Okay, here is a 1200-word product review style article about the Debt-to-Income (DTI) ratio, specifically analyzing its application to tribal mortgages.

The Double-Edged Sword: A Comprehensive Review of Debt-to-Income Ratio in Tribal Mortgages

Product Name: Debt-to-Income (DTI) Ratio as Applied to Tribal Mortgage Underwriting

Category: Financial Assessment Tool / Lending Standard

Target User: Lenders, Tribal Members Seeking Homeownership, Tribal Housing Authorities, Policymakers

Overall Rating: 3.5/5 stars (A powerful tool, but one requiring significant customization and cultural sensitivity in this specific context)

Executive Summary

The Debt-to-Income (DTI) ratio is a cornerstone of conventional mortgage lending, designed to assess a borrower’s ability to manage monthly debt payments in relation to their gross monthly income. While its utility in mitigating risk and ensuring affordability is undeniable, its application within the unique landscape of tribal mortgages presents a complex scenario. This review examines DTI not as a standalone product, but as a critical financial standard whose efficacy is profoundly shaped by the distinct socio-economic, cultural, and jurisdictional realities of Indian Country. We will explore its inherent advantages and significant drawbacks when applied to tribal borrowers, ultimately offering a nuanced "purchase recommendation" on its adoption and necessary adaptations.

Understanding the "Product": Debt-to-Income (DTI) Ratio

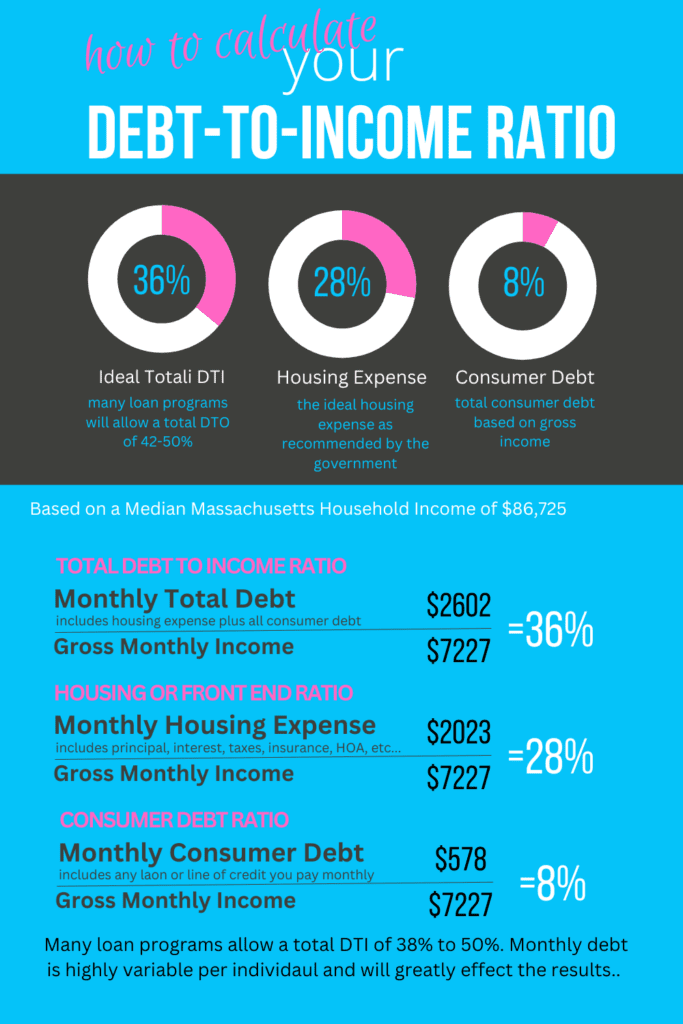

At its core, the Debt-to-Income ratio is a personal finance metric that compares how much you earn to how much you owe. It is typically expressed as two percentages:

- Front-End Ratio (Housing Ratio): This calculates the percentage of your gross monthly income that goes towards housing costs (principal, interest, property taxes, homeowner’s insurance, and HOA fees). A common threshold is 28%.

- Back-End Ratio (Total Debt Ratio): This is a broader measure, including all housing costs plus other monthly debt payments (car loans, student loans, credit card minimums, etc.). Typical conventional limits hover around 36% to 43%, though government-backed loans like FHA and VA may allow for higher percentages under certain conditions.

