Navigating the Labyrinth: Understanding Average APRs for Tribal Loans with Bad Credit

For individuals with less-than-perfect credit, securing a loan can feel like navigating a complex maze. Traditional lenders often shy away, leaving borrowers to explore alternative options. Among these, tribal loans have emerged as a prominent, albeit controversial, choice. While they offer accessibility, especially for those with bad credit, their Annual Percentage Rates (APRs) can be astronomically high.

This comprehensive guide will delve into what tribal loans are, why their APRs are so elevated, what "average" truly means in this context for bad credit borrowers, and crucial considerations before engaging with them. Our goal is to provide a professional tutorial that equips you with the knowledge to make informed financial decisions.

1. What Are Tribal Loans?

Before we discuss APRs, it’s essential to understand the nature of tribal loans.

1.1 Definition and Operational Model

Tribal loans are short-term, small-dollar installment loans offered by lenders operating under the jurisdiction of a federally recognized Native American tribe. These lenders claim sovereign immunity, meaning they are not subject to state lending laws, including interest rate caps (usury laws) that apply to traditional lenders.

1.2 Target Audience

The primary demographic for tribal loans includes individuals with poor credit scores who face urgent financial needs and have been rejected by conventional banks, credit unions, or even some payday lenders. They are often marketed as a quick solution for unexpected expenses like medical emergencies, car repairs, or utility bills.

1.3 Key Characteristics

- Online Application: Most tribal lenders operate exclusively online, making them accessible nationwide.

- Quick Funding: Approval and funding can often happen within one business day.

- No Hard Credit Check (Often): While they may perform soft credit checks, many tribal lenders prioritize other factors like income and employment history over traditional credit scores.

- Installment Structure: Unlike single-payment payday loans, tribal loans are typically repaid over several scheduled installments.

2. Why Are APRs for Tribal Loans So High, Especially for Bad Credit?

The elevated APRs associated with tribal loans are a result of several interconnected factors:

2.1 Higher Risk Associated with Bad Credit Borrowers

Individuals with bad credit are statistically more likely to default on loans. To offset this increased risk, lenders charge higher interest rates. For tribal lenders, who specifically target this high-risk demographic, this risk premium is significantly factored into their pricing.

2.2 Lack of State Regulation and Interest Rate Caps

This is the most significant factor. Due to their claim of sovereign immunity, tribal lenders assert that state laws limiting interest rates (usury laws) do not apply to them. This allows them to charge rates that would be illegal for licensed lenders in most states. Without these caps, the market can bear much higher rates.

2.3 Operational Costs and Profit Motive

Tribal lenders, like any business, aim to be profitable. They incur operational costs, marketing expenses, and must account for loan defaults. Given the high-risk nature of their clientele and the relatively small loan amounts, they often need to charge higher rates on successful loans to cover these overheads and generate profit.

2.4 Limited Alternatives for Borrowers

For individuals with bad credit, options are scarce. This creates a supply-and-demand dynamic where borrowers, desperate for funds, are often willing to accept terms that are less favorable, including very high APRs, because they perceive no other viable choice.

3. Understanding "Average" APR for Tribal Loans with Bad Credit

It’s crucial to preface this section by stating that there is no single, universally agreed-upon "average" APR for tribal loans, especially for bad credit borrowers. The rates are highly variable and depend on numerous factors. However, we can provide a realistic range and context.

3.1 What APR Means in This Context

APR (Annual Percentage Rate) represents the true cost of borrowing over a year, including the interest rate and any fees. For tribal loans, this figure is often expressed as a very large percentage, reflecting the short-term, high-cost nature of the loan.

