Native American Home Loans in North Dakota: A Comprehensive Product Review for Aspiring Homeowners

Homeownership is often lauded as a cornerstone of the American dream, a vital pathway to building intergenerational wealth, fostering community stability, and securing a tangible asset. However, for many Native American individuals and families, particularly those residing on tribal lands or in rural reservation communities, the journey to homeownership is fraught with unique challenges that traditional mortgage products often fail to address. This comprehensive product review examines the landscape of Native American home loans available in North Dakota, dissecting their features, advantages, disadvantages, and ultimately offering a recommendation on their value as a financial tool.

North Dakota is home to several federally recognized tribal nations, including the Mandan, Hidatsa, and Arikara Nation (Fort Berthold Indian Reservation), the Spirit Lake Nation, the Standing Rock Sioux Tribe, and the Turtle Mountain Band of Chippewa Indians. These communities, while rich in culture and resilience, often face systemic barriers to conventional lending, such as issues with land tenure (trust land vs. fee simple), limited credit histories, lower median incomes, and a scarcity of local financial institutions. Recognizing these disparities, specialized loan programs have emerged, effectively creating a distinct "product" category in the mortgage market tailored to Native American borrowers.

Understanding the "Product": What Are Native American Home Loans?

Unlike generic conventional mortgages, Native American home loans are a suite of specialized financial products designed to overcome the unique hurdles faced by eligible tribal members. The primary programs reviewed here include:

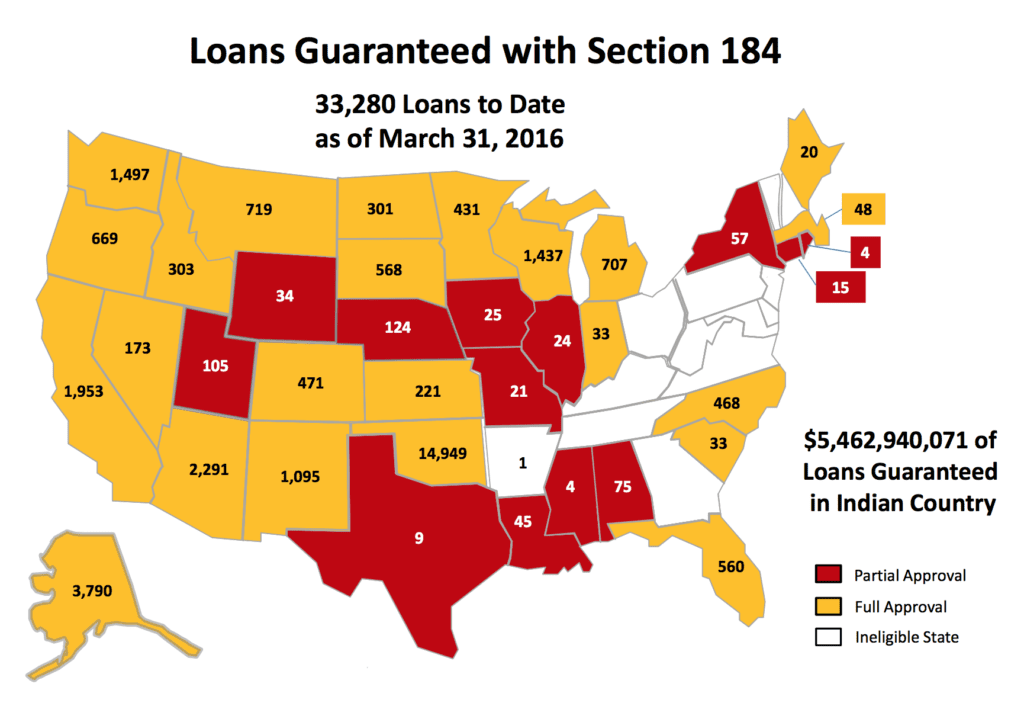

- HUD Section 184 Indian Home Loan Guarantee Program: This is arguably the most significant and widely used program. Administered by the U.S. Department of Housing and Urban Development (HUD), it guarantees loans made by private lenders to eligible Native American and Alaska Native individuals, tribes, and Tribally Designated Housing Entities (TDHEs). This guarantee reduces the risk for lenders, encouraging them to provide mortgages in areas where they might otherwise be hesitant.

- VA Native American Direct Loan (NADL) Program: Exclusively for Native American veterans, the NADL program provides direct home loans from the Department of Veterans Affairs (VA) to help eligible Native American veterans finance the purchase, construction, or improvement of homes on Federal Trust Land.

- USDA Rural Development Home Loan Programs (e.g., Section 502 Direct and Guaranteed Loans): While not exclusively for Native Americans, these programs are highly relevant given the predominantly rural nature of North Dakota’s reservations. They offer low-income individuals and families the opportunity to own adequate, modest, decent, safe, and sanitary homes in eligible rural areas.

