Navigating Homeownership: An In-Depth Review of the VA Native American Direct Loan (NADL) in Washington State

The dream of homeownership is a cornerstone of the American experience, representing stability, security, and a legacy for future generations. For many veterans, the Department of Veterans Affairs (VA) loan program has been an invaluable tool in achieving this dream. However, a lesser-known yet profoundly impactful variant, the VA Native American Direct Loan (NADL) program, offers a unique pathway specifically tailored for eligible Native American veterans seeking to purchase, construct, or improve homes on Native American trust lands.

In a state as diverse and geographically rich as Washington, home to numerous tribal nations and a significant veteran population, understanding the nuances of the VA NADL loan becomes particularly relevant. This comprehensive review will delve into the intricacies of the NADL program within the context of Washington State, examining its myriad advantages, inherent disadvantages, and ultimately, providing a well-considered recommendation for prospective borrowers.

What is the VA Native American Direct Loan (NADL)?

The VA Native American Direct Loan (NADL) program stands distinct from the standard VA home loan. While both are backed by the VA and offer significant benefits to veterans, the NADL is a direct loan from the VA itself (not a private lender) and is exclusively designed for eligible Native American veterans to purchase, construct, or improve a home on Native American trust land. It also facilitates refinancing existing NADL loans or certain other types of loans.

Key Eligibility Criteria:

- Veteran Status: The applicant must be an eligible veteran who has served the required time in the military.

- Native American Status: The veteran must be Native American (or their spouse, if not Native American, is applying jointly with an eligible Native American veteran).

- Trust Land: The property must be located on Native American trust land, and the veteran must be an enrolled member of a federally recognized tribe that has a Memorandum of Understanding (MOU) with the VA. This MOU ensures the tribal government agrees to the terms and conditions of the NADL program.

This highly specific eligibility makes the NADL a niche but incredibly powerful tool for the right demographic.

Washington State: A Unique Landscape for NADL

Washington State presents a fascinating backdrop for the NADL program. With its diverse geography, ranging from the bustling urban centers of Seattle and Bellevue to the vast agricultural lands of Eastern Washington and the dense forests of the Olympic Peninsula, the state also boasts a rich tapestry of federally recognized tribal nations. Tribes such as the Yakama Nation, Spokane Tribe, Lummi Nation, Suquamish Tribe, and many others have significant trust lands across the state.

