Navigating the Complexities: A Comprehensive Review of Conventional Loans on Tribal Land

The dream of homeownership is a cornerstone of the American experience, representing stability, wealth building, and a place to call one’s own. However, for Native Americans residing on tribal lands, or for non-Natives seeking to purchase homes within tribal jurisdictions where permitted, this dream often encounters a unique and intricate set of challenges. While government-backed programs like the Section 184 Indian Home Loan Guarantee Program are specifically designed to address these complexities, the question frequently arises: can conventional loans, the bedrock of the broader housing market, be used for homes on tribal land?

This comprehensive review delves into the viability, advantages, disadvantages, and ultimately, the recommendation for utilizing conventional loans for properties situated on tribal lands. We will explore the inherent conflicts between standard lending practices and the unique legal framework of tribal sovereignty and land tenure, providing a nuanced perspective for anyone considering this path.

Understanding the Landscape: Tribal Land and Homeownership

Before evaluating conventional loans, it’s crucial to grasp the distinct nature of tribal land. Unlike fee simple ownership prevalent across most of the United States, tribal lands often fall into one of two primary categories:

- Trust Land: This land is held in trust by the U.S. government for the benefit of a specific tribe or individual Native Americans. It is not owned outright by the individual in the conventional sense, but rather a beneficial interest is held. Trust land is generally immune from state and local property taxes and, crucially, from foreclosure by external creditors without specific federal and tribal authorization.

- Restricted Fee Land: While the individual holds the deed to this land, its alienation (sale, transfer, encumbrance) is restricted by federal law, requiring the approval of the Secretary of the Interior (through the Bureau of Indian Affairs, or BIA). This restriction aims to protect Native American land interests.

The fundamental challenge for any lending institution is the concept of collateral. In a conventional mortgage, the lender secures the loan against the property itself. If the borrower defaults, the lender can foreclose, take possession of the property, and sell it to recover their investment. This mechanism is severely complicated, if not entirely undermined, by the trust status and sovereign nature of tribal lands. Lenders cannot easily seize or sell property on trust land, making it a highly unattractive form of collateral for conventional financing.

What are Conventional Loans?

Conventional loans are mortgages that are not insured or guaranteed by a government agency (like FHA, VA, or USDA). Instead, they are typically backed by private lenders and conform to the guidelines set by government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac. These loans usually require:

- Good credit scores (typically 620 or higher).

- A down payment (often 3% to 20% or more).

- A manageable debt-to-income (DTI) ratio.

- Private Mortgage Insurance (PMI) if the down payment is less than 20%.

For most homebuyers, conventional loans offer competitive interest rates and flexible terms, making them a preferred choice when eligible. However, their reliance on standard property ownership and clear collateral poses significant hurdles on tribal lands.

The Intersection: Conventional Loans on Tribal Land

The direct answer to whether conventional loans can be used on tribal land is rarely, and with extreme difficulty. The primary mechanism that might make it possible is through a long-term leasehold agreement on tribal or trust land.

Here’s how it theoretically works:

- Leasehold Interest: Instead of owning the land outright (fee simple), the borrower enters into a long-term lease (e.g., 50-99 years) with the tribal government or the individual Native American landowner (if it’s individual trust land).

- BIA Approval: This lease agreement must be approved by the Bureau of Indian Affairs (BIA) to ensure it complies with federal regulations protecting tribal interests.

- Lender Security: The lender then takes a security interest in the leasehold estate and the improvements (the house built on the land), rather than the land itself. In the event of default, the lender’s recourse would be to take over the lease and the home, then attempt to sell the leasehold interest and home to another qualified buyer.

This process is fraught with complications, making it a path less traveled by both borrowers and lenders.

Pros of Conventional Loans on Tribal Land (Limited and Conditional)

Given the inherent difficulties, the "pros" of using conventional loans on tribal land are highly conditional and often theoretical.

- Potentially Lower Interest Rates (for highly qualified borrowers): In a hypothetical scenario where a lender was willing to offer a conventional loan on tribal land, a borrower with excellent credit and a substantial down payment might secure a slightly lower interest rate compared to some specialized government-backed programs, simply because conventional rates can sometimes be more competitive in the broader market. This is a big "if," however.

- Higher Loan Limits: Conventional loans generally have higher loan limits than some government-backed loans, which could be an advantage for purchasing more expensive properties, assuming such properties exist and are financeable on tribal land.

- No Upfront Mortgage Insurance Premiums (if 20%+ Down): Unlike FHA or USDA loans, conventional loans allow borrowers to avoid upfront mortgage insurance premiums if they put down 20% or more, and eventually cancel PMI once sufficient equity is built.

