Navigating the world of credit building can be challenging, especially for individuals with limited or poor credit history. While numerous traditional and alternative financial products exist, some individuals explore specific niche options, such as loans offered by Native American lending entities. This guide aims to provide a professional, step-by-step tutorial on understanding and potentially utilizing Native American loans for credit score improvement, while critically examining the associated risks and offering crucial guidance for responsible borrowing.

Navigating Native American Loans for Credit Score Improvement: A Professional Step-by-Step Guide

Introduction: The Credit Score Landscape and Alternative Paths

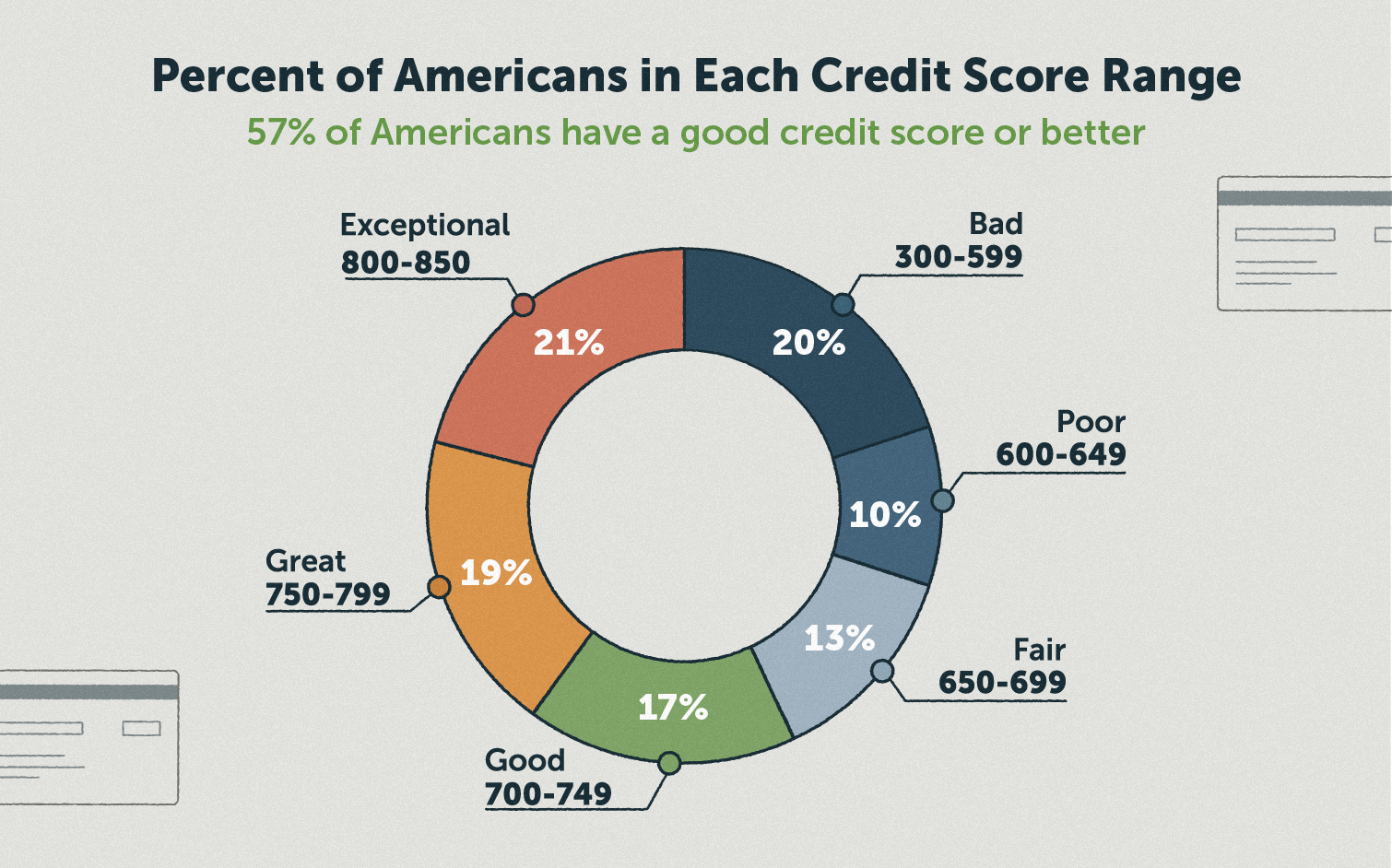

A strong credit score is a cornerstone of financial stability, influencing everything from loan approvals and interest rates to housing applications and even insurance premiums. For many, establishing or repairing credit can be a daunting task. Traditional avenues like credit cards or personal loans often require a pre-existing good credit history, creating a "catch-22" for those who need to build one.

