Empowering Sustainable Futures: A Comprehensive Review of Energy Efficiency Home Loans for Tribal Homes

The pursuit of energy efficiency in homes has become a global imperative, driven by escalating energy costs, environmental concerns, and the desire for enhanced comfort and health. For many, accessing the capital to make these crucial upgrades is a significant hurdle, a challenge amplified exponentially within tribal communities across the United States. Energy Efficiency Home Loans (EEHLLs) emerge as a potent financial instrument, promising to bridge this gap. This comprehensive review examines the concept of EEHLLs specifically tailored for tribal homes, delving into their inherent advantages, significant drawbacks, and offering critical recommendations for their successful implementation and adoption.

Understanding the Landscape: Energy Efficiency and Tribal Sovereignty

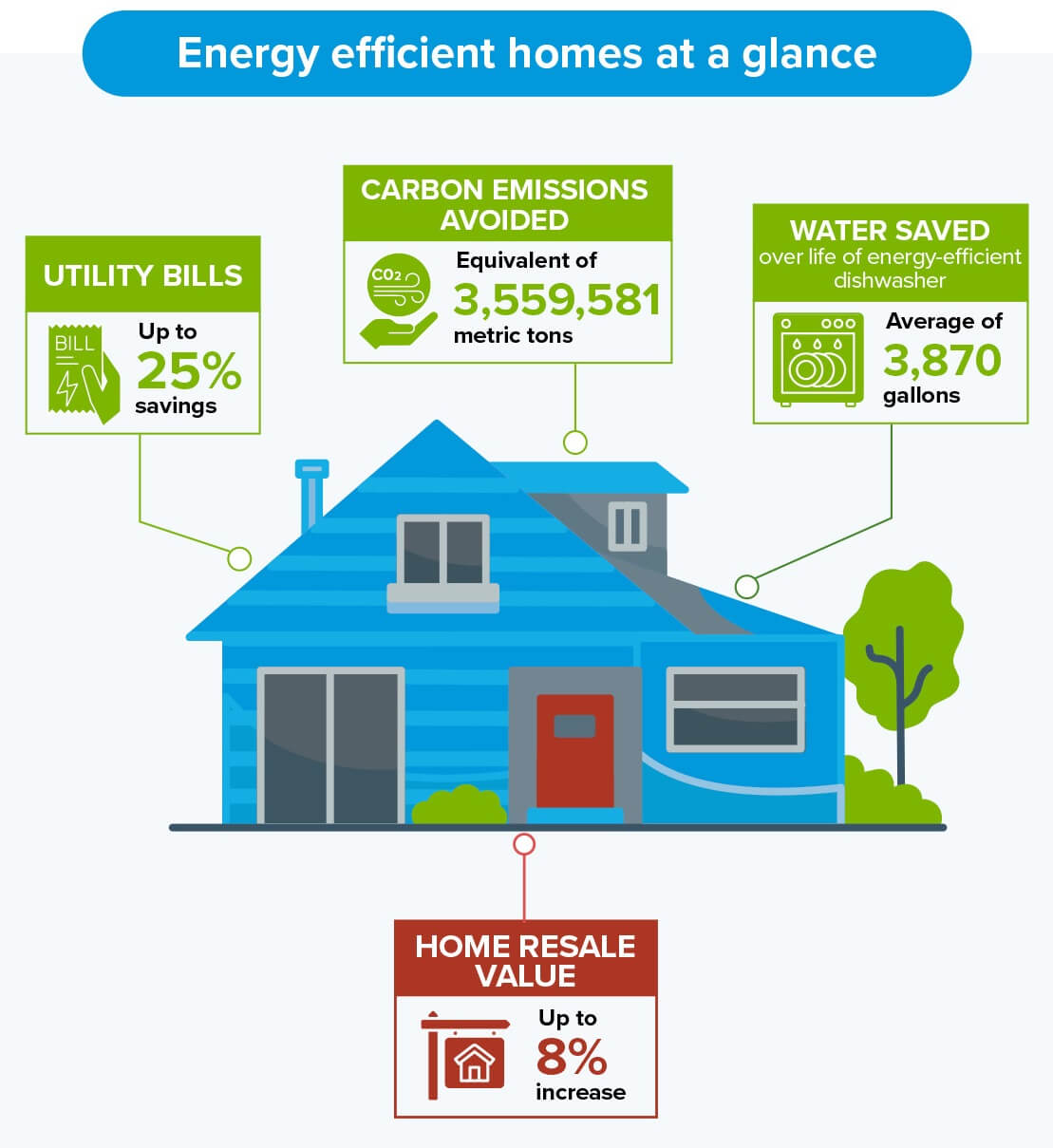

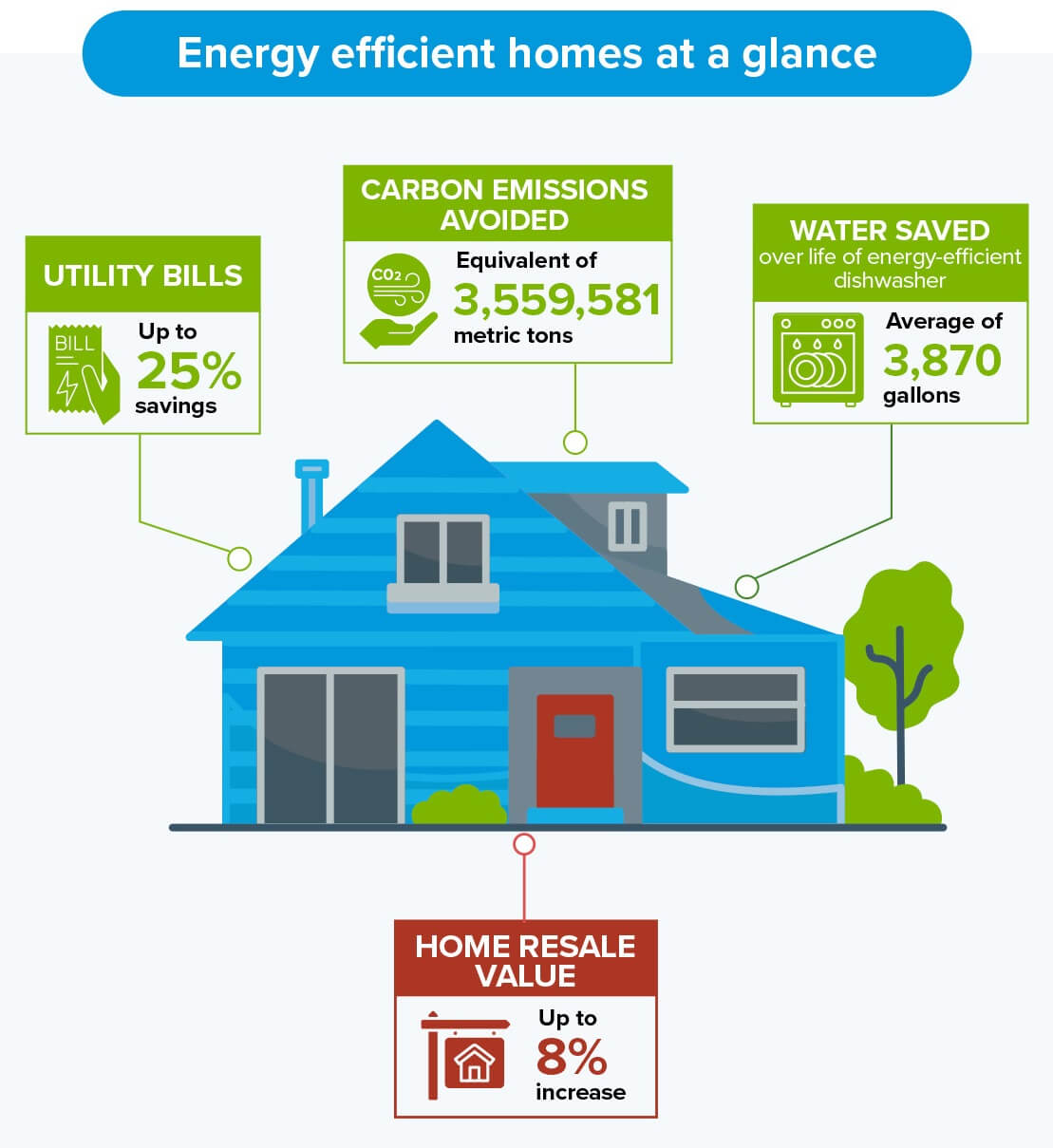

Energy efficiency upgrades, ranging from improved insulation and high-efficiency windows to solar panel installations and smart HVAC systems, offer a myriad of benefits. They reduce utility bills, enhance indoor air quality and thermal comfort, decrease reliance on fossil fuels, and contribute to a smaller carbon footprint. However, for tribal nations, the journey toward energy independence and resilient housing is uniquely complex, intertwined with historical injustices, land ownership intricacies, and often, geographic isolation.

Tribal lands, frequently held in trust by the federal government, present distinctive challenges for conventional lending. The inability to use trust land as collateral in the traditional sense has historically limited access to mortgages and home improvement loans for tribal members. This has resulted in a significant