Navigating Homeownership and Development: A Comprehensive Review of Leasehold Mortgage Financing for Native Americans

Introduction: Bridging the Gap to Economic Self-Determination

For Native American communities, the dream of homeownership and robust economic development on tribal lands has long been intertwined with a unique and complex legal framework. Unlike conventional fee-simple land ownership, much of the land within Indian Country is held in trust by the U.S. government for the benefit of tribes and individual Native Americans. This trust status, while safeguarding tribal sovereignty and land base, historically created significant barriers to accessing conventional mortgage financing, as lenders could not secure traditional collateral in the form of outright land ownership.

Enter leasehold mortgage financing: a specialized financial instrument that has emerged as a crucial bridge, allowing Native Americans to leverage their long-term interests in trust lands for housing and commercial development. This article offers a comprehensive review of leasehold mortgage financing for Native Americans, examining its mechanics, highlighting its distinct advantages and disadvantages, and providing a nuanced recommendation for its utilization as a vital tool for self-determination and prosperity.

Understanding the Product: Leasehold Mortgage Financing in Indian Country

At its core, a leasehold mortgage involves a borrower obtaining a loan secured by their interest in a long-term land lease, rather than by outright ownership of the land itself. In the context of Native American trust lands, this means an individual or tribal entity leases a parcel of trust land (typically from the tribe or the individual allottee) for an extended period, often 50 to 99 years. This long-term lease, approved by the Bureau of Indian Affairs (BIA), then serves as the collateral for a mortgage loan, allowing for the construction or purchase of homes, businesses, or infrastructure improvements on that leased land.

The distinction between fee-simple and leasehold is paramount. In fee-simple ownership, the owner holds all rights to the land and can mortgage, sell, or transfer it freely (within local zoning laws). With a leasehold, the borrower owns the improvements (e.g., the house) but only holds a contractual right to use the land for the duration of the lease. The underlying land remains in trust status, preventing its alienation and preserving tribal land bases.

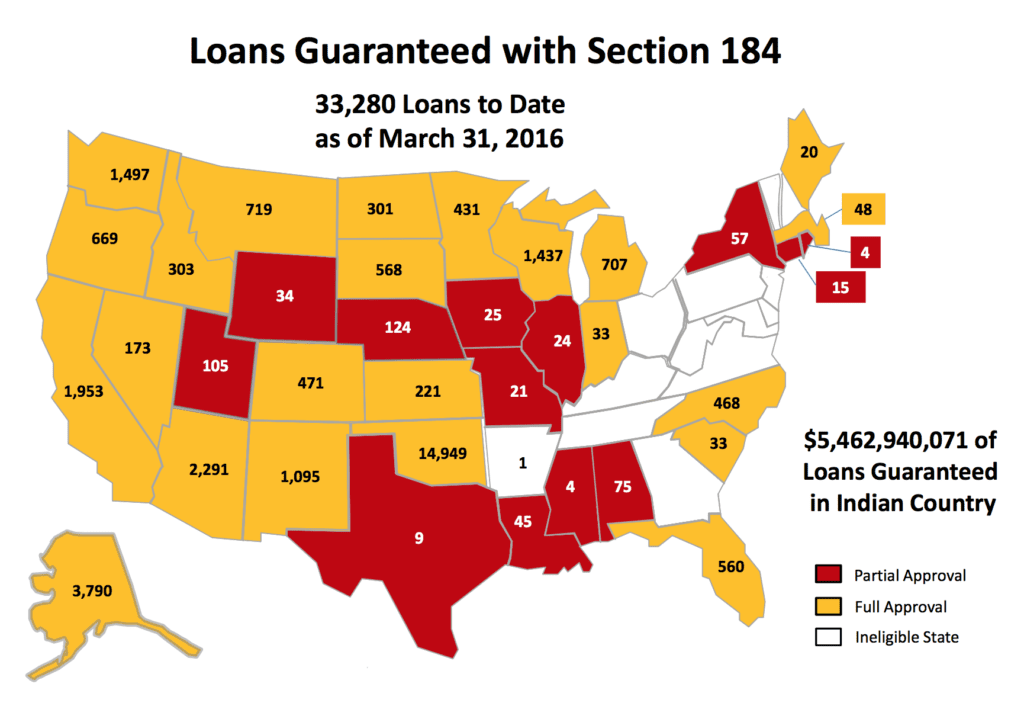

The primary mechanism facilitating leasehold mortgages on tribal lands is the Indian Home Loan Guarantee Program (Section 184), administered by the U.S. Department of Housing and Urban Development (HUD). This program guarantees loans made by private lenders to Native Americans, Alaska Natives, and Native Hawaiian families for homes on trust lands, restricted lands, or even fee-simple lands within reservation boundaries. This guarantee significantly mitigates lender risk, making private capital available in areas where it would otherwise be scarce.

