Understanding Native American Sovereign Nation Loans: A Comprehensive Guide

Introduction

Native American Sovereign Nation loans, often referred to as tribal loans, have emerged as a significant, albeit controversial, segment of the online lending market. These loans are typically short-term, high-interest financial products offered by lenders directly owned and operated by, or formally affiliated with, federally recognized Native American tribes. Understanding how these loans work requires a deep dive into the unique legal status of Native American tribes, the structure of the loans themselves, and the specific implications for borrowers.

This guide will provide a professional, step-by-step tutorial on the mechanics of Native American Sovereign Nation loans, explaining their legal foundation, operational procedures, and the critical considerations for potential borrowers.

Disclaimer: This guide is for informational purposes only and does not constitute legal or financial advice. Individuals considering these loans should consult with a qualified financial advisor or legal professional.

1. Understanding Tribal Sovereignty: The Legal Bedrock

The fundamental principle underlying Native American Sovereign Nation loans is tribal sovereignty.

1.1 What is Tribal Sovereignty?

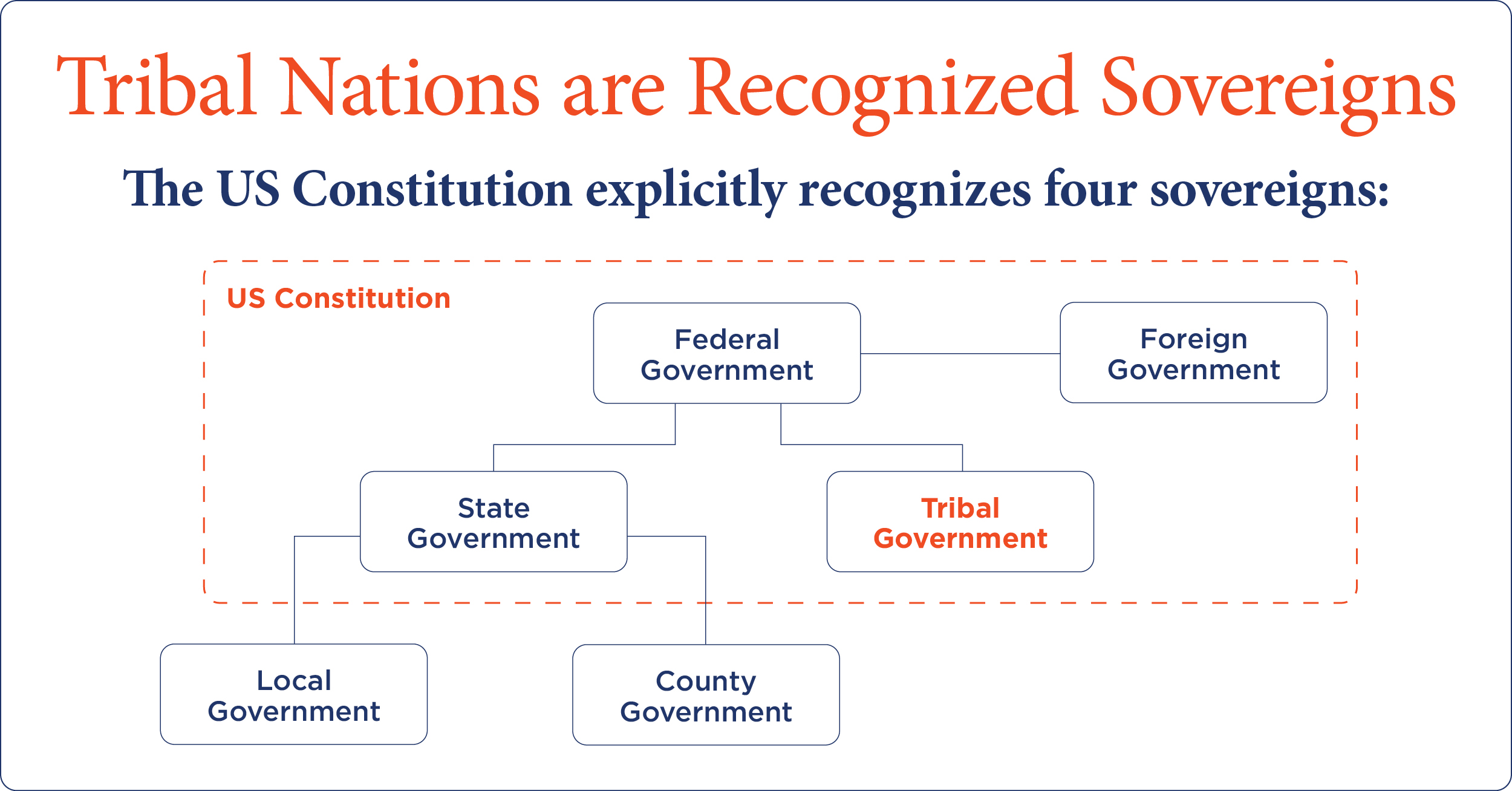

Native American tribes are recognized by the U.S. federal government as distinct, self-governing political entities, often referred to as "nations within a nation." This status grants them inherent powers of self-governance over their members and territory, much like states or even foreign countries, though subject to federal law.

