Bridging the Gap: A Comprehensive Review of Bridging Loans for Native American Home Construction

The dream of homeownership and the fundamental need for adequate housing are universal. Yet, for many Native American communities, this dream remains tragically out of reach. Decades of systemic underinvestment, complex land tenure issues, and a lack of access to conventional financial markets have created a profound housing crisis across Indian Country. While numerous federal programs and tribal initiatives strive to address this deficit, the sheer scale of the challenge often necessitates innovative and agile financial solutions. Among these, bridging loans emerge as a potential tool, promising to bridge critical funding gaps in the often-protracted journey of Native American home construction.

This article provides a comprehensive product review of bridging loans within the unique context of Native American housing development. We will explore what bridging loans are, how they theoretically apply to this specialized sector, and critically analyze their advantages and disadvantages. Finally, we will offer a buying recommendation, outlining scenarios where this financial instrument can be a strategic asset and when it poses significant risks.

Understanding the "Product": What Are Bridging Loans?

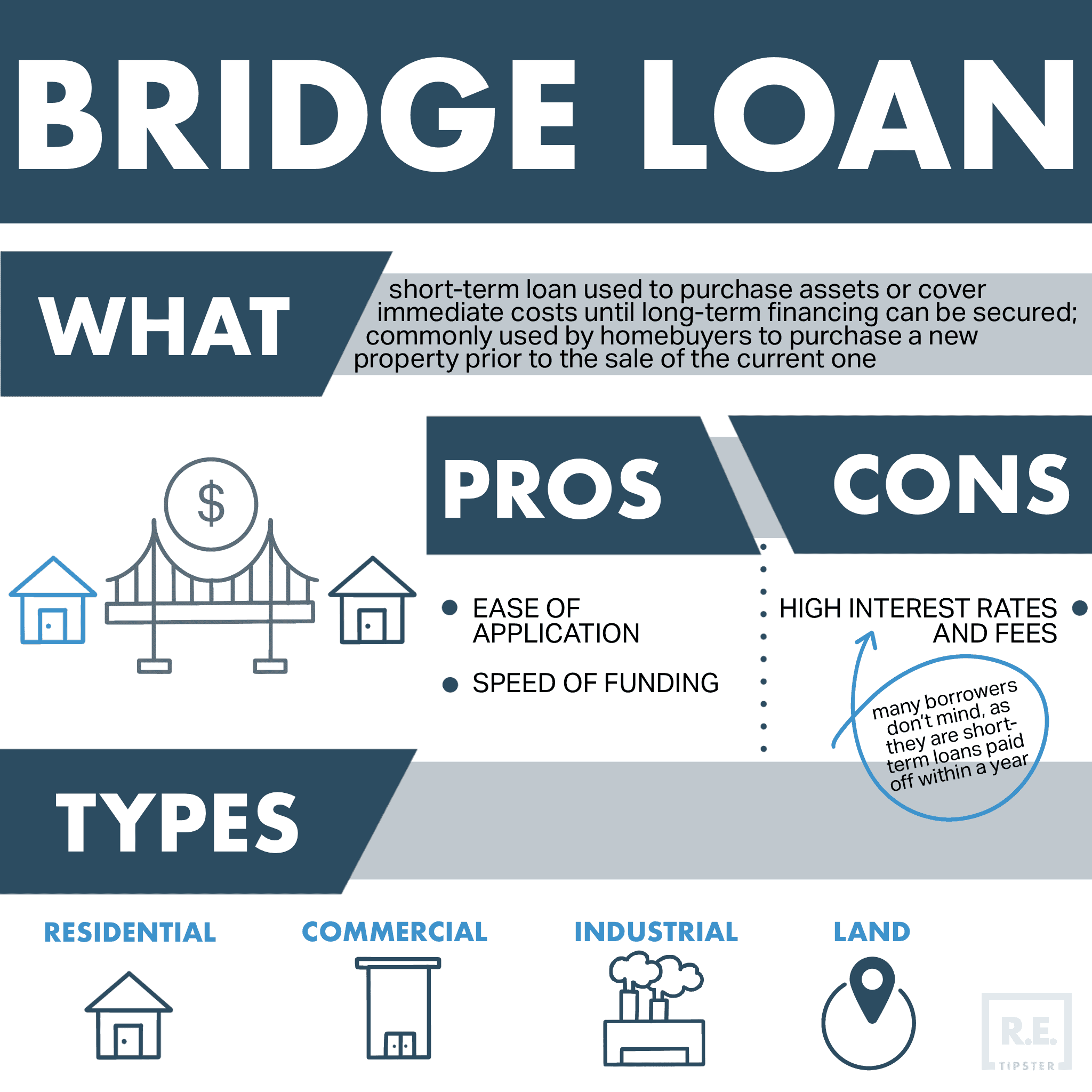

At their core, a bridging loan is a short-term, temporary financing solution designed to cover a financial gap between an immediate need for funds and the availability of long-term financing or a confirmed capital event. Think of it as a financial "bridge" connecting two points in time. These loans are characterized by:

- Short Term: Typically ranging from a few months to two years.

- High Interest Rates: Generally higher than conventional long-term loans due to their short duration and perceived higher risk.

- Quick Approval and Disbursement: Less stringent underwriting processes compared to traditional mortgages, making them suitable for time-sensitive situations.

- Asset-Backed: Often secured by existing assets or a clear future revenue stream.

- Clear Exit Strategy: A definitive plan for how the loan will be repaid, usually through the sale of another property, the securing of permanent financing, or the receipt of grant funds.

In the context of construction, bridging loans are often used to purchase land, cover initial development costs, or keep a project moving while waiting for a larger construction loan or grant disbursement.

The Unique Landscape: Native American Home Construction Challenges