In this context, some individuals turn to less conventional options, including loans offered by lending institutions operating under Native American tribal sovereignty. These loans are often marketed as accessible alternatives for those with less-than-perfect credit. While they can theoretically contribute to credit building, they come with significant risks that borrowers must fully understand. This guide will meticulously break down how these loans function, their potential for credit improvement, and, most importantly, the critical steps to mitigate their inherent dangers.

Understanding Native American Loans

What Are They?

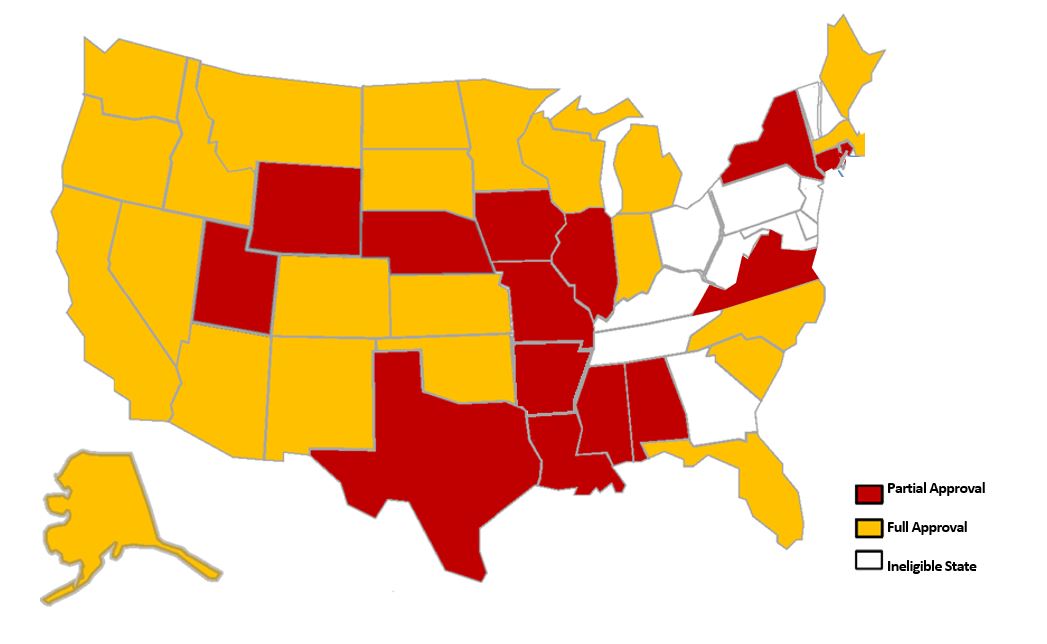

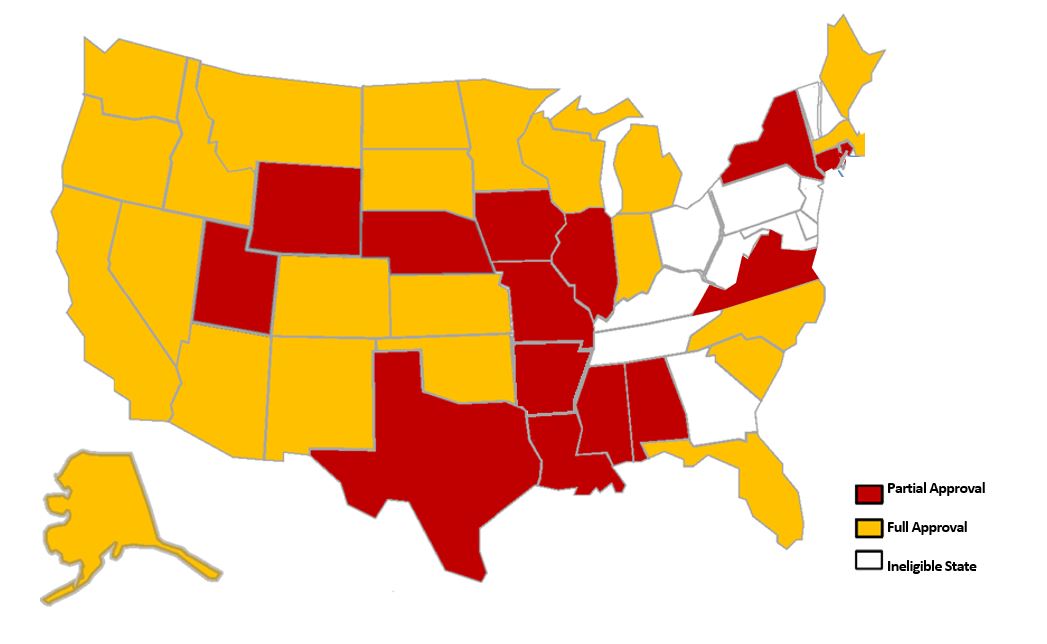

Native American loans, also known as tribal loans, are short-term, high-interest loans offered by financial entities owned and operated by Native American tribes. Due to the tribes’ sovereign status, these lenders operate under tribal law rather than state law, which can mean different regulatory frameworks, particularly concerning interest rate caps that apply to traditional lenders. They are predominantly offered online, making them easily accessible to a broad audience.

Key Characteristics:

- Sovereign Immunity: This is the most defining characteristic. Tribal lenders assert that they are not subject to state lending laws, including those that cap interest rates or regulate loan terms.

- High-Interest Rates: Tribal loans typically carry Annual Percentage Rates (APRs) that are significantly higher than conventional loans, often comparable to payday loans, ranging from hundreds to over a thousand percent.

- Short-Term Repayment: Loan terms are generally short, often designed to be repaid by the borrower’s next payday or within a few weeks to months.

- Easier Qualification: Lenders often have more relaxed eligibility criteria compared to traditional banks, making them accessible to individuals with poor credit or no credit history.

The Mechanism: How Native American Loans Could Build Credit

The fundamental way any loan or credit product helps build a credit score is through consistent, on-time payments reported to the major credit bureaus (Equifax, Experian, and TransUnion). When a lender reports your positive payment history, it demonstrates your ability to manage debt responsibly, which positively impacts your FICO and VantageScore.

For Native American loans, the credit-building mechanism hinges entirely on one critical factor: whether the lender reports your payment activity to the major credit bureaus. If they do, and you make all your payments punctually and in full, this positive history will appear on your credit report and can contribute to:

- Payment History (35% of FICO Score): This is the most significant factor. Regular, on-time payments are crucial.

- Credit Mix (10% of FICO Score): Adding an installment loan to your credit profile, especially if you primarily have revolving credit (like credit cards), can slightly diversify your credit mix.

