Navigating the Sacred Ground: Best Practices for Due Diligence on Tribal Land Purchases

The landscape of real estate investment is constantly evolving, with increasing interest in unique opportunities that offer both economic potential and the chance to foster meaningful partnerships. Among these, the acquisition or leasing of tribal lands presents a particularly complex, yet potentially rewarding, frontier. However, unlike conventional land transactions, conducting due diligence on tribal lands demands a specialized approach, deep cultural sensitivity, and an intricate understanding of a multi-layered legal and political framework.

This article explores best practices for conducting due diligence on tribal land purchases, outlining the inherent advantages and disadvantages, and providing comprehensive recommendations for prospective purchasers. Our goal is to equip investors with the knowledge to navigate this unique terrain respectfully, ethically, and successfully.

Understanding the Unique Landscape of Tribal Land

Before delving into due diligence specifics, it is crucial to grasp the foundational distinctions of tribal land. In the United States, tribal lands are generally categorized into two primary types, each with profound implications for due diligence:

- Trust Lands (or "Indian Country"): These lands are held in trust by the U.S. federal government for the benefit of a tribe or individual tribal members. They are not subject to state jurisdiction, but rather governed by federal law and tribal law. Direct "purchase" in fee simple of trust land is generally not possible; instead, transactions typically involve long-term leases, rights-of-way, or assignments, all of which require approval from the Bureau of Indian Affairs (BIA).

- Fee Lands: These are lands owned in fee simple by a tribe, a tribal enterprise, or individual tribal members, outside of the federal trust status. While still often subject to tribal governmental authority and potentially some federal oversight, they are generally more akin to conventional real estate transactions, though unique tribal ordinances may still apply.

The sovereign status of Native American tribes is paramount. Tribes possess inherent governmental authority over their lands and members, a power that predates the formation of the United States. This sovereignty means that any transaction involving tribal land is subject to tribal laws, codes, and customs, in addition to relevant federal statutes and regulations. State and local laws typically have limited or no applicability on trust lands.

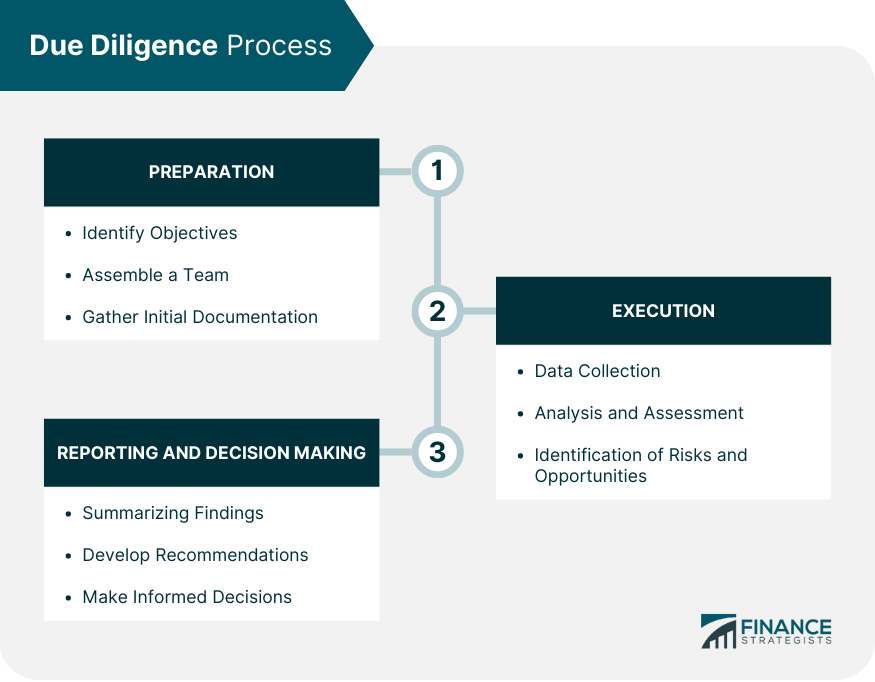

Core Pillars of Due Diligence on Tribal Land

Effective due diligence on tribal land extends far beyond standard commercial real estate practices. It requires a multi-disciplinary approach that prioritizes legal expertise, cultural understanding, and relationship building.

1. Legal and Jurisdictional Review: The Labyrinth of Law

This is arguably the most critical and complex component.

