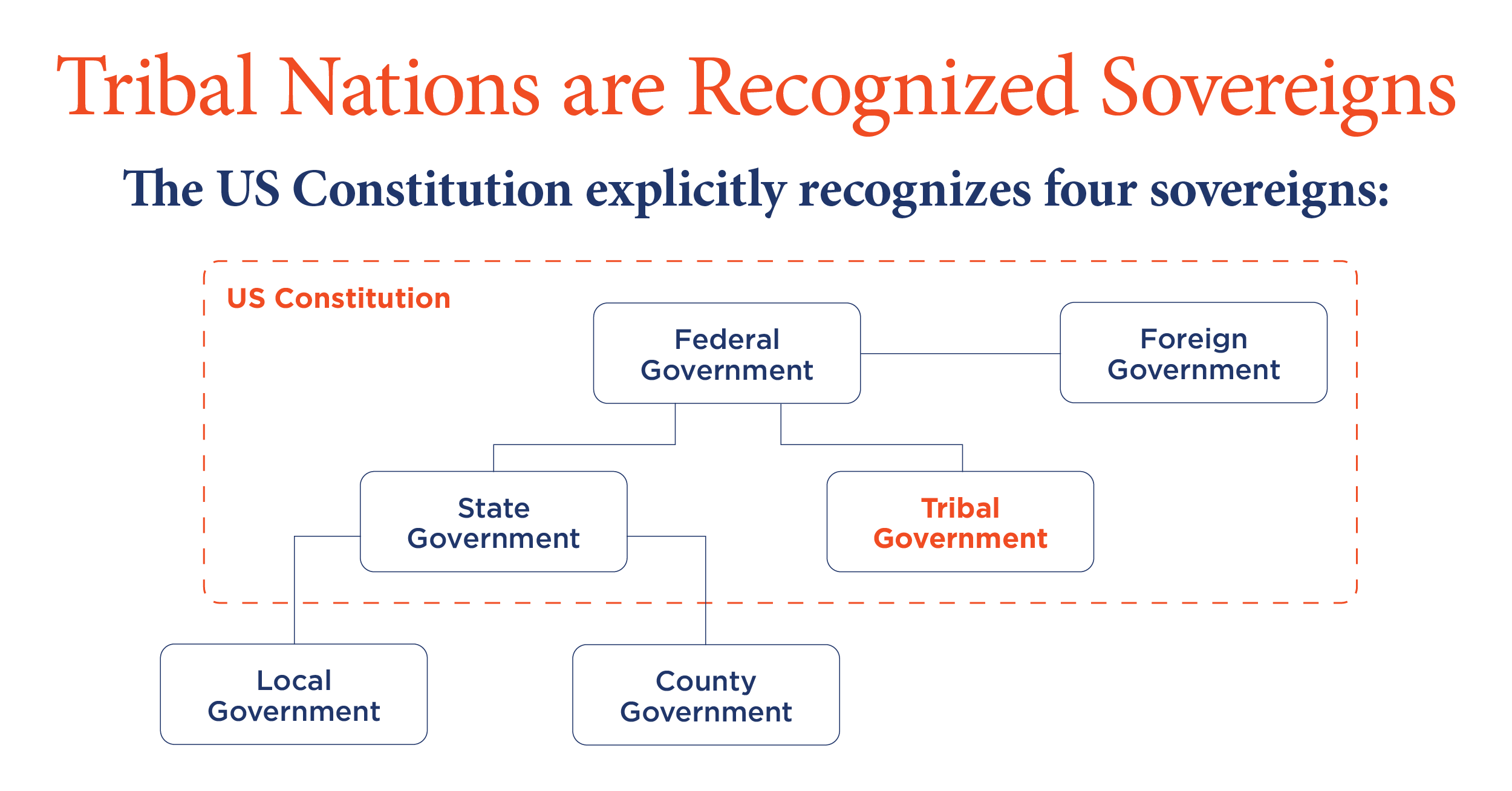

At the heart of Native American sovereign lending lies the concept of tribal sovereignty. Federally recognized Native American tribes are distinct political entities with inherent governmental powers, preceding the formation of the United States. This sovereignty grants tribes the right to self-governance, including the power to establish their own laws, courts, and economic enterprises on their lands, largely independent of state jurisdiction.

- Definition: Tribal sovereignty means tribes possess inherent rights to govern themselves, manage their lands, and establish economic ventures without direct state interference.

- Implications for Lending: This power extends to financial services. Tribes can charter corporations and establish lending institutions under their own laws, which may differ significantly from state laws, particularly regarding interest rate caps (usury laws) and consumer protection regulations.

- Federal vs. State Authority: While Congress holds plenary power over tribal affairs, states generally lack jurisdiction over tribal activities on tribal lands, unless explicitly granted by federal law or tribal consent. This jurisdictional divide is crucial for understanding how tribal loans operate outside typical state regulatory frameworks.