Key players in this financing model include:

- The Borrower: An eligible Native American individual or tribal entity.

- The Tribe/Allottee: The lessor of the land, whose consent and often a tribal housing ordinance are crucial.

- The BIA: The federal agency responsible for approving leases, ensuring they meet federal regulations, and protecting tribal interests.

- The Lender: A financial institution approved to participate in programs like Section 184.

- HUD: The guarantor of the loan under Section 184, providing the necessary security for lenders.

The process typically involves:

- Securing a long-term ground lease for the desired parcel of trust land.

- Obtaining necessary tribal consents and resolutions, including a tribal housing ordinance that addresses lender rights and remedies in the event of default.

- BIA approval of the lease and any associated documents (e.g., Leasehold Mortgages, Subordination Agreements).

- Underwriting by a participating lender, often leveraging the Section 184 guarantee.

- Recording of the lease and mortgage with the BIA Land Titles and Records Office.

This intricate dance of federal, tribal, and private entities creates a unique but essential pathway to financial empowerment within Indian Country.

Advantages (Pros) of Leasehold Mortgage Financing

Leasehold mortgage financing, particularly through programs like Section 184, offers a multitude of benefits for Native Americans and tribal communities:

-

Access to Capital and Homeownership on Trust Land: This is arguably the most significant advantage. Prior to these mechanisms, conventional financing for homes on trust land was virtually non-existent. Leasehold mortgages open the door for Native Americans to build, purchase, or rehabilitate homes on their ancestral lands, fostering stable communities and reducing reliance on often substandard tribal housing programs or off-reservation living.

-

Preservation of Tribal Land Base and Sovereignty: Unlike fee-simple transactions that could lead to the alienation of tribal lands, leasehold mortgages ensure that the underlying land remains in trust status. This is crucial for maintaining tribal sovereignty, cultural integrity, and communal land ownership, which are foundational to Native American identity. The land is leased, not sold, ensuring it remains within the tribal domain.

-

Economic Development Catalyst: Beyond individual homeownership, leasehold mortgages can finance commercial enterprises, community facilities, and infrastructure projects on trust lands. This influx of capital stimulates local economies, creates jobs, and allows tribes to diversify their economic bases, moving towards greater self-sufficiency and reducing dependence on federal funding.

-

Tailored Programs and Favorable Terms (e.g., Section 184): Programs like HUD’s Section 184 are specifically designed to address the unique challenges of lending in Indian Country. They offer attractive features such as low down payments, flexible underwriting criteria, competitive interest rates, and reduced mortgage insurance premiums. This makes homeownership more attainable for a population that often faces economic disparities.

-

Building Individual and Community Wealth: Homeownership is a primary driver of wealth creation in the United States. Leasehold mortgages allow Native Americans to build equity in their homes, providing a significant asset that can be passed down to future generations, used for further investment, or serve as collateral for other financial needs. This contributes to individual financial stability and strengthens the overall economic fabric of tribal communities.

-

Enhanced Tribal Capacity and Self-Determination: The process of establishing a tribal housing ordinance, approving leases, and working with lenders builds tribal capacity in governance, finance, and real estate. It empowers tribes to exert greater control over their land use planning and economic development strategies, aligning with the principles of self-determination.

-

Improved Living Conditions and Social Outcomes: Access to safe, affordable, and quality housing directly correlates with improved health, educational outcomes, and overall quality of life. By facilitating homeownership, leasehold mortgages contribute to healthier, more stable, and thriving Native American communities.

Disadvantages (Cons) of Leasehold Mortgage Financing

Despite its undeniable benefits, leasehold mortgage financing for Native Americans is not without its challenges and complexities:

-

Bureaucracy and Extended Timelines: The involvement of multiple entities—the borrower, the tribe, the BIA, and the lender—creates a multi-layered approval process. BIA approval for leases and associated documents can be notoriously slow, sometimes taking months or even years. This bureaucratic hurdle can deter potential borrowers, delay projects, and frustrate lenders.

-

Complexity and Lack of Standardization: Each tribe may have its own housing ordinances, land codes, and internal approval processes, leading to a lack of standardization across Indian Country. This variability can be confusing for lenders and borrowers alike, requiring extensive education and due diligence for each transaction.

-

Limited Lender Pool and Expertise: Many mainstream financial institutions are hesitant to engage in leasehold lending on trust lands due to perceived risks, lack of familiarity with federal Indian law, and the complex approval processes. This limits competition, potentially resulting in fewer options or less favorable terms for borrowers not covered by Section 184.

-

Foreclosure Challenges: In the event of borrower default, foreclosure on a leasehold mortgage can be significantly more complicated than on a fee-simple property. The lender’s ability to take possession and resell the leasehold interest is contingent on tribal law, BIA regulations, and the terms of the lease. The market for foreclosed leasehold interests on trust land is also limited, further increasing lender risk and making traditional foreclosure less attractive.