- Determine Land Status: The first step is unequivocally to determine if the land is trust land, fee land, or a mixture. This dictates the entire legal framework.

- Federal Law Review: For trust lands, thorough review of relevant federal statutes (e.g., Indian Reorganization Act, National Environmental Policy Act (NEPA), National Historic Preservation Act (NHPA), Indian Gaming Regulatory Act (IGRA) if applicable) and BIA regulations (25 CFR parts) is essential. All leases or agreements on trust land must be approved by the BIA, a process that can be lengthy and involves specific requirements.

- Tribal Law and Ordinances: Engage with the tribal government to understand their specific land use codes, zoning ordinances, business regulations, taxation policies, environmental standards, and cultural resource protection laws. These can vary significantly from tribe to tribe and may supersede or supplement federal regulations.

- Title Search and Encumbrances: Even on fee land, title can be complex due to historical land allotments, heirship issues, and fragmented ownership. For trust land, a "title status report" from the BIA is critical, detailing current ownership interests, encumbrances, and lease records. Be prepared for potential complexities arising from fractional ownership.

- Contractual Review: Scrutinize all existing leases, easements, rights-of-way, and service agreements. Understand their terms, duration, and whether they can be assigned or terminated.

- Dispute Resolution Mechanisms: Understand the tribal judicial system, tribal court jurisdiction, and any established dispute resolution processes outlined in tribal law or proposed agreements.

2. Environmental and Cultural Resource Assessment: Beyond Standard ESAs

Environmental due diligence on tribal lands must go deeper than a typical Phase I/II Environmental Site Assessment.

- Tribal Environmental Regulations: Many tribes have their own environmental protection agencies and regulations, which may be more stringent than federal or state standards. Compliance with these is mandatory.

- Cultural Resource Surveys (CRS): This is paramount. Federal law (NHPA, NEPA) requires consultation with tribes on projects impacting cultural resources. Many tribes also have their own cultural preservation offices and laws. A comprehensive CRS, often involving tribal monitors and cultural experts, is essential to identify archaeological sites, sacred lands, burial grounds, and other culturally sensitive areas. Failure to do so can lead to project delays, redesigns, or outright cancellation, alongside severe reputational damage.

- Natural Resources: Assess water rights, mineral rights, timber rights, and other natural resources. These are often complex and may be held separately or be subject to specific tribal or federal regulations.

- Infrastructure and Utilities: Verify the availability and capacity of water, sewer, electricity, and telecommunications. Understand who owns and maintains these systems and the process for securing new connections or upgrades. Tribal infrastructure can be less developed than off-reservation, requiring significant investment.

3. Political and Community Engagement: Building Trust and Partnerships

This is not merely a formality but a foundational element of successful tribal land transactions.

- Early and Sustained Communication: Initiate dialogue with tribal leadership (Tribal Council, President, Chair) early in the process. Be transparent about your intentions, project scope, and potential impacts.

- Stakeholder Identification: Understand the various groups within the tribe that may be affected or have an interest (e.g., elders, spiritual leaders, specific families, tribal departments, community members).

- Cultural Competence: Demonstrate genuine respect for tribal culture, history, traditions, and values. This involves listening actively, being patient, and understanding that decisions may be made through consensus-building processes that differ from Western business norms.

- Aligning with Tribal Priorities: Understand the tribe’s economic development goals, community needs, and long-term vision. Projects that align with and genuinely benefit the tribe are far more likely to gain approval and support.

- Public Meetings and Consultation: Be prepared to participate in and respect tribal consultation processes, which may include public meetings, hearings, and formal resolutions.

4. Financial and Economic Impact Assessment: Mutual Benefit

- Revenue Sharing and Economic Development: Clearly outline the economic benefits for the tribe, including potential revenue sharing, job creation (especially for tribal members), training programs, and local procurement opportunities.

- Financing Challenges: Traditional lenders may be hesitant to finance projects on trust land due to the federal trust status complicating collateral. Explore alternative financing mechanisms, federal loan guarantees (e.g., through the BIA or HUD), or tribal lending institutions.

- Tax Implications: Understand tribal taxation policies (e.g., sales tax, property tax, severance tax) and how they interact with federal and, if applicable, state taxes.