These advantages are largely overshadowed by the profound challenges, making them often unattainable in practice.

Cons of Conventional Loans on Tribal Land (Extensive and Significant)

The disadvantages of attempting to use conventional loans on tribal land are numerous and often insurmountable, representing the core reason why this is not a recommended path for most.

- Extreme Lender Reluctance and Limited Availability: This is the single biggest hurdle. Most conventional lenders, unfamiliar with the unique legal framework of tribal land, will simply refuse to lend. The perceived risk, coupled with the lack of clear foreclosure mechanisms, makes these loans an unattractive prospect for private banks and credit unions. Finding a lender willing to even consider such a loan is exceptionally rare.

- Collateral and Foreclosure Challenges: As discussed, trust land is immune from involuntary alienation (foreclosure) without specific federal and tribal consent. Even with a leasehold interest, a lender’s ability to foreclose and then sell that leasehold interest (and the home) is severely restricted by tribal sovereignty and federal regulations. This creates an unacceptable risk profile for most conventional lenders.

- Leasehold vs. Fee Simple Ownership: The borrower does not own the land; they only lease it for a specific term. This is a fundamental difference from traditional homeownership. While the home itself can be owned, the land underneath it reverts to the tribe or original landowner at the end of the lease term, unless the lease is renewed. This impacts long-term equity, inheritance, and future planning.

- Complex Legal and Administrative Processes: Securing a long-term lease on tribal land involves navigating tribal laws, BIA regulations, and potentially tribal council approval. This process can be lengthy, complex, and require specialized legal expertise, adding significant time and cost.

- Appraisal Difficulties: Appraisers rely on comparable sales (comps) of similar properties in the vicinity to determine a home’s value. On tribal lands, comparable sales are often scarce or non-existent, especially for properties with a leasehold interest. This makes accurate valuation extremely difficult, further deterring lenders.

- Title and Survey Challenges: Establishing clear title on tribal lands can be intricate. Trust land titles are managed by the BIA, and surveys may be historical or require specialized attention to delineate leasehold boundaries, adding to the complexity and cost.

- Limited Marketability and Resale Value: If a borrower needs to sell a home on tribal land with a leasehold interest, the potential pool of buyers is significantly smaller. Buyers must be willing to accept a leasehold arrangement, navigate tribal laws, and potentially qualify for specific tribal-approved financing. This limited market can significantly depress resale value and make it difficult to sell quickly.

- Potential for Higher Costs (Due to Legal and Administrative Fees): While the interest rate might theoretically be lower, the added legal fees, administrative costs, and potential for specialized surveys or appraisals can offset any savings.

- Lack of Federal Guarantee or Insurance: Unlike FHA, VA, or Section 184 loans, conventional loans on tribal land would lack any government guarantee or insurance, placing the full risk squarely on the private lender and, indirectly, on the borrower if complications arise.

Alternatives to Consider (Highly Recommended)

Given the overwhelming challenges, attempting to use a conventional loan on tribal land is generally not advisable. Fortunately, several specialized programs are specifically designed to facilitate homeownership in these unique circumstances:

-

HUD Section 184 Indian Home Loan Guarantee Program (Strongly Recommended): This is the primary and most effective program for Native Americans and Alaska Natives to purchase, construct, or rehabilitate homes on and off tribal lands.

- How it Works: HUD guarantees the loan, reducing the risk for lenders and making them more willing to lend on tribal lands.

- Benefits: Requires low down payments, flexible credit requirements, and works with the unique land tenure systems (trust land, restricted fee land, and leaseholds). It directly addresses the collateral issue.

- Process: Involves tribal government approval and BIA review, but the process is standardized and familiar to participating lenders.

- Eligibility: Must be an enrolled member of a federally recognized tribe.

-

VA Home Loans (for Eligible Veterans): If a Native American veteran is eligible for a VA loan, this can be an excellent option. VA loans are guaranteed by the Department of Veterans Affairs and offer competitive rates, no down payment, and no private mortgage insurance. The VA has specific provisions for financing homes on tribal trust land through the Native American Direct Loan (NADL) Program, which is a direct loan from the VA itself for Native American veterans.

-

USDA Rural Development Loans (Section 502 Direct and Guaranteed): For tribal lands located in eligible rural areas, USDA loans can be an option. These loans offer low interest rates and no down payment for qualified low-to-moderate income borrowers. While primarily designed for fee simple properties, the USDA has shown some flexibility in working with long-term leasehold estates, though it’s less tailored than Section 184.