To properly evaluate bridging loans, one must first understand the distinct challenges inherent in Native American home construction. These challenges significantly impact the applicability and risk profile of any financial product:

- Land Tenure Complexity: The most significant hurdle. Much of Native American land is held in federal trust, restricted fee status, or is tribally owned. This means individual homeowners or even tribes often do not hold clear, marketable title in fee simple, complicating the use of land as collateral for conventional mortgages.

- Infrastructure Deficits: Many tribal lands lack basic infrastructure – water, sewer, roads, electricity, internet – which are prerequisites for housing development. The cost of installing this infrastructure can be prohibitive.

- Remote Locations and High Costs: Many reservations are in remote, rural areas, leading to higher material transportation costs and a limited pool of skilled labor.

- Regulatory Environment: Navigating federal agencies (BIA, HUD, IHS) and tribal governmental structures can add layers of complexity and time to projects.

- Limited Access to Capital: Mainstream financial institutions often lack understanding or willingness to lend in Indian Country due due to perceived risks and the unique legal framework.

- Poverty and Credit History: Many Native American families face economic hardship, making it difficult to qualify for traditional loans or accumulate sufficient down payments.

- Capacity Gaps: Smaller tribal housing authorities or development entities may lack the internal financial and project management expertise to navigate complex financing.

It is against this backdrop of intricate challenges that bridging loans are considered as a potential solution, offering a pathway through otherwise impassable financial terrain.

Advantages of Bridging Loans for Native American Home Construction (The "Pros")

When strategically deployed, bridging loans can offer several compelling advantages in Native American home construction:

-

Speed and Flexibility: This is arguably the most significant advantage. Project timelines in Indian Country can be notoriously unpredictable due to grant cycles, federal approvals, and intricate planning processes. A bridging loan can provide immediate capital to:

- Seize Opportunities: Quickly acquire land or materials when they become available.

- Maintain Momentum: Prevent costly delays by covering unexpected expenses or shortfalls while waiting for the next tranche of a grant or a larger loan.

- Meet Grant Deadlines: Many federal grants have strict expenditure timelines. A bridging loan can ensure funds are available to meet these deadlines, preventing forfeiture.