- Tribal Housing Programs and Partnerships: Many tribes in North Dakota also operate their own housing authorities or partner with external organizations to offer down payment assistance, financial literacy training, or even direct lending programs to their members, often complementing federal initiatives.

The core distinction of these "products" lies in their adaptability to trust land. Trust land, held by the U.S. government for the benefit of Native American tribes or individuals, cannot typically be mortgaged in the same way as fee-simple land. Section 184 and NADL programs have mechanisms, such as leasehold mortgages (where the borrower mortgages their leasehold interest in the land), to address this, requiring tribal consent and specific legal agreements.

Advantages: The "Features" That Make These Loans Attractive

When evaluating Native American home loans in North Dakota as a product, their advantages stand out, directly addressing the historical and systemic barriers to homeownership.

- Accessibility and Flexible Underwriting: One of the most significant benefits is the relaxed credit score requirements and flexible underwriting guidelines compared to conventional loans. Lenders participating in Section 184 or VA NADL programs are often more willing to consider alternative credit histories (e.g., utility payments, rent history) and understand the unique financial circumstances that may not fit a traditional FICO score model. This opens the door for many Native Americans who might otherwise be denied a mortgage.

- Lower Down Payments and Competitive Interest Rates: Section 184 loans typically require a very low down payment – as little as 2.25% for loans over $50,000 and 1.25% for loans under $50,000. VA NADL loans often require no down payment at all. This significantly reduces the upfront financial burden, a major hurdle for many. Furthermore, interest rates are generally competitive, often fixed, providing stability and predictability in monthly payments.

- No Monthly Mortgage Insurance (PMI) on VA NADL: For Native American veterans, the NADL program offers the tremendous advantage of no private mortgage insurance (PMI), which can save borrowers hundreds of dollars each month. While Section 184 does have an upfront and annual mortgage insurance premium, it is generally lower than FHA mortgage insurance.

- Addressing Unique Land Tenure Challenges (Trust Land Solutions): This is perhaps the most critical feature. These programs provide a legal and financial framework for homeownership on trust land, a feat nearly impossible with conventional mortgages. The ability to secure a leasehold mortgage, requiring tribal approval and ensuring the land remains in trust, is a game-changer for preserving tribal sovereignty and cultural connection to the land. This is particularly relevant in North Dakota, where substantial portions of reservations are trust land.

- Cultural Competency and Tailored Support: Lenders specializing in these programs often have a deeper understanding of tribal customs, governance structures, and the socio-economic realities of Native American communities. This cultural competency can lead to a more empathetic and supportive lending experience, fostering trust and providing guidance that goes beyond standard loan processing. Many programs also integrate financial literacy and homeownership counseling as part of the process.

- Community Development and Economic Impact: By facilitating homeownership, these loans contribute directly to the economic development and stability of Native American communities in North Dakota. Homeowners are more likely to invest in their properties and local businesses, fostering a stronger tax base and creating a more vibrant community infrastructure. It also helps to address housing shortages that are prevalent on many reservations.

- Broad Eligibility for Use: These loans aren’t just for purchasing existing homes. They can be used for new construction, rehabilitation, refinance, and even modular or manufactured homes (under specific conditions), offering flexibility to meet diverse housing needs within North Dakota’s rural and reservation contexts.

Disadvantages: The "Flaws" and "Limitations" of the Product

While highly beneficial, Native American home loan programs are not without their drawbacks. Aspiring homeowners in North Dakota should be aware of these limitations before committing.

- Complexity and Bureaucracy: The very features that make these loans unique also contribute to their complexity. Navigating tribal laws, federal regulations, and multiple layers of approval (e.g., tribal council consent for land leases, HUD/VA approvals) can be time-consuming and challenging. The process often involves more paperwork and longer closing times than a conventional loan.

- Limited Lender Participation: Because of the specialized nature and regulatory intricacies, not all mortgage lenders offer Section 184 or VA NADL loans. In North Dakota, finding a local lender with expertise in these programs, particularly for properties on specific reservations, can be difficult. This limited competition can sometimes affect the availability of diverse loan products or competitive rates. Borrowers may need to seek out-of-state lenders experienced in this niche.

- Appraisal Challenges on Trust Land: Appraising homes on trust land presents unique difficulties. The lack of comparable sales data in remote reservation communities, combined with the legal status of the land, can make it hard to determine market value. Appraisers must be familiar with the nuances of tribal land tenure, which can lead to delays or lower appraisals than expected, impacting loan amounts.

