Ethical and Legal Considerations of Tribal Loans: A Professional Tutorial

The landscape of consumer lending is vast and complex, often presenting unique challenges for both borrowers and regulators. Among the most debated forms of lending are "tribal loans," offered by entities affiliated with Native American tribes. These loans exist at the intersection of sovereign rights, economic development, and consumer protection, raising significant ethical and legal questions. This tutorial will delve into the intricacies of tribal loans, exploring whether they are ethical and examining the legal challenges surrounding Native American lending practices.

1. Understanding Tribal Loans: Foundations and Framework

To appreciate the ethical and legal debates, it’s crucial to first understand what tribal loans are and how they operate.

1.1 What are Tribal Loans?

Tribal loans are short-term, high-interest loans offered by lenders owned and operated by Native American tribes, or by companies partnered with tribes. These lenders claim to operate under the sovereign laws of the tribe, rather than state or federal regulations that typically govern consumer credit. The core premise is that, as sovereign nations, Native American tribes are immune from state laws and, in some cases, certain federal regulations.

1.2 Key Characteristics and Differences

- Jurisdiction: Unlike traditional lenders regulated by state licensing and usury laws, tribal lenders assert jurisdiction under tribal law.

- Interest Rates: Tribal loans often carry significantly higher Annual Percentage Rates (APRs) than conventional loans, frequently exceeding the limits set by state usury laws. These rates can range from 200% to over 1000%.

- Target Audience: They primarily target consumers with poor credit histories or limited access to traditional banking services, often those in urgent need of funds.

- Loan Structure: Typically small-dollar, short-term installment loans, designed to be repaid over several pay periods. However, the high fees and interest can lead to "rollovers" and a cycle of debt.

1.3 The Concept of Tribal Sovereignty

At the heart of tribal lending is the principle of tribal sovereignty. Native American tribes are recognized as distinct, independent political communities with inherent powers of self-government, predating the formation of the United States. This sovereignty grants tribes the authority to establish and regulate their own laws, including those governing economic enterprises. A key aspect of this sovereignty is "sovereign immunity," which generally protects tribes from lawsuits unless they expressly waive that immunity or Congress abrogates it. Tribal lenders leverage this immunity to shield themselves from state consumer protection and usury laws.

