The VA Native American Direct Loan: A Pathway to Homeownership on Trust Lands

Homeownership is often heralded as the cornerstone of the American Dream, a symbol of stability, wealth accumulation, and community integration. For many U.S. Veterans, this dream is facilitated by the Department of Veterans Affairs (VA) loan program, offering unparalleled benefits like no down payment and competitive interest rates. However, for Native American Veterans residing on or wishing to build on Federal Trust Lands, the path to homeownership has historically been fraught with unique and complex challenges. Traditional lending institutions often shy away from properties on trust lands due to the intricate legal framework surrounding land ownership and collateral.

Recognizing this significant barrier, the VA developed a specialized program: the Native American Direct Loan (NADL). This unique initiative is not merely an extension of the standard VA loan but a direct intervention designed to empower Native American Veterans and their families to achieve homeownership on trust lands. This comprehensive review will delve into the benefits, advantages, disadvantages, and ultimately, provide a recommendation for this vital program, assessing its efficacy as a product designed to serve a specific, underserved demographic.

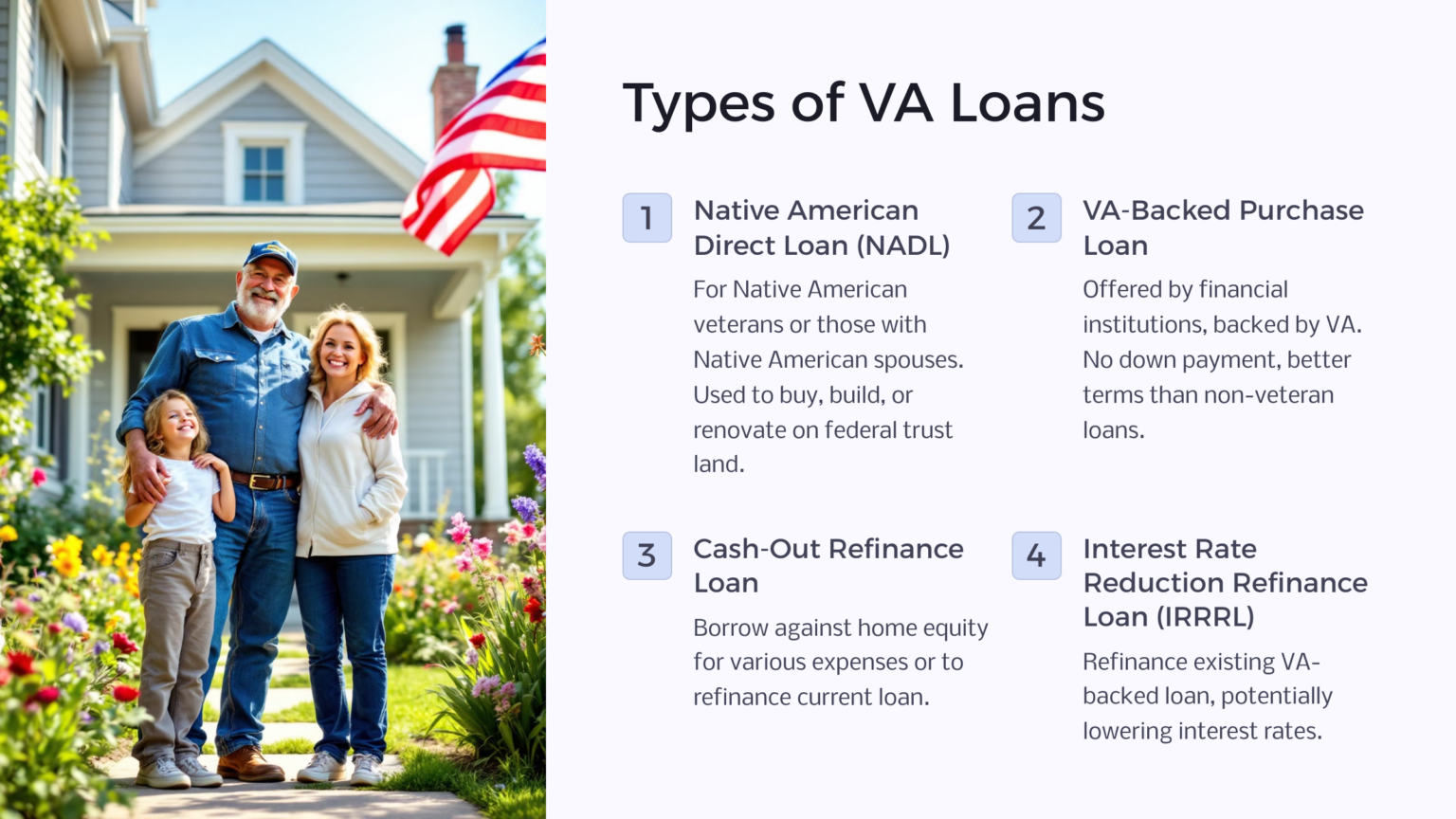

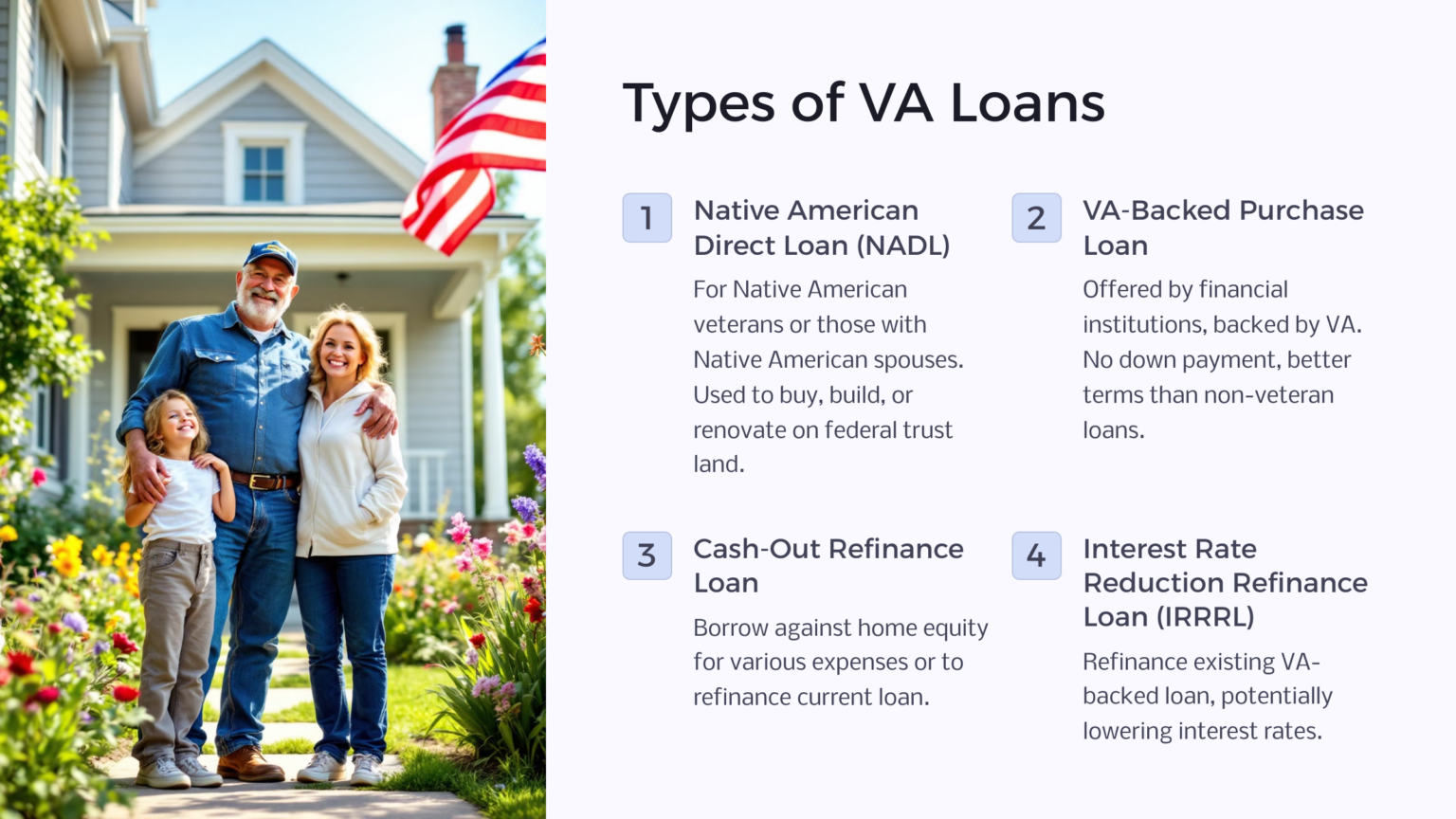

Understanding the VA Native American Direct Loan

At its core, the VA Native American Direct Loan is a direct loan from the VA itself, not a guaranteed loan from a private lender. This distinction is crucial. It means the VA directly originates, services, and holds the loan, allowing for greater flexibility and understanding of the unique circumstances involved with trust land properties.

