Okay, here is a 1200-word article in English about best practices for managing debt while applying for a tribal home loan, including pros, cons, and recommendations.

Navigating the Path to Homeownership: Best Practices for Managing Debt While Applying for a Tribal Home Loan

For many Native Americans and Alaska Natives, the dream of owning a home within their ancestral lands or tribal communities is deeply intertwined with cultural identity, family legacy, and community well-being. Tribal home loan programs, notably the HUD Section 184 Indian Home Loan Guarantee Program, serve as vital pathways to making this dream a reality. These unique loan products offer significant advantages tailored to the specific circumstances of tribal members and their lands. However, the journey to homeownership, even through these specialized programs, often intersects with the common challenge of managing existing debt.

Debt, whether from student loans, credit cards, medical bills, or other sources, can feel like an insurmountable barrier. Yet, with strategic planning, financial discipline, and an understanding of how tribal home loans assess an applicant’s financial health, managing debt while pursuing a tribal home loan is not only possible but entirely achievable. This article will delve into best practices for navigating this dual challenge, exploring the advantages and disadvantages of these loans in the context of debt, and offering actionable recommendations to empower prospective homeowners.

Understanding Tribal Home Loans and Their Unique Landscape

Before diving into debt management, it’s crucial to understand the foundation of tribal home loans. The most prominent is the HUD Section 184 Indian Home Loan Guarantee Program. This program is specifically designed to provide mortgage financing to eligible Native American and Alaska Native individuals, tribes, and Tribally Designated Housing Entities. Key features include:

- Low Down Payments: Often as low as 2.25% for loans over $50,000, and 1.25% for loans under $50,000.

- Flexible Underwriting: Lenders often consider alternative credit histories and have more flexibility in evaluating debt-to-income ratios (DTI) compared to conventional loans.

- Lower Interest Rates: Rates are typically competitive and often below market rates for conventional loans.

- Guaranteed by HUD: This reduces the risk for lenders, making them more willing to offer loans to tribal members.

- Acceptance of Trust/Restricted Land: Crucially, these loans can be used to finance homes on trust land, restricted land, or fee simple land, addressing a significant hurdle in tribal land homeownership.

Other programs, such as USDA Rural Development loans or specific tribal housing programs, may also offer options. While each program has unique criteria, the core principle remains: facilitating homeownership for Native Americans and Alaska Natives, often with a more culturally sensitive and flexible approach to financial assessment.

The Interplay of Debt and Loan Eligibility

While tribal home loans offer more flexibility, debt still plays a significant role in the application process. Lenders will assess:

- Credit Score: Though Section 184 loans are more forgiving than conventional loans, a higher credit score (generally 620+) demonstrates financial responsibility and can lead to better terms.

- Debt-to-Income (DTI) Ratio: This is the percentage of your gross monthly income that goes towards debt payments. Lenders typically look for a DTI below 41-43% for Section 184 loans, though some flexibility exists.

- Payment History: Consistent, on-time payments for existing debts are critical indicators of reliability.

- Nature of Debt: The type of debt (revolving credit like credit cards vs. installment loans like student loans) and the amount of available credit versus used credit (credit utilization) are considered.

Best Practices for Managing Debt While Applying for a Tribal Home Loan

Successfully navigating the loan application process with existing debt requires a proactive and strategic approach.

1. Comprehensive Financial Assessment and Budgeting

- Know Your Numbers: The first step is to get a clear picture of all your debts (creditor, balance, interest rate, minimum payment) and your monthly income and expenses.

- Create a Detailed Budget: Track every dollar coming in and going out. Identify areas where you can cut back to free up more money for debt repayment or savings. Use budgeting apps, spreadsheets, or even pen and paper.

- Prioritize Needs vs. Wants: Distinguish between essential expenses (housing, food, utilities) and discretionary spending (entertainment, dining out). Aggressively reducing discretionary spending can create significant wiggle room.

2. Obtain and Review Your Credit Report

- Annual Free Report: Everyone is entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion) annually via AnnualCreditReport.com.

- Check for Errors: Discrepancies, fraudulent accounts, or outdated information can negatively impact your score. Dispute any errors immediately.

- Understand Your Score: Identify factors dragging your score down. Common culprits include late payments, high credit utilization, and collection accounts.

3. Strategic Debt Reduction

- High-Interest Debt First (Debt Avalanche): Focus on paying off debts with the highest interest rates first (e.g., credit cards). Once the first is paid off, roll that payment amount into the next highest interest debt. This saves the most money over time.

