A Professional Guide to the Dangers of Tribal Payday Loans for Bad Credit

Introduction: The Allure and the Abyss

In times of financial distress, especially when faced with a poor credit score, the options for quick cash can seem incredibly limited. Traditional banks often turn away applicants, and the urgency of the situation – be it an unexpected medical bill, car repair, or rent due – pushes individuals towards less conventional solutions. Among these, "Tribal Payday Loans" often emerge as an appealing, seemingly easy way out. They promise fast approval, no credit checks, and direct deposit, catering specifically to those with bad credit who are desperate for immediate funds.

However, beneath this veneer of convenience lies a complex web of legal loopholes, exorbitant interest rates, and predatory practices that can ensnare borrowers in a devastating cycle of debt. This professional guide aims to shed light on the profound dangers associated with tribal payday loans, particularly for individuals with bad credit, and provide actionable advice on how to avoid them and explore safer alternatives.

Understanding Tribal Payday Loans

Before delving into the dangers, it’s crucial to understand what tribal payday loans are. These are short-term, high-interest loans offered by lenders who claim affiliation with or are directly owned by a Native American tribe. The key characteristic that sets them apart is their assertion of "sovereign immunity."

- Sovereign Immunity: Native American tribes are recognized as sovereign nations under U.S. law, meaning they are generally not subject to state laws. Lenders operating under a tribe’s umbrella claim this same immunity, arguing they are exempt from state-level consumer protection laws, including caps on interest rates (usury laws) and licensing requirements.

- "Rent-a-Tribe" Model: Often, the actual lending operation is run by a non-tribal third party that simply partners with a tribe, paying them a fee to use their sovereign status as a shield against regulation. This is sometimes referred to as a "rent-a-tribe" scheme.

- Target Audience: Their primary target market is individuals with poor credit histories who are unable to secure loans from traditional lenders. The promise of "no credit check" or "guaranteed approval" is a significant draw.

The Core Danger: Sovereign Immunity and Lack of Regulation

The most significant danger of tribal payday loans stems directly from their claim of sovereign immunity. This legal shield fundamentally alters the consumer protection landscape, leaving borrowers incredibly vulnerable.

- Exemption from State Usury Laws: State laws often cap the maximum interest rate lenders can charge. Tribal lenders bypass these caps, leading to Annual Percentage Rates (APRs) that can soar into the hundreds or even thousands of percent. For example, while a state-regulated payday loan might have an APR of 400%, a tribal loan could easily exceed 1,000% or more, making it virtually impossible to repay the principal.

- Limited Legal Recourse: If a dispute arises, or if you feel you’ve been unfairly treated, your options for legal action are severely curtailed. Suing a tribal lender in state court is often impossible due to sovereign immunity. While federal agencies like the Consumer Financial Protection Bureau (CFPB) can sometimes intervene, their jurisdiction is not always clear-cut, and the process can be protracted and complex.

- Lack of Licensing and Oversight: Unlike state-licensed lenders, tribal lenders operate without the same regulatory scrutiny. This means there are fewer mechanisms to ensure fair lending practices, transparent terms, or a clear process for handling complaints.

Other Significant Dangers for Bad Credit Borrowers

Beyond sovereign immunity, several other dangers amplify the risk for individuals with bad credit who turn to tribal payday loans:

1. Astronomical Interest Rates and Fees

- Unsustainable Debt: The interest rates are not just high; they are predatory. A small loan of $500 could quickly balloon into thousands of dollars owed due to compounding interest and various fees (origination fees, late fees, rollover fees).

- Principal Never Decreases: Borrowers often find that their regular payments only cover the interest, leaving the principal balance untouched. This perpetuates the debt cycle indefinitely.

