Navigating the Landscape: A Comprehensive Review of the HUD Section 184 Indian Home Loan Program – States, Benefits, Drawbacks, and Recommendations

Homeownership stands as a cornerstone of the American dream, representing not just a financial asset but also stability, community roots, and generational wealth. For many Native American and Alaska Native families, however, the path to homeownership has historically been fraught with unique challenges, including access to conventional financing on tribal lands, complex property ownership structures, and often, lower average incomes. Recognizing these systemic barriers, the U.S. Department of Housing and Urban Development (HUD) established the Section 184 Indian Home Loan Guarantee Program.

This comprehensive review will delve into the intricacies of the Section 184 program, addressing the crucial question of which states offer these loans, exploring its myriad advantages and potential disadvantages, and ultimately providing a recommendation for prospective homebuyers. Designed to empower Native American and Alaska Native families, the Section 184 loan is a vital tool for fostering homeownership and economic development within tribal communities across the nation.

Understanding the HUD Section 184 Loan Program

Before discussing its geographical reach, it’s essential to understand what the Section 184 program entails. Launched in 1992, the Section 184 Indian Home Loan Guarantee Program is specifically designed to increase homeownership and access to capital for eligible Native American and Alaska Native individuals, families, and tribal housing authorities. It is not a direct loan from HUD; rather, HUD guarantees loans made by private lenders (such as banks, credit unions, and mortgage companies) to eligible borrowers. This guarantee protects lenders from loss in case of borrower default, significantly reducing their risk and encouraging them to lend in areas and to populations they might otherwise overlook.

The program aims to address the unique housing circumstances in Indian Country, including trust land, restricted fee land, and the complexities of tribal legal systems. It can be used for various purposes:

- Purchasing an existing home.

- Constructing a new home.

- Rehabilitating a home.

- Refinancing an existing mortgage.

- Purchasing and rehabilitating a home.

- Purchasing a manufactured home (permanently affixed to a foundation).

What States Offer HUD Section 184 Loans?

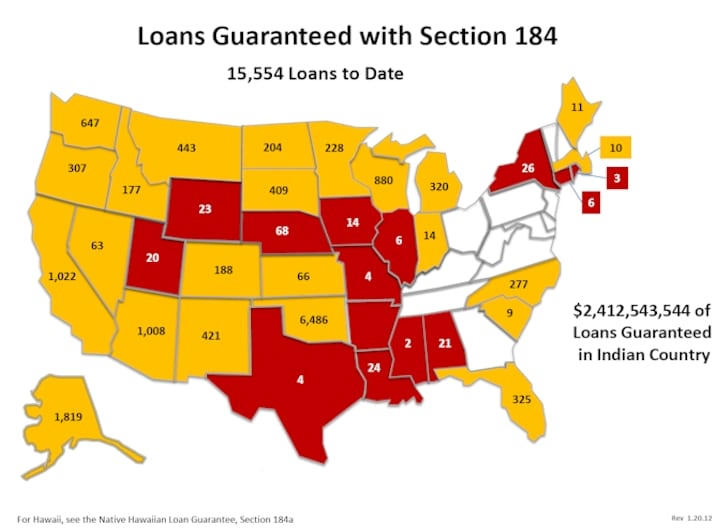

The question "What states offer HUD Section 184 loans?" often leads to a common misconception. It’s not about which states explicitly "offer" the loan in the way a state might run a specific housing program. Instead, the Section 184 program is a federal initiative, and its availability is tied to the presence of federally recognized Native American tribes and their designated lands or approved areas within those states.

The most accurate answer is: The HUD Section 184 loan program is available in any U.S. state where there is a federally recognized Native American tribe and their lands (including reservations, tribal trust lands, or approved Indian or Alaska Native Areas).

This means the program has a national reach, covering a significant portion of the United States. While certain states have a larger number of tribal nations and thus a higher volume of Section 184 activity, the program is not geographically limited to a select few.

Key states with substantial tribal populations and active Section 184 lending include, but are not limited to:

- Arizona: Home to numerous Navajo Nation, Hopi, Tohono O’odham, and Apache communities, among others.

- Oklahoma: Unique for its historical "Indian Territory" status and the presence of over 38 federally recognized tribes.

- New Mexico: With large Navajo, Pueblo, and Apache communities.

- California: Despite common misconceptions, California has the highest number of federally recognized tribes in the U.S., many with land bases.