- Smallest Balance First (Debt Snowball): Alternatively, pay off the smallest balance first, then roll that payment into the next smallest. This method provides psychological wins and motivation, which can be crucial for long-term adherence.

- Negotiate with Creditors: If you’re struggling, contact creditors to discuss lower interest rates, payment plans, or even debt settlement (though debt settlement can negatively impact your credit).

- Consolidate High-Interest Debt: A personal loan with a lower interest rate can sometimes consolidate multiple high-interest debts, simplifying payments and potentially reducing overall interest paid. Be cautious, as this doesn’t eliminate debt, only reorganizes it.

4. Improve Your Credit Score

- Pay Bills On Time, Every Time: Payment history is the most significant factor in your credit score. Set up automatic payments or reminders.

- Reduce Credit Utilization: Aim to keep your credit card balances below 30% of your credit limit (lower is better, ideally under 10%).

- Avoid Opening New Credit Accounts: New credit inquiries can temporarily ding your score, and new debt will increase your DTI.

- Address Delinquent Accounts: Work to bring any past-due accounts current. If accounts are in collections, consider negotiating a "pay for delete" (where the collection agency agrees to remove the item from your report upon payment).

5. Build Savings and an Emergency Fund

- Down Payment and Closing Costs: While Section 184 loans have low down payments, you’ll still need funds for closing costs (typically 2-5% of the loan amount) and potentially a small down payment.

- Emergency Fund: Aim for at least 3-6 months of living expenses. This fund protects you from unexpected costs that could force you to incur new debt or miss mortgage payments after you buy your home.

6. Engage with Lenders and Housing Authorities Early

- Pre-Qualification/Pre-Approval: Get pre-qualified to understand how much you might be able to borrow. This is a soft credit pull and won’t hurt your score significantly. A pre-approval involves a harder pull but gives a more definitive number.

- Be Transparent: Discuss your debt situation openly with your lender. They can offer guidance and help structure your application. Tribal housing authorities or counselors specializing in Section 184 loans can also be invaluable resources.

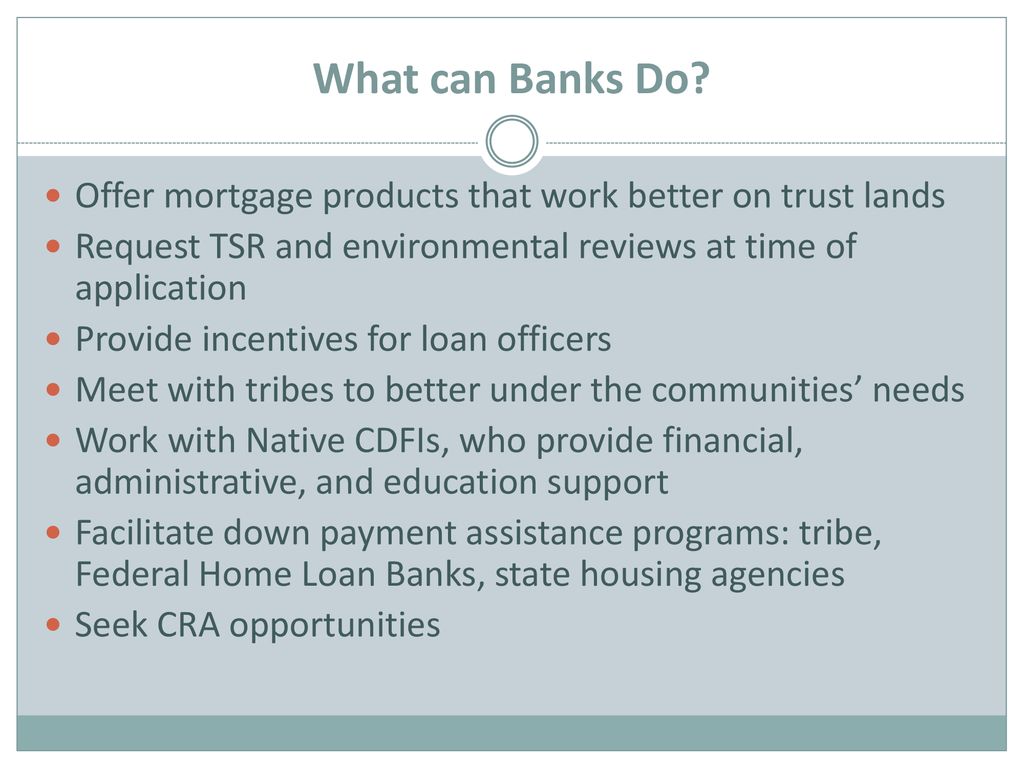

- Native CDFIs (Community Development Financial Institutions): These organizations often specialize in serving Native communities and can offer culturally appropriate financial counseling, credit building programs, and even small loans to help consolidate debt or build credit.

