FHA Loans for Native Americans: A Comprehensive Review of a Homeownership Pathway

For many, the dream of homeownership is a cornerstone of financial stability, community building, and generational wealth. For Native Americans, this dream is often intertwined with unique historical, cultural, and legal considerations, particularly concerning land tenure and access to traditional financial markets. While specific programs like the Section 184 Indian Home Loan Guarantee Program exist to address these unique circumstances, Federal Housing Administration (FHA) loans also present a pathway to homeownership for Native American individuals and families.

This article provides an in-depth "product review" of FHA loans as a financing option for Native Americans. We will explore the general features of FHA loans, analyze their specific advantages and disadvantages within the context of Native American communities, compare them briefly to the Section 184 program where relevant, and offer a comprehensive recommendation for potential borrowers.

Understanding FHA Loans: The "Product" Overview

FHA loans are government-insured mortgages designed to make homeownership accessible to a broader range of borrowers, particularly those who might not qualify for conventional loans due to lower credit scores or smaller down payments. The FHA does not directly lend money; instead, it insures loans made by FHA-approved lenders. This insurance protects lenders against losses if a borrower defaults, which in turn encourages them to offer more favorable terms to borrowers.

Key Features of FHA Loans:

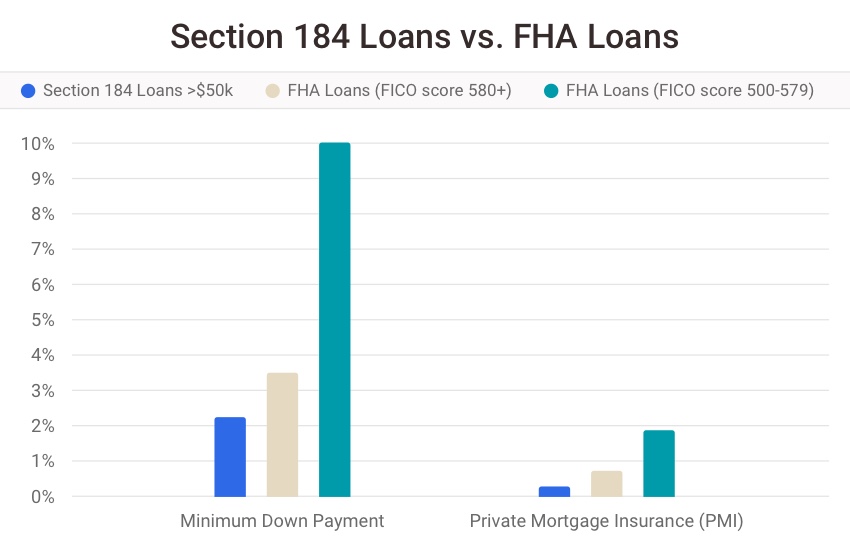

- Low Down Payment: One of the most attractive features is the low minimum down payment requirement, currently set at 3.5% of the purchase price for borrowers with a credit score of 580 or higher. Those with scores between 500 and 579 may still qualify with a 10% down payment.

- Flexible Credit Requirements: FHA loans are generally more forgiving than conventional loans when it comes to credit history. Lenders are often willing to accept lower credit scores and may consider alternative credit data (like utility payments) in their underwriting process.

- Mortgage Insurance Premium (MIP): Because of the lower down payment and more flexible credit requirements, FHA loans require both an upfront Mortgage Insurance Premium (UFMIP) and an annual Mortgage Insurance Premium (MIP), paid monthly. This protects the lender.

- Property Standards: Homes financed with an FHA loan must meet specific safety, security, and structural soundness standards during an FHA appraisal. This ensures the property is habitable and a good investment for the FHA.

- Loan Limits: FHA loans have specific limits on the maximum amount that can be borrowed, which vary by county and are adjusted annually.

- Assumable Mortgages: FHA loans are assumable, meaning a qualified buyer can take over the existing mortgage from the seller, potentially offering an advantage in future resale.

FHA Loans for Native Americans: The Specific Context

When evaluating FHA loans for Native Americans, it’s crucial to consider the unique legal and practical realities faced by these communities. The most significant factor is land tenure. Native American lands can be categorized broadly into:

- Fee Simple Land: This is land owned outright by an individual or entity, similar to typical private property. It can be on or off a reservation.

- Trust Land (or Restricted Fee Land): This land is held in trust by the U.S. government for the benefit of individual Native Americans or tribes. It cannot be sold or encumbered without the approval of the Secretary of the Interior. This unique ownership structure significantly impacts traditional mortgage lending, as lenders cannot easily foreclose on trust land in the event of default.

FHA loans, like most conventional mortgages, are primarily designed for properties on fee simple land. This distinction is critical for Native American borrowers.