Calculation:

- (Total Monthly Debt Payments) / (Gross Monthly Income) = DTI Ratio

Lenders use DTI to gauge a borrower’s capacity to take on new debt and manage their financial obligations responsibly, thereby minimizing default risk. A lower DTI generally indicates less risk, while a higher DTI suggests a borrower might be overextended.

The Unique Landscape of Tribal Mortgages

Before evaluating DTI, it’s crucial to understand the context of tribal mortgages, which differ significantly from conventional lending due to several factors:

- Land Tenure: Much of Indian Country is held in trust by the U.S. government for tribes or individual tribal members (allotments). This means the land cannot be directly mortgaged, requiring unique leasehold arrangements (e.g., Section 184 Loan Guarantees, VA Native American Direct Loan). This adds complexity to appraisals and foreclosure processes.

- Sovereignty and Jurisdictional Issues: Tribal nations possess inherent sovereign authority, leading to distinct legal frameworks, courts, and regulations that can impact lending agreements.

- Socio-Economic Realities:

- Income Volatility: Many tribal communities face higher rates of unemployment, underemployment, and reliance on seasonal work or per capita payments, leading to less consistent income streams.

- Informal Economies: Traditional economic activities or reliance on cash transactions may not generate formal, verifiable income easily recognized by conventional underwriting.

- Multi-Generational Households: It’s common for multiple generations to live together, pooling resources but also sharing expenses, which can complicate individual DTI calculations.

- Limited Credit History: A lack of access to mainstream financial services, reliance on cash, or historical distrust of financial institutions can result in "thin" or non-existent credit files.

- Infrastructure and Remote Locations: Many tribal communities are geographically isolated, leading to higher costs for goods, services, and utilities, which are not always reflected in standard DTI models.

Advantages of DTI Application in Tribal Mortgages (Pros)

Despite the challenges, a thoughtful application of the DTI ratio can offer several benefits:

- Risk Mitigation for Lenders: DTI provides a standardized, quantifiable metric to assess a borrower’s repayment capacity. This helps lenders make informed decisions, protecting their investments and ensuring the long-term viability of their lending programs.

- Borrower Protection and Affordability: By establishing a clear threshold for debt, DTI helps prevent borrowers from taking on more debt than they can realistically manage. This is crucial for tribal members who may be new to homeownership or complex financial products, safeguarding them against financial distress and potential foreclosure.

- Standardization and Program Eligibility: For government-backed programs like the HUD Section 184 Indian Home Loan Guarantee Program or VA Native American Direct Loans, DTI is a key eligibility criterion. Its use facilitates access to these vital programs designed to increase homeownership in Indian Country.

- Financial Literacy and Planning Tool: Understanding DTI can empower tribal members to better manage their finances, make informed borrowing decisions, and plan for future homeownership. It highlights the importance of debt management and income stability.

- Gateway to Mainstream Capital: Adhering to DTI standards, even with adaptations, can help tribal lending programs attract capital from conventional lenders and secondary markets, expanding the pool of available funds for tribal housing development.

- Benchmarking and Performance Tracking: DTI provides a consistent benchmark for evaluating the performance of tribal mortgage portfolios, allowing for data-driven adjustments to lending policies and support programs.

Disadvantages and Challenges of DTI Application in Tribal Mortgages (Cons)

The rigid application of conventional DTI standards can pose significant barriers and lead to inequitable outcomes in tribal communities:

- Inflexible Income Definition: Conventional DTI often struggles with non-traditional income sources common in tribal communities, such as per capita payments, seasonal employment, subsistence activities, or income from informal economies. These may be stable and reliable for the borrower but difficult to document or verify according to standard underwriting guidelines.

- Underserved by Credit Systems: Many tribal members have limited or no formal credit history due to historical and systemic barriers. While DTI doesn’t directly measure credit score, a lack of formal credit often means higher interest rates on existing debts, artificially inflating DTI or making it harder to qualify for new loans.

- Higher Cost of Living, Not Captured: Remote tribal communities often face significantly higher costs for essentials like groceries, utilities, and transportation. These expenses reduce disposable income but are not directly factored into DTI calculations, making a "standard" DTI limit less realistic for these borrowers.

- Multi-Generational Household Dynamics: The pooling of income and sharing of expenses in extended family households can distort individual DTI. A single borrower might appear to have a high DTI based on their individual income, even if household resources make the mortgage highly affordable.

- Cultural and Linguistic Barriers: The complex financial terminology and documentation requirements associated with DTI can be intimidating for borrowers unfamiliar with mainstream financial systems or for whom English is a second language.