disparity in housing quality and energy burden, with many tribal homes suffering from inadequate insulation, inefficient heating systems, and a lack of access to renewable energy technologies. EEHLLs, therefore, are not just about saving money; they are about fostering self-determination, improving public health, promoting economic development, and preserving cultural values through sustainable practices. They represent a critical tool in addressing systemic inequities and empowering tribal nations to build a more resilient and sustainable future on their own terms.

Key Features and Mechanics of EEHLLs for Tribal Homes

Unlike generic home improvement loans, EEHLLs for tribal homes must be designed with an acute awareness of the unique legal and cultural frameworks at play. While the core principle remains the same – financing improvements that reduce energy consumption – the mechanisms often differ:

- Tailored Eligibility Criteria: Traditional credit scoring and income verification methods may not fully capture the financial realities within some tribal communities. EEHLLs designed for tribal members often incorporate more flexible underwriting, recognizing varied income sources and community-based financial histories. Programs like the HUD Section 184 Indian Home Loan Guarantee Program and USDA Rural Development programs are crucial here, as they are specifically designed to overcome trust land barriers.

- Approved Improvements: These loans are specifically for projects that yield measurable energy savings. This includes, but is not limited to:

- Building Envelope: Insulation (attic, wall, floor), air sealing, energy-efficient windows and doors.

- HVAC Systems: High-efficiency furnaces, boilers, heat pumps, smart thermostats.

- Water Heating: Tankless water heaters, solar water heaters.

