Navigating the Path to Homeownership: A Deep Dive into HUD 184 Loan Documentation

The dream of homeownership, a cornerstone of the American ideal, often feels distant for many, particularly within underserved communities. For Native Americans, Alaska Natives, and members of federally recognized tribes, a unique and powerful tool exists to bridge this gap: the Section 184 Indian Home Loan Guarantee Program, often simply referred to as the HUD 184 loan. This program, administered by the U.S. Department of Housing and Urban Development (HUD), offers an accessible pathway to owning a home on and off tribal lands, including fee simple land, trust land, and individually allotted land.

However, like any significant financial undertaking, securing a HUD 184 loan involves a meticulous application process, demanding a specific set of documentation. In this comprehensive review, we will treat the "HUD 184 Loan Application Documentation" as a product itself, dissecting what’s needed, exploring the benefits and drawbacks of this "product," and ultimately providing a recommendation on its utility and value.

Understanding the "Product": HUD 184 Loan Documentation

Think of the documentation as the instruction manual and ingredient list for building your financial future. It’s the information package that allows lenders to assess your eligibility, financial stability, and capacity to repay the loan. While the specific requirements can vary slightly between lenders and individual circumstances, the core documentation categories remain consistent.

1. Personal Identification and Eligibility Verification

This is the foundational layer, confirming who you are and that you meet the program’s primary eligibility criteria.

- Government-Issued Photo ID: Driver’s license, state ID, or passport for all applicants.

- Social Security Card: For all applicants.

- Tribal Enrollment Documentation: This is critical. You’ll need proof of enrollment in a federally recognized American Indian tribe or Alaska Native village. This typically includes a tribal enrollment card or a letter from your tribe’s enrollment office.

- Proof of Residency: Utility bills, lease agreements, or other documents confirming your current address.

2. Income and Employment Documentation

Lenders need to verify your ability to make consistent mortgage payments. This section aims to paint a clear picture of your current and historical income.

- Pay Stubs: Your most recent 30 days of consecutive pay stubs, showing gross and net income, year-to-date earnings, and any deductions.

- W-2 Forms: Your W-2s for the past two years. If you’ve had multiple employers, you’ll need W-2s from all of them.

- Federal Tax Returns: Complete federal tax returns (all schedules) for the past two years. This is particularly important for self-employed individuals or those with complex income structures.

- Employment Verification: The lender will typically contact your employer(s) directly to verify employment and income. You may need to provide employer contact information.

- Self-Employment Documentation (if applicable): If you are self-employed, expect to provide:

- Business license.

- Year-to-date profit and loss statement.

- Business bank statements (usually 12-24 months).

- K-1s (if applicable, for partnerships or S-corps).

- Other Income Sources: Documentation for any additional income, such as:

- Social Security benefits (award letters).

- Pension/Retirement income (award letters, statements).

- Child support/Alimony (court orders, payment history – note: this is optional to disclose but can help qualify).

- Rental income (lease agreements, tax schedules).

3. Asset Documentation

This category demonstrates that you have sufficient funds for the down payment, closing costs, and any required reserves after closing.

- Bank Statements: Your most recent 2-3 months of bank statements (checking and savings) for all accounts. All pages, even blank ones, must be provided. Lenders will scrutinize large, unexplained deposits.

- Investment Account Statements: Statements for any stocks, bonds, mutual funds, or retirement accounts (401k, IRA) you plan to use for the loan or list as reserves.

- Gift Letters (if applicable): If a portion of your down payment or closing costs is a gift from a relative, you’ll need a signed gift letter stating the amount, that it’s a gift (not a loan), and the donor’s relationship to you. The donor’s bank statements may also be required.

- Other Liquid Assets: Documentation for any other assets that can be easily converted to cash.

4. Credit History Documentation

While HUD 184 loans are known for more flexible credit requirements than conventional loans, lenders still need to assess your financial responsibility.

- Credit Report: The lender will pull your credit report. You may need to provide explanations for any derogatory marks (late payments, collections, bankruptcies, foreclosures).

- Letters of Explanation: For any credit issues, employment gaps, or unusual financial activity that appears on your credit report or application.

5. Property-Specific Documentation

Once you have a property in mind, additional documents related to the home itself become necessary.

- Purchase Agreement/Sales Contract: The fully executed contract between you and the seller.

- Appraisal Report: HUD requires an appraisal from a HUD-approved appraiser to ensure the property meets minimum standards and is valued appropriately.

