Unlocking Homeownership: A Deep Dive into HUD 184 Loan Debt-to-Income Ratio Limits

The dream of homeownership is a cornerstone of the American ideal, representing stability, wealth building, and a place to call one’s own. However, for many, particularly within Native American and Alaska Native communities, traditional lending avenues can present significant barriers. Enter the HUD Section 184 Indian Home Loan Guarantee Program – a vital initiative designed to make this dream a reality. This comprehensive review will delve into a critical aspect of qualifying for a HUD 184 loan: the Debt-to-Income (DTI) ratio limits. We will explore what these limits entail, dissect the program’s strengths and weaknesses in this regard, and ultimately provide actionable recommendations for prospective homebuyers.

Understanding the HUD Section 184 Indian Home Loan Guarantee Program

Before we scrutinize DTI, it’s essential to grasp the core purpose and structure of the HUD 184 loan program. Established by the Department of Housing and Urban Development (HUD), this program is specifically designed to provide mortgage financing opportunities for eligible Native American and Alaska Native individuals, families, and Tribal governments. It aims to address the unique challenges faced by these communities, including limited access to conventional credit and the complexities of financing homes on trust land or in Native communities.

Key features of the HUD 184 loan include:

- Low Down Payment: Often as low as 2.25% for loans over $50,000, and 1.25% for loans under $50,000.

- Flexible Credit Requirements: While creditworthiness is still assessed, the program can be more forgiving than conventional loans.

- Fixed Interest Rates: Provides stability and predictability in monthly payments.

- Property Eligibility: Can be used to purchase, construct, or rehabilitate homes on and off trust land, reservations, and in approved Native communities.

- Mortgage Insurance Premium (MIP): A one-time upfront MIP and an annual MIP are required, similar to FHA loans, but often at lower rates.

The HUD 184 loan is not a direct loan from the government but rather a loan guaranteed by HUD, which reduces risk for approved lenders and encourages them to offer more favorable terms to eligible borrowers.

The Crucial Role of Debt-to-Income Ratio (DTI)

At the heart of any mortgage qualification process is the Debt-to-Income (DTI) ratio. This metric is a key indicator of a borrower’s ability to manage monthly payments and repay debt. Lenders use DTI to assess risk and determine how much money a borrower can realistically afford to borrow.

