Navigating the Intricacies: A Comprehensive Review of Appraisals for Homes on Trust Land

The dream of homeownership is a universal aspiration, a cornerstone of financial stability and community building. However, for those looking to buy, sell, or refinance a home located on trust land, the path to valuation is paved with unique complexities and considerations. Unlike conventional fee simple properties, homes on trust land—primarily those on Native American reservations—exist within a distinct legal and economic framework, making the appraisal process a specialized endeavor.

This article serves as a comprehensive "product review" of appraisals for homes on trust land, treating the appraisal process itself as a critical service. We will delve into its unique characteristics, weigh its significant advantages and disadvantages, and offer a clear recommendation for anyone navigating this vital step.

Understanding the "Product": Appraisals on Trust Land

Before diving into the pros and cons, it’s crucial to understand what "trust land" signifies and why it necessitates a specialized appraisal. Trust land refers to land, the title to which is held by the U.S. federal government in trust for the benefit of an Indian tribe or individual Indians. This arrangement has profound implications for property ownership:

- Leasehold Interest: In most cases, individuals do not own the land outright (fee simple). Instead, they hold a leasehold interest in the land, meaning they own the improvements (the house) but lease the underlying land from the tribe or another individual tribal member. This lease typically has a defined term (e.g., 25, 50, or 99 years) and may involve ground rent.

- Tribal Sovereignty: Trust lands are subject to tribal law, federal law, and the oversight of the Bureau of Indian Affairs (BIA). This creates a distinct jurisdictional environment that differs from state or county regulations governing conventional properties.

- Restricted Alienation: The ability to sell, mortgage, or transfer interests in trust land is often restricted, requiring BIA approval and adherence to tribal codes.