- Title Search and Title Insurance: Documentation proving clear title to the property, free of liens or encumbrances.

- Home Inspection Report (Recommended): While not always strictly required by HUD, a professional home inspection is highly recommended to uncover any potential issues with the property.

- Flood Zone Determination: To determine if flood insurance is required.

- Hazard Insurance Policy: Proof of homeowner’s insurance coverage.

- Lead-Based Paint Disclosure: For homes built before 1978.

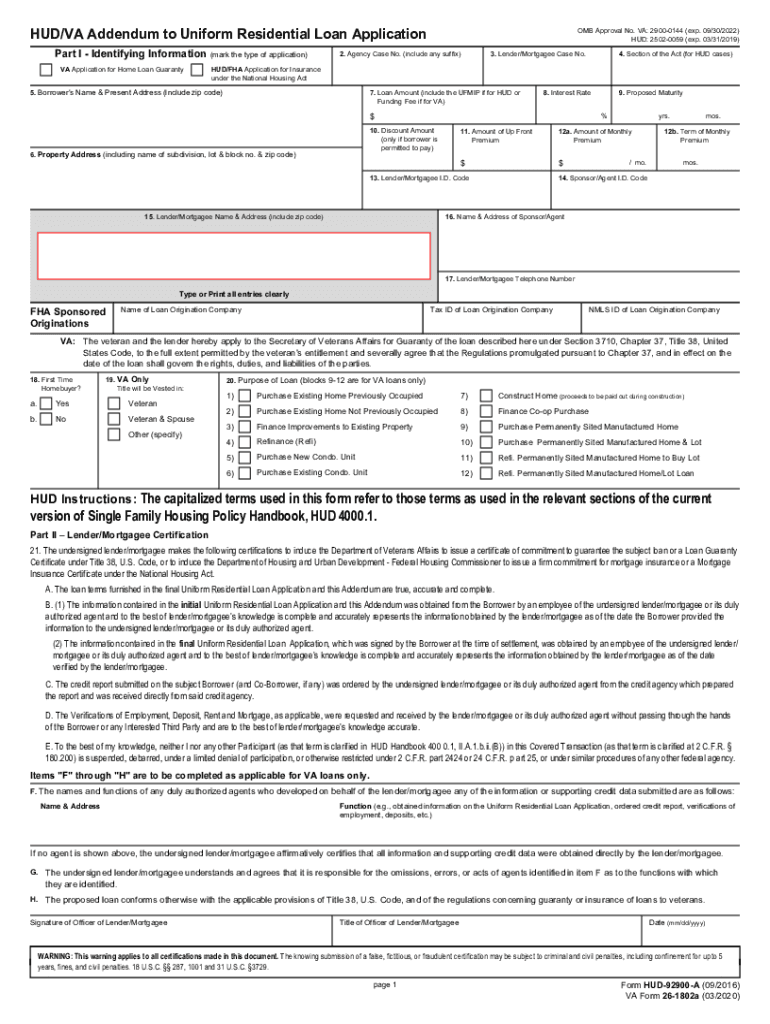

6. Loan-Specific Documentation

- HUD 184 Counseling Certificate: Some lenders or tribal housing programs may require pre-purchase counseling specific to the HUD 184 program.

- Occupancy Agreement: You must intend to occupy the property as your primary residence.

- Signed Disclosures: Various federal and state disclosures related to the loan terms, costs, and rights.

The Pros and Cons of This "Documentation Product"

Now, let’s evaluate the experience of compiling and submitting this documentation.

Pros (Advantages of the HUD 184 Program & its Documentation Process)

- Accessibility for Specific Communities: The primary advantage of the HUD 184 loan itself is its targeted support for Native American and Alaska Native communities. The documentation ensures this benefit reaches its intended recipients, fostering homeownership where it might otherwise be challenging.

- Flexible Underwriting Standards: Compared to conventional loans, HUD 184 loans often have more lenient credit score requirements and debt-to-income ratios. While documentation is still thorough, the interpretation of that documentation is more understanding of unique circumstances.

- Low Down Payment Requirement: With a down payment as low as 2.25% for loans over $50,000 and 1.25% for loans under $50,000, the barrier to entry is significantly lowered. The documentation verifies you have these funds, making the dream more attainable.

- No Monthly Mortgage Insurance (PMI): Unlike FHA loans or conventional loans with low down payments, HUD 184 loans do not require monthly mortgage insurance (PMI). There’s an upfront guarantee fee (1%) and an annual guarantee fee (0.25% of the unpaid principal balance), but the absence of monthly PMI saves borrowers money over the life of the loan. The documentation verifies these fees are factored into the closing costs.