- Alaska: Crucial for Alaska Native Villages and regional corporations.

- Washington: Home to many Coast Salish and other tribes.

- Montana: With large Blackfeet, Crow, and Northern Cheyenne reservations.

- North Dakota & South Dakota: Essential for the Lakota, Dakota, and other Plains tribes.

- Minnesota & Wisconsin: With significant Ojibwe and Ho-Chunk populations.

- Michigan: Home to various Anishinaabe (Ojibwe, Odawa, Potawatomi) tribes.

- Florida: With the Seminole and Miccosukee tribes.

- North Carolina: Home to the Eastern Band of Cherokee Indians.

- New York: With the Seneca, Mohawk, Oneida, and other Iroquois nations.

It’s crucial to understand that even if a state doesn’t appear on a "top list," if it contains federally recognized tribal lands or designated "Indian Areas," the Section 184 program can be utilized there. The defining factor is the borrower’s eligibility (being an enrolled member of a federally recognized tribe) and the property’s location within an eligible area as defined by HUD. These areas include:

- Indian Reservations

- Tribal Trust Lands

- Dependent Indian Communities

- Approved Indian or Alaska Native Areas (which can include off-reservation land near tribal areas, as approved by HUD).

The key takeaway is that the program’s availability is widespread, contingent on tribal presence rather than state-specific legislation. However, finding a lender experienced in Section 184 loans, especially those familiar with the specific tribal land leasing and legal structures in a particular region, is paramount.

Advantages (Pros) of the HUD Section 184 Loan

The Section 184 program offers several significant benefits that make it an attractive option for eligible borrowers:

- Low Down Payment: One of the most compelling features is the low down payment requirement. For loans over $50,000, only a 1.25% down payment is required. For loans $50,000 or less, it’s an even lower 2.25%. This significantly reduces the initial financial barrier to homeownership, making it accessible to more families.

- Flexible Credit Underwriting: Unlike conventional loans that often demand pristine credit scores, Section 184 offers more flexible underwriting guidelines. While a good credit history is still beneficial, the program considers a broader range of factors, including alternative credit histories, to assess a borrower’s ability to repay. This flexibility is crucial for individuals who may not have extensive credit histories or who have faced past financial challenges.

- No Monthly Private Mortgage Insurance (PMI): Instead of monthly PMI, which is common with conventional loans requiring less than a 20% down payment, Section 184 only charges a one-time upfront Guarantee Fee of 1% of the loan amount. This fee can often be financed into the loan, reducing out-of-pocket costs and lowering the monthly mortgage payment compared to loans with recurring PMI.

- Competitive Interest Rates: Because the loans are federally guaranteed, lenders face less risk, often translating into competitive interest rates for borrowers. These rates are typically fixed for the life of the loan, providing stability and predictability in monthly payments.

- Versatile Use: The program’s flexibility extends to its uses. Whether you want to buy an existing home, build a new one from scratch, rehabilitate an older property, or refinance, Section 184 can accommodate various housing needs. It also covers manufactured homes, which are a common housing solution in many rural and tribal areas.

- No Income Limits: Unlike some other government-backed programs, the Section 184 loan does not impose income limits on borrowers. This means higher-income eligible individuals are not excluded from benefiting from the program’s advantages.

- Ability to Combine with Down Payment Assistance (DPA) Programs: Borrowers can often combine Section 184 loans with down payment assistance programs offered by states, tribes, or non-profit organizations, further reducing their out-of-pocket expenses at closing.

- Support for Tribal Sovereignty and Economic Development: By facilitating homeownership on tribal lands, the program indirectly supports tribal sovereignty, strengthens tribal economies, and contributes to the overall well-being and stability of Native American communities.

- Streamlined Process for Trust Lands: The program is specifically designed to navigate the complexities of lending on trust land, offering a streamlined process that acknowledges tribal leasehold agreements and property laws, which can be a significant barrier for conventional lenders.

Disadvantages (Cons) of the HUD Section 184 Loan

While highly beneficial, the Section 184 program does come with certain limitations and potential drawbacks:

- Eligibility Restrictions: The most significant limitation is its exclusivity. The program is only available to enrolled members of federally recognized Native American tribes or Alaska Native Villages. Non-Native individuals, even if married to an eligible member, cannot be the primary borrower.