Advantages ("Pros") of FHA Loans for Native Americans

For Native American individuals and families purchasing homes on fee simple land, FHA loans offer several compelling benefits:

- Accessible Entry Point to Homeownership: The low 3.5% down payment requirement significantly lowers the barrier to entry, making homeownership attainable for many who might struggle to save for a larger down payment required by conventional loans. This is particularly beneficial for younger families or those with limited accumulated wealth.

- More Flexible Credit Requirements: FHA’s more lenient credit standards can be a lifeline for borrowers who have faced financial hardships, have a limited credit history, or whose credit scores are not high enough for conventional financing. This inclusivity is vital for communities where access to mainstream financial products might have been historically limited.

- Competitive Interest Rates: While FHA loans come with MIP, their government backing often allows lenders to offer competitive interest rates, which can result in lower monthly payments compared to some conventional options, especially for borrowers with less-than-perfect credit.

- Streamlined Refinancing Options: FHA offers several refinancing options, including the FHA Streamline Refinance, which requires less paperwork and no appraisal in some cases. This can help Native American homeowners reduce their interest rates or change their loan terms, improving their financial situation over time.

- Protection Against Predatory Lending: As a government-insured product, FHA loans come with strict regulations designed to protect borrowers. This provides a layer of security against predatory lending practices that have historically disproportionately affected vulnerable communities.

- Can Be Used for Homes on Fee Simple Land within Reservations: For Native Americans purchasing homes on fee simple land within reservation boundaries (where such land exists), FHA loans provide a viable financing option, expanding the choices beyond off-reservation properties.

- Single-Family, Multi-Family, and Manufactured Homes: FHA loans can be used to purchase a variety of property types, including single-family homes, multi-family homes (up to four units, if the borrower occupies one), and even manufactured homes (under specific programs like Title II and Title I loans). This flexibility can be beneficial in areas where traditional stick-built homes are less common or affordable.

Disadvantages ("Cons") of FHA Loans for Native Americans

Despite their benefits, FHA loans also come with notable drawbacks, particularly when considering the unique context of Native American communities:

- Ineligibility for Trust Land/Restricted Land: This is the most significant limitation. FHA loans cannot be used to purchase or build homes on land held in trust by the federal government for tribes or individual Native Americans. This is because the FHA requires a clear, marketable title for the property, which is not available for trust lands due to the federal government’s role as trustee. This effectively excludes a large portion of reservation lands from FHA financing.

- Mandatory Mortgage Insurance Premium (MIP): Unlike conventional loans where Private Mortgage Insurance (PMI) can eventually be canceled, FHA’s annual MIP is typically required for the life of the loan if the down payment is less than 10%. This adds a perpetual cost to the mortgage, increasing the overall expense of homeownership. The upfront MIP (1.75% of the loan amount) also adds to the principal balance.

- Stricter Property Requirements: While ensuring safety, FHA’s property standards can sometimes be a hurdle. Older homes, or homes in rural areas (common on or near reservations), may require significant repairs to meet FHA guidelines, adding unexpected costs and delays. This can be particularly challenging in areas with limited access to contractors or building materials.

- Loan Limits May Be Restrictive: While FHA loan limits are adjusted annually and vary by county, they may still be restrictive in some higher-cost areas, limiting the purchasing power for larger or more expensive homes.

- Less Specific to Native American Needs: Unlike programs explicitly designed for Native Americans (like Section 184), FHA loans are a general product. They do not offer the cultural sensitivity, tribal government involvement, or specific provisions for unique land tenure situations that tailored programs do.

- Perception of "Last Resort" Loan: Due to the mandatory MIP and more flexible credit, FHA loans are sometimes perceived as a "last resort" for borrowers who can’t qualify for conventional loans. While this is not always true, it can carry a stigma for some.

The "Competitor Product": Section 184 Indian Home Loan Guarantee Program

No review of FHA loans for Native Americans would be complete without acknowledging the Section 184 Indian Home Loan Guarantee Program. While FHA loans are a general housing product, Section 184 is specifically designed to address the unique needs of Native American individuals and tribes, most notably its ability to finance homes on trust land.

Brief Comparison with FHA:

- Land Eligibility: Section 184 can be used on trust land, restricted land, and fee simple land. This is its primary advantage over FHA for many Native American borrowers.

- Down Payment: Section 184 typically requires a lower down payment (2.25% for loans over $50,000, 1.25% for loans under $50,000) than FHA.

- Mortgage Insurance: Section 184 has an upfront guarantee fee (1.50%) and an annual servicing fee (0.25%), which is often lower than FHA’s combined MIP costs.