- Geographic and Infrastructure Limitations: While designed for rural areas, the remote nature of some reservation communities in North Dakota can still pose challenges. Access to utilities, roads, and other essential infrastructure can affect property eligibility and appraisal values. New construction in very remote areas might face higher costs and longer timelines.

- Credit and Financial Readiness Gaps (Borrower Side): While the programs offer flexible underwriting, borrowers still need to demonstrate a capacity to repay the loan. Many Native American individuals may still struggle with limited credit history, high debt-to-income ratios, or a lack of financial literacy, requiring significant pre-loan counseling and preparation. The "product" itself helps, but it doesn’t solve all underlying financial issues.

- Loan Caps and Property Type Restrictions: While generous, there are loan limits for Section 184 loans, which vary by county. While these limits are generally sufficient for most homes in North Dakota’s rural areas, they might restrict options for higher-priced properties. Additionally, certain property types or conditions might not qualify, requiring properties to meet specific safety and quality standards.

- Tribal Requirements and Approval: The need for tribal council approval for leasehold agreements on trust land, while essential for sovereignty, adds another layer of administrative burden and can introduce delays depending on the specific tribe’s processes and meeting schedules.

Who is this "Product" For?

These specialized home loan "products" are primarily designed for:

- Eligible Native American and Alaska Native individuals, families, and tribal entities seeking to purchase, construct, or refinance a home.

- Native American veterans looking to utilize their VA benefits for homeownership, especially on trust land.

- Borrowers in North Dakota who reside on or near federally recognized reservations, where conventional lending is often inaccessible or unsuitable due to land tenure issues or rural conditions.

- First-time homebuyers who may not have robust credit histories or significant savings for a large down payment.

The "Purchase Recommendation": Is It Worth Investing In?

After a thorough review of their features, advantages, and disadvantages, the "product" of Native American home loans in North Dakota receives a strong and affirmative recommendation for its target demographic. For eligible Native American individuals and families in North Dakota, these loan programs represent an invaluable, often indispensable, pathway to homeownership that is simply not available through conventional channels.

The core value proposition of these loans lies in their ability to bridge the gap between traditional lending practices and the unique socio-economic and land tenure realities of Native American communities. They are not just alternative mortgages; they are specialized tools meticulously crafted to address systemic inequities and foster self-determination.

However, a "purchase" (or application) for these loans should be approached with realistic expectations and thorough preparation. Here’s why and what to consider:

- Undeniable Value for Trust Land: For those aspiring to own a home on trust land in North Dakota, programs like HUD Section 184 and VA NADL are virtually the only viable financial products. Their existence is crucial for preserving cultural ties to ancestral lands and building equity within tribal communities.

- Accessibility Outweighs Complexity: While the process can be more complex and time-consuming, the benefits of lower down payments, flexible underwriting, and competitive rates often far outweigh these administrative hurdles, especially for borrowers who might otherwise be shut out of the market.

- Long-Term Wealth Building: Despite the initial challenges, securing a home loan allows Native Americans to build equity, stabilize housing costs, and contribute to the long-term financial security of their families, mirroring the benefits of homeownership enjoyed by the broader population.

Recommendations for Aspiring Homeowners:

- Seek Specialized Lenders: Do not approach just any mortgage lender. Actively search for lenders in North Dakota (or those licensed to operate there) who explicitly advertise their expertise in Section 184 or VA NADL programs. These lenders will have the necessary experience and relationships to navigate the process efficiently.

- Engage with Tribal Housing Authorities: Your tribal housing authority or a designated housing department is an invaluable resource. They can provide guidance on tribal-specific requirements, offer financial literacy programs, and often connect you with experienced lenders and counselors.

- Prioritize Financial Preparedness: Even with flexible underwriting, demonstrating financial readiness is crucial. Work on improving your credit history, reducing debt, and saving for the down payment and closing costs. Utilize available financial counseling services.

- Be Patient and Persistent: The process can be lengthy. Maintain open communication with your lender, tribal authorities, and any housing counselors. Persistence is key to successfully navigating the intricacies.

- Understand Your Land Tenure: Know whether the land you intend to build or buy on is trust land, allotted land, or fee-simple land, as this significantly impacts the type of loan and the process required.

Conclusion

Native American home loans in North Dakota are more than just financial instruments; they are critical enablers of self-sufficiency, cultural preservation, and economic empowerment for tribal nations and their members. While the "product" comes with inherent complexities and requires diligent navigation, its advantages in terms of accessibility, tailored solutions for trust land, and the fundamental opportunity for homeownership make it an overwhelmingly positive and essential offering. For eligible individuals and families in North Dakota, investing the time and effort to secure one of these loans is not just a smart financial decision, but a vital step towards securing their future and strengthening their communities.