- Renewable Energy: Solar photovoltaic (PV) systems, small wind turbines.

- Lighting & Appliances: LED lighting upgrades, ENERGY STAR® certified appliances.

.png)

- Loan Products: These can range from standalone energy efficiency loans (often smaller, for specific upgrades) to an integrated component of a broader mortgage or refinance. Some programs offer grants or loan subsidies to further reduce the financial burden, particularly for low-income households.

- Lender Network: The availability of lenders familiar with tribal legal structures and federal programs (like HUD 184) is critical. This often involves working with a mix of tribal housing authorities, Native community development financial institutions (CDFIs), and a select group of mainstream banks that have developed expertise in this niche.

- Technical Assistance & Energy Audits: A fundamental component is often the requirement or strong recommendation for a professional energy audit. This assessment identifies the most cost-effective upgrades and provides a roadmap for efficiency improvements, ensuring that the loan funds are utilized optimally. Technical assistance may also extend to connecting homeowners with qualified contractors.

Advantages: The Transformative Potential

The benefits of well-structured EEHLLs for tribal homes extend far beyond individual financial savings, touching upon community resilience, economic development, and cultural preservation.

- Significant Cost Savings and Reduced Energy Burden: This is the most immediate and tangible benefit. By reducing electricity, natural gas, or propane consumption, homeowners see a direct decrease in their monthly utility bills. This frees up household income for other necessities, improving overall financial stability, especially in communities where energy poverty is prevalent.