The NADL program is specifically designed to help eligible Native American Veterans:

- Purchase a home on Native American Trust Land.

- Construct a home on Native American Trust Land.

- Improve a home on Native American Trust Land.

- Refinance an existing NADL to lower the interest rate.

The program addresses the fundamental issue that trust land cannot be mortgaged or sold in the same way as fee simple land. Instead, the VA obtains a leasehold interest in the property, providing the necessary security for the loan, thereby circumventing the traditional lending roadblocks.

Key Benefits of the VA Native American Direct Loan

The NADL program offers several compelling benefits that make it an indispensable tool for its target audience:

-

Access to Homeownership on Trust Lands: This is, without doubt, the program’s paramount benefit. Prior to NADL, securing financing for a home on trust land was exceedingly difficult. Trust land is held by the U.S. government for the benefit of a Native American tribe or individual, meaning the land itself cannot be used as collateral in the traditional sense. The NADL provides a mechanism for veterans to build or buy homes where private lenders would not, thereby opening up the possibility of homeownership for thousands of Native American Veterans who wish to remain connected to their ancestral lands and communities.

-

No Down Payment Requirement: Similar to the standard VA loan, the NADL generally does not require a down payment. This significantly reduces the upfront financial burden, making homeownership more accessible, especially for younger veterans or those with limited savings.

-