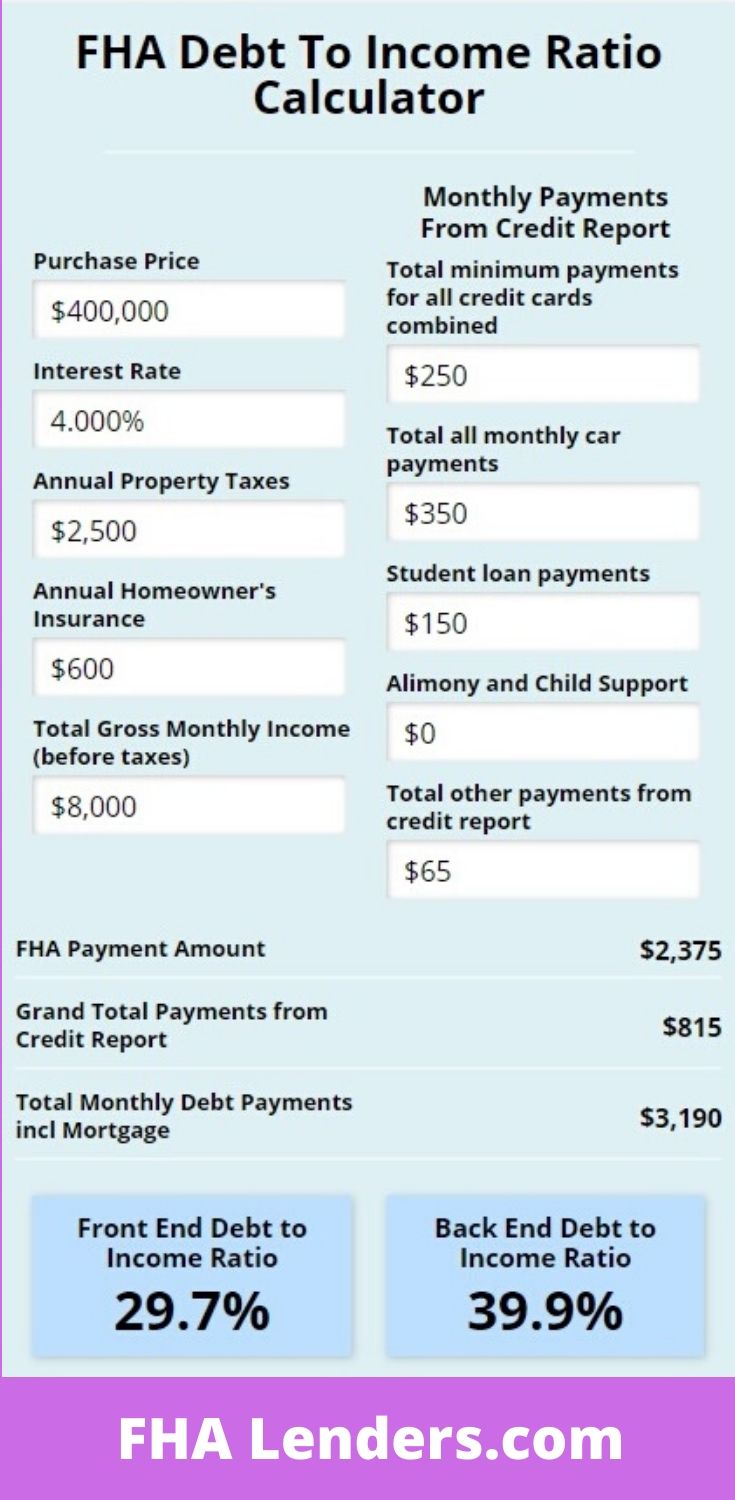

DTI is generally calculated in two ways:

-

Front-End DTI (Housing Ratio): This ratio compares your proposed monthly housing expenses (mortgage principal and interest, property taxes, homeowner’s insurance, and any HOA fees) to your gross monthly income. For example, if your total housing costs are $1,500 and your gross monthly income is $5,000, your front-end DTI is 30% ($1,500 / $5,000).

-

Back-End DTI (Total Debt Ratio): This ratio is more comprehensive. It includes your proposed monthly housing expenses plus all other recurring monthly debt payments, such as car loans, student loans, credit card minimum payments, and other installment debts. This total is then compared to your gross monthly income. Using the previous example, if your housing costs are $1,500 and your other debts total $500, your total monthly debt payments are $2,000. Against a $5,000 gross monthly income, your back-end DTI is 40% ($2,000 / $5,000).

Generally, a lower DTI indicates less risk to lenders, as it suggests you have more disposable income to cover your financial obligations.