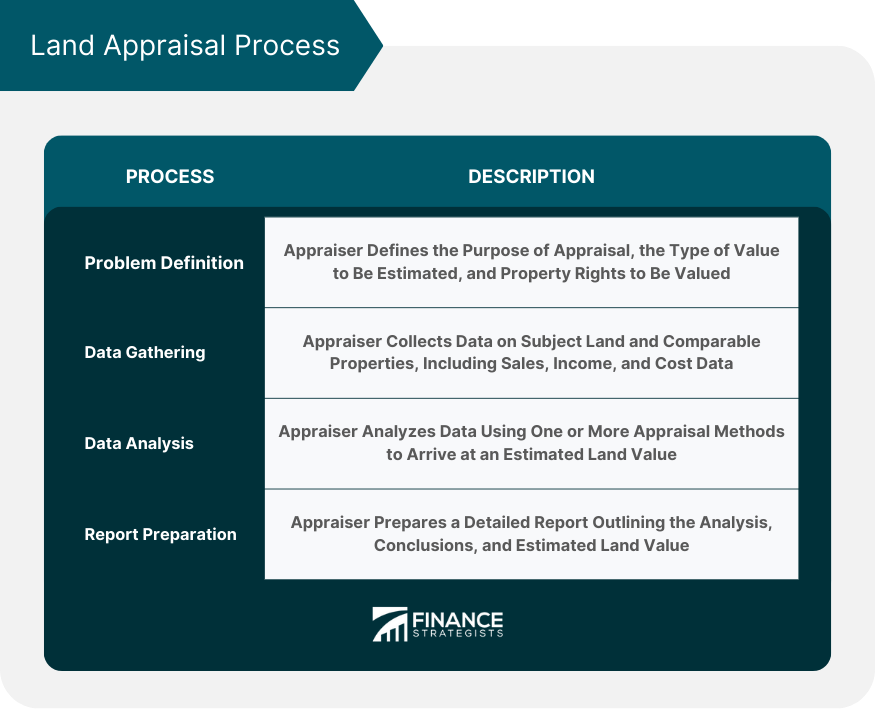

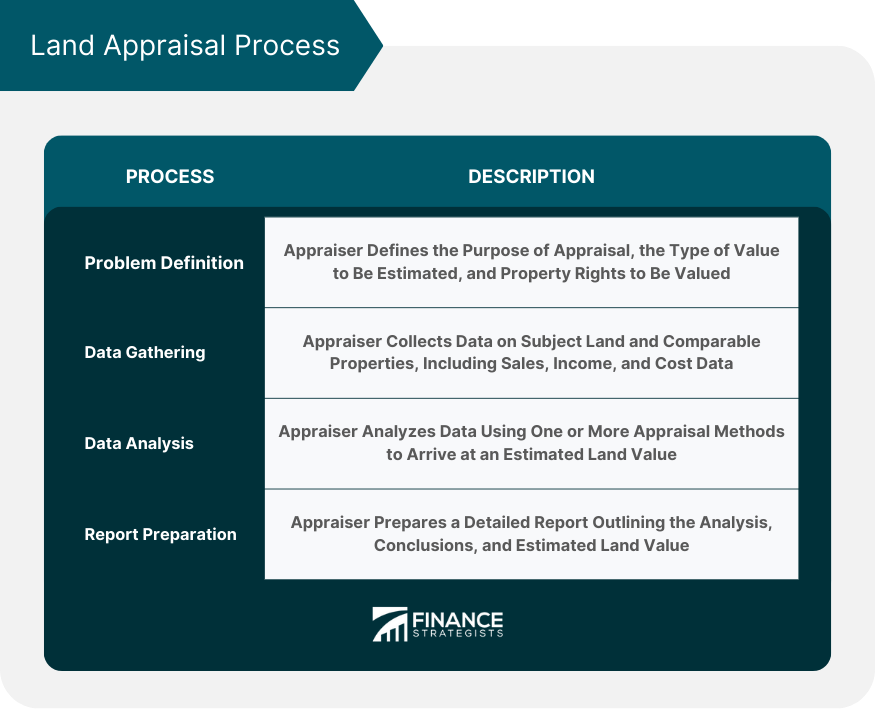

Therefore, an appraisal for a home on trust land is not merely an assessment of the physical structure and its location. It’s a nuanced valuation of a leasehold interest in the improvements, taking into account the remaining lease term, ground lease payments, tribal regulations, federal oversight, and the unique market dynamics within a sovereign nation. The "product" we are reviewing is the specialized service that delivers this complex valuation.

The Advantages: Why a Trust Land Appraisal is Indispensable

Despite the complexities, obtaining a professional appraisal for a home on trust land offers a multitude of benefits, making it an indispensable step for homeowners, buyers, sellers, and lenders alike.

-

Facilitates Financing and Lending: This is arguably the most significant advantage. Traditional lenders are often hesitant to finance homes on trust land due to the unique ownership structure. However, specialized loan programs like the FHA Section 184 Indian Home Loan Guarantee Program and VA Native American Direct Loan (NADL) program are designed specifically for these properties. A robust, BIA-compliant appraisal is a mandatory cornerstone for securing these loans. It provides lenders with the necessary assurance of collateral value, enabling tribal members and eligible non-members to access critical funding for home purchase, construction, or refinance.

-

Establishes Fair Market Value (FMV) for Transactions: For both buyers and sellers, an appraisal provides an objective, professional assessment of the property’s worth. This is crucial for:

- Sellers: Ensuring they receive a fair price for their home, maximizing their return on investment.

- Buyers: Preventing overpayment and providing a solid basis for negotiation. Without an appraisal, transactions could be based on speculation, leading to disputes or financial losses.

-

Supports Estate Planning and Probate: When a homeowner on trust land passes away, an accurate appraisal is essential for determining the property’s value for inheritance purposes. It helps heirs understand the asset’s worth, facilitates equitable distribution among beneficiaries, and simplifies the probate process, especially given the BIA’s role in approving transfers of trust property.

-

Provides Basis for Refinancing and Home Equity Loans: For existing homeowners, an appraisal is critical for accessing their home’s equity. Whether seeking a lower interest rate through refinancing or drawing cash out for other needs, lenders require an updated valuation to determine the loan-to-value (LTV) ratio.

-

Aids in Insurance Valuation: While not directly for insurance premiums, an appraisal provides a professional estimate of the replacement cost of the improvements, which can be invaluable when negotiating insurance coverage or filing a claim in the event of damage or loss.

-

Empowers Homeowners with Information: Understanding the true value of their primary asset is empowering for any homeowner. For those on trust land, where market data can be opaque, an appraisal provides clarity, allowing them to make informed decisions about improvements, sales, and long-term financial planning.

-

Supports Tribal Housing Initiatives: Appraisals are vital for tribal housing authorities in developing and managing affordable housing programs, assessing the value of tribal assets, and ensuring the sustainability of their housing infrastructure.

The Disadvantages: Navigating the Hurdles

While essential, the process of appraising homes on trust land is not without its significant challenges, which can sometimes translate into higher costs, longer timelines, and increased frustration.

-

Lack of Comparables (Comps): This is perhaps the most formidable hurdle. The market for homes on trust land is often smaller, less liquid, and less transparent than conventional markets. Sales data may not be publicly recorded in the same manner, and transactions can be private or involve unique considerations (e.g., intra-tribal transfers). Finding genuinely comparable properties with similar lease terms, property characteristics, and market exposure within the same community can be exceptionally difficult, forcing appraisers to rely on less direct methods or make significant adjustments.

-

Complexity of Leasehold Valuation: Appraising a leasehold interest is inherently more complex than appraising a fee simple estate. The appraiser must consider:

- Remaining Lease Term: A shorter remaining term can significantly depress value.

- Ground Lease Payments: These act like an encumbrance, reducing the value of the improvements.

- Renewal Options: The certainty and cost of lease renewal are critical factors.

- Market Perception: The perceived risk and uncertainty associated with leaseholds can lead to a "leasehold discount" in the market, resulting in lower appraised values compared to similar fee simple properties.