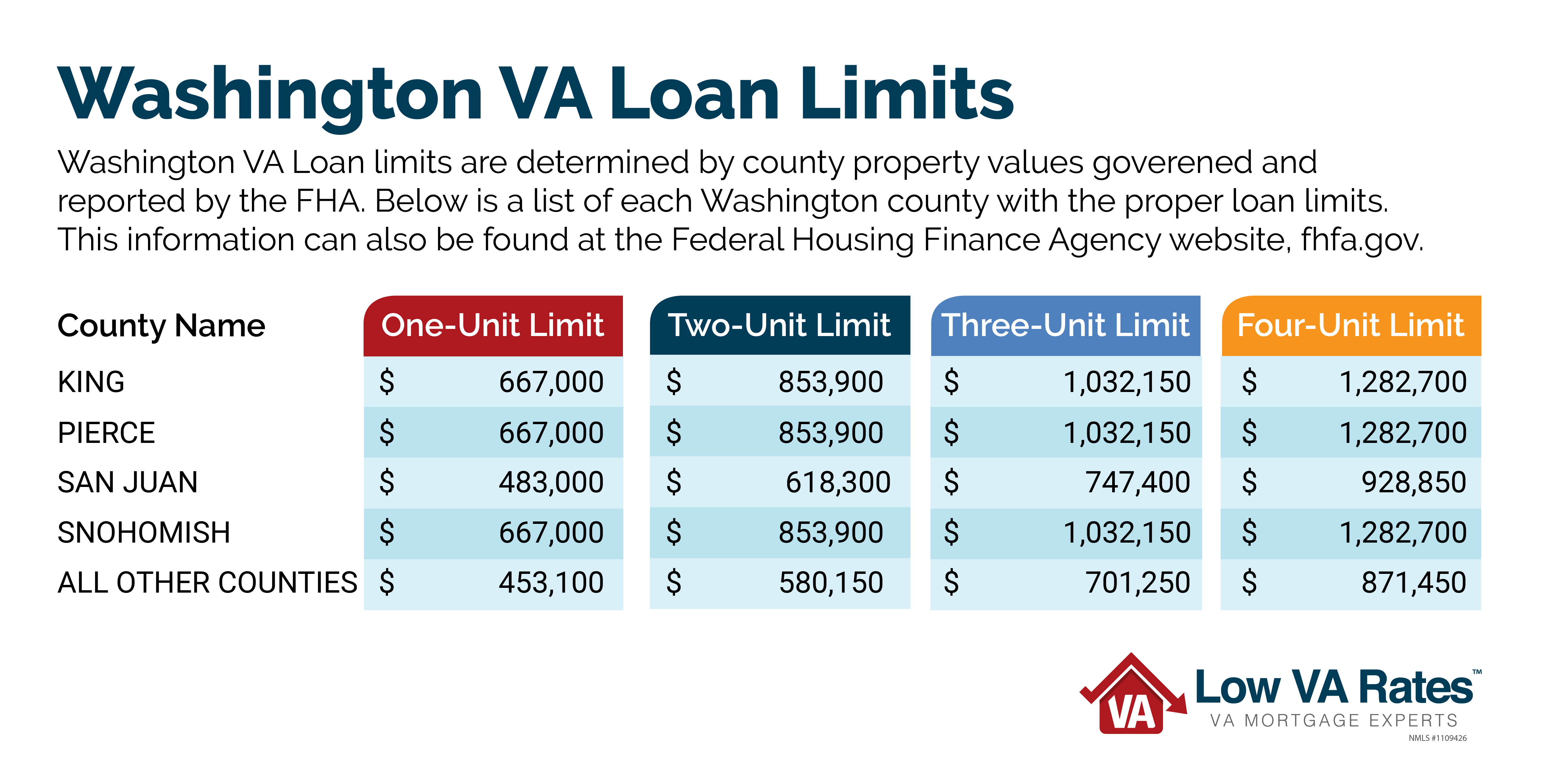

The housing market in Washington, particularly in the Puget Sound region, is notoriously expensive. While NADL focuses on trust lands, which may have different market dynamics than urban areas, the overall pressure of housing affordability in the state underscores the value of a low-cost, direct loan program. For Native American veterans seeking to establish or strengthen their roots within their tribal communities, the NADL provides an unparalleled opportunity to achieve homeownership on land that holds deep cultural and historical significance. The presence of established tribal housing authorities and infrastructure on many reservations also facilitates the application and construction process.

The Advantages (Pros) of the VA NADL Loan

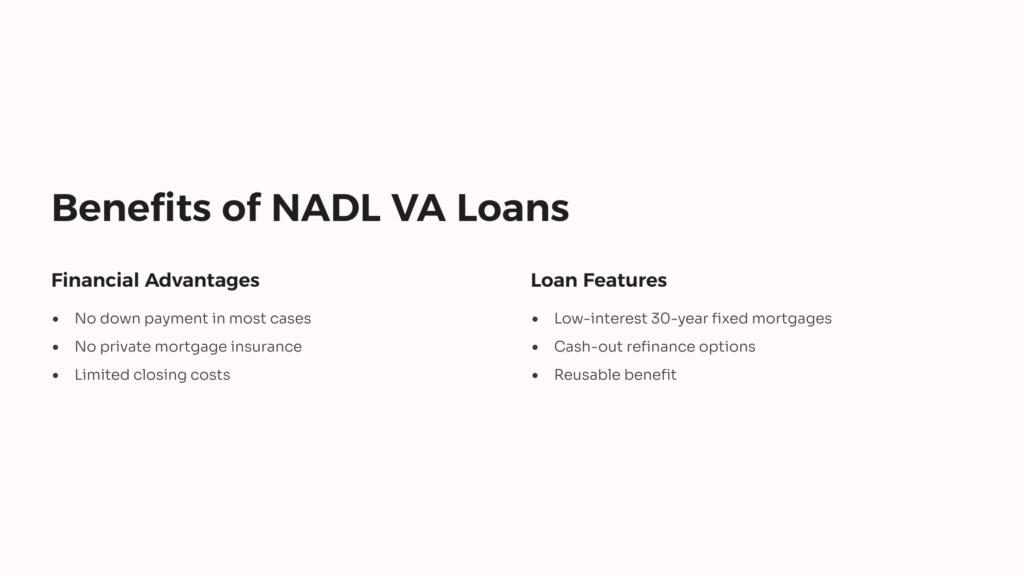

The VA NADL loan comes packed with benefits that make it an exceptionally attractive option for its target demographic:

-

Zero Down Payment: This is arguably the most significant advantage. Unlike conventional loans that often require substantial down payments (typically 5-20% of the home’s price), the NADL allows eligible veterans to finance 100% of the home’s value. This eliminates a major barrier to homeownership, especially for those who may not have accumulated significant savings.

