Navigating the Waters: A Comprehensive Review of Tribal Installment Loans with Monthly Payments

In an increasingly complex financial landscape, many individuals find themselves in urgent need of funds, often with less-than-perfect credit scores. When traditional lenders close their doors, alternative options emerge, some more contentious than others. Among these are Tribal Installment Loans with Monthly Payments, a product that has gained significant traction, yet remains shrouded in both opportunity and caution.

This comprehensive review aims to shed light on tribal installment loans, dissecting their mechanics, exploring their advantages and disadvantages, and ultimately providing a well-rounded recommendation for potential borrowers. With a target length of 1200 words, we will delve deep into what makes these loans unique, who they are designed for, and the crucial considerations one must weigh before committing.

What Are Tribal Installment Loans?

Tribal installment loans are short-to-medium-term loans offered by financial institutions owned and operated by Native American tribal governments, or by companies directly affiliated with them. The distinguishing characteristic of these lenders is their status as sovereign entities. This means they are not subject to state laws concerning interest rate caps or lending regulations that often govern traditional lenders. Instead, they operate under tribal law and federal law.

Unlike traditional payday loans, which typically require a lump-sum repayment on the borrower’s next payday, tribal installment loans are structured with a series of fixed payments spread out over several months, often between 6 to 24 months. This installment structure is designed to make repayments more manageable for borrowers, allowing them to budget for smaller, regular payments rather than a single large one. These loans are typically unsecured, meaning they do not require collateral, and the application process is almost entirely online, promising quick decisions and rapid funding.

The primary target demographic for tribal installment loans includes individuals with poor credit histories, those who have been rejected by conventional banks or credit unions, or anyone needing immediate access to funds for an unexpected expense. Because these lenders often perform less stringent credit checks – sometimes focusing more on income stability than credit score – they become a viable, albeit often more expensive, option for a segment of the population with limited alternatives.

How They Work: The Mechanics of Repayment

The operational mechanics of tribal installment loans are relatively straightforward, designed for speed and convenience.

- Online Application: Borrowers typically complete an application form on the lender’s website. This usually requires personal information (name, address, contact details), employment details (income, employer), and banking information (for direct deposit and automatic withdrawals).

- Underwriting and Approval: Lenders assess the applicant’s ability to repay the loan, often using proprietary underwriting models that may prioritize income stability over traditional credit scores. While a credit check might be performed, it’s often a "soft" check that doesn’t significantly impact the borrower’s score, or the requirements for approval are much lower than traditional lenders. Approval can often be granted within minutes or hours.

- Funding: Once approved, funds are usually deposited directly into the borrower’s checking account, often within one business day. This rapid access to cash is a significant draw for those facing urgent financial needs.

- Installment Payments: The loan agreement outlines a fixed repayment schedule, typically on a monthly basis, aligned with the borrower’s pay cycle. Payments include both principal and interest. Lenders usually require borrowers to authorize automatic withdrawals from their bank account on the due dates. This ensures timely payments and reduces the risk of default for the lender.

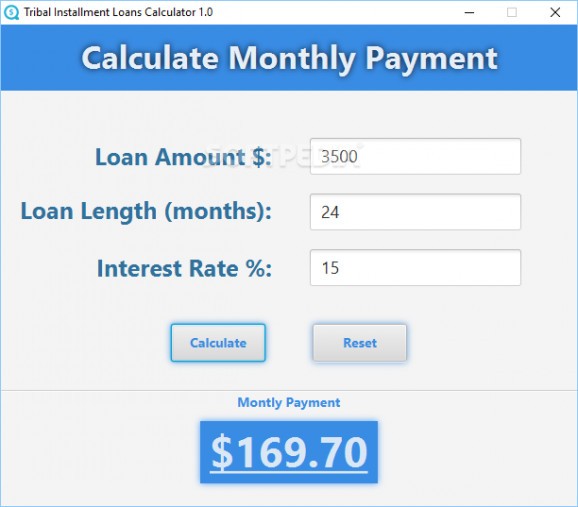

- Loan Term and Amount: Loan amounts can range from a few hundred dollars to several thousand, depending on the lender and the borrower’s income. Terms can vary, but commonly fall within 6 to 24 months.