-

Appraiser Availability and Expertise: Not all appraisers are qualified or willing to appraise properties on trust land. It requires specialized knowledge of federal and tribal regulations, BIA procedures, the unique market dynamics, and cultural sensitivities. Finding an experienced and certified appraiser in certain rural or remote tribal areas can be challenging, leading to limited choices and potentially higher fees due to travel and specialized expertise.

-

Jurisdictional Nuances and BIA Oversight: The involvement of the BIA, tribal housing authorities, and tribal councils adds layers of administrative complexity. Lease agreements, assignments, and sales often require multiple approvals, which can be time-consuming and introduce potential delays into the appraisal process. The appraiser must understand how these entities influence property rights and marketability.

-

Lender Hesitation (Even with an Appraisal): While specialized appraisals are designed to facilitate lending, some conventional lenders may still be reluctant to engage with properties on trust land, even with a strong appraisal. This often stems from a lack of familiarity with the legal framework, perceived higher risk, or internal policy restrictions, limiting financing options for homeowners.

-

Higher Costs and Longer Timelines: Due to the specialized knowledge required, the difficulty in finding comparables, and the additional time spent researching regulations and market data, appraisals for trust land homes are often more expensive and take longer to complete than standard appraisals. This can add to the financial burden and stress for buyers and sellers.

-

Marketability Concerns: The unique nature of trust land ownership can limit the pool of potential buyers. Non-tribal members may be hesitant due to the leasehold structure, jurisdictional differences, or simply a lack of understanding. This reduced market depth can, in turn, impact appraised values.

Key Considerations When "Purchasing" (Ordering) an Appraisal

Given the unique nature of this service, "purchasing" an appraisal for a home on trust land requires careful consideration.

- Seek a Specialist Appraiser: This is paramount. Do not hire an appraiser who is unfamiliar with trust land, BIA regulations, and tribal housing. Look for appraisers with specific certifications or a proven track record in these unique markets. Ask for references and examples of their work on trust land.

- Clarify the Purpose: Ensure the appraiser understands the specific purpose of the appraisal (e.g., FHA Section 184 loan, VA loan, private sale, estate planning) as this dictates the scope and type of value being sought.

- Provide Comprehensive Documentation: Arm your appraiser with all relevant documents: the ground lease agreement (including term, ground rent, and renewal clauses), any BIA approvals, tribal housing authority agreements, and details of any restrictions or covenants. The more information provided upfront, the smoother the process.

- Understand the Scope: Discuss with the appraiser what methodologies they plan to use, especially in the absence of direct comparables. They may rely more heavily on the cost approach (estimating replacement cost new minus depreciation) or, in some cases, the income approach (if the property generates rental income).

- Expect Thoroughness: A good trust land appraisal will meticulously detail the unique legal framework, the leasehold interest, and how these factors impact value. It should clearly explain the market analysis and any adjustments made due to the specific conditions.

- Be Prepared for Potential Value Adjustments: Understand that the leasehold interest and market perception can lead to a different valuation than a similar fee simple property, often a discount.

Purchase Recommendation: An Essential Investment

Our recommendation is unequivocal: For any transaction or financial decision involving a home on trust land, a professional, specialized appraisal is not merely recommended; it is an absolute necessity and a wise investment.

Who Needs It:

- Homebuyers: Essential for securing financing and ensuring fair purchase price.

- Home Sellers: Crucial for setting a competitive price and attracting qualified buyers.

- Existing Homeowners: Imperative for refinancing, home equity loans, and estate planning.

- Lenders: A mandatory requirement for assessing collateral risk.

- Tribal Housing Authorities and Governments: For program development, asset management, and community planning.

When to "Purchase" It:

- Before Listing a Property for Sale: To establish an accurate asking price.

- Immediately Upon Receiving a Purchase Offer (as a Buyer): To confirm the offer aligns with market value and for loan approval.

- Prior to Refinancing or Seeking a Home Equity Loan: To determine current equity.

- During Estate Planning or Probate: To value assets for beneficiaries.

How to "Purchase" It:

- Prioritize Expertise Over Price: While cost is a factor, the specialized knowledge required for trust land appraisals means that choosing the cheapest option is often a false economy. Invest in an appraiser with verifiable experience in tribal lands and BIA-compliant appraisals.

- Start Early: Due to the potential for delays and the complexity of the process, initiate the appraisal order as early as possible in your transaction timeline.

- Communicate Continuously: Maintain open lines of communication with your appraiser, providing any requested documentation promptly and clarifying any questions they may have.

In conclusion, the appraisal process for homes on trust land is a complex yet critically important service. While it presents unique challenges—primarily due to limited comparables, leasehold complexities, and the need for specialized expertise—its advantages far outweigh these hurdles. It is the linchpin for unlocking financing, ensuring fair market transactions, facilitating wealth building, and empowering homeowners within the unique framework of tribal sovereignty. Viewing this specialized appraisal not as a mere cost, but as an essential investment in certainty, security, and informed decision-making, is the key to successfully navigating the distinctive landscape of homeownership on trust land.