-

Tribal Housing Programs and Direct Lending: Many tribal nations have established their own housing authorities or programs to assist their members with homeownership, construction, and rehabilitation. Some tribes may offer direct loans or grants, or partner with specific lenders familiar with their unique land tenure.

Recommendation

Based on the extensive challenges and the existence of highly effective, purpose-built alternatives, the recommendation regarding conventional loans on tribal land is strongly against their use as a primary financing option.

Do NOT pursue conventional loans for properties on tribal land unless:

- You have exhausted all other specialized options (especially Section 184 and VA NADL).

- You have found a conventional lender with extensive, documented experience specifically in financing homes on tribal leasehold land, with a proven track record.

- You fully understand the implications of a leasehold interest (not owning the land) and the severe limitations on resale and equity building.

- You have secured independent legal counsel specializing in tribal law and real estate, who can thoroughly review all lease agreements and lending terms.

- The tribal government explicitly supports and facilitates such conventional lending arrangements, which is rare.

Instead, the unequivocal recommendation is to first and foremost explore and utilize the HUD Section 184 Indian Home Loan Guarantee Program. This program was specifically created to bridge the gap between mainstream lending and the unique legal framework of tribal lands, offering a safer, more accessible, and more effective pathway to homeownership for eligible Native Americans. If you are a Native American veteran, the VA Native American Direct Loan program is also a highly superior alternative.

Conclusion

While the allure of conventional loan rates and terms might seem appealing, the reality of applying them to tribal lands reveals a complex and often insurmountable barrier. The fundamental conflict between a conventional lender’s need for clear collateral and the sovereign nature and trust status of tribal lands makes this path largely impractical and risky.

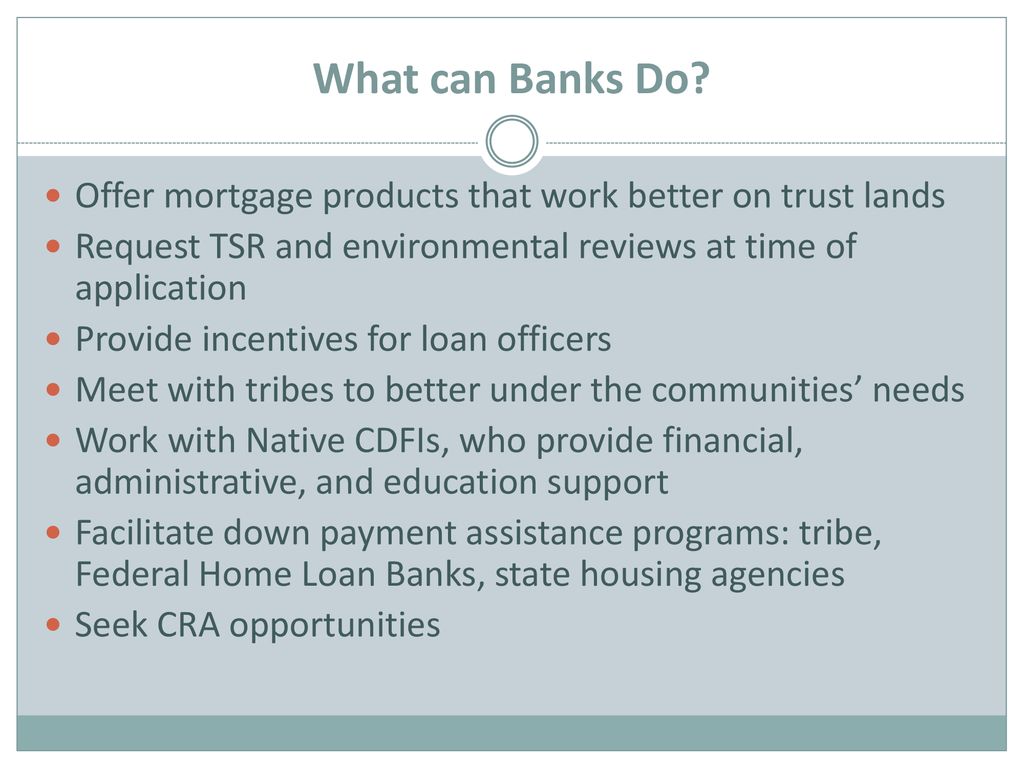

For those seeking homeownership on tribal lands, education, diligence, and a focus on specialized programs like the HUD Section 184 program are paramount. These programs are not merely alternatives; they are the intended and most viable solutions, designed to respect tribal sovereignty while empowering Native Americans to achieve their homeownership dreams within their communities. Consulting with tribal housing authorities, BIA officials, and lenders experienced in tribal lending is the most prudent first step towards navigating this unique and important journey.