Advantages (Pros) of Tribal Home Loans for Those with Debt

- More Flexible Underwriting: Section 184 loans are often more understanding of past financial challenges. While conventional loans might strictly adhere to credit score cutoffs, tribal lenders may look at the "story" behind the debt and your overall financial stability.

- Lower Down Payment Requirements: Reducing the upfront cash needed means you can allocate more of your savings toward debt reduction or an emergency fund, making homeownership more accessible.

- Lower Interest Rates: Competitive interest rates can result in lower monthly mortgage payments, freeing up more of your income to manage existing debts or save for future needs.

- Access to Homeownership on Tribal Lands: For many, these loans are the only viable path to owning a home on trust or restricted lands, which traditional lenders often shy away from due to unique land tenure issues.

- Culturally Competent Support: Lenders and housing counselors specializing in tribal loans often have a deeper understanding of the unique economic and social factors affecting Native communities, providing more empathetic and effective guidance.

- Community Development Focus: The program’s goal is to support tribal self-determination and economic development, meaning the loans are designed to benefit the community and its members.

Disadvantages (Cons) of Tribal Home Loans (in the context of debt management)

- Debt Still Matters: While flexible, these loans are not a magic bullet. Significant, unmanaged debt, especially high DTI or recent delinquencies, can still lead to denial or less favorable terms.

- Limited Lender Availability: Not all mortgage lenders offer Section 184 loans. Finding a qualified and experienced lender can sometimes be a challenge, requiring applicants to do more research.

- Appraisal and Land Complexities: Homes on trust land can have unique appraisal challenges. While not directly related to debt, these complexities can sometimes extend the loan process, requiring sustained financial discipline.

- Ongoing Financial Responsibility: Obtaining the loan is only the first step. Homeownership comes with new expenses (maintenance, property taxes, insurance). If debt isn’t truly managed, these new costs can exacerbate financial strain.

- Potential for Misinformation: Because these loans are specialized, some applicants might receive incomplete or incorrect advice if they don’t consult with experienced tribal housing authorities or specialized lenders.

Recommendations for Prospective Tribal Homeowners

- Start Early, Plan Meticulously: Begin your debt management and savings efforts long before you plan to apply. The more time you give yourself, the better your financial standing will be.

- Educate Yourself Thoroughly: Understand the specifics of the HUD Section 184 program and any other tribal or state-specific programs available. Knowledge is power.

- Seek Professional Guidance: Connect with a HUD-approved housing counseling agency specializing in Native American programs, a Native CDFI, or a lender with extensive experience in Section 184 loans. They can provide personalized advice.

- Be Honest and Transparent with Your Lender: Don’t hide debt or financial challenges. Lenders appreciate honesty and can often work with you to find solutions if they have the full picture.

- Prioritize Debt Reduction Over New Spending: Every extra dollar should go towards reducing high-interest debt or building your emergency fund. Avoid taking on new debt during the application process.

- Build a Robust Emergency Fund: This is crucial for long-term homeownership success. It provides a buffer against unexpected repairs, job loss, or medical emergencies, preventing you from falling back into debt.

- Leverage Tribal Resources: Many tribal nations offer housing assistance programs, financial literacy courses, or partnerships with lenders that can further support your journey.

Conclusion

The dream of homeownership is a powerful motivator, and for Native Americans and Alaska Natives, tribal home loan programs like HUD Section 184 offer an invaluable opportunity. While existing debt can present a challenge, it is by no means an insurmountable one. By adopting best practices in financial assessment, strategic debt reduction, credit score improvement, and transparent communication with specialized lenders, prospective homeowners can effectively manage their debt while navigating the loan application process.

The advantages of these programs – flexible underwriting, lower costs, and access to homeownership on tribal lands – far outweigh the complexities, provided applicants approach the journey with diligence and an informed strategy. By embracing financial literacy, seeking expert guidance, and committing to responsible debt management, Native individuals and families can confidently open the door to sustainable homeownership and strengthen their communities for generations to come.