Homeownership Dreams: A Comprehensive Review of HUD 184 vs. FHA Loans for Native Americans

For many Native Americans, the dream of homeownership is deeply intertwined with family, community, and cultural heritage. Securing a safe, affordable, and stable home, whether on tribal lands or in urban areas, represents not just a financial asset but a cornerstone for future generations. However, the path to homeownership can be complex, often complicated by unique land tenure systems, varying economic conditions, and the need for specialized financial products.

Among the various mortgage options available, two stand out as particularly relevant for Native American borrowers: the HUD Section 184 Indian Home Loan Guarantee Program and the Federal Housing Administration (FHA) loan. While both are government-backed programs designed to make homeownership more accessible, they cater to different needs and offer distinct advantages and disadvantages. This comprehensive review will delve into the intricacies of HUD 184 and FHA loans, outlining their benefits and drawbacks, and ultimately providing a recommendation to help Native American families make an informed decision on their journey to homeownership.

Understanding the HUD Section 184 Indian Home Loan Guarantee Program

The HUD Section 184 program is a unique mortgage product specifically designed for enrolled members of federally recognized Native American tribes. Established under the Indian Housing Act of 1988, its primary goal is to increase homeownership and access to capital in Native American communities, both on and off reservations. HUD 184 loans are guaranteed by the Office of Native American Programs (ONAP), which means that if a borrower defaults, HUD reimburses the lender for a portion of the loss, reducing risk for financial institutions and encouraging them to lend to Native American borrowers.

Key Features of HUD 184 Loans:

- Eligibility: Must be an enrolled member of a federally recognized tribe.

- Property Location: Can be used to purchase a home on tribal trust land, individually allotted trust land, fee simple land, or in approved off-reservation areas within certain states.

- Loan Purpose: Purchase, refinance, rehabilitation, new construction, or even land acquisition in conjunction with home construction.

Advantages of HUD 184 Loans:

-

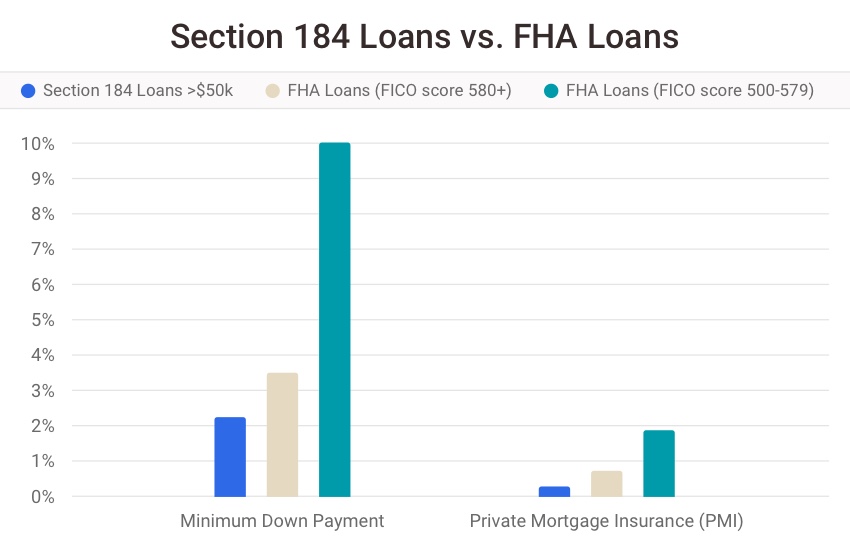

Lower Down Payment Requirements: One of the most significant benefits of the HUD 184 loan is its remarkably low down payment. For loans over $50,000, only a 2.25% down payment is required. For loans $50,000 or less, the down payment drops to an even more accessible 1.25%. This significantly reduces the upfront financial barrier to homeownership, making it attainable for many who might otherwise struggle to save for a larger down payment.

-

No Monthly Mortgage Insurance Premium (MIP): Unlike FHA loans, HUD 184 loans do not require monthly mortgage insurance. While there is a one-time upfront guarantee fee of 1.5% of the loan amount, this can be financed into the loan, meaning no out-of-pocket payment at closing for this fee. The absence of a recurring monthly mortgage insurance payment translates to lower monthly housing costs and substantial savings over the life of the loan.

-

Flexible Underwriting and Credit Requirements: HUD 184 loans are known for their more flexible underwriting guidelines compared to conventional loans, and often even FHA loans. Lenders are encouraged to consider non-traditional credit histories, such as rental payment history, utility bills, and other payment records, which can be particularly beneficial for individuals with limited or non-existent traditional credit scores. This flexibility acknowledges the unique financial realities that some Native American individuals may face.