Advantages (Kelebihan) of Investing in Tribal Land

While complex, investing in tribal lands offers unique and compelling advantages:

- Untapped Economic Potential: Many tribal lands, particularly in rural areas, possess significant undeveloped resources (e.g., renewable energy potential, agricultural land, tourism sites, mineral resources) and strategic locations (e.g., near major highways or population centers).

- Long-Term, Stable Partnerships: Once trust is established, tribes often seek long-term, stable partnerships that provide sustained economic development. These relationships can be more resilient than typical commercial agreements.

- Sovereign Advantages: For certain industries (e.g., gaming, specific manufacturing), tribal sovereignty can offer unique regulatory environments or tax advantages not available off-reservation.

- Federal Support and Incentives: The federal government often provides grants, loan guarantees, and technical assistance programs aimed at promoting economic development on tribal lands, which can benefit partnered projects.

- Access to Unique Markets and Workforce: Projects can tap into specific tribal markets and a dedicated, often underemployed, tribal workforce, contributing to community building and shared prosperity.

- Cultural and Social Impact: Beyond financial returns, successful projects can provide meaningful social and cultural benefits to tribal communities, fostering a positive reputation for the investor.

- Environmental Stewardship: Many tribes have strong traditions of environmental stewardship, which can align with and enhance sustainable development goals.

Disadvantages & Challenges (Kekurangan) of Tribal Land Purchases

Despite the advantages, the unique nature of tribal lands presents significant challenges:

- Complexity and Timeframes: The multi-layered legal framework (federal, tribal, sometimes state) and the necessity of BIA approval (for trust land) can lead to significantly longer transaction timelines compared to conventional real estate. Bureaucratic processes can be slow.

- Jurisdictional Ambiguity: Navigating the interplay between federal and tribal laws, especially in areas like civil jurisdiction, taxation, and environmental regulation, can be confusing and lead to disputes if not thoroughly understood.

- Cultural Sensitivity and Misunderstanding: A lack of cultural competence or perceived disrespect can quickly derail a project, regardless of its economic merits. Misunderstandings about tribal decision-making processes or priorities are common.

- Financing Difficulties: The federal trust status of much tribal land complicates its use as collateral, making it challenging to secure traditional commercial financing.

- Political Shifts: Tribal governments are democratic, and leadership can change through elections. A change in tribal administration may lead to shifts in priorities or a re-evaluation of existing agreements.

- Reputational Risk: Missteps in due diligence or community engagement can lead to negative publicity, protests, and damage to an investor’s reputation, potentially impacting other ventures.

- Heirship and Fractional Ownership: On trust lands, historical allotment policies have led to extreme fractional ownership, where a single parcel might have hundreds of owners, complicating consensus and approvals.

- Limited Infrastructure: Many tribal lands, especially in remote areas, lack robust infrastructure, necessitating significant upfront investment in roads, utilities, and services.

Recommendations for Prospective Purchasers (Rekomendasi Pembelian)