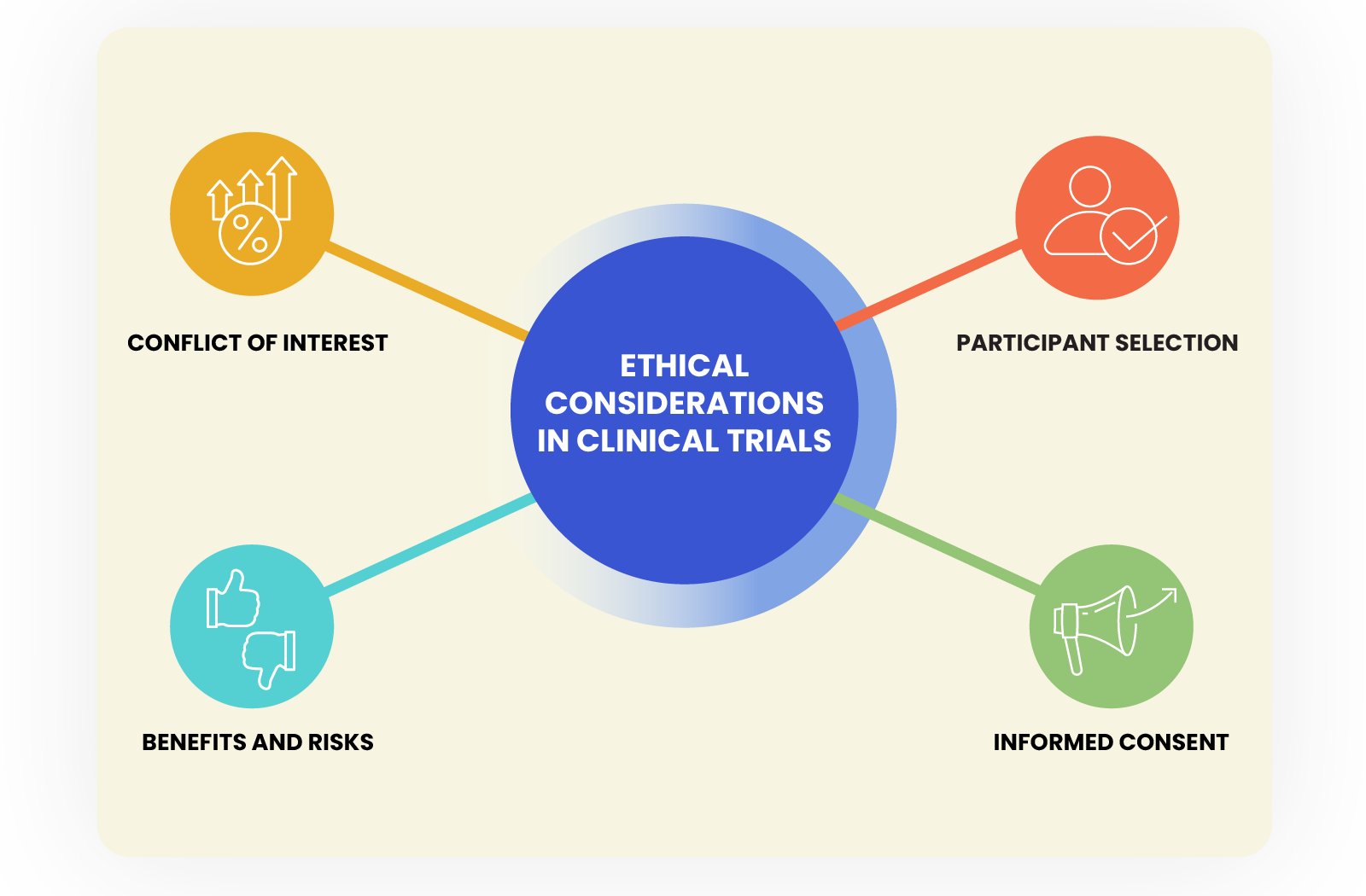

2. "Are Tribal Loans Ethical?" – An Ethical Dilemma

The ethicality of tribal loans is a contentious issue, viewed differently depending on one’s perspective.

2.1 Arguments for Ethical Concerns (The Borrower’s Perspective)

Many critics argue that tribal loans are inherently unethical due to their potential for exploitation:

- Predatory Lending Practices: The excessively high APRs are often cited as predatory, trapping vulnerable borrowers in a cycle of debt. What begins as a small loan can quickly escalate into an unmanageable financial burden due to compounding interest and fees.

- Targeting Vulnerable Populations: These loans are often marketed to individuals who are financially distressed, have low credit scores, or lack access to mainstream credit. Critics argue that preying on such vulnerability is unethical.

- Lack of Transparency: Loan agreements can be complex, containing clauses that are difficult for the average consumer to understand, particularly regarding interest calculation, fees, and dispute resolution mechanisms (e.g., mandatory arbitration under tribal law).

- Exploitation of Legal Loopholes: Leveraging sovereign immunity to bypass consumer protection laws that apply to other lenders is seen by some as an unethical exploitation of a legal shield, rather than a legitimate exercise of self-governance.

- Negative Societal Impact: The proliferation of high-cost credit can exacerbate financial inequality, contribute to personal bankruptcies, and undermine the financial stability of communities.

2.2 Arguments for Ethical Justification (The Lender’s/Tribe’s Perspective)

From the perspective of the tribes and their lending entities, these operations are often viewed as ethical and necessary:

- Economic Development and Self-Sufficiency: For many tribes, particularly those without successful gaming operations, online lending is a significant source of revenue. This revenue is often crucial for funding essential tribal government services such such as education, healthcare, housing, and infrastructure, which are frequently underfunded by federal and state governments.

- Exercise of Sovereign Rights: Tribes assert their inherent right to self-determination and economic self-sufficiency. Operating lending businesses under tribal law is viewed as a legitimate exercise of their sovereignty, no different from other tribal enterprises.

- Filling a Market Gap: Tribal lenders argue they serve a demographic that is underserved by traditional banks and credit unions. Without tribal loans, many subprime borrowers would have no access to emergency credit, potentially forcing them into even riskier alternatives or financial destitution.

- Consumer Choice: Proponents argue that borrowers are consenting adults who voluntarily choose these loans after reviewing the terms. They contend that restricting such choices infringes on individual autonomy.

- Tribal Regulation: Many tribes claim to have their own robust regulatory frameworks for their lending operations, ensuring fair practices under tribal law, even if those laws differ from state regulations.

3. Native American Loan Legal Challenges

The legal landscape surrounding tribal loans is a battleground, primarily centered on the scope of tribal sovereign immunity and its application to commercial activities.

3.1 The Core Legal Battleground: Sovereign Immunity

The central legal challenge revolves around whether tribal lending entities can genuinely claim sovereign immunity from state and federal laws.

- "Arm of the Tribe" Doctrine: For a lending entity to claim sovereign immunity, it must demonstrate it is an "arm of the tribe" – meaning it is genuinely controlled by and operates for the benefit of the tribe. This is a highly litigated area, with courts scrutinizing the degree of tribal ownership, management, and direct benefit derived by the tribal government.

- Challenges to Immunity: State attorneys general and consumer advocates frequently challenge claims of immunity, arguing that many tribal lenders are merely "rent-a-tribe" schemes. In these arrangements, non-Native American lenders allegedly partner with tribes in name only, primarily to exploit sovereign immunity while the real economic benefit flows to the non-tribal entity.

3.2 Key Legal Precedents and Cases

- Oklahoma Tax Comm’n v. Citizen Band Potawatomi Indian Tribe of Oklahoma (1991): The U.S. Supreme Court affirmed that tribal sovereign immunity extends to commercial activities conducted by the tribe, not just governmental functions. This case provided a foundational precedent for tribal economic enterprises, including lending.

