HUD Section 184 Loans: Unpacking Income Limits, Benefits, Challenges, and Recommendations for Native American Homeownership

Homeownership is a cornerstone of the American Dream, offering stability, wealth building, and a sense of belonging. However, for many Native American and Alaska Native individuals and families, achieving this dream has historically been fraught with unique challenges, including complex land tenure systems, limited access to traditional financial services, and the legacy of systemic inequities.

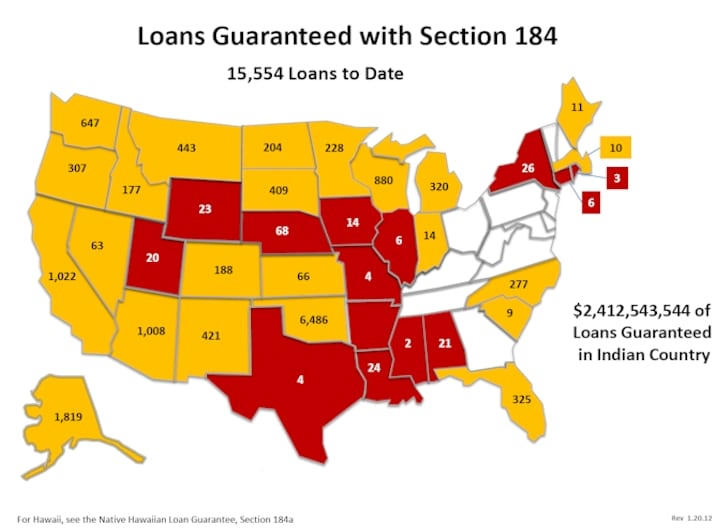

Enter the HUD Section 184 Indian Home Loan Guarantee Program. Established in 1992, this vital program is designed specifically to help Native American and Alaska Native families and Tribal entities purchase, construct, or rehabilitate homes, or refinance existing mortgages, both on and off trust land. Unlike many conventional loan products, Section 184 is tailored to the specific needs and circumstances of Native communities, offering flexible underwriting, competitive interest rates, and a unique government guarantee.

This article will delve into the intricacies of HUD Section 184 loans, with a particular focus on the often-misunderstood concept of "income limits." We will explore the program’s numerous advantages, candidly discuss its potential drawbacks, and conclude with practical recommendations for those considering this powerful homeownership tool.

Understanding the HUD Section 184 Program

At its core, the Section 184 program is a mortgage loan guarantee initiative. This means that the U.S. Department of Housing and Urban Development (HUD) guarantees the loan made by a private lender (such as a bank or mortgage company) to an eligible Native American or Alaska Native borrower. This guarantee reduces the risk for lenders, encouraging them to provide financing in areas or to borrowers they might otherwise deem too high-risk.

Key Features of Section 184 Loans:

- Target Audience: Federally recognized Native American Tribal members, Alaska Natives, or Tribal Housing Entities.

- Purpose: Purchase an existing home, construct a new home, rehabilitate an existing home, or refinance an existing mortgage.

- Location: Available on and off trust lands, within areas determined by HUD to be eligible for the program.

- Lender Network: Loans are originated by private lenders approved by HUD.

- Guarantee: HUD guarantees 100% of the loan to the lender, providing security.

The Nuance of Income Limits in Section 184

One of the most common misconceptions surrounding HUD programs is the automatic assumption of strict income limits. While many HUD-backed initiatives, such as Section 8 housing vouchers or Low-Income Housing Tax Credit (LIHTC) properties, are explicitly tied to Area Median Income (AMI) thresholds, the Section 184 program operates differently.

Unlike many other HUD programs, the Section 184 program does NOT impose specific, hard-and-fast income limits on individual borrowers. This is a critical distinction. The program’s primary goal is not to provide housing subsidies for low-income individuals (though it certainly can serve them), but rather to provide access to credit and make homeownership achievable for eligible Native Americans and Alaska Natives across a broader income spectrum.

Instead of fixed income caps, the eligibility for a Section 184 loan hinges on a borrower’s ability to repay the mortgage. Lenders assess this ability through standard underwriting criteria, including:

- Debt-to-Income (DTI) Ratio: This ratio compares a borrower’s total monthly debt payments to their gross monthly income. While Section 184 offers more flexibility than conventional loans, lenders still need to ensure the borrower can comfortably afford the monthly mortgage payments alongside other financial obligations.

- Credit History: Lenders review a borrower’s credit report to gauge their financial responsibility. Section 184 is often more forgiving of past credit issues than conventional loans, sometimes allowing for alternative credit histories (e.g., utility payments, rent payments) where traditional credit scores are low or non-existent.

- Stable Employment/Income: Borrowers must demonstrate a stable and reliable source of income. This can include traditional wages, self-employment income, seasonal income specific to tribal economies, or even tribal dividends, often with more flexible documentation requirements than conventional loans.

- Loan Limits: While there are no income limits, there are loan limits. These are the maximum loan amounts permitted under the program, which are typically tied to FHA loan limits for the specific county where the property is located. These limits are updated annually and vary by geographical area, reflecting the median home prices in those regions. Therefore, while a high-income earner might qualify, they can only borrow up to the county’s established loan limit for a Section 184 mortgage.

The absence of explicit income limits means that a Section 184 loan can be a viable option for a wide range of income levels, from those just starting their careers to established professionals, as long as they meet the lending criteria and the property falls within the loan limits. The focus is on financial readiness and eligibility as a Native American or Alaska Native, not on being below a certain income threshold.