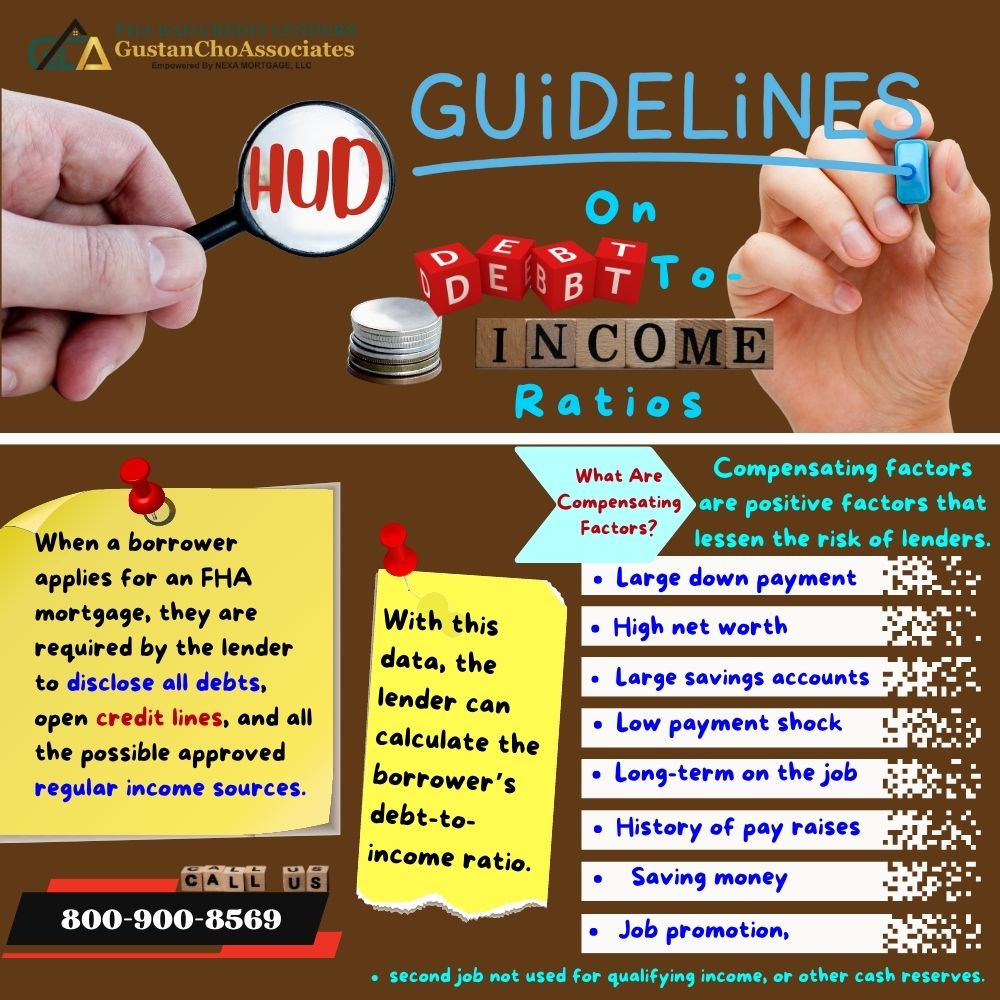

HUD 184 Loan DTI Limits: The Specifics

Like most government-backed loan programs, HUD 184 loans have specific guidelines for DTI ratios. While the program offers flexibility in other areas, DTI limits are still a significant hurdle for many.

Typical DTI Limits for HUD 184 Loans:

- Front-End DTI: Generally, the maximum front-end DTI for a HUD 184 loan is 31%. This means your projected monthly housing costs should not exceed 31% of your gross monthly income.

- Back-End DTI: The maximum back-end DTI is typically 43%. This implies that your total monthly debt obligations, including housing and all other recurring debts, should not exceed 43% of your gross monthly income.

Important Nuances and Compensating Factors:

It’s crucial to understand that these limits are not always rigid, especially with government-backed loans. Lenders may consider "compensating factors" that could allow for slightly higher DTI ratios, often up to around 45% or even 48% in some cases, although this is less common for the front-end ratio. These factors demonstrate a borrower’s ability to manage finances despite a higher DTI and might include:

- Excellent Credit Score: A strong credit history and high credit score (e.g., above 680-700) signal responsible financial behavior.

- Significant Cash Reserves: Having several months’ worth of mortgage payments in savings provides a safety net.

- Low Loan-to-Value (LTV) Ratio: A larger down payment reduces the loan amount and the lender’s risk.

- Stable Employment History: A long tenure with the same employer or in the same industry indicates reliable income.

- Minimal Payment Shock: If your new housing payment is not significantly higher than your previous rent payment, it can be a positive factor.