3.2 The Realistic APR Range

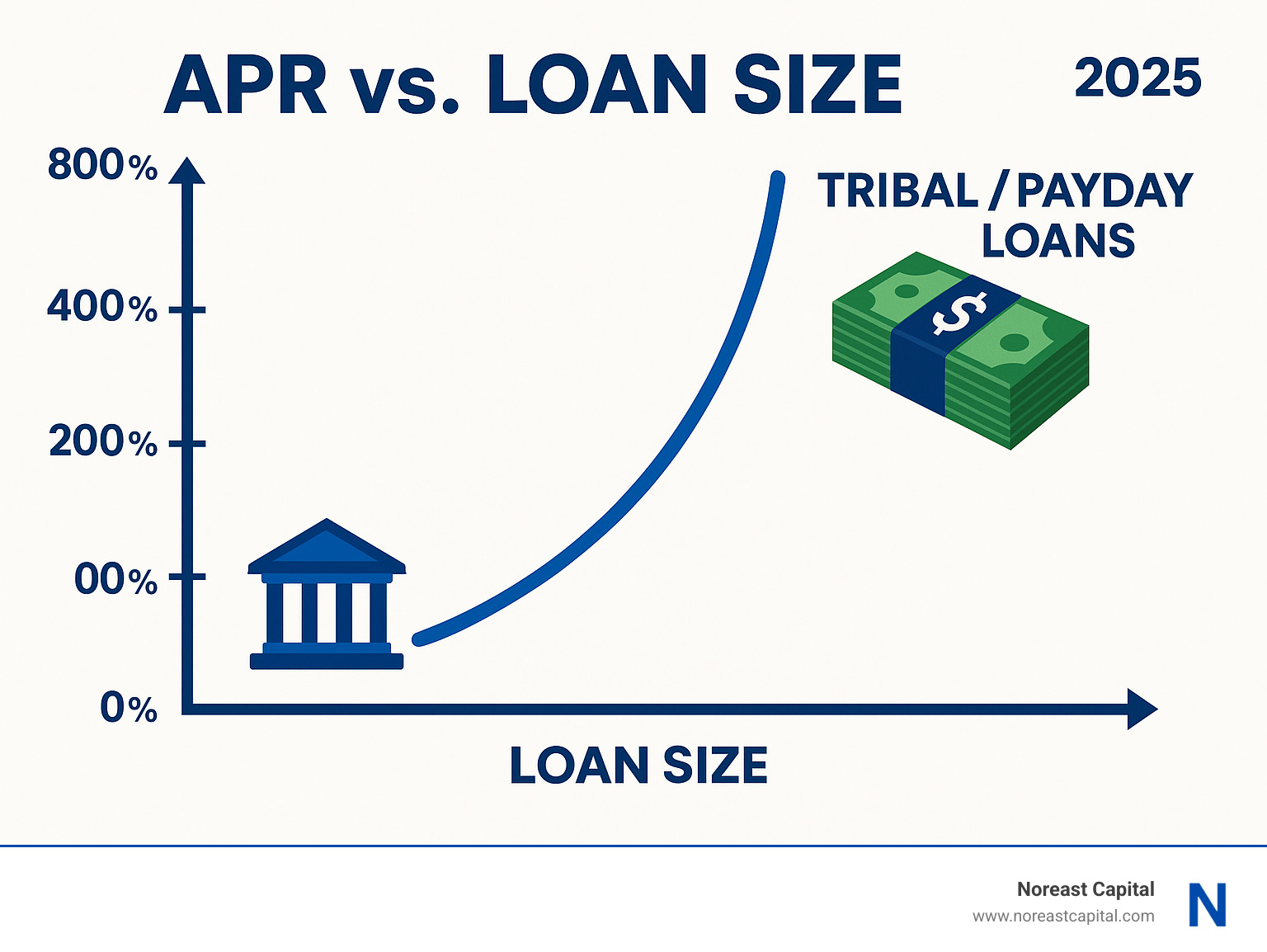

For borrowers with bad credit, the APRs for tribal loans typically range from 300% to over 700%. In some extreme cases, particularly for very small, short-term loans or for borrowers with exceptionally poor credit, APRs can even exceed 1000% or 1500%.

To put this into perspective:

- A traditional personal loan for someone with good credit might have an APR of 6% to 36%.

- A credit card cash advance might have an APR of 20% to 30%.

- Even traditional payday loans, known for high costs, typically average around 300% to 400% APR. Tribal loans often operate at or above the higher end of the payday loan spectrum.

3.3 Factors Influencing Your Specific APR

Even within the "bad credit" category, several variables can affect the specific APR you are offered:

- Severity of Bad Credit: Someone with a credit score of 580 might be offered a slightly lower APR than someone with a score of 450.

- Loan Amount: Smaller loan amounts can sometimes have disproportionately higher APRs when calculated annually.

- Loan Term: Shorter terms, while having fewer payments, can result in a higher calculated APR.

- Individual Lender Policies: Each tribal lender has its own underwriting criteria and rate structure.

- Your Income and Employment Stability: Lenders assess your ability to repay. A stable, verifiable income may result in a slightly better offer.

- State of Residence: While tribal lenders claim immunity, some states have taken measures to limit their operations, which can indirectly influence the availability and terms of loans.

4. Potential Risks and Downsides of Tribal Loans

Given the extremely high APRs, it’s imperative to understand the significant risks involved:

4.1 The Debt Trap

The most critical risk is falling into a "debt trap." With APRs in the hundreds or even thousands of percent, the interest can quickly outpace the principal, making it incredibly difficult to pay off the loan. Borrowers often end up paying far more in interest and fees than the original loan amount.

4.2 Exorbitant Cost

Even a small loan can become prohibitively expensive. For example, a $500 loan with a 600% APR repaid over six months would cost hundreds of dollars in interest alone, potentially leading to a total repayment of $1,000 or more.

4.3 Aggressive Collection Practices

While claiming immunity from state lending laws, tribal lenders are generally still subject to federal collection laws like the Fair Debt Collection Practices Act (FDCPA). However, enforcement can be more challenging due to their sovereign status, and some borrowers report aggressive or unconventional collection tactics.

4.4 Limited Consumer Protection and Recourse

Due to sovereign immunity, if you have a dispute with a tribal lender, your legal options are often limited. State attorneys general may have little power to intervene, and pursuing legal action against a tribal entity can be complex and costly.