Advantages (Pros) of HUD Section 184 Loans

The Section 184 program offers several compelling benefits that set it apart from other mortgage products:

- Low Down Payment Requirements: This is a significant advantage. For loan amounts over $50,000, only a 2.25% down payment is required. For loans $50,000 or less, the down payment is an even lower 1.25%. This makes homeownership much more accessible for many families.

- Flexible Underwriting: Section 184 lenders are trained to understand the unique financial situations of Native American communities. This includes considering non-traditional income sources (like tribal dividends or seasonal income) and offering more lenient credit score requirements or alternative credit history evaluations.

- Competitive Interest Rates: Because the loans are guaranteed by HUD, lenders perceive less risk, often resulting in more favorable and competitive interest rates for borrowers compared to conventional mortgages.

- No Monthly Mortgage Insurance (MI) on Trust Land: For homes located on Indian trust land, there is no annual mortgage insurance premium, leading to lower monthly payments. For homes on fee simple land, an annual mortgage insurance premium is required, similar to FHA loans, but it can be less expensive than private mortgage insurance (PMI) on conventional loans.

- Ability to Finance on Trust and Restricted Lands: This is perhaps the program’s most distinctive feature. Section 184 is specifically designed to navigate the complexities of lending on individually allotted or tribally owned trust lands, which are often difficult to finance with conventional mortgages due to unique land tenure laws.

- Lower Upfront Guarantee Fee: Section 184 requires a one-time upfront guarantee fee of 1% of the loan amount, which is often lower than the upfront mortgage insurance premium for FHA loans (typically 1.75%). This fee can also be financed into the loan.

- Financial Counseling and Support: Many lenders offering Section 184 loans are well-versed in Native American financial literacy and can provide valuable guidance throughout the homeownership process.

Disadvantages (Cons) & Challenges

While the benefits are substantial, potential borrowers should also be aware of the program’s limitations and challenges:

- Limited Lender Availability: Not all mortgage lenders offer Section 184 loans. Borrowers may need to seek out specialized lenders who are approved by HUD and have experience working with Native American communities and land tenure issues.

- Geographic and Eligibility Restrictions: The program is exclusively for eligible Native American and Alaska Native individuals and Tribal entities. Furthermore, the property must be located within an eligible area, typically on or near a reservation, or in specific counties with a significant Native American population.

- Complexities of Trust Land: While a key advantage, financing on trust land can also introduce complexities. It often requires additional tribal approvals, leases, and title status reports from the Bureau of Indian Affairs (BIA), which can extend the processing time.

- Property Eligibility: The home must meet HUD’s minimum property standards, and appraisals on trust land can be more challenging due to fewer comparable sales data.

- Misconception Regarding Income Limits: As discussed, the lack of explicit income limits can sometimes be a source of confusion. Some potential borrowers mistakenly believe they earn too much to qualify, while others might wrongly assume it’s a "free" or heavily subsidized program for only the lowest income earners, leading to misaligned expectations.

- Loan Limits Exist: While not income limits, the presence of county-specific loan limits means that very high-value properties may not be fully financeable through Section 184, regardless of the borrower’s income.

- Processing Times: Due to the unique requirements and the need for tribal and BIA approvals on trust land, Section 184 loans can sometimes take longer to process than conventional mortgages.

Who is Section 184 For? (Recommendations)

The HUD Section 184 program is an invaluable resource for:

- Eligible Native American and Alaska Native individuals and families who wish to achieve homeownership, whether it’s their first home or a subsequent one.

- Borrowers who may struggle to qualify for conventional financing due to unique land situations (trust land), non-traditional income sources, or less-than-perfect credit histories.

- Individuals seeking a low down payment option to make homeownership more affordable upfront.

- Those looking for competitive interest rates and potentially lower overall housing costs.

- Tribal Housing Entities looking to expand housing opportunities for their members.

Recommendations for Prospective Borrowers:

- Verify Eligibility: Ensure you are an enrolled member of a federally recognized tribe or an Alaska Native.

- Seek Specialized Lenders: Don’t just go to any bank. Find a mortgage lender specifically approved by HUD to offer Section 184 loans and, ideally, one with a strong track record and expertise in working with Native American communities and trust land.

- Understand Land Tenure: Be clear about whether you are buying on trust land (individually allotted or tribally owned) or fee simple land. This will impact the process and specific requirements.

- Prepare Your Finances: Even without strict income limits, lenders will assess your ability to repay. Work on improving your credit score, reducing debt, and maintaining stable employment. Gather documentation for all income sources, including non-traditional ones.

- Engage with Your Tribal Housing Department: Many tribes have housing departments or authorities that can provide valuable guidance, resources, and even financial assistance that can be paired with a Section 184 loan.

- Don’t Self-Disqualify Based on Income: If you are an eligible Native American or Alaska Native, do not assume you make "too much" or "too little" for a Section 184 loan without speaking to a qualified lender. The absence of explicit income limits means a wider range of financial situations can qualify.

- Utilize Financial Counseling: Take advantage of any available financial literacy and homeownership counseling services, which can help you navigate the process confidently.

Conclusion

The HUD Section 184 Indian Home Loan Guarantee Program stands as a testament to the commitment to fostering homeownership within Native American and Alaska Native communities. By providing a unique, flexible, and accessible pathway to owning a home, it addresses historical barriers and supports economic development.

The key takeaway regarding "income limits" is that they are not a direct barrier in the traditional sense. Instead, the program focuses on a borrower’s overall financial health and ability to repay, coupled with county-specific loan limits. For eligible individuals and families, Section 184 is not merely a loan product; it is a powerful tool for building generational wealth, strengthening communities, and realizing the dream of homeownership on one’s own terms. By understanding its nuances, leveraging its benefits, and proactively addressing potential challenges, Native Americans and Alaska Natives can unlock the doors to stable and secure housing through this invaluable program.