Unlocking Dreams: A Comprehensive Review of Expanding HUD Section 184 Loan Access

Introduction

Homeownership is a cornerstone of the American dream, a powerful vehicle for wealth creation, community stability, and intergenerational prosperity. Yet, for Native American and Alaskan Native communities, this dream has historically been fraught with unique challenges, stemming from complex land tenure systems, historical economic disparities, and a lack of access to conventional financial products. Enter the U.S. Department of Housing and Urban Development (HUD) Section 184 Indian Home Loan Guarantee Program. Established under the Indian Housing Act of 1992, Section 184 was designed to address these systemic barriers, providing a vital pathway to affordable homeownership for eligible Native Americans and Alaskan Natives.

This review delves into the critical concept of "expanding access" to the Section 184 program. It’s not merely about increasing numbers; it’s about optimizing a crucial financial tool to better serve its intended beneficiaries. We will examine the inherent strengths and weaknesses of the program, particularly as its reach and impact are broadened, and ultimately offer a comprehensive recommendation on its continued strategic expansion. As a "product," Section 184 offers a specialized financial service, and its effectiveness must be evaluated through the lens of its impact on the lives and economic well-being of Native communities.

Background: The Genesis of Section 184

Before evaluating its expansion, it’s essential to understand the foundation of Section 184. Traditional mortgage lending often struggles with the unique legal framework of trust and restricted lands, which constitute much of Indian Country. Conventional lenders are often hesitant to accept tribal leases or trust allotments as collateral, leading to significant hurdles for Native individuals seeking home loans on their own lands. Furthermore, many Native communities have faced historical economic marginalization, resulting in lower incomes, less traditional credit histories, and fewer financial institutions operating within their territories.

The Section 184 program was a direct response to these issues. It provides a loan guarantee to approved lenders, protecting them against loss in the event of foreclosure. This guarantee significantly reduces the risk for lenders, encouraging them to operate in areas they might otherwise avoid. Key features include:

- Low Down Payment: Often as low as 2.25% for loans over $50,000, and 1.25% for loans under $50,000.

- Flexible Underwriting: Considers non-traditional credit, tribal income, and other unique financial circumstances.

- Property Eligibility: Allows for loans on fee simple land, tribal trust land, allotted trust land, and even certain leasehold interests, a critical differentiator from conventional loans.

- Fixed Interest Rates: Provides stability and predictability for borrowers.

- No Mortgage Insurance Premium (MIP) for Life: Unlike FHA loans, Section 184 has a one-time guarantee fee, significantly reducing the long-term cost of the mortgage.

The "Product" Under Review: Expanding Access

"Expanding access" to Section 184 is a multi-faceted endeavor, encompassing several critical areas:

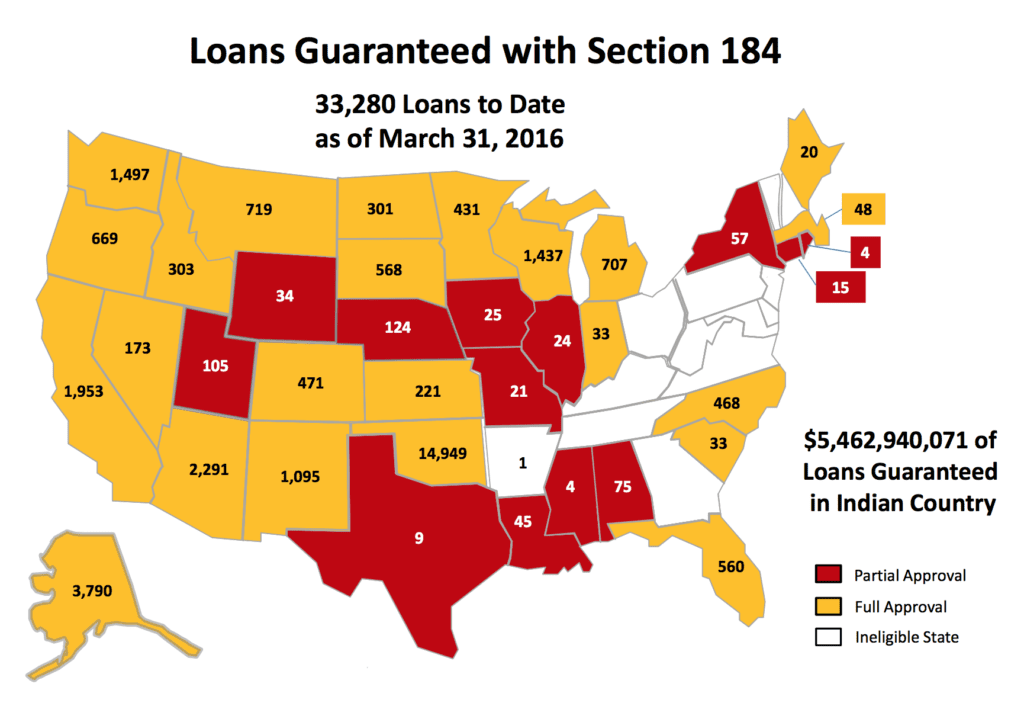

- Geographic Reach: Ensuring the program is available and effectively utilized across all eligible tribal lands and Native communities, including those in remote rural areas and urban centers with significant Native populations.

- Lender Participation: Increasing the number of financial institutions (banks, credit unions, tribal housing entities) that are approved and actively originating Section 184 loans. This includes educating lenders on the program’s nuances and benefits.

- Borrower Awareness and Education: Enhancing outreach efforts to ensure that eligible Native Americans and Alaskan Natives are aware of the program, understand its benefits, and know how to apply.

- Streamlining Processes: Reducing bureaucratic hurdles and processing times at all levels – HUD, Bureau of Indian Affairs (BIA) for land title issues, tribal governments, and lenders.

- Technological Integration: Leveraging technology to simplify applications, improve communication, and expedite approvals.

- Policy Adjustments: Periodically reviewing and updating program guidelines to ensure they remain relevant, effective, and responsive to the evolving needs of Native communities.

The goal of this expansion is to maximize the program’s potential, ensuring that it is not merely an option, but a readily available and efficient solution for eligible individuals and families seeking homeownership.

Advantages of Expanding HUD Section 184 Loan Access (Pros)

Expanding the reach and effectiveness of the Section 184 program brings a multitude of significant benefits, not just to individual borrowers but to tribal nations and the broader economy.

-

Enhanced Homeownership Rates and Wealth Creation: The most direct benefit is the increase in homeownership among Native Americans. By overcoming the unique barriers posed by trust land and non-traditional credit, Section 184 allows more individuals to purchase homes. Homeownership is a primary driver of household wealth accumulation, providing equity that can be leveraged for education, entrepreneurship, or retirement. Expanding access directly contributes to closing the significant wealth gap faced by Native communities.

-

Economic Empowerment and Tribal Sovereignty: Increased homeownership fosters stable communities and stimulates local economies. Home construction, renovation, and related services create jobs within or near tribal lands. Property taxes (where applicable) or tribal lease fees contribute to tribal government revenues, supporting essential services. Furthermore, by enabling tribal members to build equity on their own lands, the program strengthens tribal self-determination and economic sovereignty, reducing reliance on external aid.

-

Tailored Underwriting for Unique Circumstances: Section 184’s flexible underwriting guidelines are a critical advantage. Many Native individuals may have excellent payment histories on tribal housing, utility bills, or informal lending arrangements that don’t appear on traditional credit reports. The program’s ability to consider these alternative credit sources, alongside income from diverse sources (e.g., per capita payments, seasonal employment), ensures that deserving borrowers are not unfairly excluded. Expanding access means more lenders are trained and willing to apply these flexible standards.

-

Addresses Unique Land Tenure Challenges: The program’s fundamental strength lies in its ability to navigate the complexities of trust and restricted land. This is arguably its most crucial differentiator. By allowing mortgages on land where the title is held by the U.S. government for the benefit of a tribe or individual (trust land), or where alienation is restricted (restricted land), Section 184 unlocks vast potential for home development in Indian Country that would otherwise be impossible. Expanded access ensures more lenders understand and are equipped to process the necessary BIA and tribal approvals.