- Non-Occupant Co-Borrowers: Sometimes, adding a qualified co-borrower can help meet DTI requirements, though this is less common for HUD 184 specific eligibility.

Lenders utilize automated underwriting systems (AUS) to process applications, which often consider these factors. However, some loans may undergo manual underwriting, where a human underwriter has more discretion to evaluate the overall financial picture.

The Advantages of HUD 184 for DTI Management (Pros)

When evaluating the HUD 184 loan program through the lens of DTI, several advantages emerge that make it a uniquely beneficial "product" for its target demographic:

-

Access to Homeownership for Underserved Communities: The primary advantage isn’t DTI flexibility itself, but the program’s existence. Without HUD 184, many Native Americans and Alaska Natives might struggle to find any financing at all, regardless of their DTI, due to unique property ownership structures (e.g., trust land) or a lack of conventional lenders in their areas. By providing a guaranteed loan, HUD 184 opens doors where others are closed.

-

Potential for More Flexible Underwriting with Compensating Factors: While the stated DTI limits are similar to FHA, HUD 184 lenders often have a deep understanding of the unique financial situations within Native communities. This specialized knowledge, coupled with the allowance for compensating factors, can mean that a borrower with a slightly higher DTI might still qualify if they present a strong overall financial picture (e.g., excellent credit, substantial savings). This can be a lifeline for those who might be marginally above the DTI limits for other programs.

-

Predictable Fixed Rates: The fixed interest rates offered by HUD 184 loans contribute significantly to DTI stability. Borrowers can budget effectively without fear of fluctuating payments, making it easier to manage their overall debt and maintain their DTI over time. This predictability is a major "feature" that helps borrowers stay within their DTI comfort zone.

-

Lower Down Payment Reduces Initial Financial Strain: The low down payment requirement (as little as 1.25% or 2.25%) means borrowers don’t need to tie up a large sum of cash upfront. This can free up funds that might otherwise be used for a down payment, potentially allowing borrowers to pay down existing debts, thus improving their DTI before applying, or maintain a stronger cash reserve, which serves as a compensating factor.

-

Focus on Financial Education and Counseling: Many organizations and lenders involved with HUD 184 loans offer or recommend homeownership counseling. This education can empower borrowers to better understand and manage their finances, including strategies for reducing debt and improving their DTI, leading to more sustainable homeownership.

The Challenges and Considerations (Cons)

Despite its many benefits, the HUD 184 loan program, particularly concerning DTI, does present certain challenges:

-

Strict DTI Limits Can Still Be a Barrier: While there’s some flexibility, the 31%/43% DTI limits are still relatively stringent. Many individuals, particularly those with student loan debt, car payments, or credit card balances, can find themselves exceeding these thresholds, even with a stable income. This can be frustrating for eligible borrowers who otherwise meet the program’s criteria.

-

Fewer Participating Lenders: Compared to conventional or FHA loans, there are fewer lenders approved to originate HUD 184 loans. This limited pool can restrict a borrower’s options for shopping around for the best terms or finding a lender willing to be more flexible with compensating factors. This lack of competition can sometimes lead to less individualized attention to unique DTI situations.

-

Complexities with Property Appraisal on Trust Land: While not directly a DTI issue, the unique nature of financing homes on trust land or in Tribal areas can lead to extended appraisal processes and potential delays. These delays can sometimes mean that a borrower’s financial situation (and thus their DTI) could change between application and closing, potentially jeopardizing the loan if new debts are incurred or income changes.

-

Mandatory Mortgage Insurance Premiums (MIP): Although the MIP rates for HUD 184 are often lower than FHA, they still add to the monthly housing expense, which directly impacts the front-end DTI. This additional cost can push some borrowers closer to or over the DTI limit, making qualification more challenging.