- Property Location Restrictions: The property being purchased must be located within an eligible "Indian Area" as defined by HUD. This includes reservations, tribal trust lands, and other approved areas. This means an eligible borrower cannot use a Section 184 loan to purchase a home in a non-tribal, non-approved area far from any tribal lands, even if they are an enrolled tribal member.

- Limited Lender Availability: While the program is nationwide, not all mortgage lenders are approved by HUD to offer Section 184 loans, nor do all approved lenders have extensive experience with the program. This can make finding a knowledgeable lender challenging in some areas, potentially leading to longer processing times or less efficient service.

- Upfront Guarantee Fee: Although there’s no monthly PMI, the 1% upfront Guarantee Fee, even if financed into the loan, adds to the total loan amount and interest paid over the life of the loan.

- Property Standards: Like other FHA-insured loans, homes financed with Section 184 loans must meet HUD’s Minimum Property Standards (MPS). This can sometimes lead to additional repair requirements before closing, particularly for older or rural properties.

- Potential for Slower Processing: Due to the specialized nature of the program, the need for tribal approvals (e.g., ground leases on trust land), and HUD’s oversight, the loan process can sometimes be longer than for conventional loans, especially if the lender is inexperienced.

- Not for Investment Properties: The Section 184 loan is strictly for owner-occupied primary residences. It cannot be used to purchase investment properties, second homes, or vacation homes.

- Appraisal Challenges on Trust Land: Appraising homes on trust land can sometimes be more complex due to unique market conditions, limited comparable sales, and the distinct nature of property ownership (leasehold vs. fee simple).

Is the HUD Section 184 Loan Right for You? (Purchase Recommendation)

The HUD Section 184 loan program is an invaluable resource, but its suitability depends on individual circumstances.

Who Should Strongly Consider a Section 184 Loan:

- Eligible Native American and Alaska Native individuals and families who are enrolled members of federally recognized tribes.

- Those looking to purchase, build, or rehabilitate a home within "Indian Country" or an approved Indian Area.

- First-time homebuyers who may not have a substantial down payment saved.

- Individuals with a less-than-perfect credit history but a stable income and a demonstrated ability to manage finances.

- Anyone seeking competitive, fixed interest rates and avoiding recurring monthly PMI.

- Families interested in building or buying a home on tribal trust land, where conventional financing is often difficult or impossible.

- Borrowers who can benefit from the financial counseling and support often provided in conjunction with these loans.

Who Might Reconsider or Explore Alternatives:

- Individuals who are not enrolled members of federally recognized tribes. This is the fundamental eligibility requirement.

- Those looking to purchase a home far outside of any eligible Indian Area where the program cannot be utilized.

- Borrowers with excellent credit and a substantial down payment (20% or more) who might qualify for very favorable terms on a conventional loan without any federal guarantees or fees.

- Individuals seeking to purchase an investment property or a second home.

- Those in a situation requiring an extremely rapid closing, as the specialized nature of Section 184 can sometimes lead to longer processing times (though this varies greatly by lender).

Purchase Recommendation:

For eligible Native American and Alaska Native families seeking homeownership within their communities, the HUD Section 184 loan program is highly recommended. Its benefits – particularly the low down payment, flexible underwriting, lack of monthly PMI, and its ability to navigate tribal land complexities – directly address many of the historical barriers to homeownership for this population.

Key Recommendation Steps:

- Verify Eligibility: Confirm your enrollment with a federally recognized tribe.

- Find an Experienced Lender: Seek out HUD-approved lenders who have significant experience specifically with Section 184 loans and are familiar with the tribal land laws in your desired area. An experienced lender can make a significant difference in the smoothness and speed of the process.

- Understand Tribal Requirements: If purchasing or building on tribal land, understand the specific tribal housing codes, leasehold agreements, and any other unique requirements of that particular tribe.

- Utilize Resources: Connect with your tribal housing authority, HUD’s Office of Native American Programs (ONAP), and HUD-approved housing counseling agencies for guidance and support.

In conclusion, the HUD Section 184 Indian Home Loan Guarantee Program is a powerful and essential tool, available across a vast landscape of states wherever federally recognized tribes reside. It is a testament to HUD’s commitment to supporting Native American and Alaska Native self-determination and economic prosperity by making the dream of homeownership a tangible reality for countless families. For those who meet the eligibility criteria, exploring this program is not just a financial decision, but often a step towards strengthening community, culture, and future generations.