This comprehensive guide aims to clarify the intricacies of home loan interest rates for Native American communities. While the prompt specifically mentions "USDA Native American Home Loan Interest Rates," it’s important to clarify that the primary federal program specifically designed for Native Americans and Alaska Natives to achieve homeownership is the HUD Section 184 Indian Home Loan Guarantee Program, administered by the U.S. Department of Housing and Urban Development (HUD).

Often, there’s a general association of federal housing assistance in rural areas with "USDA," which offers its own home loan programs (like USDA Rural Development loans). However, these USDA programs are not specifically tailored for Native American tribal lands or unique tribal trust land considerations in the same way Section 184 is. This guide will therefore focus on the HUD Section 184 Program as the most relevant and impactful federal initiative for Native American homeownership and its associated interest rates, while acknowledging the common but sometimes conflated terminology.

Navigating HUD Section 184 Indian Home Loan Interest Rates: A Professional Tutorial

1. Introduction: Empowering Native American Homeownership

Homeownership is a cornerstone of financial stability and community development. For Native American and Alaska Native communities, however, unique challenges often exist, including access to conventional financing on tribal lands. The HUD Section 184 Indian Home Loan Guarantee Program was established precisely to address these barriers, offering a vital pathway to homeownership, rehabilitation, and construction for eligible Native individuals, families, and Tribal governments.

This guide will provide a professional, step-by-step tutorial on understanding the Section 184 program, with a particular focus on how interest rates are determined, the associated costs, and the overall application process. Our aim is to demystify this powerful tool and empower prospective homeowners with the knowledge needed to make informed decisions.

2. Understanding the HUD Section 184 Indian Home Loan Guarantee Program

The Section 184 program is a unique mortgage product specifically designed for Native Americans and Alaska Natives. It’s not a direct loan from the government, but rather a loan guarantee program. This means HUD guarantees the loan against default, reducing the risk for private lenders (banks, mortgage companies) and encouraging them to lend in Native communities where they might otherwise hesitate.

Key Characteristics:

- Guaranteed by HUD: This is the program’s foundation, making loans more accessible.

- Administered by HUD’s Office of Native American Programs (ONAP): ONAP oversees the program, ensuring it meets the needs of tribal communities.

- Flexible Use: Loans can be used for purchasing an existing home, constructing a new home, rehabilitating a home, or refinancing.

- Eligible Borrowers: Federally recognized individual Native Americans or Alaska Natives, or an Indian tribe or Tribally Designated Housing Entity (TDHE).

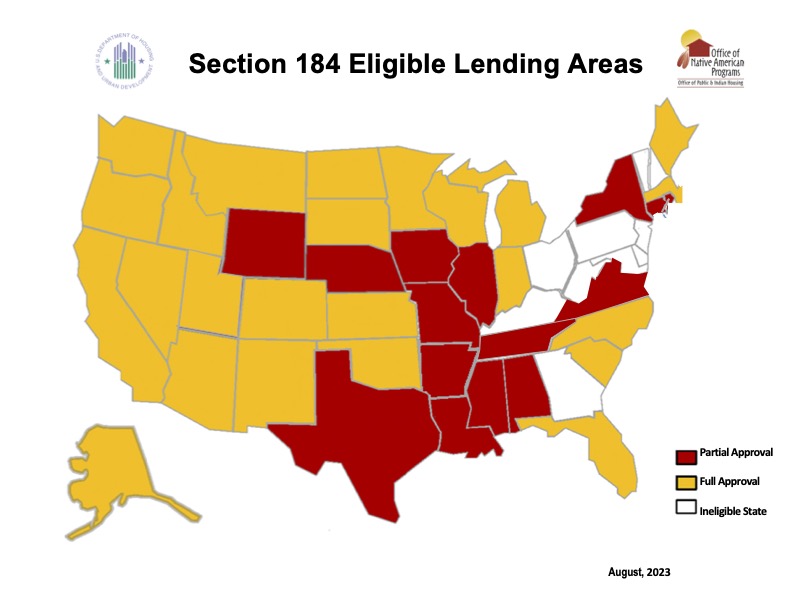

- Eligible Locations: Homes can be located on or off trust land, in Native American Areas, or eligible areas defined by HUD.

3. Eligibility Requirements for Section 184 Loans

Before delving into interest rates, it’s crucial to understand who qualifies for a Section 184 loan.

- Native American or Alaska Native Status: The primary requirement is that the borrower must be an enrolled member of a federally recognized tribe. Proof of tribal enrollment is mandatory.

- Creditworthiness: While Section 184 offers more flexible underwriting guidelines than conventional loans, borrowers must still demonstrate the ability to repay the loan. Lenders will assess credit history, debt-to-income ratio, and employment stability.

- Income Requirements: Borrowers must have a stable and verifiable income sufficient to meet monthly mortgage payments and other housing-related expenses. There are no strict income limits, but affordability is key.

