Unlocking Homeownership on Trust Land: A Deep Dive into VA NADL Loan Property Requirements

Homeownership is a cornerstone of the American dream, offering stability, equity, and a place to call one’s own. For Native American Veterans, this dream often comes with unique complexities, particularly when aspiring to build or buy a home on Native American trust land. Traditional mortgage lenders frequently shy away from properties on trust land due to the intricate legal framework of ownership and tribal sovereignty. This is where the VA Native American Direct Loan (NADL) program steps in, a crucial and often overlooked "product" designed to bridge this gap.

The VA NADL is not just another loan program; it’s a specialized financial instrument that directly addresses the specific challenges faced by Native American Veterans seeking homeownership on their ancestral lands. As a "product," its value lies in its ability to facilitate a transaction that would otherwise be nearly impossible. This comprehensive review will delve into the VA NADL loan property requirements, examining its strengths and weaknesses, and offering detailed recommendations for eligible veterans considering this vital pathway to homeownership.

Understanding the VA NADL Program: A Specialized Solution

Before dissecting the property requirements, it’s essential to grasp the fundamental nature of the VA NADL program. Administered directly by the Department of Veterans Affairs (VA), it provides direct home loans to eligible Native American Veterans to purchase, construct, or improve a home on Native American trust land, or to refinance an existing NADL loan. Unlike the more common VA-guaranteed loans, which are issued by private lenders, NADL loans come directly from the VA. This direct relationship is a key differentiator and often simplifies aspects of the process.

The program’s existence acknowledges the unique legal status of trust land, which is held in trust by the U.S. government for the benefit of Native American tribes or individual Native Americans. This "trust" status means that the land cannot be directly owned in fee simple by individuals in the traditional sense, posing significant hurdles for conventional lenders who require the ability to take a lien on the property as collateral. The NADL program navigates these complexities through specific agreements with tribal governments, ensuring the VA’s interest is protected while empowering veterans.

The Core "Product" Feature: VA NADL Property Requirements

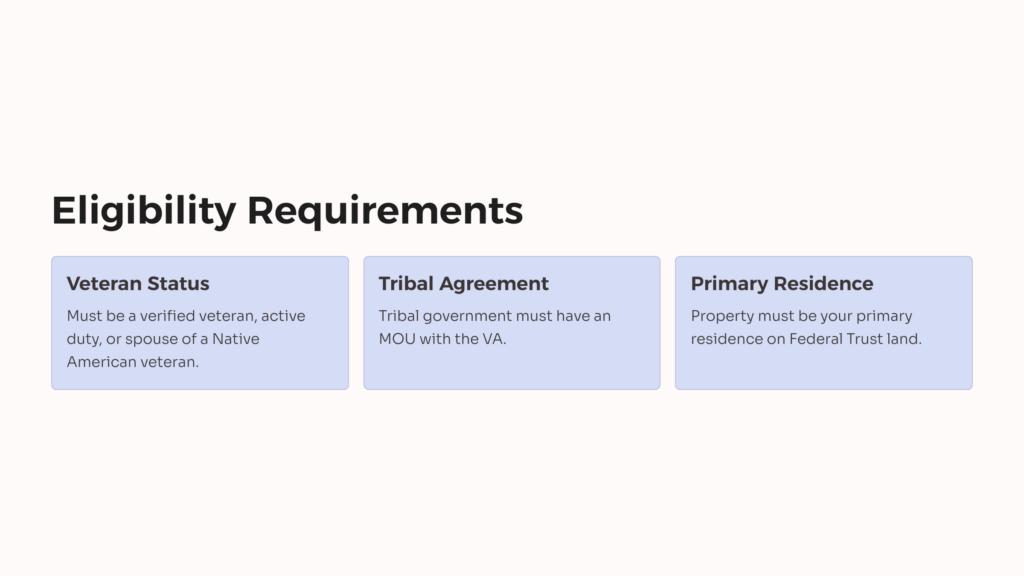

The property requirements for a VA NADL loan are the bedrock of the program, designed to ensure the home is a sound investment for both the veteran and the VA, while respecting the unique legal environment of trust land. These requirements are often more stringent or specific than those for conventional loans, reflecting the program’s specialized nature.

-

Location on Native American Trust Land: This is the most fundamental requirement. The property must be located on land held in trust by the U.S. government for a federally recognized Native American tribe or individual Native Americans. This automatically excludes properties on fee simple land, even if located within or near a reservation. The VA requires documentation confirming the land’s trust status.

-

Tribal Organization Participation Agreement (TOPA): For the VA to lend on tribal trust land, the specific tribe must have an active TOPA with the VA. This agreement outlines the terms and conditions under which the VA can make direct loans on that tribe’s trust land, including provisions for foreclosures, lease assignments, and other legal processes. Without a TOPA, the loan cannot proceed. This is a critical initial check for any veteran.

