Navigating the Path to Homeownership: A Comprehensive Review of the VA Loan Application Process

For millions of brave men and women who have served our nation, the dream of homeownership is a tangible symbol of stability and the pursuit of a fulfilling civilian life. The Department of Veterans Affairs (VA) Loan program stands as a cornerstone benefit, designed to make this dream an achievable reality. Far more than just a mortgage, it’s a hard-earned entitlement that offers unparalleled advantages.

This comprehensive review will delve deep into the VA loan application process, treating it as a "product" that veterans interact with. We will dissect its various stages, highlight its numerous advantages, critically examine its potential drawbacks, and provide actionable recommendations for navigating this unique path to homeownership, with a particular focus on the enhanced benefits available to disabled veterans.

What is a VA Loan? Understanding the "Product"

At its core, a VA loan is a mortgage loan guaranteed by the U.S. Department of Veterans Affairs. This guarantee protects lenders from loss if the borrower defaults, enabling them to offer more favorable terms to eligible veterans. Unlike conventional or FHA loans, the VA doesn’t originate the loans themselves; instead, it sets the guidelines and partners with private lenders (banks, credit unions, mortgage companies) who issue the mortgages.

The primary goal of the VA loan program is to assist eligible veterans, active-duty service members, and certain surviving spouses in purchasing, constructing, or refinancing a home. It’s a testament to the nation’s gratitude, providing a robust financial tool to those who have sacrificed so much.

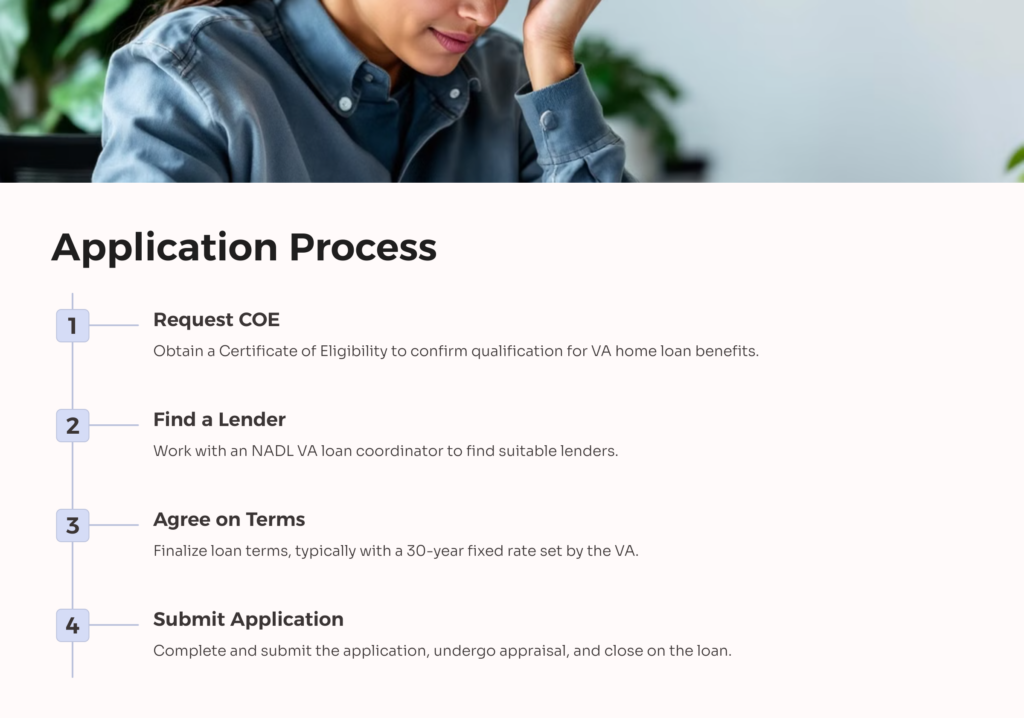

The VA Loan Application Process: A Step-by-Step Walkthrough

The "product" we are reviewing is the journey itself – the application process. While it shares similarities with other mortgage applications, the VA loan has distinct requirements and nuances.

-

Establishing Eligibility and Obtaining Your Certificate of Eligibility (COE):

- The First Hurdle: Before anything else, a veteran must determine their eligibility based on service requirements (length of service, type of discharge).

- The COE: This crucial document proves to the lender that you meet the VA’s service requirements. It details your entitlement amount and whether you are exempt from the VA funding fee.

- How to Get It: You can apply online through the VA’s eBenefits portal, by mail, or most commonly, your chosen VA-approved lender can help you obtain it quickly through an automated system.

- Review: This step is generally straightforward, especially with a proactive lender. It’s the gateway to the entire process.

-

Finding a VA-Approved Lender:

- Specialization Matters: Not all lenders are equally proficient in VA loans. It is paramount to work with a lender experienced in VA financing, as they understand the specific guidelines, paperwork, and timelines.