- Borrower Eligibility: Section 184 is available exclusively to enrolled members of federally recognized tribes. FHA loans are available to anyone who meets the general eligibility criteria.

- Lender Network: While both programs require approved lenders, the network of lenders specializing in Section 184 loans is smaller and more specialized.

For Native Americans looking to purchase or build on trust land, Section 184 is almost always the superior and more appropriate "product." FHA becomes relevant primarily for those buying on fee simple land who may not qualify for or prefer Section 184 for other reasons.

"Purchase Recommendation" for Native American Borrowers

Given the comprehensive analysis of FHA loans, here is a nuanced "purchase recommendation":

Recommendation: FHA loans are a VIABLE option for Native Americans, but they are NOT always the BEST option. The suitability of an FHA loan depends heavily on the type of land being purchased and the borrower’s specific financial profile.

Who should consider an FHA Loan (Positive Recommendation):

- Native Americans purchasing homes on Fee Simple Land (on or off reservation): If the property is not on trust or restricted land, and the borrower needs the benefits of FHA (low down payment, flexible credit), then FHA is a strong contender.

- Borrowers with Lower Credit Scores or Limited Credit History: If a borrower’s credit score is below the threshold for conventional loans (typically 620-640) but above 500, or if they have non-traditional credit, FHA can be an excellent stepping stone to homeownership.

- Borrowers with Limited Savings for a Down Payment: The 3.5% down payment is significantly less burdensome than the 5-20% often required for conventional mortgages.

- Native Americans who do not qualify for, or prefer not to use, the Section 184 program for fee simple purchases: While Section 184 can be used on fee simple land, some borrowers may find FHA more accessible through a wider range of lenders or perceive its terms as more favorable for their specific situation.

Who should CAREFULLY EVALUATE or AVOID FHA Loans (Conditional/Negative Recommendation):

- Native Americans purchasing or building on Trust Land/Restricted Land: Absolutely avoid FHA loans for this purpose. FHA loans cannot be used on these types of land. The Section 184 Indian Home Loan Guarantee Program is the appropriate and recommended "product" here.

- Borrowers with Excellent Credit and a Substantial Down Payment: If a Native American borrower has a strong credit score (680+) and can afford a 5-20% down payment, a conventional loan might be a better choice. Conventional loans typically do not require lifelong mortgage insurance (PMI can be canceled once 20% equity is reached), potentially leading to lower overall costs.

- Borrowers who want to avoid Mortgage Insurance for the life of the loan: The mandatory, often lifelong, MIP on FHA loans is a significant financial burden. If avoiding this is a priority, exploring conventional loans (with 20% down) or the Section 184 program (with its lower annual fee) is advisable.

- Borrowers seeking loans for properties that may not meet FHA’s strict property standards: While FHA aims to ensure safety, its appraisal requirements can be a hurdle for older or rural homes. Be prepared for potential repair costs if pursuing FHA in such cases.

Overall Recommendation and Actionable Advice:

For Native American individuals and families contemplating homeownership, the decision between FHA, Section 184, or a conventional loan is a critical one that requires careful consideration of their unique circumstances.

- Understand Your Land: The very first step is to definitively determine the land tenure of the property you intend to purchase. If it’s trust or restricted land, Section 184 is your primary and most suitable option. If it’s fee simple land, then FHA and conventional loans come into play.

- Assess Your Financial Profile: Honestly evaluate your credit score, down payment savings, and debt-to-income ratio. This will help determine which loan types you qualify for.

- Consult with Specialists: Seek advice from lenders who specialize in Native American lending and are well-versed in both FHA and Section 184 programs. Additionally, connect with tribal housing authorities and HUD-approved housing counseling agencies that serve Native American communities. These resources can provide invaluable guidance tailored to your specific situation and access to relevant programs.

- Compare All Options: Do not limit yourself to just one type of loan. Get pre-approvals for all options you qualify for (FHA, Section 184, conventional) and compare interest rates, down payment requirements, monthly payments, and total costs over the life of the loan (including all insurance premiums and fees).

- Consider Long-Term Goals: Think about how long you plan to stay in the home and your future financial aspirations. This will influence whether the lifelong MIP of an FHA loan is a manageable trade-off for the immediate benefits.

In conclusion, FHA loans are a powerful tool for expanding homeownership access, and they can certainly serve as a valuable "product" for Native Americans seeking to buy homes on fee simple land. However, they are not a one-size-fits-all solution. The unique landscape of Native American land tenure necessitates a careful and informed approach, with the Section 184 program often providing a more tailored and advantageous pathway for on-reservation housing development. By understanding the intricacies of each loan program and seeking expert guidance, Native American families can navigate the path to homeownership with confidence and secure the best possible financing for their future.