Crucial Caveat: Not all Native American lenders report to credit bureaus. Many focus solely on providing short-term cash without the intention of helping borrowers build credit. This distinction is paramount.

The Inherent Risks and Drawbacks

Before considering a Native American loan for credit building, it is imperative to fully comprehend the substantial risks involved:

- Exorbitant Interest Rates (APR): This is the most significant danger. The high APRs mean that a small loan can quickly accumulate a massive amount of interest, making it incredibly difficult to repay the principal. You could end up paying back several times the amount you initially borrowed.

- Debt Cycle Trap: Due to high costs and short repayment periods, many borrowers find themselves unable to repay the loan on time. This can lead to rolling over the loan, incurring additional fees, or taking out another loan to pay off the first, spiraling into a cycle of debt.

- Limited Regulatory Oversight & Jurisdictional Issues: Operating under tribal law, these lenders may not be subject to state consumer protection laws. This can complicate legal recourse for borrowers in case of disputes or predatory practices.

- Not All Report to Credit Bureaus: As mentioned, many tribal lenders do not report payment history. If a lender doesn’t report, the loan offers no credit-building benefit, leaving you only with the high cost.

- Negative Credit Impact: If you miss payments or default on a tribal loan (especially one that reports to bureaus), it will severely damage your credit score, potentially worse than your initial situation.

- Aggressive Collection Practices: Some lenders may employ aggressive collection tactics due to the unique legal framework.

Step-by-Step Guide: Utilizing Native American Loans for Credit Building (With Extreme Caution)

If, after understanding the profound risks, you still decide to explore Native American loans specifically for credit building, follow these steps with the utmost caution and diligence.

Step 1: Exhaust All Safer Alternatives

Before even looking at tribal loans, rigorously explore every conventional and less risky credit-building option. These include:

- Secured Credit Cards: Requires a security deposit, but reports to bureaus and has lower interest rates.

- Credit Builder Loans: Offered by credit unions or community banks, where your payments are saved in an account and released to you after the loan term.

- Becoming an Authorized User: On a trusted family member’s credit card account (ensure they have good payment habits).

- Small Personal Loans from Credit Unions: Often have more flexible terms and lower rates than traditional banks for members.

- Peer-to-Peer Lending Platforms: Some offer more accessible loans.

- "Self" or "Credit Strong" type services: These are specifically designed to build credit through installment payments.

Only proceed if these alternatives are genuinely unavailable or insufficient for your specific, urgent needs.