The crucial element to understand here is the Annual Percentage Rate (APR). Because tribal lenders operate outside most state usury laws, their APRs can be exceptionally high, often ranging from 200% to over 700%, and sometimes even higher. While the monthly payments may seem manageable individually, the cumulative cost of the loan over its term can be substantial, often leading to a repayment amount that is several times the original principal borrowed.

Advantages of Tribal Installment Loans

Despite the controversies, tribal installment loans offer several distinct advantages for specific borrower segments:

- Accessibility for Poor Credit: This is arguably the most significant benefit. Traditional banks and credit unions are often unwilling to lend to individuals with low credit scores or limited credit history. Tribal lenders, by contrast, are specifically designed to cater to this demographic, offering a lifeline when other avenues are closed.

- Quick Funding: When an emergency strikes – a car repair, a medical bill, or an unexpected home expense – time is often of the essence. The online application process and rapid direct deposit mean borrowers can access funds within 24-48 hours, significantly faster than many traditional loan products.

- Convenience: The entire process, from application to funding, can be completed online from the comfort of one’s home. This eliminates the need for in-person visits, extensive paperwork, and lengthy approval processes.

- Installment Structure: Unlike single-payment payday loans, the installment model allows borrowers to spread out repayments over several months. This can make the individual payments more manageable and less burdensome on a tight budget, reducing the immediate financial shock of a large lump-sum repayment.

- Alternative to Payday Loans: For some, tribal installment loans are a "lesser of two evils" compared to traditional payday loans. While still expensive, the longer repayment term can offer more flexibility than a two-week repayment window, potentially reducing the cycle of re-borrowing that is common with payday products.

- No Collateral Required: These are unsecured loans, meaning borrowers do not need to pledge any assets (like a car title or home equity) to qualify. This reduces the risk of losing valuable property if the borrower defaults.

Disadvantages of Tribal Installment Loans

The advantages, however, come with a steep price and significant risks. The disadvantages of tribal installment loans are substantial and demand careful consideration:

- Exorbitantly High Annual Percentage Rates (APRs): This is the most critical drawback. Because tribal lenders are often exempt from state usury laws, they can charge APRs that far exceed those of traditional loans, credit cards, or even many personal loans. APRs of 300%, 500%, or even higher are not uncommon. This means a relatively small loan can quickly balloon into a much larger debt due to interest accumulation, making the total repayment amount several times the original principal.

- Risk of Debt Trap: The high cost of these loans significantly increases the risk of borrowers falling into a cycle of debt. Many find it difficult to repay the principal plus the high interest, leading them to either default, take out another high-interest loan to cover the first, or continuously re-finance, digging themselves deeper into financial trouble.

- Limited Consumer Protection: Operating under tribal sovereignty, these lenders are often not subject to the same state-level consumer protection laws that regulate other lenders. While federal laws like the Truth in Lending Act still apply, state-specific safeguards against predatory lending, usury limits, and fair debt collection practices may not. This can leave borrowers with fewer avenues for recourse in case of disputes or unfair practices.

- Lack of Transparency: While many reputable tribal lenders strive for clarity, some may present loan terms in a way that obscures the true cost or makes it difficult for borrowers to fully grasp the high APR and total repayment amount. Hidden fees or complex calculations can further complicate understanding.

- Jurisdictional Challenges: In the event of a dispute or default, the legal jurisdiction can become complex. Since the lender operates under tribal law, pursuing legal action against them in state courts can be challenging, often requiring the borrower to engage with tribal dispute resolution processes, which may be unfamiliar or difficult to access.

- Potential for Predatory Practices: Critics argue that the high APRs and the targeting of financially vulnerable populations constitute predatory lending. While tribal lenders assert they provide a necessary service, the significant cost of borrowing raises ethical questions about whether the "solution" is truly beneficial in the long run for the borrower.