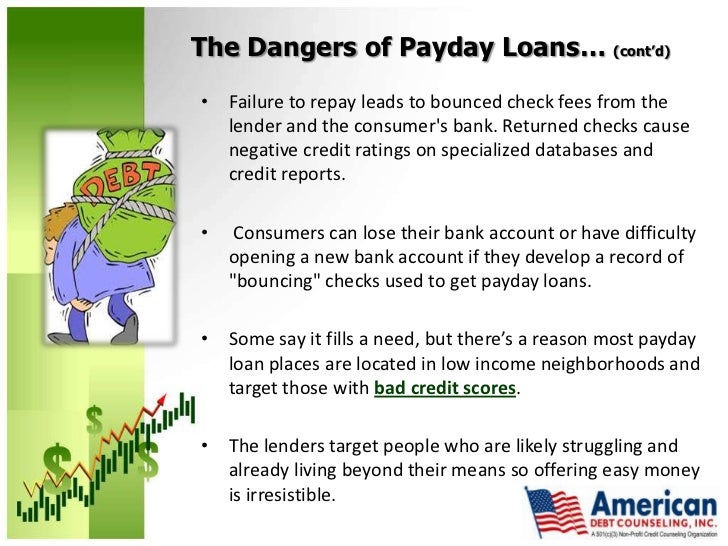

2. The Debt Trap Cycle

- Rollovers and Extensions: When a borrower cannot repay the full amount by the due date, tribal lenders frequently offer to "roll over" the loan, extending the due date but adding new fees and interest charges. This is a primary mechanism for trapping borrowers in long-term debt.

- Multiple Loans: Desperate borrowers might take out multiple tribal loans from different lenders to pay off existing ones, digging themselves into an even deeper hole.

3. Aggressive Collection Tactics

- Direct Debit Authorization: Many tribal lenders require borrowers to authorize automatic withdrawals from their bank accounts. This can lead to overdraft fees if funds are insufficient, further increasing the borrower’s financial burden.

- Harassment and Threats: When payments are missed, collection agencies (often affiliated with the lender) may employ aggressive and unethical tactics, including incessant phone calls, threats of legal action (even when unfounded due to sovereign immunity), and intimidation.

- Wage Garnishment Threats: While tribal lenders generally cannot directly garnish wages without a court order, they may threaten to do so to scare borrowers into paying. It’s crucial to understand that obtaining such an order against a sovereign entity is incredibly difficult for the lender.

4. Impact on Credit Score (Despite "No Credit Check")

- Limited Positive Impact: While tribal lenders may not check your credit initially, they typically do not report positive payment history to major credit bureaus. This means making on-time payments won’t help improve your bad credit score.

- Potential Negative Impact: If the loan goes into default, the lender might eventually sell the debt to a third-party collection agency, which can report the default to credit bureaus, further damaging your already poor credit score.

5. Data Security Risks

- Less Oversight: With less regulatory oversight, tribal lenders may not adhere to the same stringent data security standards as traditional financial institutions. This increases the risk of your personal and financial information being compromised.

How to Identify a Tribal Payday Loan

Be vigilant when seeking loans, especially online. Here are some red flags that might indicate a tribal lender:

- Website Disclaimers: Look for phrases like "governed by tribal law," "operating under the laws of ," or "sovereign entity."

- Lack of State Licensing Information: Reputable lenders will clearly display their state licenses. If this information is absent, be wary.

- Vague Contact Information: Limited physical addresses, P.O. boxes, or generic email addresses instead of specific contact details.

- Exorbitant APRs: While all payday loans have high APRs, tribal loans often advertise rates that are significantly higher than even typical state-regulated payday loans.

- "No Credit Check" Promise: While attractive to those with bad credit, this is a common tactic for predatory lenders.

What to Do If You’re Considering a Tribal Payday Loan (or Already Have One)

If You’re Considering One:

STOP. Do NOT proceed. The risks far outweigh any perceived benefits. Prioritize exploring safer, more regulated alternatives.

If You’re Already in a Tribal Loan Debt Trap:

This situation can be distressing, but you do have options.

-

Stop Payments & Revoke ACH Authorization:

- Contact Your Bank: Immediately contact your bank and revoke the Automated Clearing House (ACH) authorization that allows the lender to debit your account. Do this in writing (email, certified mail) and keep records. This can prevent further unauthorized withdrawals and overdraft fees.

- Be Aware of Consequences: The lender may still try to collect, and your credit score could be affected if the debt is sold, but stopping payments is often the first step to regaining control.

-

Document Everything:

- Keep all loan documents, emails, text messages, and records of phone calls. Note down dates, times, and names of people you speak with. This evidence will be crucial if you seek legal help.