Low and Competitive Interest Rates: The VA sets the interest rates for NADL, and these are typically competitive with, or even lower than, conventional mortgage rates. Being a direct loan from the government, the rates are not subject to the same market fluctuations or risk premiums that private lenders might apply, ensuring affordability for veterans.

-

No Private Mortgage Insurance (PMI): Unlike conventional loans where borrowers typically pay PMI if they put down less than 20%, NADL loans do not require PMI. This results in substantial monthly savings over the life of the loan, further enhancing affordability.

-

Limited Closing Costs: While some closing costs are unavoidable, the NADL program often features lower overall closing costs compared to conventional mortgages. The VA also limits what fees veterans can be charged, providing another layer of financial protection.

-

Direct VA Support and Counseling: Since the VA is the direct lender, veterans benefit from personalized support and counseling throughout the loan process. This includes guidance on tribal approval processes, land leases, and understanding the nuances of homeownership on trust lands. This level of direct engagement can be invaluable, especially given the complexities involved.

-

Ability to Finance Energy-Efficient Improvements: The NADL can also be used to finance energy-efficient improvements, promoting sustainable living and potentially reducing utility costs for the homeowner.

Pros (Advantages) of the VA Native American Direct Loan

Beyond the core benefits, the NADL program presents several distinct advantages:

- Cultural Preservation and Community Development: By enabling homeownership on trust lands, the NADL supports the cultural continuity of Native American communities and allows veterans to contribute to the economic development of their tribes without having to relocate.