4.5 Impact on Credit (Variable)

Some tribal lenders report payment history to credit bureaus, which means a default could further damage your credit. However, others do not report, meaning timely payments may not help build your credit history either.

5. Are Tribal Loans Legal?

The legality of tribal loans is a complex and often debated issue, operating in a "legal gray area."

5.1 Sovereign Immunity

Tribal lenders base their operations on the principle of tribal sovereign immunity, which protects federally recognized Native American tribes from lawsuits unless they waive that immunity. They argue that as entities of sovereign nations, they are not bound by state laws.

5.2 State Efforts to Regulate

Many states have tried to regulate tribal lending, viewing it as an evasion of consumer protection laws. Some have issued cease-and-desist orders, while others have pursued legal action against lenders they deem to be merely "rent-a-tribe" schemes (where non-tribal entities partner with tribes primarily to exploit sovereign immunity).

5.3 Federal Oversight

Federal agencies like the Consumer Financial Protection Bureau (CFPB) have also engaged with tribal lending, but their authority can be limited by sovereign immunity.

The takeaway for borrowers: While the lenders claim legality, the terms and conditions, especially the high APRs, would be illegal in many states if offered by a state-licensed lender. This legal ambiguity adds another layer of risk for the borrower.

6. Alternatives to Tribal Loans for Bad Credit Borrowers

Before considering a tribal loan, it is highly recommended to explore all other possible avenues:

6.1 Payday Alternative Loans (PALs)

Offered by federal credit unions, PALs are small loans with much lower APRs (currently capped at 28%) and more reasonable repayment terms than typical payday or tribal loans. You usually need to be a member of the credit union for at least one month.

6.2 Local Credit Unions

Credit unions are member-owned and often more willing to work with members who have less-than-perfect credit. They may offer small personal loans with more flexible terms and significantly lower interest rates than tribal lenders.

6.3 Secured Loans

If you have an asset (like a car or savings account), you might qualify for a secured loan. While these carry the risk of losing your collateral if you default, their APRs are typically much lower.

6.4 Co-signer Loans

If you have a friend or family member with good credit who is willing to co-sign a loan, you may qualify for a traditional loan with better terms. Be aware that the co-signer is equally responsible for the debt.

6.5 Borrow from Friends or Family

While potentially uncomfortable, borrowing from trusted individuals can be interest-free and more flexible, avoiding the high costs of predatory lending.

6.6 Non-profit Credit Counseling and Debt Management Plans

A non-profit credit counseling agency can help you assess your financial situation, negotiate with creditors, and develop a realistic budget. They can also explore debt management plans as an alternative to taking on new high-interest debt.

6.7 Community Assistance Programs

Local charities, government programs, and religious organizations often provide emergency financial assistance for housing, utilities, food, and other necessities.

6.8 Negotiate with Creditors

If you’re struggling to pay existing bills, contact your creditors directly. Many are willing to work out a payment plan or offer temporary hardship relief rather than risk a default.

7. Making an Informed Decision: Due Diligence is Key

If you find yourself in a position where a tribal loan seems like your only option, it is paramount to proceed with extreme caution and thorough due diligence.

7.1 Read the Entire Loan Agreement

Do not sign anything until you have meticulously read and understood every single term and condition. Pay close attention to:

- The actual APR: Don’t just look at the monthly payment.

- Total cost of the loan: Calculate how much you will pay back in total (principal + interest + fees).

- Repayment schedule: Understand the number of payments, due dates, and amounts.

- Fees: Look for origination fees, late fees, bounced check fees, and any other charges.

- Default consequences: What happens if you miss a payment or can’t repay?

7.2 Verify the Lender’s Legitimacy

While they claim sovereign immunity, research the lender. Look for online reviews, check with the Better Business Bureau (though their effectiveness with tribal lenders can be limited), and ensure their website is secure and professional. Be wary of lenders who pressure you into signing quickly.

7.3 Compare All Options (Again)

Even if you think you’ve exhausted all options, take one more look. The cost of a tribal loan can be so high that almost any other alternative, even one that seems difficult, might be more financially sound in the long run.

7.4 Only Borrow What You Absolutely Need

If you must take out a tribal loan, borrow the absolute minimum amount required to address your immediate emergency. The less you borrow, the less interest you will accrue.

Conclusion

The average APR for tribal loans for bad credit borrowers typically falls within a range of 300% to over 700%, with some extreme cases exceeding 1000% or even 1500%. These exceptionally high rates are primarily due to the increased risk of lending to bad credit borrowers and the lenders’ claim of sovereign immunity, which exempts them from state interest rate caps.

While tribal loans offer a path to immediate funds for those with limited alternatives, they come with substantial risks, most notably the potential for a severe debt trap. Before considering such a loan, it is crucial to exhaust all other options, understand the full cost and implications, and proceed with extreme caution. Financial literacy and proactive credit building are the most sustainable solutions to avoid reliance on such high-cost lending products in the future.