- Impact on Credit: While some tribal lenders may report on-time payments to credit bureaus, many do not. This means that even if a borrower diligently repays their loan, it may not help them build a positive credit history. Conversely, defaulting on a tribal loan can still lead to collections efforts and negative impacts on credit if the debt is sold to a third-party collector.

Who Are Tribal Installment Loans For?

Tribal installment loans are, at best, a last resort. They are specifically for:

- Individuals with limited or poor credit history: Those who cannot qualify for conventional loans.

- People facing urgent, unavoidable financial emergencies: When there are no other immediate sources of funds, such as savings, family assistance, or traditional credit.

- Borrowers who fully understand the high costs: Crucially, they must have a clear and realistic plan to repay the loan in full, including the substantial interest, without jeopardizing their other financial obligations.

They are not suitable for long-term financial solutions, consolidating debt, discretionary spending, or for individuals who have any other viable, less expensive borrowing options.

Alternatives to Consider

Before turning to tribal installment loans, it is imperative to explore all other possible alternatives:

- Payday Alternative Loans (PALs) from Credit Unions: Many federal credit unions offer PALs, which are small loans with much lower interest rates (capped at 28% APR) and longer repayment terms than traditional payday loans.

- Personal Loans from Traditional Banks or Credit Unions: If your credit score isn’t severely damaged, or if you can find a co-signer, traditional personal loans offer significantly lower APRs.

- Secured Credit Cards or Loans: If you have collateral (like a savings account), a secured loan or credit card can be an option to build credit and access funds at a much lower cost.

- Borrowing from Family or Friends: While potentially uncomfortable, this can be the cheapest option, often with no interest.

- Community Assistance Programs: Many non-profits, charities, and government agencies offer financial aid for rent, utilities, food, or medical expenses.

- Negotiate with Creditors: If your emergency is a bill you can’t pay, contact the creditor directly to see if you can arrange a payment plan or extension.

- Cash Advance from Employer: Some employers offer small advances on your paycheck.

- Budgeting and Emergency Fund: The best long-term solution is to build an emergency savings fund to avoid the need for high-cost loans altogether.

Purchase Recommendation

Tribal Installment Loans with Monthly Payments should be considered only as an absolute last resort, after all other, more affordable options have been exhausted.

Recommendation: Proceed with Extreme Caution and Due Diligence.

For those in dire financial straits with no other viable options, a tribal installment loan might provide temporary relief. However, this relief comes at a very high cost.

Before committing, potential borrowers MUST:

- Read the Entire Loan Agreement Carefully: Understand every single clause, especially the APR, total repayment amount, payment schedule, and any fees (origination, late payment, etc.). Do not sign anything you don’t fully comprehend.

- Calculate the Total Cost: Don’t just look at the monthly payment. Multiply the monthly payment by the number of months in the loan term to see the total amount you will repay. Compare this to the original principal to fully grasp the interest cost.

- Verify Lender Legitimacy: Ensure the lender is genuinely affiliated with a federally recognized Native American tribe. Research their reputation, read reviews, and check for any complaints with organizations like the Better Business Bureau (BBB), though remember tribal lenders have different regulatory oversight.

- Confirm Your Repayment Ability: Have a concrete and realistic plan for how you will make every single monthly payment on time. Factor this into your budget. Defaulting on these loans can lead to severe consequences, including collection agency involvement and potential legal action (though jurisdiction can be complex).

- Understand the Lack of State Protections: Be aware that you might have fewer consumer protections compared to loans from state-licensed lenders.

In conclusion, tribal installment loans with monthly payments are a double-edged sword. They offer a readily accessible financial solution for those with limited options, providing quick cash and a seemingly manageable repayment structure. However, the exorbitant APRs, coupled with reduced consumer protections, present a significant risk of trapping borrowers in a cycle of high-cost debt. They are not a long-term financial solution and should be approached with the utmost caution, a thorough understanding of their terms, and a firm commitment to timely repayment. Prioritizing more affordable alternatives should always be the first step in addressing any financial shortfall.