-

Program Specificity and Eligibility: The HUD 184 program is highly specialized, available only to eligible Native Americans and Alaska Natives. While this is its strength, it also means it’s not a universal solution. For those who don’t qualify for HUD 184 but still face DTI challenges, alternative programs might be less accommodating.

Navigating the DTI Landscape for HUD 184 Borrowers

Successfully securing a HUD 184 loan requires a proactive approach to managing your DTI. Here are key strategies:

-

Calculate Your DTI Early: Before even looking at homes, use an online DTI calculator or consult with a lender to get a realistic picture of your current ratios. This allows you to identify potential issues and address them proactively.

-

Reduce Existing Debt: This is the most impactful strategy. Focus on paying down credit card balances (especially high-interest ones), student loans, or car loans. Even small reductions in monthly minimum payments can significantly improve your DTI. Avoid taking on new debt during the loan application process.

-

Increase Your Income (If Possible): While not always feasible, exploring options like a second job, a raise, or a promotion can increase your gross monthly income, thereby lowering your DTI ratios.

-

Understand Compensating Factors: If your DTI is slightly above the threshold, discuss your compensating factors with a HUD 184 lender. Highlight your strong credit history, significant savings, or stable employment.

-

Work with a Specialized Lender: Seek out lenders with extensive experience in HUD 184 loans. They will have a deeper understanding of the program’s nuances, including how to best present your financial profile and navigate DTI requirements effectively.

-

Pre-Approval is Key: Obtain a pre-approval letter from a HUD 184 lender. This not only gives you a clear budget but also signals to sellers that you are a serious and qualified buyer, having already cleared the initial DTI hurdle.

Purchase Recommendations

Based on this comprehensive review, here are specific recommendations for prospective homebuyers considering a HUD 184 loan:

For Whom is the HUD 184 Loan Ideal?

- Eligible Native American and Alaska Native Individuals/Families: This is the foundational requirement. If you meet the eligibility criteria, this program is designed for you.

- Those Seeking Low Down Payment Options: If saving a large down payment is a barrier, the HUD 184’s low requirements are a significant advantage.

- Borrowers on Trust Land or in Native Communities: The program’s ability to finance homes in these unique property settings is unparalleled.

- Individuals with Good but Not Perfect Credit: While DTI is crucial, the program can be more forgiving on credit scores than conventional loans, making it accessible to a broader range of borrowers.

When to Pursue a HUD 184 Loan:

- When Your DTI is Within (or Close to) the 31%/43% Limits: Prioritize getting your financial house in order. If your DTI is significantly higher, dedicate time to debt reduction before applying.

- When You Have Stable Employment and Income: Consistent income is vital for DTI calculations and demonstrates your ability to make payments.

- When You Have Some Savings: While the down payment is low, having cash reserves acts as a strong compensating factor and provides financial security.

What to Look For and Prioritize:

- Specialized HUD 184 Lenders: This cannot be stressed enough. A lender with deep expertise in the program will be your most valuable asset.

- Homeownership Counseling: Seek out HUD-approved housing counseling agencies. They can provide invaluable guidance on financial preparedness, DTI management, and the homebuying process.

- Thorough Property Inspection: Ensure the property you choose meets HUD’s minimum property standards, as this can affect the appraisal and loan approval.

- Long-Term Financial Planning: Don’t just focus on qualifying. Consider how the new mortgage payment will fit into your overall budget and long-term financial goals.

Recommendation Summary:

The HUD Section 184 Indian Home Loan Guarantee Program is an exceptionally valuable "product" for its intended beneficiaries, offering a crucial pathway to homeownership. While its Debt-to-Income ratio limits (typically 31%/43%) are a significant qualification factor, the program’s inherent flexibilities, lower down payment, and fixed rates provide substantial advantages. For eligible individuals, it is a highly recommended option, provided they proactively manage their debt, understand the DTI requirements, and work with experienced lenders. By approaching the process with financial diligence and informed decision-making, the dream of homeownership through HUD 184 can become a tangible reality.