3. The Genesis: Why Tribal Lenders Emerged

The emergence of tribal lending entities is rooted in a combination of economic necessity, limited access to traditional capital, and the strategic leveraging of tribal sovereignty.

- Economic Development Needs: Many Native American tribes face significant economic challenges, including high unemployment and limited infrastructure. Generating revenue for essential government services (healthcare, education, housing, infrastructure) is a constant priority.

- Limited Access to Traditional Capital: Tribal businesses and members often struggle to secure financing from mainstream banks due to perceived risks, lack of collateral on trust lands, or historical biases.

- Leveraging Sovereignty for Revenue: Seeing the success of tribal casinos, some tribes recognized an opportunity to leverage their sovereign status to enter the lucrative online lending market. By establishing lending operations under tribal law, they could offer short-term, high-interest loans (like payday or installment loans) that might be restricted by state usury laws elsewhere. The profits generated are intended to fund tribal government services and economic development initiatives.

4. How Tribal Lending Entities Operate

Tribal lending operations are typically structured to clearly assert their connection to the sovereign tribe, often as an "arm of the tribe."

- Establishment: A federally recognized tribe establishes a lending entity, often as a tribal corporation or instrumentality, under tribal law. This entity is designed to be an extension of the tribal government, rather than a separate, privately owned business.

- Operational Structure:

- Tribal Ownership/Control: The tribe maintains significant ownership and control over the lending entity, often through a tribal council or a designated board.

- Tribal Law: All lending activities, including loan terms, interest rates, fees, and dispute resolution processes, are governed by tribal laws and regulations, not state laws.

- Online Focus: Most tribal lenders operate online, allowing them to reach a broad customer base across the United States. This online presence further complicates state attempts to assert jurisdiction.

- Loan Products: Common offerings include:

- Payday Loans: Small, short-term loans typically repaid on the borrower’s next payday, often with very high annual percentage rates (APRs).

- Installment Loans: Larger loans with longer repayment periods, also carrying high APRs compared to conventional bank loans.

- Target Audience: These loans often target consumers who have limited access to traditional credit due to poor credit scores, low income, or a lack of banking relationships.

5. The Role of Sovereign Immunity

A cornerstone of tribal lending is the doctrine of sovereign immunity, which protects the tribe and its instrumentalities from lawsuits unless the tribe explicitly waives its immunity or Congress abrogates it.

- Definition: Sovereign immunity dictates that a sovereign entity (like a federally recognized tribe) cannot be sued in state or federal court without its consent.

- Protection for Lenders: As "arms of the tribe," tribal lending entities typically assert sovereign immunity to shield themselves from state regulatory enforcement actions and consumer lawsuits. This means state attorneys general or individual borrowers often cannot sue these lenders in state courts for alleged violations of state lending laws.

- Waiver of Immunity: Tribes can waive their sovereign immunity, but such waivers are generally limited. In the context of consumer lending, waivers are often restricted to:

- Tribal Courts: Allowing disputes to be heard only in the tribe’s own court system.

- Arbitration Clauses: Loan agreements almost invariably include mandatory arbitration clauses. These clauses stipulate that any disputes must be resolved through binding arbitration, often conducted under tribal law, rather than in a state or federal court. This is a critical mechanism for tribal lenders to avoid state jurisdiction.

6. The Regulatory Landscape

The regulatory environment for Native American sovereign loans is complex, characterized by a jurisdictional void where state and federal authorities struggle to assert control.

- State Usury Laws: States have laws limiting the interest rates lenders can charge (usury laws). However, tribal lenders argue that these state laws do not apply to them because of their sovereign status and operation under tribal law. State courts have had mixed rulings on this, but many tribal lenders have successfully asserted immunity.

- Federal Oversight:

- Limited Direct Regulation: There is no specific federal law directly regulating the interest rates or terms of loans made by tribal entities.

- CFPB (Consumer Financial Protection Bureau): The CFPB has attempted to assert jurisdiction over tribal lenders, arguing that federal consumer protection laws (like the Truth in Lending Act or the Electronic Fund Transfer Act) apply. However, its authority to directly regulate the terms of loans or to enforce against tribal entities asserting sovereign immunity has been challenged in court, with varying outcomes.

- FTC (Federal Trade Commission): The FTC can take action against unfair or deceptive practices, but its reach against entities asserting sovereign immunity is also limited.

- Tribal Regulation: Some tribes establish their own regulatory bodies to oversee their lending operations, imposing requirements for transparency, fair dealing, and dispute resolution. However, the extent and rigor of this self-regulation vary significantly between tribes.

7. The Borrower’s Experience

For consumers, obtaining a Native American sovereign loan often involves a distinct set of terms and conditions.

