Navigating the Final Frontier: A Comprehensive Review of HUD 184 Loan Closing Document Requirements

The dream of homeownership is a universal aspiration, a cornerstone of financial stability and community building. For eligible Native American and Alaska Native individuals, the U.S. Department of Housing and Urban Development (HUD) Section 184 Indian Home Loan Guarantee Program serves as a vital pathway to achieving this dream. Unlike conventional mortgages, the HUD 184 program is specifically designed to address the unique circumstances of Native communities, including lending on trust land. While the program offers significant advantages, its closing process, particularly the labyrinth of required documents, can seem daunting.

This article provides an in-depth "product review" of the HUD 184 loan closing document requirements. We will dissect the various components of this "document package," examining their purpose, highlighting their advantages and disadvantages, and ultimately offering a "purchase recommendation" on how to navigate this crucial stage successfully. Think of the closing document set as a complex, yet meticulously engineered product designed to ensure a secure and compliant homeownership transaction.

The HUD 184 Closing Document "Product" Overview: What You’re Signing

The HUD 184 closing document package is a comprehensive collection of legal instruments and disclosures that finalize the loan agreement and transfer property ownership. It’s a blend of standard mortgage industry documents and those unique to the HUD 184 program and tribal land considerations. Understanding each component is key to a smooth closing.

I. Standard Mortgage Closing Documents (The Foundation)

These documents are common to most real estate transactions, regardless of the loan type, but form the bulk of the HUD 184 package:

- The Promissory Note: This is the borrower’s formal promise to repay the loan. It outlines the principal amount, interest rate, payment schedule, and terms of default. It’s the core financial agreement.

- The Deed of Trust or Mortgage: This document secures the Promissory Note, granting the lender a lien on the property. It specifies the property being purchased and the conditions under which the lender can foreclose if the borrower defaults. The terminology (Deed of Trust vs. Mortgage) varies by state.

- The Closing Disclosure (CD): A critical document mandated by the TILA-RESPA Integrated Disclosure (TRID) rule, the CD provides a clear, detailed breakdown of all financial aspects of the transaction. It includes the loan terms, projected monthly payments, closing costs, and cash to close. Borrowers must receive this at least three business days before closing.

- Truth in Lending Act (TILA) Disclosures: While many TILA disclosures are now integrated into the CD, separate forms might still address specific aspects like the Annual Percentage Rate (APR) and payment schedules.

- Title Insurance Policies (Lender’s and Owner’s):

- Lender’s Title Policy: Protects the lender against financial loss due to defects in the property’s title (e.g., unknown liens, easements, fraudulent claims).

- Owner’s Title Policy: Protects the homeowner against the same risks, ensuring clear ownership. This is often an optional but highly recommended purchase.

- Survey: A professional drawing that shows the exact boundaries of the property, including any improvements, easements, and encroachments. Crucial for understanding what you own.

- Appraisal: An independent professional valuation of the property’s worth. Ensures the property’s value supports the loan amount.

- Hazard Insurance Policy: Proof of property insurance coverage (e.g., homeowner’s insurance) for the upcoming year, protecting against fire, natural disasters, and other perils. Lenders require this to protect their investment.

- Escrow/Impound Account Agreement: If an escrow account is established (which is typical), this agreement details how the lender will collect and disburse funds for property taxes and hazard insurance premiums on behalf of the borrower.

- Occupancy Affidavit: A statement from the borrower confirming they intend to occupy the property as their primary residence, a common requirement for owner-occupied loans.

- Affidavits and Disclosures: Various state-specific and general disclosures about property condition, lead-based paint (for older homes), environmental hazards, and other pertinent information.

II. HUD 184 Specific Closing Documents (The Unique Features)

These documents are what truly differentiate the HUD 184 "product" and reflect the program’s specialized nature, especially concerning tribal lands:

- HUD 184 Loan Guarantee Certificate or Loan Guarantee Addendum: This is central to the program. It’s the official document issued by HUD’s Office of Native American Programs (ONAP) confirming that HUD guarantees the loan. While often an internal lender document, its existence and terms are crucial to the loan’s structure.

- Tribal Approval and Lease Agreement (for Trust Land): If the property is on trust or restricted land, this is arguably the most critical and unique document.

- Tribal Approval: A formal resolution or letter from the tribal government approving the transaction, acknowledging the lease, and consenting to the mortgage.

- Leasehold Interest: The borrower typically obtains a lease from the tribe (or a tribal member) for a specific term (e.g., 50-year renewable lease). The mortgage then encumbers this leasehold interest, not the underlying land (which remains tribal property). This agreement must be approved by the Bureau of Indian Affairs (BIA).

- Bureau of Indian Affairs (BIA) Documents: For transactions on trust land, the BIA plays a pivotal role. Documents requiring BIA approval or involvement include:

- BIA Lease Approval: The BIA must approve the lease agreement between the tribe/allottee and the borrower.

- BIA Subordination Agreement: The BIA’s interest in the land must be subordinated to the lender’s interest in the leasehold, allowing the lender to foreclose on the leasehold in case of default.

- BIA Assignment of Lease (if applicable): For existing leases being assigned.

- HUD 184 Specific Addendum/Rider: This document often modifies standard mortgage forms to incorporate HUD 184 program requirements, such as specific default clauses, notification requirements to HUD, and limitations on assumptions.

- Borrower Acknowledgment of HUD 184 Program: A document where the borrower explicitly acknowledges their understanding of the HUD 184 program’s terms, benefits, and responsibilities.

- Native American Status Verification: Documentation proving the borrower’s eligibility as an enrolled member of a federally recognized tribe or Alaska Native village. This might be collected earlier but is often re-verified at closing.