-

Appraisal Difficulties: Appraising properties on trust land presents unique challenges. A lack of comparable sales data (due to the limited number of transactions and the leasehold nature) can make accurate valuations difficult. Appraisers must also understand the nuances of leasehold interests, tribal specificities, and BIA regulations, which not all appraisers are equipped to do.

-

Lease Expiration Risk (Perceived and Real): While most ground leases for mortgage purposes are long-term (50-99 years), the finite nature of a lease can be a psychological barrier for some borrowers and a concern for lenders. Although renewal options are often built in, the idea of not owning the land outright, or the potential for the lease to expire, can create uncertainty, even if practically remote for a well-structured lease.

-

Perceived Lack of Full Ownership: Despite the ability to build equity and control their homes, some Native Americans may still feel a psychological disconnect due to not holding fee-simple title to the land. This perception, while not always a practical impediment, can influence personal investment and long-term planning.

-

Infrastructure and Development Challenges: Many tribal lands lack the basic infrastructure (roads, water, sewer, utilities) necessary for housing and commercial development. While financing can cover the cost of a home, it often doesn’t extend to the significant investment required for off-site infrastructure, creating additional hurdles.

Recommendation: A Necessary and Evolving Tool for Empowerment

After a thorough review, leasehold mortgage financing for Native Americans is not merely a "good product"; it is an indispensable and evolving financial instrument that is absolutely essential for promoting homeownership, economic development, and self-determination within Indian Country. Given the unique legal status of trust lands, it represents the most viable and respectful pathway for Native Americans to leverage their land assets without alienating the tribal land base.

For Whom Is It Recommended?

Leasehold mortgage financing is highly recommended for:

- Native American individuals and families seeking to achieve homeownership on their tribal lands.

- Tribal governments and tribal housing authorities aiming to develop sustainable housing solutions and commercial enterprises within their reservations.

- Lenders and investors willing to engage with Native American communities, particularly those utilizing the HUD Section 184 program, which significantly mitigates risk.

Key Considerations for "Purchasing" (Utilizing) This Product:

- Seek Experienced Lenders: Borrowers should prioritize working with lenders who have established experience and expertise in Section 184 loans and leasehold financing on tribal lands. These lenders are better equipped to navigate the complex regulatory environment and streamline the process.

- Tribal Readiness and Ordinances: The success of leasehold financing is heavily dependent on the readiness and capacity of tribal governments. Tribes with well-developed housing codes, clear land lease policies, and efficient internal approval processes will facilitate smoother transactions. Tribes should invest in developing robust legal frameworks that address lender remedies in case of default.

- BIA Engagement: Proactive engagement with the local BIA agency is crucial. Early communication, complete documentation, and understanding BIA requirements can help mitigate delays. Advocacy for BIA process improvements remains vital.

- Long-Term Planning: Borrowers should understand the terms of their long-term leases, including renewal options and any specific tribal requirements. This ensures clarity and peace of mind over the life of the mortgage.

- Financial Literacy and Counseling: Providing comprehensive financial literacy and homeownership counseling to Native American borrowers is paramount. Understanding the nuances of leasehold vs. fee-simple, the loan process, and ongoing homeowner responsibilities is key to successful outcomes.

Recommendations for Improving the "Product":

While essential, the current system can be improved. Recommendations include:

- Streamlining BIA Processes: Significant efforts are needed to modernize and expedite BIA lease and mortgage approval processes through increased staffing, improved technology, and clear service standards.

- Expanding Lender Participation: Incentives and educational initiatives are needed to encourage more private lenders to participate in Section 184 and other leasehold financing programs, fostering greater competition and access.

- Tribal Capacity Building: Continued federal and philanthropic support for tribal governments to develop and implement effective land codes, housing ordinances, and administrative capacity is crucial.

- Addressing Infrastructure Gaps: Integrated approaches that combine housing finance with infrastructure development funding are needed to ensure that homes built on trust lands have access to essential services.

- Secondary Market Development: Exploring mechanisms to develop a more robust secondary market for non-guaranteed leasehold mortgages could further increase liquidity and lender interest.

Conclusion

Leasehold mortgage financing for Native Americans, primarily through the vital Section 184 program, is a sophisticated and highly specialized financial instrument. It is not without its inherent complexities and bureaucratic hurdles, stemming from the unique legal and sovereign status of tribal lands. However, these challenges are far outweighed by its profound benefits: enabling homeownership, fostering economic growth, preserving tribal land, and empowering Native American communities to exercise greater self-determination.

This "product" is not just a loan; it is a testament to the resilience of Native American nations and a critical tool in their ongoing journey towards economic prosperity and community well-being. By acknowledging its intricacies, proactively addressing its shortcomings, and continually advocating for systemic improvements, leasehold mortgage financing will continue to serve as a cornerstone in building a brighter, more equitable future for Native Americans on their ancestral lands.