- Tailored Solutions for Unique Challenges: The program’s design explicitly addresses the legal and financial intricacies of trust land, offering solutions that no other mainstream lending product provides. It acknowledges and respects tribal sovereignty and land tenure systems.

- Financial Stability and Wealth Building: Homeownership is a powerful tool for building generational wealth. The NADL offers Native American Veterans the opportunity to build equity in their homes, providing a foundation for long-term financial stability for themselves and their families.

- Veteran-Centric Approach: The entire program is built around the needs of the veteran. The VA’s direct involvement ensures that the veteran’s interests are prioritized, and that the process is as supportive as possible.

- Long-Term Affordability: The combination of no down payment, low interest rates, and no PMI makes the NADL a remarkably affordable long-term financing option.

Cons (Disadvantages) of the VA Native American Direct Loan

While highly beneficial, the NADL program is not without its drawbacks, which potential applicants should carefully consider:

- Limited Availability (Trust Lands Only): The most significant limitation is that the NADL is only available for homes on Native American Trust Lands. This means Native American Veterans who wish to purchase a home off trust land or in a non-trust land tribal area are not eligible for this specific program and must pursue a standard VA loan or other financing.

- Bureaucratic Process and Potential Delays: As a direct government loan involving multiple agencies (VA, Bureau of Indian Affairs, tribal governments), the application and approval process can be more complex and potentially slower than a conventional loan. Coordinating between various entities, especially tribal councils, can add significant time.

- Specific Lease Requirements: Veterans must obtain a lease from the tribal government or individual landholder that meets VA requirements. Securing this lease can sometimes be a lengthy and intricate process, requiring tribal approval and understanding of specific tribal laws.

- Loan Limits: While generally generous, the NADL does have loan limits, which vary by county. For very high-cost areas or for veterans seeking to build exceptionally large or expensive homes, these limits might be a constraint.

- Mandatory Counseling: While a benefit, the mandatory credit counseling and homeownership education can be perceived as an additional step or hurdle for some applicants.

- Property Restrictions: The home must meet VA minimum property requirements, and the construction must adhere to VA-approved plans and inspections. This can sometimes limit design choices or require adjustments to traditional building practices.

- No Refinancing of Non-NADL Loans: The NADL can only be used to refinance an existing NADL. It cannot be used to refinance a conventional or FHA loan on trust land, if such a loan was somehow obtained.

Recommendation: Is the VA Native American Direct Loan Worth It?

For its intended audience – eligible Native American Veterans seeking to purchase, build, or improve a home on Federal Trust Land – the VA Native American Direct Loan is an unequivocally highly recommended and often indispensable product.

Who is it for?

The NADL is ideal for Native American Veterans who:

- Have a valid VA Certificate of Eligibility (COE).

- Desire to live on Native American Trust Land.

- Are willing to navigate a potentially longer, more involved administrative process.

- Are committed to building or improving a home that meets VA and tribal requirements.

- Value the financial benefits of no down payment, low interest rates, and no PMI.

Who might need to consider alternatives?

If a Native American Veteran wishes to purchase a home off trust land, or if the property is located in a tribal area that is not classified as trust land, they should explore the standard VA Home Loan program, which offers similar financial benefits without the trust land-specific complexities.

Overall Verdict:

Despite the bureaucratic hurdles and the specific nature of its applicability, the VA Native American Direct Loan stands as a vital and transformative program. It uniquely addresses a historical disparity and provides a powerful financial tool for Native American Veterans to achieve the dream of homeownership within their communities and on their ancestral lands. Its benefits far outweigh its disadvantages for the specific demographic it serves. The program is not just a loan; it is an affirmation of service, a commitment to cultural preservation, and a pathway to economic empowerment for a segment of our veteran population that has long faced unique challenges in accessing conventional financing.

Any eligible Native American Veteran considering homeownership on trust land should view the NADL not just as an option, but as the primary and most advantageous route available. While patience and careful navigation of the process are required, the rewards of stable, affordable homeownership on culturally significant land are immeasurable. The first step is always to contact the VA directly to understand eligibility and begin the application process.