- Michigan v. Bay Mills Indian Community (2014): This landmark Supreme Court case reaffirmed tribal sovereign immunity, even for activities conducted off-reservation. Michigan attempted to sue the Bay Mills Indian Community for operating an off-reservation casino. The Court held that immunity protected the tribe from the lawsuit, but notably, Justice Sotomayor’s concurring opinion and the dissenting justices highlighted concerns about potential abuses of immunity in online lending. The dissent, in particular, warned that the ruling could effectively create "havens for illegal activity."

- State Enforcement Actions: Despite Bay Mills, states continue to pursue tribal lenders. They often do so by:

- Suing individuals: Targeting the non-tribal executives or third-party servicers involved in the lending operations, arguing they are not protected by tribal immunity.

- Challenging the "arm of the tribe" status: Arguing that the lending entity is not truly an arm of the tribe.

- Claiming waiver of immunity: Contending that the tribe has implicitly or explicitly waived its immunity through its actions or loan agreements.

- Applying "choice of law" principles: While loan agreements often specify tribal law, courts may refuse to enforce these clauses if they conflict with fundamental public policy of the forum state (e.g., strong consumer protection laws). Cases like California v. Miami Nation of Oklahoma illustrate states’ efforts to shut down lenders operating under tribal affiliations.

- Federal Regulatory Scrutiny: The Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) have also investigated and taken action against tribal lenders, particularly when they identify deceptive practices or misrepresentations of immunity. However, their enforcement powers are often constrained by the same sovereign immunity challenges faced by states.

3.3 The Path Forward for Borrowers

For consumers who believe they have been harmed by tribal lenders, the legal path can be challenging:

- Arbitration Clauses: Many tribal loan agreements include mandatory arbitration clauses, requiring disputes to be resolved through tribal arbitration, often under tribal law, rather than in state or federal courts. The enforceability of these clauses is a frequent point of litigation.

- Limited Recourse: If a lender successfully asserts sovereign immunity, a borrower’s ability to sue or seek damages can be severely limited.

- Reporting: Borrowers can report complaints to their state attorney general, the CFPB, and the FTC. While direct legal action may be difficult, these agencies can sometimes intervene or gather evidence for broader enforcement efforts.

- Legal Counsel: Seeking legal advice from attorneys specializing in consumer protection and tribal law is crucial to understand available options.

4. Navigating Tribal Loans: Advice for Consumers and Policymakers

The complex interplay of ethics, sovereignty, and consumer protection demands careful consideration from all stakeholders.

4.1 For Consumers

- Exercise Extreme Caution: Tribal loans carry significant risks due to high interest rates and potential limitations on legal recourse.

- Explore Alternatives: Before considering a tribal loan, exhaust all other options: credit unions, small personal loans from traditional banks, community assistance programs, or asking for an advance from an employer.

- Read the Fine Print: Meticulously review all loan documents, paying close attention to the APR, fees, repayment schedule, and critically, the choice of law and arbitration clauses. Understand what jurisdiction will govern disputes.

- Verify Legitimacy: Ensure the lender is properly licensed in your state, if applicable, and research their reputation. Be wary of lenders who are evasive about their affiliations or regulatory oversight.

- Understand Collection Practices: Be aware that even with sovereign immunity, lenders can still pursue collection through legal means, including wage garnishment (if allowed by tribal law and upheld by courts) or reporting to credit bureaus.

4.2 For Policymakers

- Balance Sovereignty and Protection: Policymakers face the delicate task of respecting tribal sovereignty while ensuring robust consumer protections.

- Strengthen "Arm of the Tribe" Tests: Courts and regulators should continue to apply stringent tests to determine if a lending entity is truly an "arm of the tribe," distinguishing genuine tribal enterprises from "rent-a-tribe" arrangements.

- Promote Responsible Lending: Encourage and support tribes in developing and adhering to responsible lending practices that prioritize consumer well-being while still generating revenue.

- Foster Collaboration: Facilitate dialogue and collaboration between state/federal regulators and tribal governments to develop mutually agreeable solutions that uphold both sovereign rights and consumer protection standards.

- Support Tribal Economic Diversification: Invest in and promote diverse economic development opportunities for tribes, reducing over-reliance on high-risk enterprises like online lending.

Conclusion

The question "Are tribal loans ethical?" has no simple yes or no answer. From a consumer protection standpoint, the high costs and limited recourse often raise serious ethical concerns akin to predatory lending. However, from the perspective of tribal self-determination and economic necessity, these loans represent a legitimate exercise of sovereignty and a vital source of revenue for underfunded tribal governments.

Legally, the battle over tribal sovereign immunity continues to shape the landscape of Native American lending. While Supreme Court precedents affirm tribal immunity, state and federal agencies, along with consumer advocates, persist in challenging the structures and practices of these lenders. As the digital economy evolves, the ethical and legal complexities of tribal loans will undoubtedly remain a focal point for debate, demanding a nuanced approach that respects indigenous sovereignty while safeguarding the financial well-being of all consumers.