-

Affordable Entry with Low Down Payment and Costs: The low down payment requirements significantly lower the barrier to entry for many first-time homebuyers or those with limited savings. Coupled with the one-time guarantee fee (instead of recurring monthly mortgage insurance premiums), the overall cost of the loan is more affordable over its lifetime. This cost-effectiveness makes homeownership a more realistic goal for families with moderate incomes.

-

Community Stability and Cultural Preservation: Homeownership often translates to greater community stability. Families are more likely to invest in their homes and neighborhoods, participate in local governance, and maintain cultural traditions when they have a permanent stake. Section 184 supports this by enabling Native people to build homes on their ancestral lands, strengthening cultural ties and intergenerational continuity.

-

Reduces Predatory Lending Risk: In areas with limited access to conventional credit, vulnerable populations can fall prey to high-interest, predatory lending schemes. By providing a federally guaranteed, regulated, and affordable mortgage option, Section 184 serves as a vital safeguard, offering a secure and transparent path to homeownership that protects borrowers from exploitative practices.

Disadvantages of Expanding HUD Section 184 Loan Access (Cons)

While the expansion of Section 184 access is overwhelmingly positive, it is not without its challenges. Addressing these "disadvantages" is crucial for ensuring the program’s long-term effectiveness and equitable implementation.

-

Limited Lender Participation and Geographic Coverage (Despite Expansion Efforts): Despite efforts to expand, the number of approved lenders actively originating Section 184 loans remains relatively small compared to conventional lenders. Many financial institutions are still hesitant due to perceived complexities, lack of familiarity with tribal laws, or the lower volume of loans in certain rural areas. This means that even with "expanded access," borrowers in remote tribal communities may still have limited options, or need to travel significant distances to find an approved lender.

-

Awareness and Education Gaps (for both Borrowers and Lenders): A significant hurdle is the lack of widespread awareness about the program. Many eligible Native Americans are simply unaware that Section 184 exists or how it can benefit them. Similarly, many potential lenders and real estate professionals lack adequate training and understanding of the program’s unique features, particularly concerning trust land procedures and flexible underwriting. This knowledge gap can lead to misinformation, delays, or missed opportunities.

-

Bureaucratic Hurdles and Processing Delays: The process for Section 184 loans, especially on trust land, can be significantly longer than conventional mortgages. It often requires coordination and approvals from multiple entities: the lender, HUD, the Bureau of Indian Affairs (BIA) for leasehold or title clearances, and tribal governments. Each step can introduce delays, particularly if agencies are understaffed, lack efficient communication protocols, or have varying processing times. This extended timeline can be frustrating for borrowers and sometimes lead to deals falling through.

-

Appraisal Challenges on Tribal Lands: Valuing properties on trust or restricted lands can be complex. Conventional appraisal methodologies may not adequately account for unique market dynamics, lack of comparable sales, or the specific legal status of the land. Finding appraisers familiar with tribal land issues and Section 184 requirements can be difficult, leading to delays or potentially undervalued properties, which can impact loan amounts.

-

Infrastructure Deficiencies in Remote Areas: Expanding access doesn’t automatically solve underlying infrastructure problems. Many remote tribal communities lack essential infrastructure such as paved roads, reliable utilities (water, sewer, electricity, internet), or accessible public services. These deficiencies can make home construction more expensive, impact property values, and make certain areas less desirable for homeownership, even with loan access.

-

Capacity Issues within Tribal Governments: While tribal governments are crucial partners in the Section 184 process (e.g., approving leases, providing tribal identification), some may have limited staff or resources dedicated to housing development and loan processing. This can contribute to delays, particularly in smaller tribes with fewer administrative personnel.

-

Funding Limitations and Program Capacity: While Section 184 is a guarantee program, its overall capacity is tied to HUD’s budget and staffing. A rapid, uncontrolled expansion of access without commensurate increases in administrative resources could strain the system, leading to longer processing times and reduced efficiency. There’s also the potential for demand to outstrip the program’s current ability to serve all eligible applicants if expansion is not managed strategically.