- Property Eligibility: The home must be located in an eligible area, which includes all Native American trust lands, Alaska Native villages, and designated Indian Areas. Properties off tribal lands in eligible areas also qualify.

- Occupancy: The home financed through Section 184 must be the borrower’s primary residence.

- Tribal Approval (for trust land): If the property is on tribal trust land, the tribe must approve the leasehold or other land tenure arrangement for the loan to proceed. This is a critical step that requires coordination with tribal housing authorities.

4. Understanding Section 184 Interest Rates: The Core Focus

One of the most frequently asked questions about any home loan program concerns its interest rates. Here’s a detailed breakdown for the HUD Section 184 program:

4.1. How Section 184 Interest Rates Are Set

Unlike some government-backed programs that might have a fixed, government-mandated rate, Section 184 interest rates are market-driven. This means:

- Lender Discretion: Approved Section 184 lenders (banks, credit unions, mortgage companies) set their own interest rates based on current market conditions, their cost of funds, and their risk assessment. HUD does not dictate the specific interest rate.

- Competitive Market: Because HUD guarantees the loan, lenders are often able to offer competitive rates. Borrowers are encouraged to shop around among approved Section 184 lenders to find the best rate and terms.

- Fixed-Rate Loans: A significant advantage of Section 184 loans is that they are predominantly fixed-rate mortgages. This means your interest rate, and consequently your principal and interest payment, will remain the same for the entire life of the loan (typically 30 years). This provides stability and predictability for homeowners, protecting them from potential future rate increases. While adjustable-rate mortgages (ARMs) can be offered, they are rare for this program due to its focus on long-term stability.

4.2. Factors Influencing Your Specific Interest Rate

While market conditions set the general range, several individual factors will influence the specific interest rate you are offered:

- Current Market Conditions: Global and national economic indicators, such as the Federal Reserve’s monetary policy, inflation rates, and the bond market (especially the 10-year Treasury yield), significantly impact mortgage rates across all loan types, including Section 184.

- Borrower’s Credit Score: A higher credit score generally indicates a lower risk to the lender, often resulting in a lower interest rate. While Section 184 is more flexible with credit than conventional loans, a stronger credit profile is always beneficial.

- Debt-to-Income (DTI) Ratio: This ratio compares your total monthly debt payments to your gross monthly income. A lower DTI indicates better financial health and can contribute to a more favorable rate.

- Loan Term: Most Section 184 loans are 30-year fixed-rate. Shorter terms (e.g., 15-year fixed) typically come with slightly lower interest rates but higher monthly payments.

- Loan-to-Value (LTV) Ratio: This is the amount of your loan compared to the home’s appraised value. A lower LTV (meaning a larger down payment) can sometimes result in a slightly better rate.

- Lender-Specific Pricing: Each approved Section 184 lender has its own pricing model, overhead costs, and profit margins, which will influence the rates they offer. This reinforces the importance of shopping around.

- Points: Borrowers may have the option to pay "points" (prepaid interest) at closing to "buy down" their interest rate. This is an upfront cost that can save money over the life of the loan, but it requires careful calculation to ensure it’s financially beneficial.

4.3. Comparing Section 184 Rates to Other Loan Types

Generally, Section 184 interest rates are competitive with, and sometimes even slightly lower than, conventional or FHA loans. The HUD guarantee reduces lender risk, which can translate into more favorable terms for borrowers. The fixed-rate nature provides a strong advantage over potentially volatile adjustable-rate mortgages.

5. Beyond the Interest Rate: Other Costs Associated with Section 184 Loans

While the interest rate is a significant factor, it’s crucial to understand all associated costs to accurately budget for homeownership.

5.1. Guarantee Fees

Unlike conventional loans that might require Private Mortgage Insurance (PMI) or FHA loans with their Mortgage Insurance Premium (MIP), Section 184 loans have their own guarantee fees:

- Upfront Guarantee Fee: A one-time fee of 1.5% of the loan amount. This fee can be financed into the loan, meaning you don’t necessarily have to pay it out of pocket at closing.

- Annual Guarantee Fee: An annual fee of 0.25% of the outstanding loan balance, paid monthly as part of your mortgage payment. This fee remains for the life of the loan.

These fees ensure the continued viability of the program and are generally considered lower than FHA’s mortgage insurance premiums, especially over the long term.

5.2. Closing Costs

Like any mortgage, Section 184 loans come with various closing costs, which are fees paid at the time of loan closing. These can include:

- Origination Fees: Charged by the lender for processing the loan.

- Appraisal Fee: Cost for an independent appraisal of the property’s value.

- Inspection Fees: For home inspections to assess the property’s condition.

- Title Search and Insurance: To ensure clear ownership of the property.

- Recording Fees: Paid to the local government to record the property transaction.

