Unlocking Homeownership: Can Non-Tribal Members Access Native American Home Loans? An In-Depth Review of HUD Section 184

The dream of homeownership is a universal aspiration, often requiring navigating complex financial landscapes. For specific communities, tailored loan programs exist to address unique challenges and promote economic development. Among these, the Native American Home Loan program, specifically the HUD Section 184 program, stands out as a vital resource for Indigenous peoples. However, a common and pressing question arises: Can non-tribal members get Native American home loans?

This article will delve deep into the intricacies of the HUD Section 184 program, providing a comprehensive review that explores its purpose, eligibility requirements, advantages, disadvantages, and ultimately, offers a clear recommendation on who should consider pursuing this unique path to homeownership.

Understanding the HUD Section 184 Loan Program: A Foundation

Before addressing the core question, it’s crucial to understand what the HUD Section 184 program is and for whom it was primarily designed. Established by the Indian Housing Act of 1992, the Section 184 Indian Home Loan Guarantee Program is a unique mortgage product specifically designed to provide homeownership and housing rehabilitation opportunities for Native American and Alaska Native families, federally recognized tribes, and Tribally Designated Housing Entities (TDHEs).

Administered by the U.S. Department of Housing and Urban Development’s (HUD) Office of Native American Programs (ONAP), this program guarantees loans made by private lenders to eligible Native American borrowers. This guarantee significantly reduces the risk for lenders, making it easier for them to offer mortgages in areas and to populations that might otherwise face challenges securing conventional financing, particularly on trust lands or in rural tribal communities.

The program is designed to address historical barriers to homeownership faced by Native Americans, including issues related to land tenure (trust land vs. fee simple), income disparities, and lack of access to mainstream financial services. Its core mission is to support self-determination and economic development within Native American communities by facilitating safe, affordable housing.

The Direct Answer: Can Non-Tribal Members Be Primary Borrowers?

Let’s address the central question head-on: No, non-tribal members cannot be the primary borrower on a HUD Section 184 loan. The program’s fundamental eligibility requirement is that the borrower (or at least one of the primary borrowers) must be an enrolled member of a federally recognized American Indian or Alaska Native tribe. This is not a discriminatory practice but rather a direct reflection of the program’s legislative intent and its mission to serve and uplift Native American communities.

The program is a tool for tribal self-determination, enabling individuals and families within these communities to build wealth, establish roots, and contribute to their community’s stability and growth. Allowing non-tribal members to be primary borrowers would dilute the program’s focus and potentially divert resources from its intended beneficiaries.

The Nuance: When a Non-Tribal Member Might Be Involved

While a non-tribal member cannot be the sole or primary borrower, there is a specific scenario where they can be involved: as a co-borrower with an eligible enrolled tribal member.

This situation typically arises in marriages or partnerships where one individual is an enrolled tribal member and the other is not. In such cases, the enrolled tribal member acts as the primary eligible borrower, and their non-tribal spouse or partner can be included on the loan. Both individuals’ incomes and credit histories would typically be considered for qualification purposes.

It’s crucial to understand that even in this co-borrowing scenario, the core purpose of the loan remains tied to the eligible tribal member and their family’s access to homeownership. The property itself must also be located in an eligible area, which includes approved service areas on or off reservations where Native American populations reside.

Key Eligibility Requirements (Recap)

To be clear, here’s a summary of the fundamental eligibility requirements for a HUD Section 184 loan:

- Tribal Enrollment: At least one borrower must be an enrolled member of a federally recognized American Indian or Alaska Native tribe.