- Pre-Qualification/Pre-Approval: Once you have your COE, a good lender will guide you through pre-qualification (an estimate of what you can borrow) and then pre-approval (a more robust commitment based on verified income and credit). This provides a solid budget and makes you a more attractive buyer.

- Review: This is a critical decision point. A knowledgeable lender can make the process smooth; an inexperienced one can introduce significant delays and frustration.

-

House Hunting and Making an Offer:

- Property Requirements: VA loans have Minimum Property Requirements (MPRs) to ensure the home is safe, sanitary, and structurally sound. While this protects the veteran, it can limit choices, especially with older homes or properties needing significant repairs.

- Offer Strategy: With a pre-approval letter in hand, you can confidently make an offer. Ensure your real estate agent is also familiar with VA loans and how to structure offers to address potential VA appraisal requirements.

- Review: The MPRs are a double-edged sword – protection for the buyer, but potential constraint on choice.

-

The VA Appraisal and Underwriting:

- The VA Appraisal: Once an offer is accepted, the lender orders a VA appraisal. This is not just about valuation; it also checks for compliance with MPRs. The VA assigns an appraiser from its approved list.

- Notice of Value (NOV): The appraiser submits an NOV, which specifies the property’s value and any required repairs to meet MPRs. If the appraisal comes in lower than the sales price, the veteran may need to negotiate with the seller or pay the difference.

- Underwriting: Concurrently, the lender’s underwriter reviews all financial documentation (income, credit history, assets, liabilities) to ensure the veteran meets both VA and lender-specific guidelines for loan approval.

- Review: This is often the most scrutinized and potentially slowest part of the process. MPRs can lead to delays or renegotiations, and the underwriter’s meticulous review can feel intrusive, but it’s designed to protect all parties.

-

Closing the Loan:

- Final Steps: Once the appraisal is approved and underwriting is cleared, the loan moves to closing. This involves signing numerous legal documents, transferring funds, and receiving the keys to your new home.

- Closing Costs: While the VA limits what closing costs veterans can pay, there are still costs involved, such as title insurance, recording fees, and attorney fees.

- Review: This is the culmination of the process. While still involving paperwork, it’s generally a celebratory step.

Advantages of the VA Loan Application Process (The "Pros")

The VA loan program offers an array of benefits that often make it the most advantageous financing option for eligible individuals:

- No Down Payment Requirement: This is arguably the biggest advantage. Unlike conventional loans (typically 5-20% down) or FHA loans (3.5% down), VA loans often require no money down, saving veterans tens of thousands of dollars upfront. This dramatically lowers the barrier to entry for homeownership.

- No Private Mortgage Insurance (PMI): Most conventional loans with less than 20% down require PMI, an extra monthly fee to protect the lender. VA loans, despite often having no down payment, do not require PMI, leading to significant monthly savings over the life of the loan.

- Competitive Interest Rates: Due to the VA guarantee, lenders typically offer VA loans at interest rates that are often lower than conventional or FHA options. This translates to lower monthly payments and substantial savings over time.

- Flexible Credit Requirements: While good credit is always beneficial, VA loan guidelines are generally more forgiving than conventional loans, making homeownership accessible to a broader range of veterans. Lenders often look at the overall financial picture rather than just a credit score.

- Limited Closing Costs: The VA limits the closing costs a veteran can pay, and sellers are permitted to pay all of the veteran’s loan-related closing costs, up to a certain percentage of the loan amount. This can further reduce the upfront cash needed.

- Assumable Loans: VA loans are assumable, meaning a qualified buyer (veteran or civilian) can take over the existing mortgage with its original interest rate. In a rising interest rate environment, this can be a huge selling point.

- Reusable Benefit: The VA loan entitlement can be used multiple times throughout a veteran’s life, provided certain conditions are met (e.g., selling the previous home and repaying the loan).

- Specific Benefits for Disabled Veterans (Enhanced "Product" Features):

- Funding Fee Exemption: This is a monumental benefit. The VA charges a "funding fee" (a percentage of the loan amount) on most VA loans, which helps offset the cost to taxpayers. However, veterans receiving VA disability compensation (even 0% if it’s for a service-connected disability) are exempt from this fee. This saves thousands of dollars upfront. For example, on a $300,000 loan, a 2.15% funding fee (for first-time users with no down payment) would be $6,450. A disabled veteran saves this entire amount.

- Specially Adapted Housing (SAH) and Special Housing Adaptation (SHA) Grants: For severely disabled veterans, the VA offers grants to build, buy, or modify a home to accommodate their disability. While separate from the loan, these grants can be combined with a VA loan to create a truly accessible and comfortable living environment.

- Property Tax Exemptions: Many states offer property tax exemptions to disabled veterans, further reducing the cost of homeownership. While not part of the VA loan process itself, it’s a significant complementary benefit that makes the overall "product" of homeownership more affordable for this group.