-

Risk of Mismanagement or Inexperience: As more lenders enter the program, there’s a need for robust oversight and training to ensure compliance with HUD regulations. Inexperienced lenders or those unfamiliar with the cultural nuances of tribal communities could inadvertently create issues, although HUD has strong protocols in place to mitigate such risks.

Purchase Recommendation: A Vital Investment with Strategic Imperatives

As a "product" designed to address critical housing and economic disparities, the HUD Section 184 Indian Home Loan Guarantee Program is not merely recommended; it is highly essential and warrants continued, strategic expansion. Its unique ability to navigate the complexities of Native land tenure and credit histories makes it an indispensable tool for promoting homeownership and economic self-sufficiency in Indian Country.

Overall Assessment: The benefits of Section 184 far outweigh its challenges. It directly empowers individuals, strengthens tribal sovereignty, and contributes to the economic vitality of Native communities. The program represents a federal commitment to equitable access to the American dream.

Recommendation for "Purchase" (i.e., Continued Investment and Expansion):

We strongly recommend a sustained and enhanced commitment to expanding Section 184 access, but with a clear focus on addressing the identified disadvantages. This "purchase" should include:

- Aggressive Lender Recruitment and Training: HUD must intensify efforts to recruit more diverse lenders (including community banks and credit unions) and provide comprehensive, ongoing training on the program’s specifics, cultural competencies, and the nuances of trust land processing. Incentives for lender participation in underserved areas could be explored.

- Robust Outreach and Education Campaigns: A multi-channel approach is needed to educate eligible Native Americans about the program. This includes partnerships with tribal housing authorities, Native organizations, community events, and digital platforms. Educational materials for lenders, real estate agents, and housing counselors are also crucial.

- Streamlining and Digitization: Invest in technology to modernize the application and approval process across HUD, BIA, and participating lenders. Developing a more integrated digital platform could significantly reduce processing times and bureaucratic hurdles.

- Capacity Building for Tribal Nations: Provide technical assistance and funding to tribal governments to strengthen their housing departments, improve land record management, and expedite tribal approvals for leases and land assignments.

- Appraiser Development and Resources: Create programs to train and certify appraisers specifically for properties on tribal lands, ensuring accurate valuations and reducing delays. Develop a database of qualified appraisers familiar with Section 184.

- Addressing Infrastructure Gaps: While not solely a Section 184 responsibility, continued federal and tribal investment in infrastructure development (roads, utilities) in remote areas is crucial to maximize the impact of home loan programs.

- Adequate Staffing and Funding: Ensure that HUD’s Office of Native American Programs (ONAP) and the BIA have sufficient staffing and resources to efficiently manage and oversee the expanding program.

Who Benefits Most:

- Native American and Alaskan Native Individuals and Families: Directly gain access to affordable, tailored homeownership opportunities, leading to wealth creation and improved quality of life.

- Tribal Nations: Benefit from increased economic activity, stronger communities, enhanced self-determination, and the ability to retain their members on ancestral lands.

- Approved Lenders: Gain access to a new, growing market segment with a federally guaranteed product, diversifying their portfolios.

- The U.S. Economy: Benefits from greater economic equity, reduced disparities, and the overall positive impact of increased homeownership.

Conclusion

The HUD Section 184 Indian Home Loan Guarantee Program is more than just a mortgage product; it is a critical tool for rectifying historical inequities, fostering economic development, and empowering Native American and Alaskan Native communities. Expanding access to this program is not an option but a necessity. While challenges related to lender participation, bureaucratic delays, and awareness persist, they are surmountable with strategic investment, inter-agency collaboration, and a sustained commitment from all stakeholders.

By focusing on robust education, streamlined processes, enhanced technological integration, and targeted capacity building, we can ensure that Section 184 truly reaches its full potential. The ultimate goal is to make the dream of homeownership a tangible reality for every eligible Native individual, reinforcing community stability, building intergenerational wealth, and strengthening the fabric of tribal sovereignty across the nation. The "purchase" of expanding Section 184 access is an investment in equity, self-determination, and a more inclusive American future.