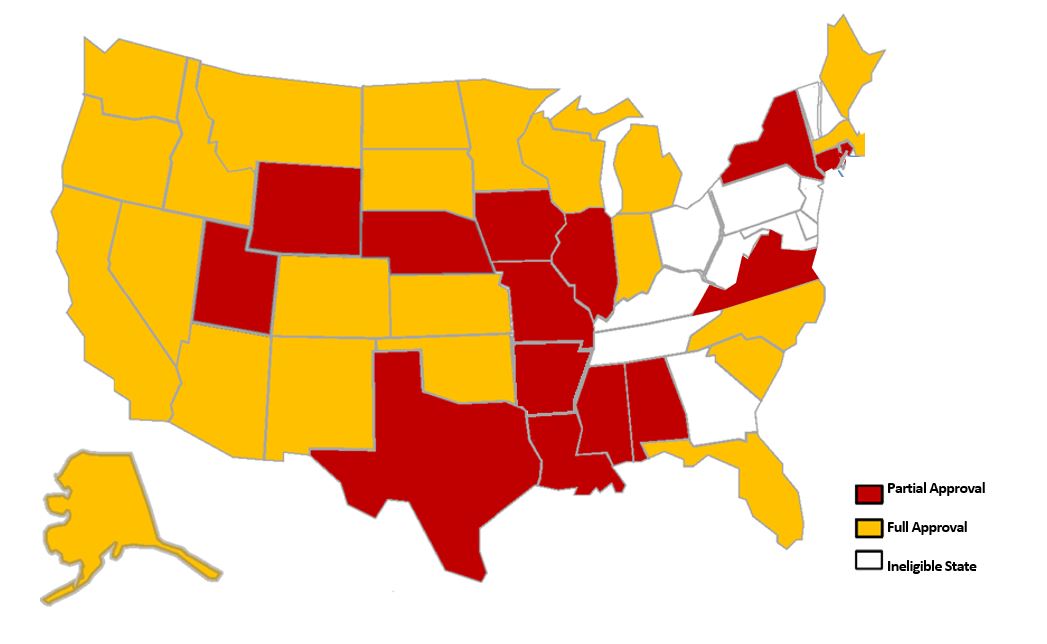

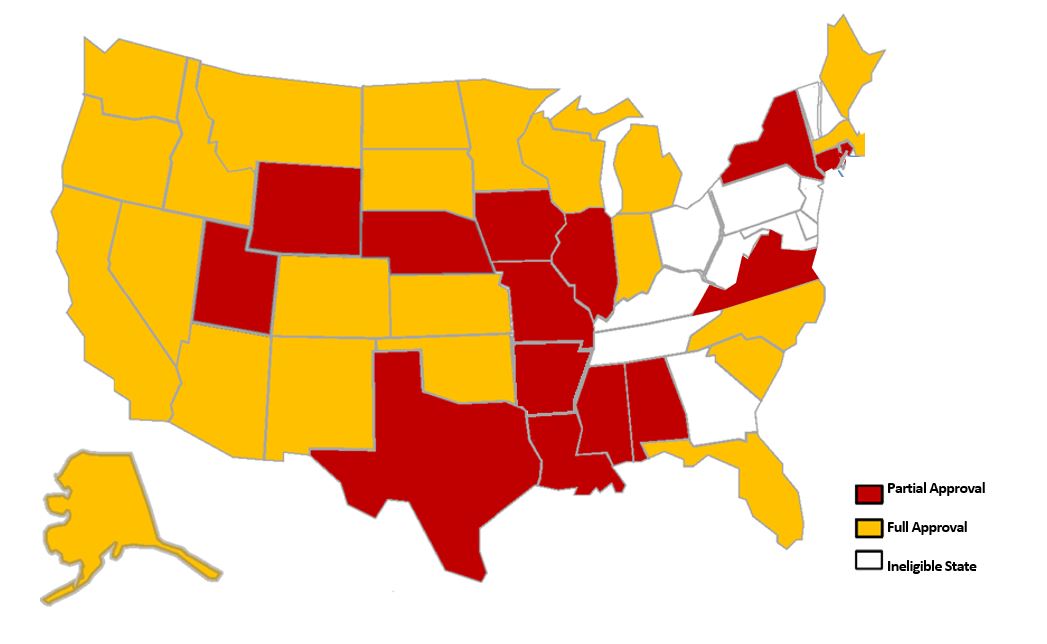

- Property Location: The property must be located in an eligible area approved by HUD for the Section 184 program. These areas extend beyond reservation boundaries to include many off-reservation communities where Native Americans reside.

- Credit and Income: While the program offers flexible underwriting, borrowers must still meet standard income, debt-to-income ratio, and credit requirements. The program is designed to be more forgiving than conventional loans, but not to approve financially unstable applicants.

- Occupancy: The home must be used as the borrower’s primary residence.

Advantages of the HUD Section 184 Program (Pros)

For those who are eligible, or who co-borrow with an eligible individual, the HUD Section 184 program offers numerous compelling advantages:

- Low Down Payment: One of the most attractive features is the remarkably low down payment requirement. For loans up to $50,000, no down payment is required. For loans over $50,000, only a 1.25% down payment is typically needed. This significantly lowers the barrier to entry for many families.

- Flexible Credit Underwriting: The program allows for more flexible credit standards compared to conventional loans. Lenders are encouraged to look beyond just credit scores and consider alternative credit histories, such as utility payments or rent history, which can be beneficial for borrowers with limited traditional credit.

- Competitive Interest Rates: Section 184 loans often offer competitive interest rates, which can be fixed for the life of the loan, providing stability and predictability in monthly payments.

- No Monthly Mortgage Insurance: Unlike FHA loans, which require monthly mortgage insurance premiums (MIP) for the life of the loan or for a significant period, Section 184 only requires a one-time upfront loan guarantee fee (1% of the loan amount), which can be financed into the loan. This results in lower monthly payments over the long term.