- Respond to Emergencies: Address unforeseen structural issues or infrastructure failures that require immediate repair to keep construction on track.

-

Less Stringent Underwriting (Potentially): While still requiring an exit strategy and collateral, bridging loan lenders may be more flexible than conventional banks. They often focus more on the viability of the exit strategy and the asset value rather than solely on the borrower’s long-term credit history. For tribal entities or developers with strong projects but limited access to conventional credit, this can be a lifeline.

-

Filling Critical Funding Gaps: Bridging loans are ideal for interim financing. Examples include:

- Pre-development Costs: Funding for planning, engineering, architectural designs, environmental reviews, and permitting before a major construction loan is secured.

- Grant Anticipation: Covering construction costs while awaiting the disbursement of awarded federal grants (e.g., NAHASDA, IHS, USDA Rural Development) which can sometimes be delayed.

- Equity Gaps: Providing a temporary boost to meet equity requirements for larger, permanent financing.

- Infrastructure Development: Funding initial phases of critical infrastructure (water lines, roads) while awaiting long-term federal or tribal infrastructure funding.

-

Enabling Larger Projects: By providing initial capital, bridging loans can act as a catalyst, allowing tribes or developers to initiate projects that would otherwise stall due to lack of upfront funding. This can help unlock larger, more comprehensive housing developments that address community-wide needs.

-

Building Capacity and Track Record: Successfully managing and repaying a bridging loan can help a tribal housing authority or development corporation build a positive financial track record, making it easier to secure more conventional financing in the future.

-

Potential for Creative Collateral Structures: While land tenure remains a challenge, specialized lenders familiar with Indian Country may be open to creative collateral solutions, such as future revenues from tribal enterprises, specific project assets, or tribal guarantees, provided a robust exit strategy is in place.

Disadvantages and Risks of Bridging Loans (The "Cons")

Despite their potential utility, bridging loans come with significant drawbacks and inherent risks, especially in the complex Native American housing environment:

-

High Interest Rates and Fees: This is the most glaring disadvantage. Bridging loans typically carry interest rates several percentage points higher than conventional loans, sometimes reaching double-digits. When combined with arrangement fees, exit fees, and other charges, the overall cost of borrowing can be substantial, eroding project budgets and potentially making projects financially unviable.

-

Short Repayment Periods and Pressure: The short-term nature of these loans means repayment deadlines are tight. This puts immense pressure on the borrower to secure the long-term financing or complete the capital event (e.g., sale of homes, receipt of grant funds) within the stipulated timeframe. Delays, which are common in Native American construction, can lead to severe penalties.

-

Over-reliance on the Exit Strategy: The success of a bridging loan hinges entirely on the certainty of the exit strategy. If the anticipated long-term financing falls through, grant funds are delayed indefinitely, or the planned sale of units does not materialize, the borrower can face a serious financial crisis, potentially leading to default, foreclosure (if collateral can be seized), or further debt. This risk is amplified in Indian Country where grant funding can be unpredictable and traditional financing difficult to secure.

-

Collateral Challenges Persist: While some flexibility exists, most bridging lenders still require significant collateral. The inability to use trust land as conventional collateral remains a fundamental hurdle. While tribal assets or future revenues can sometimes serve, this requires sophisticated legal and financial structuring and may still be insufficient for larger projects or less experienced lenders.

-

Lack of Lender Understanding: Many mainstream bridging loan providers lack the specialized knowledge and cultural competency required to operate effectively in Indian Country. They may not understand tribal sovereignty, unique land tenure systems, or federal regulations, leading to inefficient processes, inappropriate terms, or outright refusal to lend. This necessitates seeking out specialized Community Development Financial Institutions (CDFIs) or niche lenders.

-

Risk of Debt Trap: If not managed with extreme caution and a clear, confirmed exit strategy, bridging loans can push a tribe or developer into a cycle of high-interest debt, hindering rather than helping long-term development. The high cost of borrowing can quickly spiral out of control if repayment is delayed.