-

Low-Interest Rates: NADL loans typically feature competitive, often lower, interest rates compared to conventional mortgages. This is due to the VA’s backing, which reduces the risk for the lender (in this case, the VA itself). Lower interest rates translate directly into lower monthly mortgage payments and substantial savings over the life of the loan.

-

No Private Mortgage Insurance (PMI): Most conventional loans with less than 20% down payment require borrowers to pay for PMI, an additional monthly expense that protects the lender in case of default. VA loans, including NADL, do not require PMI, regardless of the down payment amount. This can save borrowers hundreds of dollars each month, significantly reducing the overall cost of homeownership.

-

Flexible Credit Requirements: While a good credit history is always beneficial, NADL loans generally have more flexible credit underwriting standards compared to conventional loans. The VA understands that life circumstances can impact credit scores, and they aim to make homeownership accessible to a broader range of veterans. This flexibility can be a lifeline for those who might otherwise struggle to qualify for a mortgage.

-

Direct Loan from the VA: The fact that the VA is the direct lender for NADL is a distinct advantage. This often means a more streamlined process, direct access to VA loan specialists for guidance, and a lender specifically dedicated to serving veterans’ needs. There’s no intermediary bank or mortgage company, which can simplify communication and reduce potential points of friction.

-

Focus on Tribal Land Homeownership: The NADL program is unique in its explicit mission to facilitate homeownership on Native American trust lands. This supports tribal sovereignty, community development, and allows veterans to live within their cultural heritage and close to family. It recognizes the special relationship Native Americans have with their ancestral lands.

-

Versatile Loan Uses: The NADL isn’t just for buying an existing home. It can be used for:

- Purchasing: An existing home on trust land.

- Construction: Building a new home on trust land.

- Improvement: Making substantial renovations or additions to an existing home on trust land.

- Refinancing: Refinancing an existing NADL loan to obtain a lower interest rate or refinance a construction loan into a permanent mortgage.

-

Assumability: NADL loans are assumable, meaning that if the veteran decides to sell their home, another eligible veteran can take over the existing mortgage, often at the original interest rate. This can be a significant selling point in a rising interest rate environment.

-

Access to VA Support and Counseling: Borrowers benefit from the VA’s extensive support network. This includes financial counseling, assistance with loan servicing, and resources designed to help veterans maintain their homeownership.

The Disadvantages (Cons) of the VA NADL Loan

Despite its many benefits, the VA NADL loan also comes with specific limitations and potential drawbacks that prospective borrowers must carefully consider:

-

Strict Eligibility Requirements: This is the most significant hurdle. The NADL is not for every veteran; it’s exclusively for Native American veterans (or their non-Native American spouses) who intend to live on Native American trust land. This narrow scope means a vast majority of veterans and even many Native American veterans will not qualify.

-

Property Restrictions (Trust Land Only): The absolute requirement that the home be on Native American trust land is a major limitation. If a Native American veteran wishes to purchase a home off tribal lands, or on fee simple land within a reservation, the NADL is not an option. They would need to pursue a standard VA loan or other conventional financing. This can restrict housing choices significantly, even within Washington State’s tribal communities where some lands may be fee simple.

-

Application Complexity and Processing Time: While the direct loan aspect can streamline some parts, applying for a government-backed loan, especially one with such specific criteria, can involve extensive paperwork and a potentially longer processing time than conventional loans. The need for tribal MOUs, leasehold agreements, and specific property valuations on trust land adds layers of complexity. Patience is often required.

-

VA Funding Fee: Unless exempt (e.g., veterans receiving VA disability compensation or Purple Heart recipients), borrowers must pay a VA funding fee. This one-time fee, typically a percentage of the loan amount, helps offset the cost of the program to taxpayers. While it can be financed into the loan, it does increase the overall loan amount. The fee for NADL loans is generally lower than for standard VA loans, but it’s still a cost to consider.

