Unlocking the American Dream: A Comprehensive Review of Closing Cost Grants for Native American Mortgages

The path to homeownership, often hailed as a cornerstone of the American Dream, can be fraught with financial hurdles. For Native American families, these challenges are often compounded by historical disenfranchisement, unique land tenure systems, and systemic economic disparities. While the dream of owning a home remains powerful, the upfront costs – particularly closing costs – can present an insurmountable barrier. Enter Closing Cost Grants for Native American Mortgages, a vital financial instrument designed to bridge this gap.

In this comprehensive product review, we will examine these grants not merely as financial aid, but as a critical "product" in the housing market for Indigenous communities. We will delve into their features, performance, benefits, drawbacks, and ultimately provide a "purchase" recommendation, helping prospective Native American homebuyers understand their immense value and navigate their complexities.

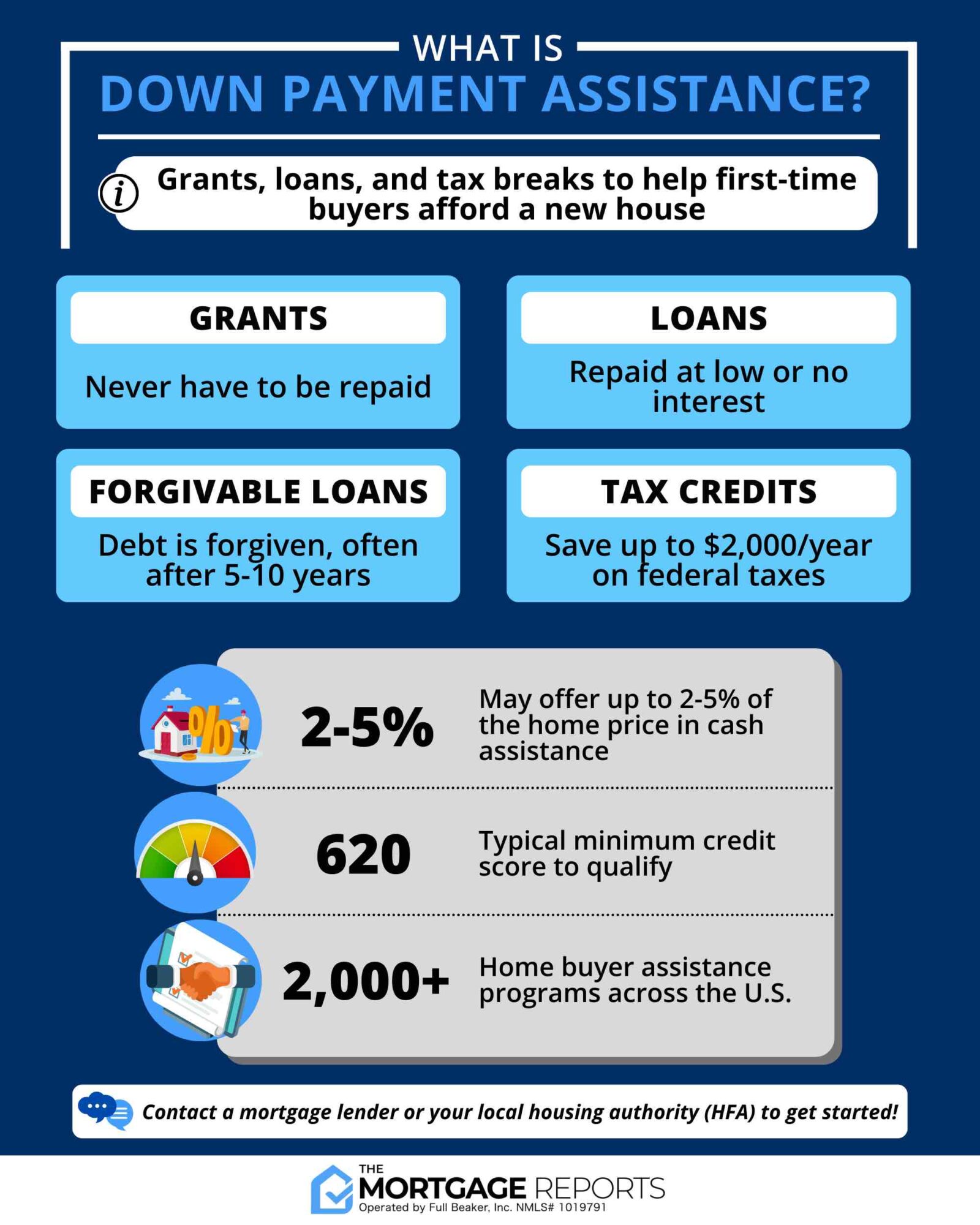

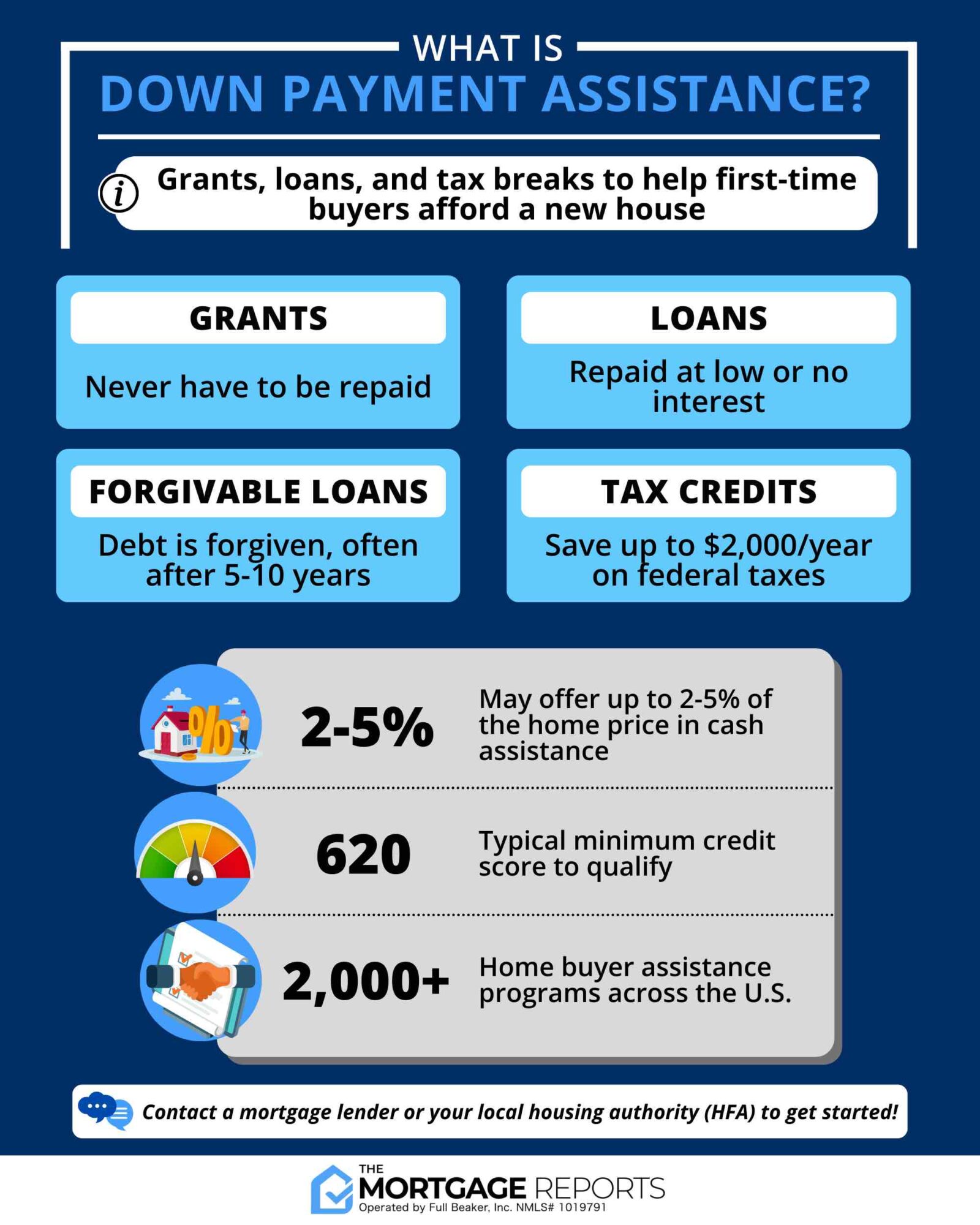

The "Product" Defined: What Are Closing Cost Grants?

Before dissecting the grants themselves, it’s crucial to understand what closing costs entail. These are the various fees and expenses paid at the closing of a real estate transaction, typically ranging from 2% to 5% of the loan amount. They include items such as:

- Loan Origination Fees: Charged by the lender for processing the loan.

- Appraisal Fees: For valuing the property.

- Title Insurance: Protects the lender and homeowner against title defects.

- Escrow Fees: For managing the closing process.

- Recording Fees: For officially registering the new property ownership.

- Attorney Fees: If legal counsel is involved.

- Prepaid Expenses: Such as property taxes and homeowner’s insurance premiums for a certain period.