- Competitive Interest Rates: Because the loans are guaranteed by the federal government, lenders are often able to offer competitive interest rates.

- Assumable Loans: This is a significant unique feature. Should you sell your home in the future, a qualified buyer (who also meets HUD 184 tribal eligibility) can assume your existing loan, potentially making your home more attractive to eligible buyers in a rising interest rate environment.

- Support for On- and Off-Reservation Homeownership: The program supports purchasing homes on trust land, individually allotted land, and fee simple land, offering flexibility in location. The documentation ensures proper land title and usage.

Cons (Disadvantages & Challenges of the Documentation Process)

- Volume and Complexity: The sheer volume of documents required can be overwhelming. Gathering everything from multiple sources (employers, banks, tax agencies, tribal offices) takes time and meticulous organization.

- Strict Adherence to Guidelines: Every document must be complete, accurate, and submitted exactly as requested. Missing pages, un-signed forms, or discrepancies can lead to delays or even denial.

- Time-Consuming: The process of collecting, reviewing, and submitting documentation, coupled with the lender’s underwriting process, can extend the loan approval timeline. This requires patience and proactive engagement from the applicant.

- Specific Eligibility Verification: The tribal enrollment documentation, while crucial for the program’s intent, adds an extra layer of verification not present in conventional loans. While straightforward for most, it’s an additional step.

- Lender Availability: Not all lenders offer HUD 184 loans. Finding an experienced lender who understands the nuances of the program and its documentation requirements is essential but can sometimes be a challenge, particularly in certain geographic areas.

- Potential for "Documentation Fatigue": Applicants can become frustrated by repeated requests for similar information or clarification, especially if initial submissions aren’t perfectly aligned with the lender’s needs.

Recommendation: Is This "Documentation Product" Worth the Effort?

Absolutely, for the eligible individual.

While the process of compiling HUD 184 loan documentation can feel like a formidable task, the benefits of the loan itself far outweigh the initial bureaucratic hurdles for those it is designed to serve. The HUD 184 program is an invaluable resource, specifically tailored to address historical and systemic barriers to homeownership for Native Americans and Alaska Natives.

Who is this "Product" for?

- Enrolled members of federally recognized American Indian tribes or Alaska Native villages: This is the non-negotiable prerequisite.

- Individuals seeking a low down payment option: If saving a 10-20% down payment is a significant barrier, the 2.25% or 1.25% requirement makes this loan highly attractive.

- Those with less-than-perfect credit: While good credit is always helpful, the more flexible underwriting can provide a second chance or an accessible first chance for homebuyers.

- Individuals interested in purchasing a home on or off tribal lands: The program’s flexibility in land types is a major advantage.

- Buyers looking for long-term savings: The absence of monthly PMI can save tens of thousands of dollars over the life of the loan.

Maximizing Your Experience with the Documentation

To make the "documentation product" less daunting, consider these strategies:

- Start Early: Begin gathering documents even before you’ve found a home. Many financial documents have expiration dates (e.g., pay stubs are usually valid for 30 days), but having the core information ready speeds up the process.

- Get Organized: Create a dedicated folder (physical or digital) for all loan documents. Label everything clearly. A checklist provided by your lender will be your best friend.

- Communicate Proactively with Your Lender: Choose a lender experienced with HUD 184 loans. Ask questions, clarify requests, and maintain open lines of communication. They are your guide through this process.

- Be Transparent: Don’t try to hide financial issues. Provide honest explanations for any credit anomalies or employment gaps. Lenders appreciate transparency.

- Be Patient and Persistent: There will likely be back-and-forth requests for additional information. View it as due diligence, not an interrogation. Each request brings you closer to approval.

- Leverage Technology: Many lenders allow secure online portals for uploading documents, which can streamline the process.

Conclusion

The HUD 184 loan application documentation, while extensive, is a necessary gateway to a highly beneficial homeownership program. It serves as the bedrock for a loan designed with specific communities in mind, offering unparalleled flexibility, lower financial barriers, and unique long-term advantages.

For eligible Native Americans and Alaska Natives, the effort invested in meticulously compiling this documentation is an investment in securing a home, building generational wealth, and realizing the dream of homeownership. Approach it with diligence, organization, and a clear understanding of the immense value it unlocks. The journey may require patience, but the destination—a place to call your own—is unequivocally worth it.