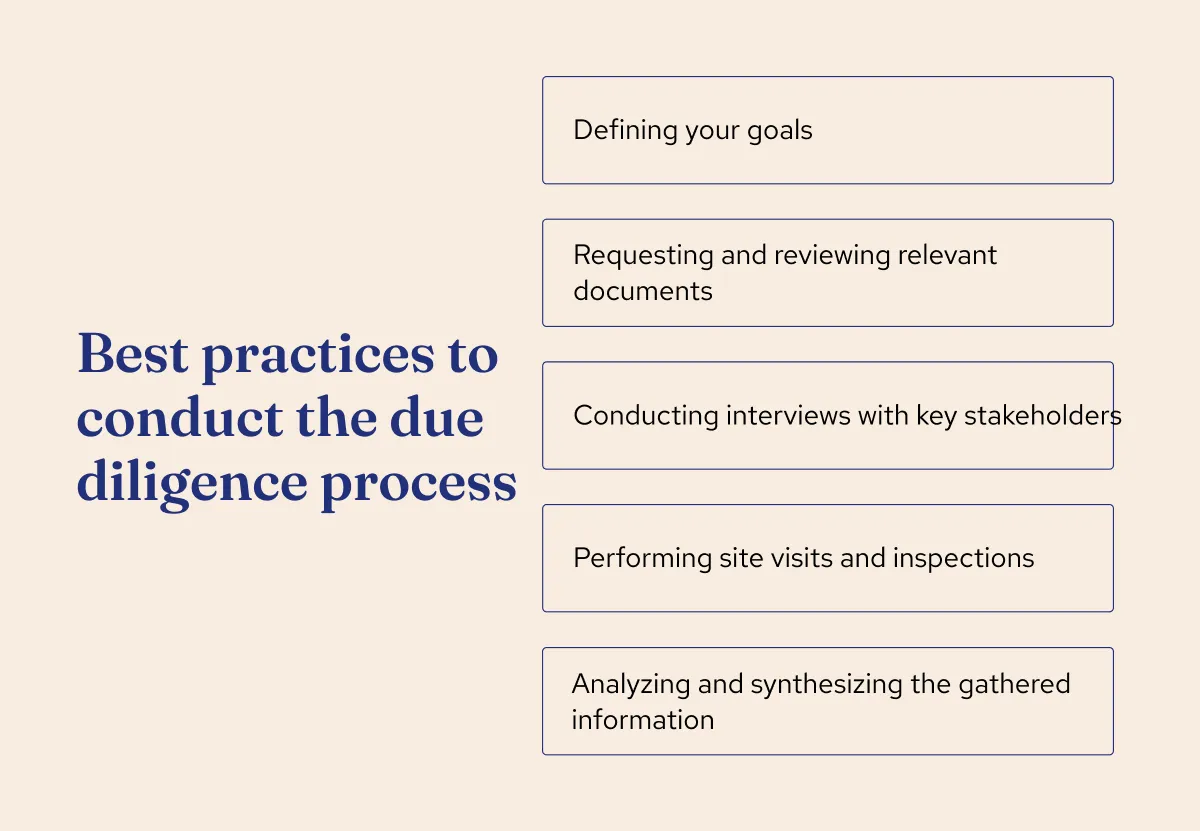

For those considering investing in tribal lands, the following recommendations are crucial for a successful and respectful engagement:

- Engage Specialized Legal Counsel: This is non-negotiable. Hire attorneys with proven expertise in federal Indian law and tribal law. They can navigate the legal complexities, interpret tribal ordinances, and facilitate BIA approvals.

- Prioritize Cultural Competence and Relationship Building: Invest time and resources in understanding the specific tribe’s history, culture, and governance structure. Foster genuine, long-term relationships based on mutual respect and transparency. Hire tribal members or local consultants who understand the community.

- Start Early and Be Patient: Acknowledge that due diligence and approval processes will take longer than conventional transactions. Factor extended timelines into your project planning and financial projections. Patience is a virtue.

- Conduct Thorough Community Engagement: Go beyond just legal requirements. Engage with tribal leadership, community members, and relevant tribal departments throughout the entire process. Listen to their concerns, incorporate their feedback, and demonstrate how the project will genuinely benefit the community.

- Develop a Comprehensive Risk Mitigation Strategy: Identify and assess all potential legal, political, cultural, environmental, and financial risks. Develop clear strategies for addressing each, including contingency plans.

- Ensure Transparency and Clear Communication: Be upfront about your intentions, the project’s scope, potential challenges, and how the tribe will benefit. Clear and consistent communication builds trust.

- Focus on Mutual Benefit and Partnership: Structure agreements that provide tangible, sustainable benefits for the tribe, such as job creation, training, revenue sharing, infrastructure development, or cultural preservation. Frame the investment as a partnership, not merely a transaction.

- Consider Leasehold Structures: For trust lands, be prepared to enter into long-term lease agreements rather than fee simple purchases. Ensure the lease terms are clear, equitable, and approved by the BIA.

- Secure Adequate Financing: Explore all available financing options, including federal programs designed for tribal economic development. Be prepared for potentially higher capital costs or different collateral requirements.

- Respect Tribal Sovereignty: Always acknowledge and respect the tribe’s inherent governmental authority. Understand that decisions will be made by the tribal government in accordance with their own laws and processes.

Conclusion

Investing in tribal lands offers a unique opportunity for economic growth, cultural exchange, and the forging of powerful, lasting partnerships. However, the path to such investments is paved with intricate legal, political, and cultural considerations that demand an exceptional level of diligence and respect. By embracing best practices in due diligence, prioritizing genuine community engagement, and approaching transactions with cultural humility, prospective purchasers can navigate this sacred ground successfully. The rewards extend beyond financial returns, encompassing the creation of shared prosperity, strengthened inter-governmental relations, and a legacy of respectful collaboration with sovereign Native American nations.