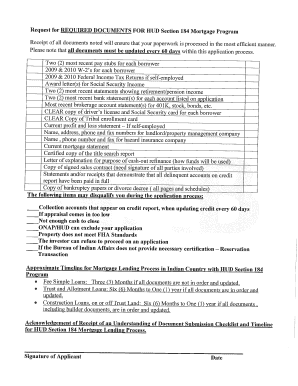

III. Financial and Identity Documents

- Proof of Funds for Closing: Bank statements or cashier’s checks verifying the source of the down payment and closing costs.

- Government-Issued Identification: Photo ID (driver’s license, passport) for identity verification.

- Final Loan Application: The completed and updated Uniform Residential Loan Application (Form 1003).

Advantages (Pros) of the HUD 184 Closing Document "Product"

Despite the volume, the comprehensive nature of these documents offers significant advantages:

- Consumer Protection and Transparency: The Closing Disclosure (CD) and other federal mandates (like TILA) ensure borrowers receive clear, standardized information about their loan terms and costs well in advance. This prevents last-minute surprises and empowers borrowers to make informed decisions.

- Program Integrity and Compliance: The HUD 184 specific documents ensure that the loan adheres to the unique requirements of the program. This safeguards both the borrower and the lender, ensuring eligibility is met and the federal guarantee is valid.

- Legal Enforceability and Security: Each document serves a specific legal purpose, ensuring the transaction is legally sound. The Promissory Note and Deed of Trust establish clear obligations and remedies, while title insurance protects against unforeseen claims, providing security for all parties.

- Tailored for Native American Homeownership: The inclusion of tribal resolutions, BIA approvals, and lease agreements directly addresses the complexities of lending on trust land. Without these specialized components, homeownership on tribal lands would be significantly more challenging or impossible through conventional means.

- Risk Mitigation for Lenders: The extensive documentation, particularly the HUD guarantee and title insurance, significantly reduces the risk for lenders. This encourages more financial institutions to participate in the HUD 184 program, increasing access to capital for Native American borrowers.

- Clarity on Responsibilities: By signing each document, borrowers explicitly acknowledge their responsibilities, from repayment terms to property maintenance, fostering a clear understanding of their homeownership commitment.

Disadvantages (Cons) of the HUD 184 Closing Document "Product"

While essential, the complexity of the closing documents can present challenges:

- Volume and Complexity: The sheer number of documents can be overwhelming. Each form has legal jargon and intricate details that can be difficult for the average borrower to fully comprehend without assistance.

- Time-Consuming Process: Preparing, reviewing, and executing all these documents takes time. Delays can occur if any document is incomplete, inaccurate, or requires additional approvals (especially with BIA involvement).

- Potential for Errors: With so many documents, the risk of clerical errors, misspellings, or incorrect figures increases. Even minor errors can cause significant delays and require re-drawing documents.

- Stress and Anxiety for Borrowers: The pressure of signing numerous legal documents, combined with the financial commitment of buying a home, can be a source of significant stress for borrowers, especially first-time homebuyers.

- Requirement for Specialized Knowledge: Lenders, title companies, and real estate agents involved in HUD 184 loans must possess specialized knowledge, particularly regarding tribal land issues and BIA procedures. A lack of this expertise can lead to errors and delays.

- Coordination Challenges on Trust Land: The need for tribal government approval and BIA sign-off adds layers of bureaucracy and coordination, potentially extending the closing timeline compared to fee-simple land transactions.

Purchase Recommendation: Navigating Your HUD 184 Closing Successfully

Considering the advantages and disadvantages, the "purchase" of a HUD 184 loan (and its accompanying document package) is a highly recommended and valuable product for eligible Native American and Alaska Native individuals seeking homeownership. However, successful navigation requires a strategic approach:

- Choose Experienced Professionals: This is perhaps the most critical recommendation. Work with a lender, real estate agent, and title company that have extensive experience with HUD 184 loans, particularly those involving trust land. Their expertise will be invaluable in anticipating issues and guiding you through the process.

- Start Early and Be Organized: Gather all required personal financial documents well in advance. Respond promptly to requests for information from your lender. Proactive communication can prevent last-minute rushes.

- Read Everything Carefully: While daunting, commit to reading through each document. Don’t just sign. Pay particular attention to the Promissory Note, Deed of Trust, and especially the Closing Disclosure. Verify all names, addresses, loan amounts, interest rates, and closing costs.

- Ask Questions, Ask More Questions: If you don’t understand a document or a specific clause, ask for clarification. Your lender, title agent, or housing counselor is there to explain it. Do not sign anything you don’t fully comprehend.

- Utilize Your Three-Day CD Review Period: The three-business-day waiting period for the Closing Disclosure is a critical consumer protection. Use this time to meticulously compare the CD to your Loan Estimate and understand every line item. If there are significant discrepancies, question them immediately.

- Understand the Tribal/BIA Process: If you are buying on trust land, gain a clear understanding of the specific requirements and timelines for tribal approval and BIA processing. This can be the most variable and time-intensive part of the closing.

- Consider Housing Counseling: HUD-approved housing counselors can provide free or low-cost guidance throughout the homebuying process, including understanding closing documents.

Conclusion

The HUD 184 loan closing document requirements, while extensive, represent a robust and meticulously designed "product" that facilitates homeownership for Native American and Alaska Native communities. Its blend of standard mortgage regulations and specialized provisions for tribal lands ensures both consumer protection and program integrity.

While the volume and complexity can be a disadvantage, the inherent value of these documents lies in their ability to secure a legally sound transaction, protect all parties involved, and ultimately make the dream of homeownership a reality in a culturally and legally appropriate manner. By approaching the closing with preparation, diligence, and the support of experienced professionals, borrowers can successfully navigate this final frontier and unlock the doors to their new home, thanks to the unique and vital HUD 184 program.