For a $200,000 mortgage, these costs could easily amount to $4,000 to $10,000 – a significant sum that many families struggle to save alongside a down payment.

Closing cost grants are non-repayable funds specifically allocated to cover these expenses. Unlike loans, they do not need to be paid back, effectively reducing the out-of-pocket burden on the homebuyer. These grants are often provided through various channels:

- Federal Programs: Most notably, the HUD Section 184 Indian Home Loan Guarantee Program often works in conjunction with tribal housing authorities and lenders who offer their own closing cost assistance or can help connect borrowers with other grant programs. While Section 184 itself is a loan guarantee, many lenders specializing in it understand the unique needs and often package it with grant opportunities.

- Tribal Housing Authorities: Many federally recognized tribes operate their own housing departments or non-profit organizations that offer direct grants or partner with state and federal programs to provide assistance to their tribal members.

- State and Local Housing Finance Agencies (HFAs): These agencies often administer programs for first-time homebuyers or specific demographics, which can include Native Americans, offering down payment and closing cost assistance.

- Non-profit Organizations: Various non-profits, some specifically focused on Indigenous communities, work to provide housing assistance, including grants.

These grants are designed to complement primary mortgage products, making the dream of homeownership tangible for those who might otherwise be priced out.

Performance Review: The Pros of Closing Cost Grants

When evaluating closing cost grants as a "product," their benefits are compelling and multifaceted, addressing both immediate financial needs and long-term societal goals.

-

Direct Financial Relief & Increased Affordability: This is the most obvious and impactful benefit. By covering thousands of dollars in closing costs, grants dramatically reduce the cash needed at closing. This frees up the homebuyer’s savings for other essential expenses, such as moving costs, minor home repairs, or simply maintaining a financial cushion. For many, this direct relief transforms homeownership from an aspiration into a realistic goal.

-

Enhanced Access to Homeownership: High upfront costs are a primary barrier for many first-time homebuyers and lower-to-moderate income families. Grants directly dismantle this barrier, allowing more Native Americans to enter the housing market. This is particularly crucial for communities that have historically faced systemic economic disadvantages. By making homeownership more accessible, these grants contribute to closing the wealth gap.

-

Catalyst for Wealth Building and Financial Stability: Homeownership is a primary driver of intergenerational wealth in the United States. By enabling more Native American families to purchase homes, these grants facilitate equity accumulation, which can be leveraged for education, business ventures, or retirement. A stable home environment also fosters financial stability, reducing the stress associated with renting and providing a predictable housing cost.

-

Community Development and Cultural Preservation: Stable homeownership contributes significantly to the health and vibrancy of Native American communities. When families own their homes, they are more likely to invest in their neighborhoods, participate in local governance, and contribute to the local economy. Furthermore, homeownership on or near tribal lands helps keep families connected to their cultural roots, facilitating the transmission of traditions, language, and communal values across generations.

-

Reduced Stress and Simplified Process: The homebuying process can be incredibly stressful, especially for first-time buyers. The financial strain of closing costs adds another layer of anxiety. Knowing that a significant portion of these fees is covered by a grant can alleviate immense pressure, allowing buyers to focus on other aspects of their move and transition. This "ease of use" makes the "product" more appealing.

-

Leveraging Other Programs: Closing cost grants often work synergistically with other beneficial programs, such as the HUD Section 184 loan, which offers flexible underwriting, lower down payments, and the ability to finance on trust lands. The combination of a specialized mortgage product and closing cost assistance creates a powerful toolkit for Native American homebuyers.

Limitations and Drawbacks: The Cons of Closing Cost Grants

While the "product" offers immense value, it is not without its limitations. Understanding these drawbacks is crucial for a realistic "user experience" and effective "purchase" strategy.

-

Limited Funding and Availability: Despite their critical importance, closing cost grants are not universally available, nor are they unlimited. Funding often depends on federal, state, or tribal budgets, which can fluctuate. This means that programs can run out of funds, be highly competitive, or be geographically restricted, leaving many eligible families without access.

-

Complex Application Process and Bureaucracy: Securing a grant often involves a detailed application process, requiring extensive documentation, income verification, and adherence to strict eligibility criteria. Navigating multiple agencies (lender, tribal housing, state HFA) can be confusing and time-consuming, potentially delaying the home purchase. This "user interface" can be cumbersome.

-

Strict Eligibility Requirements: Grants typically come with stringent eligibility criteria, including income limits (often tied to Area Median Income – AMI), tribal enrollment verification, residency requirements, and sometimes even specific property types or locations. While necessary to target aid effectively, these restrictions can exclude many Native American families who, while needing assistance, may fall outside the precise parameters.