1.2 Impact on State Law

A crucial aspect of tribal sovereignty for lending purposes is that tribal entities are generally not subject to state laws, particularly state usury laws that cap interest rates. This means that a lender operating under the umbrella of a sovereign tribe can offer loans with interest rates (Annual Percentage Rates, or APRs) that would be illegal if offered by a state-licensed lender. This exemption from state usury laws is the primary reason these loans can carry extremely high interest rates, often in the triple digits.

1.3 Federal vs. Tribal Jurisdiction

While tribes are not subject to state law, they are subject to federal law. Federal agencies like the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) have, at times, attempted to regulate tribal lenders, leading to ongoing legal battles regarding the scope of their jurisdiction. The legal landscape here is complex and constantly evolving.

2. The Structure of Native American Sovereign Nation Loans

These loans are typically designed to provide quick access to cash, often marketed to individuals with poor credit histories who may not qualify for traditional bank loans.

2.1 Common Loan Products

- Payday Loans: Short-term, small-dollar loans (e.g., $100-$1,000) typically due on the borrower’s next payday.

- Installment Loans: Larger loans (e.g., $1,000-$5,000 or more) with longer repayment periods, often several months to a year or more, repaid in scheduled installments.

2.2 High Interest Rates and Fees

As mentioned, the most defining characteristic is the extremely high APRs. While a state-licensed lender might be capped at 36% or 100% APR, tribal lenders can legally charge 400%, 800%, or even higher, depending on the loan amount and terms. These rates often translate into significant fees tacked onto the principal amount, making the total cost of borrowing very expensive.

2.3 Online Nature

The vast majority of Native American Sovereign Nation loans are offered online. This allows lenders to reach a wide audience across various states, regardless of the borrower’s geographical proximity to the tribal lands.

2.4 The "Tribal Affiliation" Model

Lenders either operate directly as an "arm of the tribe" (meaning the tribe directly owns and manages the lending entity) or through a partnership model where a third-party lending company partners with a tribe, often paying a fee or share of profits to the tribe in exchange for the use of its sovereign status. Critics often refer to the latter as "rent-a-tribe" schemes, arguing that the tribal affiliation is merely a façade to bypass state laws.

3. The Application Process: How to Apply

Applying for a Native American Sovereign Nation loan is typically a streamlined, online process designed for quick approval and disbursement.

3.1 Online Application Form

Borrowers typically visit the lender’s website and fill out an online application. This form usually requests:

- Personal information (name, address, date of birth, Social Security Number).

- Contact information (phone, email).

- Employment details and income information (employer, pay frequency, net income).

- Bank account details (routing and account number for direct deposit and repayment).

3.2 Minimal Qualification Requirements

One reason these loans are attractive to some borrowers is the relaxed qualification criteria. Lenders often do not perform traditional hard credit checks through major credit bureaus. Instead, they might use alternative data sources or simply verify income and bank account information. This makes them accessible to individuals with poor credit or no credit history.

3.3 Quick Approval and Funding

Once the application is submitted, lenders often provide an instant decision or a decision within minutes. If approved, funds are typically deposited directly into the borrower’s bank account within one business day, sometimes even on the same day.

3.4 Reviewing Loan Terms

Before finalizing, borrowers are presented with the loan agreement, which outlines the principal amount, interest rate, fees, repayment schedule, and other terms and conditions. It is crucial for borrowers to read this document carefully, as it will contain details about the high costs and potential legal clauses (like arbitration agreements).

4. Repayment and Collections

The repayment process for Native American Sovereign Nation loans is typically automated and often leads to concerns about debt cycles.

4.1 Automated Repayments (ACH)

Lenders usually require borrowers to authorize automated withdrawals (ACH debits) from their bank account on the scheduled due dates. This ensures the lender receives payment directly and automatically.

4.2 Repayment Schedule

- Payday Loans: The full loan amount plus interest and fees is typically due on the borrower’s next payday (usually 2-4 weeks).

- Installment Loans: Repayments are spread out over several scheduled installments (e.g., bi-weekly, monthly) until the loan and all accrued interest/fees are paid off.