- Versatile Use: The loan can be used for various purposes, including purchasing an existing home, constructing a new home, rehabilitating a home, or refinancing an existing mortgage. It can also be used to purchase land and construct a home on it.

- Trust Land Eligibility: Crucially, Section 184 loans are one of the few mortgage products specifically designed to work with unique land tenure systems, including homes on tribal trust land, allotted land, and fee simple land within eligible areas. This is a significant advantage where conventional financing often struggles due to the complexities of land ownership.

- Support for Community Development: By facilitating homeownership, the program indirectly supports economic development, stability, and wealth creation within Native American communities.

Disadvantages and Limitations (Cons)

Despite its many benefits, the HUD Section 184 program also comes with certain limitations and potential drawbacks, especially for those not fully understanding its purpose:

- Strict Primary Borrower Eligibility: As discussed, the most significant limitation is the strict requirement for the primary borrower to be an enrolled member of a federally recognized tribe. This immediately excludes the vast majority of non-tribal members seeking individual home loans.

- Geographic Limitations: While eligible areas extend beyond reservations, the property must still be located within a HUD-approved Section 184 service area. This means not every property in the country qualifies, limiting options for some borrowers.

- Complexity of Tribal Land: While the program is designed to work with tribal land, navigating leases, tribal approvals, and Bureau of Indian Affairs (BIA) regulations for homes on trust or allotted land can add layers of complexity and extend the closing process compared to conventional loans on fee simple land.

- Limited Lender Participation: While the program is national, not all mortgage lenders offer Section 184 loans. Borrowers may need to seek out specific HUD-approved lenders experienced with the program, which might limit their choices or require more effort in finding a suitable lender.

- Potential for Misconceptions: Non-tribal members, unaware of the program’s specific intent, may incorrectly assume it’s broadly available, leading to frustration and wasted effort when they discover their ineligibility.

- Program Focus vs. Individual Needs: The program’s core focus is on uplifting Native American communities. While beneficial, this means its structure is less about broad market access and more about targeted assistance, which can feel restrictive to those outside its target demographic.

The "Purchase Recommendation": Who Should Consider This Loan?

Given the detailed review of the HUD Section 184 program, the "purchase recommendation" isn’t about buying a product, but rather about who should actively explore and pursue this loan option.

Strongly Recommended For:

- Enrolled Members of Federally Recognized Tribes: If you are an enrolled member of a federally recognized tribe and are looking to purchase, build, rehabilitate, or refinance a home, the HUD Section 184 loan should be one of the first options you investigate. Its benefits, particularly the low down payment, flexible underwriting, and ability to finance homes on tribal land, are specifically tailored to your needs.

- Non-Tribal Members Married To or Partnered With an Eligible Tribal Member: If you are in a committed relationship with an enrolled tribal member who intends to be a co-borrower and the property will be your primary residence in an eligible area, then this program is absolutely worth exploring together. It offers a powerful pathway to homeownership that might otherwise be unavailable or more challenging to secure.

Not Recommended For:

- Non-Tribal Members Seeking a Loan Independently: If you are a non-tribal member with no eligible tribal member co-borrower, you are not eligible for the HUD Section 184 program. Pursuing this option independently will lead to disappointment. You should instead explore conventional, FHA, VA (if applicable), or USDA loan programs that are designed for the general population.

- Individuals Not Intending to Occupy the Home as a Primary Residence: The program is strictly for owner-occupied homes. It cannot be used for investment properties or secondary residences.

Conclusion

The question of whether non-tribal members can get Native American home loans has a nuanced answer. While a non-tribal member cannot be the primary borrower, they can certainly benefit from the program as a co-borrower alongside an eligible enrolled tribal member. The HUD Section 184 Indian Home Loan Guarantee Program is an invaluable resource, specifically crafted to address historical inequities and foster homeownership within Native American and Alaska Native communities.

Its advantages, including low down payments, flexible credit requirements, and the ability to finance homes on tribal land, make it a powerful tool for its intended beneficiaries. However, its strict eligibility, geographic limitations, and the complexities of tribal land tenure underscore its highly specialized nature.

For those who meet the core eligibility criteria – particularly enrolled tribal members and their families – the HUD Section 184 program represents an exceptional opportunity to achieve the dream of homeownership. For non-tribal members outside of a co-borrowing relationship, understanding the program’s purpose is key to recognizing its limitations and directing their housing search towards other appropriate financing options. Ultimately, respecting the program’s intent and seeking guidance from HUD-approved lenders are crucial steps in navigating this unique and beneficial pathway to homeownership.