-

Awareness Gap and Lack of Outreach: A significant challenge is the lack of widespread awareness about these grants. Many eligible Native American families are simply unaware that such assistance exists or how to access it. This "marketing failure" means the "product" isn’t reaching all its potential "customers," often due to insufficient outreach and education efforts within communities.

-

Potential for Delays: The administrative layers involved in processing grant applications can lead to delays in the closing timeline. This can be frustrating for homebuyers and can sometimes jeopardize a deal if sellers are unwilling to wait. The "delivery time" can be unpredictable.

-

Dependency on Primary Mortgage Approval: Closing cost grants are almost always tied to the approval of a primary mortgage. If a borrower cannot secure a mortgage due to credit issues, insufficient income, or other factors, the grant becomes irrelevant. The "product" cannot stand alone; it’s an add-on.

-

"Stacking" Limitations: While some programs allow for the "stacking" of multiple forms of assistance (e.g., a down payment grant and a closing cost grant), others have limits on the total amount of assistance a borrower can receive, or restrict combining certain programs. This requires careful navigation and understanding of specific program rules.

"User Experience" and Case Studies

Imagine Sarah, a Navajo Nation member, working as a teacher in a rural town near her ancestral lands. She has a stable income and a good credit score, making her eligible for a HUD Section 184 loan with a low down payment. However, the $7,000 in closing costs for a $250,000 home feels insurmountable, especially after saving for a down payment. Through her tribal housing authority, she learns about a state-administered closing cost grant specifically for Native American first-time homebuyers. She applies, and after a few weeks of paperwork, is approved for $5,000. This grant, combined with a seller credit for the remaining $2,000, makes her home purchase possible, allowing her to invest her savings in furnishing her new home and starting a small college fund for her children.

Contrast this with Mark, a Cherokee Nation member living in an urban area. He, too, is a first-time homebuyer. He finds a lender specializing in Section 184 loans but is unaware of any closing cost grants in his specific county or through his distant tribal nation’s programs. Without the grant, he has to choose between delaying his purchase to save more, or taking a higher-interest loan that rolls closing costs into the mortgage, increasing his monthly payments. His "user experience" is significantly more challenging due to a lack of awareness and direct access to the "product."

"Purchase" Recommendation: Should You Invest in These Grants?

Absolutely, without reservation, YES. For eligible Native American homebuyers, seeking out and utilizing closing cost grants is not just advisable, it is a critical strategy for achieving homeownership. These grants represent a significant investment in individual financial well-being and the collective strength of Indigenous communities.

Who is this "product" for?

This "product" is highly recommended for:

- Enrolled members of federally recognized tribes or Alaska Natives.

- First-time homebuyers (though some programs may not have this restriction).

- Individuals or families who meet specific income guidelines.

- Those utilizing mortgage products designed for Native Americans, such as the HUD Section 184 loan.

Our Verdict: Closing cost grants for Native American mortgages are an essential, high-value "product" that addresses a critical financial barrier. Their ability to directly reduce upfront costs is unparalleled, transforming the dream of homeownership into a reality for countless families.

Key Recommendations for the "Buyer":

- Start Early and Research Thoroughly: Don’t wait until you’ve found a home. Begin researching available grants before you start house hunting.

- Engage with Experts: Connect with lenders specializing in HUD Section 184 loans, your tribal housing authority, and local housing counseling agencies. They are often the best resources for identifying and navigating grant programs.

- Understand Eligibility: Carefully review all eligibility requirements for each grant program. Don’t self-disqualify; seek clarification if unsure.

- Be Prepared for Documentation: Gather necessary documents like tribal enrollment verification, income statements, tax returns, and asset statements in advance.

- Exercise Patience and Persistence: The application process can be lengthy and complex. Remain patient, follow up diligently, and don’t get discouraged by initial hurdles.

- Financial Literacy is Key: Even with grants, understanding your mortgage, budget, and long-term financial commitments is crucial for sustainable homeownership.

Conclusion

Closing cost grants for Native American mortgages are more than just financial aid; they are instruments of equity, empowerment, and community building. They represent a tangible effort to rectify historical injustices and pave the way for a more equitable future for Indigenous peoples. While the "product" has its limitations, primarily in terms of accessibility and complexity, its profound benefits far outweigh these drawbacks.

As more Native American families gain access to stable, affordable homeownership through these grants, we will witness not only individual prosperity but also the strengthening of tribal nations, the revitalization of cultural traditions, and the continued journey toward self-determination. For any eligible Native American considering homeownership, diligently exploring and leveraging these grants is not just a smart financial decision, but a powerful step towards realizing a fundamental aspect of the American Dream. The "purchase" of this "product" is an investment in a brighter future.