Disadvantages of the VA Loan Application Process (The "Cons")

While the advantages are substantial, the VA loan process isn’t without its potential drawbacks:

- Strict Property Requirements (MPRs): The VA’s Minimum Property Requirements (MPRs) are designed to protect the veteran from buying an unsafe or unsound home. However, they can also limit choices, especially in competitive markets or for older homes that might need minor repairs. Issues like peeling paint, lack of functioning utilities, or structural problems must be addressed before closing, which can cause delays or even scuttle a deal.

- VA Appraisal Process: While crucial, the VA appraisal can sometimes be slower than conventional appraisals due to the additional MPR checks. If an appraisal comes in low (below the sales price), it can lead to difficult negotiations or require the veteran to pay the difference in cash, which can be challenging if they’re relying on no down payment.

- The Funding Fee (If Not Exempt): For veterans who are not exempt, the VA funding fee can be a significant upfront cost (though it can be financed into the loan). While still often less than PMI, it’s an additional expense that needs to be considered.

- Limited to Primary Residences: VA loans are primarily for purchasing or refinancing a primary residence. They generally cannot be used for investment properties, vacation homes, or commercial real estate, limiting options for some investors.

- Perception Among Sellers (Less Common Now): In extremely competitive seller’s markets, some sellers or their agents, especially those unfamiliar with VA loans, might perceive them as more complex or prone to delays due to MPRs. This perception, while largely unfounded with a good lender and agent, could theoretically put a VA buyer at a slight disadvantage in a bidding war.

- Specific Paperwork and Waiting Periods: While simplified, the initial COE process and the overall documentation required by the VA and the lender can feel extensive. There are also specific VA timelines that need to be adhered to.

Who is the VA Loan For? (The Ideal User Profile)

The VA loan is an invaluable tool for:

- Veterans and Active-Duty Service Members: Anyone meeting the service requirements who dreams of homeownership.

- First-Time Homebuyers: The no-down-payment and no-PMI features are incredibly beneficial for those who haven’t had time to save a substantial down payment.

- Veterans with Limited Savings: The reduced upfront costs make homeownership accessible even with minimal liquid assets.

- Veterans Seeking Lower Monthly Payments: Competitive interest rates and the absence of PMI contribute to more affordable monthly housing expenses.

- Most Importantly: Disabled Veterans: For this group, the VA loan is an absolutely essential benefit. The funding fee exemption alone saves thousands, and when combined with potential SAH/SHA grants and state-level property tax exemptions, it drastically reduces the financial burden of homeownership, allowing them to focus on health, recovery, and quality of life. The process is specifically designed to support their unique needs.

Recommendations: "Purchasing" and Optimizing the VA Loan Experience

Considering the advantages and disadvantages, here are my recommendations for navigating the VA loan application process:

- Get Your Certificate of Eligibility (COE) Early: This is your golden ticket. Obtain it before you even start seriously looking at homes. Your lender can help, but having it ready streamlines the initial stages.

- Choose a VA-Experienced Lender and Real Estate Agent: This cannot be stressed enough. A lender specializing in VA loans will understand the nuances, process applications efficiently, and anticipate potential issues. A real estate agent familiar with VA loans can help you find suitable properties and craft offers that cater to VA requirements. This partnership is crucial.

- Understand Your Disability Benefits: If you are a disabled veteran, thoroughly understand your VA disability rating and its implications for the funding fee exemption and other potential grants (SAH/SHA). Communicate this clearly to your lender from day one. This knowledge is power and money saved.

- Be Prepared for the Appraisal and MPRs: While they can cause delays, MPRs protect you. Be patient, and if issues arise, work with your agent and lender to negotiate repairs with the seller. Don’t be afraid to walk away if the property doesn’t meet VA standards or the seller isn’t cooperative.

- Maintain Good Financial Habits: While VA loans are flexible, a strong credit score and low debt-to-income ratio will always lead to smoother underwriting and potentially better interest rates. Continue to manage your finances responsibly throughout the process.

- Ask Questions! Don’t hesitate to ask your lender, real estate agent, or the VA directly if you have any doubts or need clarification on any part of the process. This is your benefit, and you deserve to understand it fully.

- Consider the "Product" (VA Loan) as a Top Priority: For most eligible veterans, especially disabled veterans, the VA loan should be the first and often only serious financing option considered. The financial advantages are simply too significant to overlook.

Conclusion

The VA loan application process, while requiring diligence and attention to detail, stands as an exemplary "product" designed to honor and empower those who have served. Its profound benefits – particularly the zero down payment, no PMI, and competitive rates – make homeownership accessible to millions. For disabled veterans, the added advantages of funding fee exemption and the potential for housing grants elevate this program from excellent to truly indispensable.

While the stringent property requirements and appraisal process can sometimes introduce complexities, these are ultimately safeguards for the veteran buyer. By partnering with experienced professionals and understanding the process, eligible veterans can navigate these steps successfully.

In conclusion, the VA loan is not just a mortgage; it’s a deeply meaningful and financially superior benefit. For eligible veterans, and especially for our disabled veterans, the recommendation is unequivocal: embrace this invaluable entitlement. It is a powerful tool to secure the American dream of homeownership, a tangible reward for their unwavering service and sacrifice.