- Enhanced Health and Comfort: Energy-efficient homes are typically more comfortable. Improved insulation and air sealing prevent drafts and maintain consistent indoor temperatures, reducing the risk of respiratory issues exacerbated by poor indoor air quality or extreme temperatures. Modern HVAC systems often include better filtration, contributing to healthier living environments.

- Economic Development and Job Creation: The implementation of energy efficiency projects creates demand for skilled labor. This can stimulate local economies by supporting tribal enterprises and creating new job opportunities for tribal members in areas like energy auditing, insulation installation, solar panel installation, and weatherization services.

- Environmental Stewardship and Climate Resilience: Tribal nations often hold deeply ingrained values of environmental stewardship. EEHLLs align with these values by promoting sustainable living, reducing reliance on fossil fuels, and mitigating carbon emissions. Investing in renewable energy sources like solar panels further strengthens energy independence and builds resilience against climate change impacts.

- Increased Property Value (Improvements, not Land): While trust land itself cannot be collateralized, the improvements made to a home through energy efficiency upgrades undoubtedly increase its functional value and appeal. This contributes to generational wealth building within families, even if the underlying land ownership structure remains unique.

- Empowerment and Self-Determination: By providing access to capital for essential home improvements, EEHLLs empower tribal members to take control of their living conditions and contribute to the broader energy sovereignty goals of their nation. It supports the vision of self-reliance and the ability to shape their own sustainable futures.

- Leveraging Federal Programs: EEHLLs often work in conjunction with existing federal programs like HUD 184 and USDA Rural Development, which are specifically designed to address the unique lending challenges on tribal lands. This synergy can unlock significant resources that would otherwise be inaccessible.

Disadvantages: Navigating the Hurdles

Despite their immense potential, EEHLLs for tribal homes face substantial challenges that must be acknowledged and proactively addressed for widespread success.

- Access Barriers and Limited Lender Participation: A primary drawback is the scarcity of lenders willing or able to operate within the complex legal framework of tribal lands. Many mainstream banks lack the expertise, staff, or infrastructure to navigate trust land issues, tribal law, and federal guarantee programs effectively. This results in limited options and can force tribal members to travel long distances for banking services.

- Complexity of Trust Land and Legal Frameworks: The unique status of trust land, where the land is held by the federal government for the benefit of the tribe or individual, presents significant collateralization challenges. While federal programs like HUD 184 provide guarantees, the underlying legal intricacies can still deter lenders and add layers of administrative burden and legal costs.

- Awareness and Education Gap: There is often a significant lack of awareness among tribal members about the existence and benefits of EEHLLs, as well as the technical aspects of energy efficiency upgrades. Similarly, many lenders and contractors are unfamiliar with the specific needs and legal environment of tribal communities.

- Credit History and Underwriting Challenges: Many tribal members, particularly in remote areas, may have limited traditional credit histories due to historical financial exclusion. Conventional underwriting models may not adequately assess creditworthiness, leading to denials or less favorable loan terms.

- High Upfront Costs and Affordability Concerns: While EEHLLs provide financing, the initial cost of comprehensive energy efficiency upgrades can still be substantial. Even with favorable interest rates, the repayment burden might be challenging for low-income households, particularly if the expected energy savings are overestimated or take longer to materialize.

- Lack of Skilled Labor and Contractor Capacity: In many remote tribal communities, there is a shortage of qualified and culturally competent contractors specializing in energy efficiency upgrades. This can lead to higher project costs, quality control issues, and delays, or necessitate bringing in outside contractors who may not understand the community’s context.

- Regulatory and Bureaucratic Hurdles: Navigating the various federal, tribal, and state regulations related to housing, lending, and energy can be daunting. The bureaucratic processes involved in securing and administering these loans can be slow and cumbersome.

- Risk of Predatory Lending: In areas with limited access to reputable lenders, there is a risk that tribal members could fall prey to less scrupulous lenders offering high-interest, unfavorable loan products that exploit their limited options.