-

Limited Awareness and Resources: Because the NADL is a niche program, there can be less general awareness and fewer readily available resources or experienced personnel compared to standard VA loans or conventional mortgages. Finding specific guidance and navigating the process might require more proactive research and direct engagement with the VA.

-

Challenges with Leasehold Estates: Homes on trust land are typically held under a leasehold agreement, not fee simple ownership. This means the veteran owns the home, but leases the land from the tribe. While standard practice for NADL, leasehold estates can sometimes be perceived differently by future buyers or appraisers, potentially impacting resale value or the ease of future transactions if not properly understood. The duration of the lease and its terms are critical considerations.

-

Dependence on Tribal MOUs: The availability of NADL depends on the specific tribal government having an MOU with the VA. While many tribes in Washington State do, it’s not universal. Veterans must confirm their tribe has this agreement in place before proceeding.

-

Appraisal Challenges: Appraising properties on tribal trust land can present unique challenges. Comparables (comps) might be scarcer, and appraisers need specific expertise in valuing leasehold interests and understanding tribal land regulations. This can sometimes lead to delays or valuation issues.

Who is the VA NADL Loan For?

The VA Native American Direct Loan is unequivocally designed for a very specific demographic: Native American veterans (or their eligible spouses) who are members of a federally recognized tribe with an MOU with the VA, and who intend to purchase, construct, or improve a home on Native American trust land.

For this particular group in Washington State, it represents an unparalleled opportunity to achieve homeownership with exceptional financial benefits, while simultaneously strengthening their ties to their tribal community and cultural heritage.

The Application Process (Simplified)

While detailed, the NADL application generally follows these steps:

- Obtain a Certificate of Eligibility (COE): This confirms the veteran’s eligibility for VA loan benefits.

- Contact the VA’s NADL Office: Engage directly with VA specialists who handle these specific loans.

- Identify Property and Tribal Land: Ensure the property is on trust land and the tribe has an MOU.

- Complete Application and Provide Documentation: Submit detailed financial, personal, and property-related documents.

- Property Appraisal and Underwriting: The VA will conduct an appraisal and review all aspects of the loan.

- Loan Closing: Once approved, the loan is closed, and the veteran becomes a homeowner.

Recommendation: A Powerful Tool, But Not for Everyone

For the precise demographic it serves, the VA Native American Direct Loan (NADL) in Washington State is highly recommended and stands as an exceptional product. Its benefits – zero down payment, low interest rates, no PMI, and direct VA support – are simply unmatched by conventional financing options for homeownership on tribal trust lands. For a Native American veteran in Washington State who meets all the eligibility criteria and wishes to live within their tribal community, the NADL can be a life-changing financial instrument.

However, this recommendation comes with significant caveats:

- Self-Selection is Key: If you are not an eligible Native American veteran seeking to live on tribal trust land, this loan is not for you. Do not spend time researching it if you do not fit the narrow eligibility.

- Patience and Due Diligence: The process can be lengthy and complex due to the unique nature of tribal land and direct government lending. Borrowers must be prepared for extensive documentation and potential delays. Proactive engagement with the VA NADL office and their tribal housing authority is crucial.

- Understand Leasehold Estates: Thoroughly comprehend the terms of the leasehold agreement with the tribal government. This is fundamental to owning a home on trust land.

- Explore All Options: While NADL is fantastic for its niche, always compare it with other potential options if they are available to you (e.g., tribal housing programs, HUD Section 184 loans for Native Americans, or even standard VA loans if you are purchasing off trust land).

Conclusion

The VA Native American Direct Loan program in Washington State is a testament to the VA’s commitment to serving all veterans, acknowledging the unique needs and cultural significance of Native American communities. While its stringent eligibility and property requirements limit its applicability, for the specific Native American veteran who desires to put down roots on their ancestral trust lands, the NADL offers an unparalleled pathway to affordable and secure homeownership.

For those who fit the criteria, the NADL is not just a loan; it’s an opportunity to build a home, strengthen community ties, and honor both military service and cultural heritage. It demands diligence and patience, but the rewards of zero down payment, low-interest rates, and direct VA support make it an invaluable resource worth exploring in detail.