-

Seek Legal Counsel:

- Consumer Protection Attorney: Consult with an attorney specializing in consumer protection law. They understand the complexities of sovereign immunity and can advise you on your specific rights and options.

- Legal Aid Societies: If you cannot afford a private attorney, look for local legal aid organizations that offer free or low-cost legal services.

-

File Complaints:

- Consumer Financial Protection Bureau (CFPB): File a complaint with the CFPB. While they may not always have direct jurisdiction over tribal lenders, they track complaints and can sometimes mediate or investigate.

- Your State’s Attorney General: File a complaint with your state’s Attorney General’s office. They may be able to take action if the lender is operating illegally within your state’s borders, even if claiming tribal affiliation.

- Better Business Bureau (BBB): File a complaint with the BBB. While not a regulatory body, it can create public pressure.

-

Understand Your Rights:

- Fair Debt Collection Practices Act (FDCPA): While tribal lenders may claim immunity from some state laws, they are generally still subject to the FDCPA, which governs how debt collectors can operate. Harassment, threats, and false statements are illegal.

- Usury Laws: In some cases, state courts have ruled that the "rent-a-tribe" model is a sham, and the underlying lender is subject to state usury laws. An attorney can help determine if this applies to your situation.

Safer Alternatives to Tribal Payday Loans (Especially for Bad Credit)

Even with bad credit, there are significantly safer and more responsible ways to address short-term financial needs.

-

Credit Unions:

- Member-Focused: Credit unions are non-profit organizations focused on their members. They often offer more flexible loan options, lower interest rates, and financial counseling, even for those with imperfect credit.

- Payday Alternative Loans (PALs): Many federal credit unions offer PALs, which are small loans ($200-$1,000) with much lower interest rates (capped at 28% APR) and longer repayment terms than traditional payday loans.

-

Personal Loans from Reputable Lenders:

- Online Lenders: Some online lenders specialize in loans for people with bad credit. While rates will be higher than for good credit, they are generally far lower and more regulated than tribal loans. Research lenders thoroughly (e.g., check reviews, BBB ratings, state licenses).

- Secured Personal Loans: If you have an asset (like a car or savings account), you might qualify for a secured personal loan with better terms.

-

Borrow from Friends or Family:

- While sometimes awkward, borrowing from loved ones can be a zero-interest or low-interest solution. Formalize the agreement in writing to avoid misunderstandings.

-

Advance from Employer:

- Some employers offer payroll advances or small loans to employees. This can be a quick and interest-free solution.

-

Local Assistance Programs:

- Charities and Non-Profits: Organizations like the Salvation Army, United Way, or local churches often provide emergency financial assistance for rent, utilities, or food.

- Government Programs: Explore state and federal assistance programs designed to help low-income individuals or those facing specific hardships.

-

Debt Management Plans or Credit Counseling:

- Non-profit credit counseling agencies can help you create a budget, negotiate with creditors, and explore debt management plans. This won’t provide immediate cash but can help stabilize your financial situation long-term.

-

Credit Builder Loans or Secured Credit Cards:

- These options are designed to help you improve your credit score over time, making it easier to qualify for better loans in the future. They are not quick cash solutions but are crucial for long-term financial health.

-

Emergency Savings:

- If possible, start building an emergency fund, even if it’s just a small amount each month. This buffer can prevent the need for high-interest loans in the future.

Conclusion: Empowering Yourself Against Predatory Lending

The temptation of a quick fix for financial woes, especially when saddled with bad credit, is understandable. Tribal payday loans capitalize on this desperation, offering a seemingly simple solution that hides devastating consequences. Their legal shield of sovereign immunity, combined with exorbitant interest rates and aggressive collection practices, creates a debt trap from which escape is incredibly difficult.

By understanding the unique dangers of tribal payday loans and proactively seeking regulated, safer alternatives, you can protect your financial well-being. Always prioritize lenders who operate transparently, adhere to state and federal consumer protection laws, and offer reasonable interest rates. Empower yourself with knowledge, explore all legitimate options, and never fall prey to the illusion of easy money from predatory lenders. Your financial future depends on making informed and responsible choices.