- Accessibility: These loans are often easier to obtain for individuals with poor credit histories who may be rejected by traditional lenders. The application process is typically quick and online.

- High Interest Rates: A defining characteristic is the extremely high Annual Percentage Rate (APR). While a state-licensed lender might be capped at 36% APR for a small loan, tribal loans can have APRs ranging from 400% to over 1000%. Lenders justify these rates by citing the higher risk associated with lending to subprime borrowers and the costs of operating under the unique legal framework.

- Repayment Structure: Loans are often structured for quick repayment (e.g., bi-weekly or monthly), with payments automatically debited from the borrower’s bank account.

- Dispute Resolution: As mentioned, loan agreements almost always include mandatory arbitration clauses. This means borrowers cannot sue the lender in court. Instead, disputes are resolved through an arbitrator, often under tribal law, which can be perceived as less favorable to consumers than traditional court proceedings.

8. Controversies and Criticisms

Native American sovereign lending is a subject of intense debate and criticism.

- Predatory Lending Accusations: Critics argue that the high interest rates and fees, combined with the often limited recourse for borrowers, constitute predatory lending, trapping vulnerable consumers in cycles of debt.

- "Rent-a-Tribe" Schemes: A significant concern involves non-tribal third-party lenders who allegedly partner with tribes primarily to "rent" their sovereign immunity. In these arrangements, the non-tribal entity often handles the day-to-day operations, marketing, and capital, while the tribe receives a small percentage of revenue in exchange for lending its name and sovereign immunity shield. Critics argue these are not genuine tribal enterprises.

- Lack of Consumer Protection: Compared to state-regulated lenders, tribal lenders often operate with fewer consumer protections regarding interest rate caps, loan rollovers, and collection practices, leading to concerns about consumer harm.

9. Arguments in Favor (Tribal Perspective)

Despite the criticisms, proponents of tribal lending highlight its benefits from the perspective of tribal self-determination and economic development.

- Economic Self-Sufficiency: The revenue generated provides essential funding for tribal governments, reducing reliance on federal aid and enabling investments in tribal infrastructure, social programs, and cultural preservation.

- Job Creation: Tribal lending operations create jobs for tribal members, fostering economic opportunity within the reservation.

- Access to Credit: Tribal lenders argue they serve a vital role by providing credit to underserved populations—individuals who are locked out of traditional banking systems due to poor credit or low income. They contend that without these options, many would turn to even less regulated or illegal sources of credit.

- Exercise of Sovereignty: For tribes, operating these businesses is an assertion of their inherent right to self-governance and economic development on their own terms.

10. Navigating a Tribal Loan: Advice for Borrowers

For individuals considering a Native American sovereign loan, understanding the unique characteristics is paramount.

- Read the Entire Loan Agreement: Pay close attention to the APR, fees, repayment schedule, and especially the dispute resolution clause (arbitration).

- Understand the Jurisdiction: Be aware that the loan is governed by tribal law, and your ability to sue in state or federal court may be severely limited.

- Assess the True Cost: Calculate the total cost of the loan, including all interest and fees, to determine if it’s truly affordable.

- Explore Alternatives: Before committing, investigate all other options, such as credit counseling, negotiating with creditors, small loans from credit unions, or community assistance programs, which typically offer much lower costs.

- Verify Tribal Affiliation: Ensure the lender is genuinely affiliated with a federally recognized tribe and not a fraudulent entity.

11. The Future and Evolving Landscape

The landscape of Native American sovereign lending is continuously evolving, marked by ongoing legal battles and increased scrutiny.

- Legal Challenges: State and federal regulators, as well as consumer advocacy groups, continue to challenge the sovereign immunity defense in various courts, leading to an uncertain legal future for some tribal lending models.

- Increased Federal Scrutiny: The CFPB and other federal agencies are actively seeking ways to regulate these entities more effectively, potentially through new interpretations of existing laws or calls for new legislation.

- Tribal Self-Regulation: Some tribes are developing more robust self-regulatory frameworks to enhance consumer protection and ensure the legitimacy of their lending operations, aiming to differentiate themselves from "rent-a-tribe" models.

- Focus on Transparency: There is growing pressure for greater transparency in loan terms and affiliations to help consumers make informed decisions.

12. Conclusion

Native American sovereign loans represent a complex intersection of tribal sovereignty, economic necessity, and consumer finance. While offering a potential pathway to economic development and access to credit for underserved populations, they also raise significant concerns about consumer protection due to high costs and limited legal recourse. A professional understanding requires acknowledging both the legitimate exercise of tribal sovereignty and the ethical debates surrounding the industry’s practices. As the legal and regulatory landscape continues to shift, the dynamics of Native American sovereign lending will undoubtedly remain a subject of intense interest and scrutiny.