+Program.jpg)

-

Leasehold Interest: Since trust land cannot be owned in fee simple by individuals, NADL loans finance a leasehold interest in the land. The veteran essentially leases the land from the tribe or an individual allottee for a long term (typically 50 years or longer, renewable). The home built or purchased on this leased land becomes the veteran’s asset. The lease must be assignable to the VA in the event of default, ensuring the VA can protect its interest. The terms of this lease are rigorously reviewed by the VA.

-

Minimum Property Requirements (MPRs): Like all VA loans, properties financed through NADL must meet the VA’s MPRs. These are designed to ensure the home is safe, sanitary, structurally sound, and meets basic living standards. Key aspects include:

- Safety: No hazards such as exposed wiring, structural deficiencies, or environmental contaminants.

- Sanitation: Adequate and safe water supply (potable), functional sewage disposal system (municipal, septic, or approved alternative), and proper waste disposal.

- Structural Soundness: The foundation, roof, walls, and overall structure must be in good repair and provide adequate shelter.

- Habitability: The home must have a functional heating system, adequate ventilation, and reasonably functional plumbing and electrical systems.

- Accessibility: The property must have direct and safe access from a public or private road.

- Adequate Space: Sufficient living area for the occupants.

-

Property Type: The NADL program is generally for single-family homes. This can include:

- Existing Homes: Must meet MPRs.

- New Construction: Plans and specifications must be approved by the VA, and construction must adhere to local building codes and VA standards.

- Manufactured Homes: Can be financed, but they must be permanently affixed to a foundation, meet specific construction standards (e.g., HUD code for manufactured homes), and be treated as real property. They cannot be on wheels or easily moved.

-

Utilities: All essential utilities (water, electricity, sewage/septic) must be present, functional, and meet local health and safety standards. Off-grid systems may be considered but require extensive documentation and VA approval to ensure reliability and safety.

-

Appraisal: A VA-approved appraiser must conduct an appraisal to determine the property’s fair market value. The appraisal process for properties on trust land can be more complex due to limited comparable sales data, requiring appraisers with specific expertise in this unique market. The appraisal must also confirm that the property meets all VA MPRs.

-

Environmental Hazards: The property must be free from significant environmental hazards such as excessive noise, proximity to hazardous waste sites, or flood zones without adequate mitigation.

Advantages (Pros) of the VA NADL Program

The VA NADL program, as a "product," offers significant benefits that make it an invaluable tool for eligible Native American Veterans:

- No Down Payment Required: This is arguably the most substantial advantage. Veterans can finance 100% of the home’s value, removing a major barrier to homeownership for many.

- No Private Mortgage Insurance (PMI): Unlike conventional loans with less than 20% down, NADL loans do not require PMI, saving veterans hundreds of dollars per month and significantly reducing the overall cost of the loan.

- Low Fixed Interest Rates: NADL loans typically offer competitive, fixed interest rates, providing predictable monthly payments and protecting borrowers from market fluctuations.

- Reduced Closing Costs: While some closing costs are still applicable, the VA sets limits on certain fees, and some can be paid by the seller, further reducing the upfront financial burden on the veteran.

- Relaxed Credit Requirements: While a good credit history is always beneficial, the VA’s underwriting standards for NADL loans can be more flexible compared to conventional lenders, focusing on the veteran’s overall financial picture and ability to repay.

- Direct Loan from the VA: The fact that the VA is the lender streamlines communication and often provides a more veteran-centric experience. Veterans deal directly with VA loan specialists who understand the unique aspects of the program and trust land.

- Addresses Unique Trust Land Challenges: The program’s very existence is a pro, as it specifically tackles the legal and financial hurdles that make traditional financing on trust land nearly impossible. It creates a viable path to homeownership where none previously existed.

- Opportunity for Home Building: For veterans who wish to build a custom home on their allotted or tribal land, the NADL offers a construction loan option, providing funds throughout the building process.

Disadvantages (Cons) of the VA NADL Program

Despite its significant advantages, the VA NADL program also comes with certain limitations and complexities that veterans should be aware of:

- Limited Availability: The most significant drawback is its geographic restriction. NADL loans are only available on Native American trust land and only in areas where the VA has a TOPA with the specific tribe. This severely limits the program’s reach.

- Complex Property Requirements: While designed to facilitate loans on trust land, the requirements themselves (leasehold interest, TOPA, specific MPRs, and appraisal challenges) add layers of complexity that can prolong the process.

- Longer Processing Times: Due to the need for tribal agreements, specific appraisals, and direct VA underwriting, NADL loans can often take longer to process than conventional or even VA-guaranteed loans. Coordination between the veteran, tribe, and VA can be extensive.