- Prepaid Expenses: Such as property taxes and homeowner’s insurance premiums for a certain period.

Closing costs typically range from 2% to 5% of the loan amount. Section 184 allows sellers, Tribes, or lenders to contribute to closing costs, which can significantly reduce the borrower’s upfront expenses.

5.3. Down Payment

Section 184 loans offer a low down payment option:

- 1.25% down payment: For loans with a Loan-to-Value (LTV) ratio between 95% and 100%.

- 2.25% down payment: For loans with an LTV ratio less than or equal to 95%.

This low down payment requirement makes homeownership more accessible compared to conventional loans, which often require 5% to 20% down.

6. The Application Process: A Step-by-Step Guide

Securing a Section 184 loan involves several key steps:

Step 1: Pre-Qualification / Pre-Approval

Begin by contacting an approved Section 184 lender. They will review your financial situation, credit history, and tribal enrollment to give you an estimate of how much you can afford and formally pre-approve you for a loan amount. This step is crucial as it clarifies your borrowing power and signals to sellers that you are a serious buyer.

Step 2: Find an Approved Section 184 Lender

Not all lenders offer Section 184 loans. HUD maintains a list of approved lenders on its website. It’s essential to work with a lender experienced in this program, especially regarding tribal land issues. Shop around for the best rates and service.

Step 3: Gather Required Documentation

Your lender will request a variety of documents, including:

- Proof of tribal enrollment (Tribal ID card or letter).

- Income verification (pay stubs, W-2s, tax returns).

- Asset verification (bank statements).

- Credit history authorization.

- Photo ID.

Step 4: Loan Application and Underwriting

Once you’ve found a home, you’ll submit a formal loan application. The lender’s underwriting department will thoroughly review your financial information, credit, and the property details to ensure all HUD Section 184 guidelines are met.

Step 5: Home Appraisal and Inspection

The property will undergo an appraisal to determine its market value, ensuring it meets HUD’s minimum property standards. A home inspection is highly recommended to identify any potential issues with the property. For homes on tribal trust land, the appraisal process may require specific expertise.

Step 6: Tribal Approval (for Trust Land Properties)

If the home is on tribal trust land, the tribe must approve the leasehold interest or other land tenure document. This often involves working with the tribal housing authority and legal department to ensure compliance with tribal law and HUD requirements. This step can sometimes add time to the process.

Step 7: Loan Closing

Once all conditions are met, and the loan is approved, you’ll attend the closing. Here, you’ll sign all necessary documents, pay any remaining closing costs, and officially become the homeowner. The funds are disbursed, and the loan is recorded.

7. Key Benefits of the Section 184 Program

Beyond competitive interest rates, the Section 184 program offers several significant advantages:

- Low Down Payment: As low as 1.25% or 2.25%, making homeownership more accessible.

- Flexible Underwriting: More lenient credit guidelines compared to conventional loans.

- Fixed Interest Rates: Provides payment stability and predictability.

- No Private Mortgage Insurance (PMI): Instead, the lower guarantee fees are charged.

- Ability to Finance Guarantee Fee: The upfront 1.5% fee can be rolled into the loan.

- Specific to Native American Needs: Designed to address unique challenges of lending on and off tribal lands.

- Property Rehabilitation and Construction: Can be used for more than just home purchases.

8. Important Considerations and Potential Challenges

While highly beneficial, borrowers should be aware of potential considerations:

- Limited Number of Lenders: While growing, the pool of approved Section 184 lenders is smaller than for conventional loans, requiring some research.

- Complexity of Tribal Land Laws: Navigating leases and land tenure on tribal trust land can add complexity and time to the process.

- Appraisal Challenges: Appraising properties in remote or unique tribal settings can sometimes be more challenging.

- Financial Education: While not a challenge of the program itself, understanding the responsibilities of homeownership is crucial. Many tribal housing authorities and lenders offer financial literacy resources.

9. Resources for Further Information

For the most accurate and up-to-date information, prospective borrowers should consult:

- HUD’s Office of Native American Programs (ONAP) Website: The official source for Section 184 program details, eligibility, and a list of approved lenders.

- Approved Section 184 Lenders: Direct consultation with lenders experienced in the program is invaluable.

- Tribal Housing Authorities: Your tribal housing authority can provide guidance on tribal-specific requirements and resources.

10. Conclusion

The HUD Section 184 Indian Home Loan Guarantee Program is an invaluable federal resource, specifically tailored to meet the housing needs of Native American and Alaska Native communities. By offering competitive, fixed interest rates, flexible underwriting, and low down payments, it significantly lowers the barriers to homeownership. Understanding how these interest rates are determined, the associated costs, and the step-by-step application process empowers eligible individuals and families to confidently pursue their dream of owning a home. With careful planning and engagement with approved lenders and tribal resources, the path to stable, affordable homeownership through Section 184 is within reach.