- Exclusion of Qualified Borrowers: Strict DTI limits can inadvertently exclude deserving and capable tribal members from homeownership, stifling economic development and self-determination efforts. A borrower with a slightly higher DTI might be perfectly capable of repayment, especially with strong community support or stable but non-traditional income.

- Overemphasis on Formal Debt: DTI focuses on formal, reported debt. It doesn’t account for informal financial obligations or community-based support systems that can significantly impact a borrower’s actual financial stability.

Nuances and Adaptations: How DTI is Being (or Should Be) Modified

Recognizing these challenges, programs like HUD Section 184 already incorporate some flexibility. For example, Section 184 allows for higher DTI ratios (up to 41% for the back-end) compared to conventional loans, and encourages lenders to consider alternative credit histories and non-traditional income sources with proper documentation.

However, more comprehensive adaptations are needed:

- Holistic Underwriting: Moving beyond strict ratios to a more qualitative assessment of a borrower’s overall financial picture, including character, capacity, capital, and collateral (the "4 Cs").

- Expanded Income Verification: Developing protocols to verify and consider diverse income sources, including per capita payments, traditional arts and crafts sales, or subsistence income, with appropriate documentation.

- Alternative Credit Scoring: Utilizing rent, utility, and tribal loan payment histories to establish creditworthiness for borrowers with thin files.

- Financial Literacy and Counseling: Pairing DTI assessment with robust financial education and homeownership counseling tailored to tribal contexts, helping borrowers understand and manage their financial obligations effectively.

Recommendation for "Purchase" (Application/Adoption)

Recommendation: Adopt a Flexible, Culturally Competent, and Contextualized DTI Framework, Supported by Robust Financial Infrastructure.

The Debt-to-Income ratio, in its unmodified, conventional form, is not recommended for universal, rigid application in tribal mortgage lending. Its inherent biases against non-traditional income, informal credit, and unique socio-economic structures risk perpetuating historical inequities and hindering homeownership in Indian Country.

However, completely abandoning DTI would be throwing the baby out with the bathwater. DTI remains a powerful tool for risk assessment and affordability. Therefore, the "purchase recommendation" is not to reject DTI, but to invest in its strategic adaptation and integration within a broader, more nuanced financial ecosystem for tribal communities.

Specific Recommendations for Implementation:

- Prioritize Contextualized DTI Models: Lenders and policymakers should collaborate with tribal nations to develop DTI guidelines that are flexible enough to accommodate:

- Broader Income Definitions: Include verifiable per capita payments, consistent tribal distributions, and documented income from traditional enterprises.

- Higher but Justified Ratios: Allow for higher DTI percentages than conventional loans, especially when supported by strong compensating factors (e.g., significant cash reserves, stable employment history, multi-generational household income contributions).

- Consideration of High Local Costs: Implement adjustments for documented higher utility, transportation, or food costs in remote areas.

- Integrate Holistic Underwriting: Move beyond a solely quantitative DTI approach. Emphasize manual underwriting that allows for a comprehensive review of the borrower’s entire financial story, character, and community support systems.

- Invest Heavily in Financial Education and Credit Building: Implement culturally relevant financial literacy programs that help tribal members understand debt management, credit, and the homeownership process. Support the creation of tribal lending institutions and CDFIs that offer credit-building products.

- Strengthen Tribal Housing Infrastructure: Support Tribal Housing Authorities and other tribal entities in developing their capacity to provide pre-purchase counseling, post-purchase support, and technical assistance to borrowers.

- Advocate for Policy Adjustments: Encourage federal agencies (HUD, VA, USDA) to continuously review and update their DTI guidelines for tribal loan programs, ensuring they remain responsive to the evolving needs and realities of Indian Country.

- Foster Partnerships: Promote strong partnerships between tribal governments, federal agencies, and private lenders to share best practices, develop innovative lending solutions, and ensure that DTI is applied in a manner that respects tribal sovereignty and promotes self-determination.

Conclusion

The Debt-to-Income ratio is a robust financial instrument, but like any tool, its effectiveness depends on the skill and context of its application. For tribal mortgages, a one-size-fits-all approach to DTI is insufficient and potentially harmful. By embracing flexibility, cultural competency, and a commitment to robust support systems, lenders and policymakers can transform DTI from a potential barrier into an empowering component of a successful homeownership journey for tribal members, fostering economic development and strengthening tribal nations. The goal is not merely to assess risk, but to build pathways to sustainable homeownership that honor the unique heritage and future aspirations of Indian Country.