Step 2: Thoroughly Research Potential Lenders

If you must proceed, rigorous research is non-negotiable.

- Identify Tribal Affiliation: Reputable tribal lenders will clearly state their tribal ownership and jurisdiction on their website.

- Look for Transparency: A legitimate lender will have clear terms, conditions, contact information, and privacy policies readily available.

- Check Online Reviews (with skepticism): Search for reviews, but be aware that the high-interest nature of these loans often leads to negative feedback, and some reviews may not be entirely objective. Look for patterns in complaints.

- Avoid Unlicensed Lenders: If a lender is not clearly affiliated with a recognized Native American tribe, it may be operating illegally and should be avoided.

Step 3: Verify Credit Bureau Reporting Practices

This is the most critical step for credit building.

- Direct Inquiry: Contact the lender directly (via phone or email) and explicitly ask:

- "Do you report payment history to the major credit bureaus (Equifax, Experian, TransUnion)?"

- "Which specific bureaus do you report to?"

- "How often do you report?"

- "Do you report both positive and negative payment history?"

- Seek Written Confirmation: Whenever possible, get this information in writing (e.g., an email response or a clause in the loan agreement). Do not rely solely on verbal assurances.

- Be Skeptical: If a lender is vague, evasive, or claims to report but provides no specifics, assume they do not, or that reporting is inconsistent.

Step 4: Understand All Terms and Conditions (The Fine Print)

Before applying, meticulously read the entire loan agreement.

- Annual Percentage Rate (APR): This is the true cost of the loan annually. It will likely be very high. Understand exactly how much you will pay in interest over the loan term.

- Total Repayment Amount: Calculate the total amount you will owe, including principal and all interest/fees.

- Repayment Schedule: Know the exact due dates and amounts for each payment.

- Fees: Understand any origination fees, late payment fees, rollover fees, or other charges.

- Prepayment Penalties: Check if there are any penalties for paying off the loan early (ideally, there shouldn’t be, and you should aim to pay it off early).

- Jurisdiction Clause: Be aware of the stated legal jurisdiction for disputes.

Step 5: Apply Only for What You Can Absolutely Afford to Repay Immediately

- Minimal Borrowing: If your primary goal is credit building, borrow the smallest possible amount necessary to establish a payment history. Do not borrow more than you need.

- Guaranteed Repayment: Only apply for a loan if you have a concrete, reliable plan and the funds readily available to repay the entire loan amount plus interest by the due date(s). Ideally, have the full repayment amount set aside in a separate account. This loan should be treated as a "credit-building exercise" that you can fully control.

Step 6: Manage Payments Diligently and On-Time

This is the only way the loan will help your credit score.

- Strict Adherence: Make every single payment on or before the due date.

- Set Reminders: Use calendar alerts, phone reminders, or automatic payment setups (if you trust the lender and your bank account balance).

- Maintain Funds: Ensure your bank account always has sufficient funds to cover the payments. Bounced payments can incur additional fees and damage your relationship with the lender and your bank.

- Communicate: If an unforeseen circumstance arises, contact the lender immediately to discuss options, though options for high-interest loans are often limited.

Step 7: Monitor Your Credit Report

After a few months of making payments:

- Check Your Credit Report: Obtain free copies of your credit report from AnnualCreditReport.com (one from each bureau per year).

- Verify Reporting: Look for the tribal loan listed on your credit report. Confirm that the payments are being reported accurately as "on-time."

- Dispute Errors: If you find discrepancies or if the loan is not being reported as promised, contact the lender and the credit bureau to dispute the error.

Responsible Borrowing Practices (General Advice)

Regardless of the type of loan, responsible financial habits are key to long-term success:

- Create a Budget: Understand your income and expenses to manage your money effectively.

- Build an Emergency Fund: Save money for unexpected expenses to avoid relying on high-interest loans in the future.

- Improve Financial Literacy: Continuously educate yourself about personal finance, credit, and debt management.

- Avoid Excessive Debt: Only borrow what you genuinely need and can comfortably repay.

Conclusion: Proceed with Extreme Caution

Utilizing Native American loans for credit score improvement is a strategy fraught with significant risks. While the potential exists for positive credit reporting, the exorbitant interest rates and potential for a debt spiral make them a precarious choice. This guide has laid out a detailed, professional pathway, emphasizing the critical steps of due diligence, verification, and meticulous repayment.

Ultimately, Native American loans should be considered a last resort for credit building, only after exhausting all safer and more affordable alternatives. If you choose this path, do so with your eyes wide open to the dangers, a clear plan for repayment, and an unwavering commitment to making every payment on time. Your financial well-being depends on it.