4.3 Rollovers and Refinancing: The Debt Trap

A common issue with these loans is the option to "rollover" or "refinance" the loan if a borrower cannot make the full payment. This means paying only the interest and fees, and extending the principal to the next pay period or a new installment plan. While this provides temporary relief, it significantly increases the total cost of the loan and can trap borrowers in a cycle of debt, where they continually pay fees without reducing the principal.

4.4 Default and Collections

If a borrower defaults on the loan (i.e., fails to make payments as agreed), the lender will typically attempt to collect the debt. This can involve:

- Repeated ACH attempts: The lender may try multiple times to withdraw funds from the borrower’s account, potentially leading to overdraft fees from the borrower’s bank.

- Collection calls and emails: Lenders or third-party collection agencies will contact the borrower.

- Reporting to credit bureaus: While many tribal lenders don’t report positive payment history to major credit bureaus, some may report defaults, negatively impacting the borrower’s credit score.

- Legal Action (Arbitration): Many loan agreements include mandatory arbitration clauses. This means that instead of going to court, disputes must be resolved through an arbitrator, a process often perceived as favorable to the lender. Because of sovereign immunity, suing the tribe or its lending arm in state court is often not possible.

5. Risks and Controversies for Borrowers

While these loans offer quick access to funds, they come with significant risks and have been the subject of considerable controversy.

5.1 Exorbitant Interest Rates

The most significant risk is the extremely high cost of borrowing. A small loan can quickly balloon into an unmanageable debt due to compounding interest and fees.

5.2 The Debt Cycle

The ease of rollovers and the high cost make it very easy for borrowers to fall into a long-term debt cycle, where they are constantly paying off one high-interest loan only to take out another.

5.3 Limited Consumer Protections

Borrowers of Native American Sovereign Nation loans may not benefit from the same state-level consumer protection laws (like interest rate caps) that apply to traditional lenders. While federal laws like the Truth in Lending Act still apply (requiring disclosure of terms), enforcement can be challenging.

5.4 Arbitration Clauses

Mandatory arbitration clauses limit a borrower’s ability to sue the lender in court, funneling disputes into a private arbitration process that can be less transparent and more costly for the borrower.

5.5 Data Security Concerns

As with any online lender, borrowers share sensitive personal and financial information. While reputable lenders employ security measures, the risk of data breaches or misuse of information always exists.

5.6 Reputation and "Rent-a-Tribe" Schemes

The controversy surrounding "rent-a-tribe" arrangements can make it difficult for borrowers to discern truly tribally-owned and operated lenders from those using tribal affiliation as a loophole.

6. Before You Consider a Native American Sovereign Nation Loan: Alternatives and Advice

Given the high costs and risks, it is strongly advised to explore all other options before considering a Native American Sovereign Nation loan.

6.1 Explore Alternatives

- Traditional Banks/Credit Unions: Personal loans, lines of credit, or even small-dollar loans with much lower interest rates.

- Credit Card Cash Advance: While also high-interest, often lower than tribal loans.

- Employer Advance: Some employers offer payroll advances or small loans to employees.

- Borrow from Friends/Family: If possible, this can be an interest-free solution.

- Non-Profit Credit Counseling: Organizations can help you manage debt and find alternatives.

- Community Resources: Local charities, churches, or government programs may offer assistance.

- Debt Consolidation: If you have multiple debts, consolidating them into one lower-interest loan can help.

- Pawn Shops: While also high-cost, they don’t involve credit checks and don’t typically pursue collection actions beyond keeping the collateral.

6.2 Understand the Terms Fully

If you must consider one of these loans, read every word of the loan agreement. Understand the total cost, the APR, all fees, the repayment schedule, and any clauses regarding arbitration or default.

6.3 Verify Lender Legitimacy

Ensure the lender clearly states its tribal affiliation. Research reviews, but be aware that many review sites can be biased. Check if they are registered with any tribal lending associations, though this is not a guarantee of ethical practices.

6.4 Beware of Unsolicited Offers

Be cautious of emails or calls offering loans that seem too good to be true, or those that pressure you into taking a loan immediately.

6.5 Consider the Long-Term Impact

Think about how this loan will affect your finances in the long run. Can you truly afford the repayments, or will it push you into a cycle of debt?

Conclusion

Native American Sovereign Nation loans operate within a unique legal framework, leveraging tribal sovereignty to offer high-interest, short-term financial products often inaccessible through traditional channels. While they provide quick access to cash for some, their exorbitant costs, potential for debt cycles, and limited consumer protections present significant risks for borrowers. A thorough understanding of their operational mechanics, legal basis, and potential pitfalls is crucial. It is always recommended to exhaust all other financial alternatives and seek professional advice before engaging with such lending services.