- Leasehold vs. Fee Simple Ownership: While the NADL makes homeownership possible, veterans are acquiring a leasehold interest in the land, not fee simple ownership. This distinction can be confusing and might feel less secure to some, even though the long-term leases are designed to provide stability.

- Appraisal Challenges: Finding qualified appraisers familiar with trust land and able to accurately assess value with limited comparable sales data can be difficult and time-consuming. This can impact loan amounts and processing.

- Required Tribal Cooperation: The success of an NADL loan heavily depends on the cooperation and active participation of the veteran’s tribal government. Without an existing TOPA or the tribe’s willingness to engage, the loan cannot proceed.

- Limited Refinancing Options: While NADL loans can be refinanced under certain conditions (e.g., Interest Rate Reduction Refinancing Loan or a refinance to improve the existing NADL), the options might not be as broad as for conventional loans.

- Potential for Cultural Misunderstandings: While the VA strives for cultural competency, navigating the intersection of federal regulations, tribal law, and individual veteran needs can sometimes lead to misunderstandings or delays.

Purchase Recommendations: Is the VA NADL "Product" Right for You?

The VA NADL program is not for every veteran, but for its specific target demographic, it is an indispensable "product." Here are our recommendations:

Who Should Consider It:

- Native American Veterans (Federally Recognized Tribes): This is the absolute prerequisite. If you are a veteran and a member of a federally recognized Native American tribe, this program is designed for you.

- Veterans Desiring to Live on Trust Land: If your goal is specifically to reside on tribal trust land, whether allotted or communal, the NADL is likely your best, if not only, viable option for home financing.

- Veterans Seeking Affordable Homeownership: With no down payment and no PMI, the NADL offers a highly affordable path to homeownership, making it attractive even if you could qualify for other loans.

When to Pursue the NADL:

- When Traditional Financing is Unavailable: If you’ve explored conventional or VA-guaranteed loans and found them impossible for properties on trust land, the NADL is your go-to solution.

- When Building a New Home on Trust Land: For veterans with an allotment or access to tribal land who wish to construct a new residence, the NADL provides specific construction loan options.

- For Long-Term Residency on Tribal Land: The leasehold interest is designed for long-term stability, making it suitable for veterans planning to stay in their tribal community for decades.

Key Recommendations for Success:

- Verify Eligibility and Tribal Participation Early: First, confirm your veteran and tribal eligibility. Crucially, verify that your tribe has an active Tribal Organization Participation Agreement (TOPA) with the VA. If not, you may need to work with your tribal housing authority to initiate one, which can take time.

- Understand Leasehold Ownership: Educate yourself thoroughly on what a leasehold interest means for you, your family, and future generations. While providing stability, it’s different from fee simple ownership.

- Engage with Your Tribal Housing Authority: Your tribal housing authority or government will be an invaluable resource. They can guide you through tribal requirements, help with land assignments, and facilitate the TOPA process if needed.

- Seek VA-Experienced Professionals: Work with a real estate agent (if applicable for existing homes) and an appraiser who have experience with NADL loans and properties on trust land. Their expertise will be crucial in navigating the unique aspects.

- Prepare for a Detailed Process: Be patient and organized. Gather all necessary documentation (DD-214, Certificate of Eligibility, tribal enrollment verification, land lease agreements) upfront.

- Focus on MPRs (Minimum Property Requirements): If purchasing an existing home, ensure it meets VA MPRs. If building, ensure your plans adhere to all VA and local/tribal building codes. Budget for any necessary repairs or upgrades.

- Consider New Construction: If existing homes on trust land are scarce or don’t meet MPRs, building a new home with an NADL construction loan might be a more straightforward path to meeting property standards.

- Utilize VA Resources: The VA directly administers these loans. Lean on their loan specialists for guidance, clarification, and assistance throughout the process.

Conclusion

The VA Native American Direct Loan program stands as a testament to the VA’s commitment to supporting all veterans, especially those facing unique systemic barriers. As a "product," it meticulously addresses the intricate challenges of homeownership on Native American trust land, transforming what would otherwise be an insurmountable hurdle into a tangible reality.

While its property requirements are specific and the process can be more complex and time-consuming than conventional loans, the NADL’s benefits—zero down payment, no PMI, and low fixed rates—are profound. For eligible Native American Veterans dedicated to establishing roots in their tribal communities, the VA NADL is not just a loan; it’s an empowering bridge to stability, heritage, and the deeply personal fulfillment of homeownership. By understanding its intricacies, leveraging available resources, and approaching the process with diligence, Native American Veterans can successfully navigate the NADL program and achieve their dream of a home on trust land.