Purchase/Action Recommendations: Paving the Way Forward

To truly unlock the potential of EEHLLs for tribal homes, a multi-faceted approach involving tribal nations, government agencies, financial institutions, and non-profits is essential.

For Tribal Nations and Housing Authorities:

- Prioritize Education and Outreach: Launch comprehensive campaigns to inform tribal members about the benefits of energy efficiency and the availability of EEHLLs. This includes financial literacy education and workshops on home energy management.

- Develop Internal Capacity: Invest in training tribal members for roles in energy auditing, weatherization, solar installation, and project management. This builds a skilled local workforce and creates sustainable job opportunities.

- Form Strategic Partnerships: Collaborate with Native CDFIs, federal agencies (HUD, USDA, DOE), and mainstream financial institutions that demonstrate a commitment to serving tribal communities. Seek out technical assistance providers experienced in tribal housing.

- Advocate for Policy Changes: Work with federal agencies to streamline loan processes, develop more flexible underwriting criteria, and increase funding for programs that support energy efficiency in tribal housing.

- Leverage Tribal Resources: Explore the creation of tribal loan funds, grant programs, or revolving loan funds to supplement federal programs and address specific community needs.

For Financial Institutions and Lenders:

- Develop Specialized Products: Design EEHLL products specifically tailored to the unique financial and legal circumstances of tribal lands, explicitly incorporating HUD 184 or USDA guarantees.

- Invest in Cultural Competency Training: Train loan officers and staff on tribal sovereignty, trust land issues, and cultural protocols to build trust and provide more effective service.

- Expand Outreach and Presence: Actively engage with tribal housing authorities and communities to understand their needs and build relationships. Consider establishing satellite offices or mobile banking services in remote areas.

- Adopt Flexible Underwriting: Explore alternative credit scoring methods and consider community-based financial data when assessing creditworthiness for tribal members.

For Government Agencies (Federal and State):

- Increase Funding and Streamline Programs: Allocate more resources to existing programs (HUD 184, USDA Rural Development, LIHEAP, WAP) and work to simplify application processes and reduce bureaucratic hurdles.

- Provide Technical Assistance: Fund programs that offer free or subsidized energy audits, project planning support, and contractor vetting services for tribal communities.

- Facilitate Lender Education: Create resources and training programs for financial institutions to educate them on lending within tribal nations and the specifics of federal guarantee programs.

- Support Workforce Development: Invest in grants and initiatives that help tribal colleges and vocational schools develop energy efficiency training programs.

For Individual Tribal Members:

- Seek Information: Research available EEHLLs, grants, and technical assistance programs through tribal housing authorities, federal agencies, and Native CDFIs.

- Get an Energy Audit: Prioritize a professional energy audit to identify the most impactful and cost-effective upgrades for your home.

- Compare Lenders: Shop around for lenders familiar with tribal lending and compare loan terms, interest rates, and fees.

- Understand Your Loan: Ensure you fully comprehend the terms and conditions of any loan, including repayment schedules and any associated risks.

Conclusion

Energy Efficiency Home Loans for tribal homes are not merely a financial product; they are a critical pathway toward self-determination, improved quality of life, and environmental sustainability for tribal nations. While the potential benefits are transformative – from alleviating energy poverty and enhancing health to fostering economic development and strengthening climate resilience – the path is fraught with challenges. The complexities of trust land, limited lender access, and historical inequities demand a thoughtful, collaborative, and culturally informed approach.

By proactively addressing the disadvantages through targeted policy changes, dedicated financial products, robust educational initiatives, and strategic partnerships, EEHLLs can become a powerful catalyst. The "purchase recommendation" is not simply to acquire a loan, but to invest in a vision: a future where tribal homes are models of energy independence, where cultural values of stewardship are reflected in sustainable infrastructure, and where the promise of a brighter, healthier future is accessible to all members of sovereign nations. The time for this investment is now, recognizing that empowering tribal communities to build resilient, energy-efficient homes is an investment in the collective well-being of all.