-

Not a Long-Term Solution: It’s crucial to remember that a bridging loan is a tactical tool, not a strategic answer to the systemic housing crisis. It cannot replace the need for robust, long-term, and affordable financing mechanisms tailored to the unique needs of Native American communities.

Recommendation: When to "Buy" and When to "Pass" on Bridging Loans

Considering the nuanced advantages and significant risks, bridging loans for Native American home construction are a conditional "buy" product. They are a powerful, but dangerous, tool that demands expertise, foresight, and a rock-solid exit strategy.

"Buy" (Consider Purchase) If:

- You Have a CONFIRMED Exit Strategy: This is non-negotiable. There must be a signed commitment for long-term financing (e.g., a NAHASDA grant award letter, a confirmed conventional loan, a guaranteed purchase agreement for constructed units) that will fully repay the bridging loan within its term.

- The Need is Urgent and Time-Sensitive: The project faces imminent delays or missed opportunities (e.g., materials price increase, grant deadline, critical infrastructure repair) that a bridging loan can quickly resolve.

- The Cost-Benefit Analysis is Favorable: The cost of the bridging loan (interest + fees) is significantly less than the cost of project delays, lost opportunities, or penalties incurred without the interim funding.

- You Have Strong Financial Management Capacity: The tribal housing authority or development entity possesses the expertise to manage complex financial instruments, monitor project timelines, and ensure the exit strategy is executed flawlessly.

- You Can Secure Favorable Terms: You have identified lenders (ideally CDFIs or those with proven experience in Indian Country) willing to offer competitive rates and flexible terms that acknowledge the unique challenges of tribal land.

- Adequate Collateral or Guarantees Exist: You have identified suitable assets or tribal guarantees that can secure the loan, even if traditional land collateral is not feasible.

"Pass" (Do Not Purchase) If:

- The Exit Strategy is Unconfirmed or Speculative: Relying on the hope of future funding or sales is a recipe for disaster. If there’s no firm commitment for repayment, a bridging loan is an unacceptable risk.

- Project Timelines are Highly Unpredictable: If the project is prone to frequent, uncontrollable delays (e.g., complex BIA approvals, environmental reviews with uncertain outcomes), the short repayment period of a bridging loan becomes a significant liability.

- The Costs Outweigh the Benefits: If the high interest rates and fees will consume too much of the project budget or make the homes unaffordable for the target beneficiaries, it’s not a viable solution.

- Limited Financial Management Capacity: If the borrower lacks the experience or resources to manage the loan, its terms, and the associated risks effectively.

- No Suitable Collateral or Guarantees: Without a viable way to secure the loan, most reputable lenders will not even consider it, and those that do might offer predatory terms.

- It’s Seen as a Primary Funding Source: Bridging loans are not a substitute for comprehensive, long-term financing. They are a temporary fix.

Conclusion

Bridging loans, when viewed through the lens of Native American home construction, are a double-edged sword. They offer a potent, rapid solution to immediate financial gaps, capable of preventing costly delays and unlocking critical projects in communities desperately needing housing. Their flexibility and speed can be invaluable in navigating the often-complex and protracted journey of development on tribal lands.

However, this "product" comes with a high price tag and inherent risks. The high interest rates, short repayment periods, and the absolute reliance on a firm exit strategy demand meticulous planning, robust financial management, and a deep understanding of the unique challenges of Indian Country. For tribal housing authorities and developers, engaging with lenders who possess this specialized knowledge, such as certain CDFIs, is paramount.

Ultimately, bridging loans are a sophisticated tool, not a panacea. They should be considered a strategic component within a broader, well-thought-out financial plan for housing development, deployed only when a clear, confirmed path to repayment exists. When wielded responsibly and strategically, they can indeed bridge critical gaps, bringing the dream of safe, affordable homes closer to reality for Native American families. When misused, they risk exacerbating existing financial vulnerabilities, pushing communities further into debt. The recommendation, therefore, is to proceed with extreme caution, comprehensive due diligence, and an unwavering commitment to a confirmed exit.