-

Competitive Interest Rates: Despite the lower down payment and flexible underwriting, HUD 184 loans typically offer competitive, fixed interest rates, comparable to or even better than FHA or conventional rates. This ensures predictable monthly payments and long-term financial stability.

-

Understanding of Tribal Land Issues: Lenders approved to offer HUD 184 loans are generally more familiar with the complexities of tribal land tenure, including trust lands, leases, and tribal ordinances. This expertise can streamline the process for homes located on reservations, which often involve additional layers of approval from tribal governments.

-

No Loan Limits (within reason): While there isn’t a strict national loan limit like FHA, the maximum loan amount is determined by the FHA loan limits for the specific county in which the property is located. This provides significant flexibility for borrowers seeking homes in higher-cost areas.

Disadvantages of HUD 184 Loans:

-

Limited Availability: While the program serves all federally recognized tribes, not all states or counties have active HUD 184 approved lenders. Even within approved states, the number of participating lenders can be limited, potentially reducing options for borrowers.

-

Specific to Federally Recognized Tribes: Eligibility is strictly limited to enrolled members of federally recognized Native American tribes. Individuals who are not members, or members of non-federally recognized tribes, do not qualify.

-

Potentially Slower Processing Times: Due to the unique nature of tribal land transactions and the additional layer of HUD guarantee approval, the processing time for HUD 184 loans can sometimes be longer than for FHA or conventional loans. This is especially true for properties on tribal lands, which may require tribal lease agreements, title status reports, and other tribal governmental approvals.

-

Specialized Appraisal Requirements: Appraisals for properties on tribal lands can be more complex due to unique land valuations and the limited number of comparable sales data. This may require appraisers with specific expertise in valuing properties on trust or restricted lands, potentially extending the appraisal process.

-

Upfront Guarantee Fee: While there’s no monthly PMI, the upfront guarantee fee of 1.5% (though financable) still adds to the total loan amount, meaning borrowers pay interest on this fee over the life of the loan.

Understanding the FHA Loan Program

The Federal Housing Administration (FHA), a part of HUD, insures mortgages made by FHA-approved lenders. This insurance protects lenders against losses if a borrower defaults, encouraging them to offer loans to a wider range of borrowers, particularly those who might not qualify for conventional mortgages due to lower credit scores or smaller down payments. FHA loans are a popular choice for first-time homebuyers and those with less-than-perfect credit.

Key Features of FHA Loans:

- Eligibility: Open to any credit-qualified individual, regardless of tribal affiliation.

- Property Location: Can be used to purchase a home anywhere in the United States, provided it meets FHA property standards.

- Loan Purpose: Purchase, refinance, rehabilitation (e.g., FHA 203(k) loan).

Advantages of FHA Loans:

-

Low Down Payment: FHA loans require a minimum down payment of 3.5% of the purchase price for borrowers with a credit score of 580 or higher. For those with credit scores between 500 and 579, a 10% down payment is required. This low entry barrier is a major draw for many homebuyers.

-

Lenient Credit Score Requirements: FHA loans are known for their more forgiving credit score requirements compared to conventional loans. While a 580 FICO score is typically needed for the 3.5% down payment, lenders can sometimes approve borrowers with scores as low as 500 (with a 10% down payment), provided other financial factors are strong.

-

Nationwide Availability: FHA loans are widely available through thousands of FHA-approved lenders across all states and territories. This widespread accessibility means borrowers typically have many options when searching for a lender.

-

Assumable Mortgages: An FHA loan is assumable, meaning a buyer can take over the seller’s mortgage and its existing interest rate, which can be a significant advantage in a rising interest rate environment.

-

Fixed Interest Rates: FHA loans typically offer fixed interest rates, providing stability and predictability in monthly payments for the life of the loan.

Disadvantages of FHA Loans:

-

Mandatory Mortgage Insurance Premium (MIP): This is the most significant drawback of FHA loans. Borrowers are required to pay two types of MIP:

- Upfront Mortgage Insurance Premium (UFMIP): A one-time fee equal to 1.75% of the loan amount, which is typically financed into the loan.

- Annual Mortgage Insurance Premium (Annual MIP): An annual fee paid monthly, ranging from 0.45% to 1.05% of the loan amount, depending on the loan-to-value (LTV) ratio and loan term. For most FHA loans with a low down payment, this annual MIP is required for the entire life of the loan, regardless of how much equity the borrower builds. This significantly increases the total cost of the loan over time.

-

FHA Loan Limits: FHA loans have specific loan limits that vary by county and are updated annually. While these limits are generally sufficient for modest homes, they can restrict borrowers in high-cost housing markets.

-

Strict Property Condition Requirements: FHA loans have strict property standards designed to ensure the home is safe, sound, and secure. While this protects the borrower, it can also lead to delays or even denial if the property requires extensive repairs to meet FHA guidelines. This can be particularly challenging when purchasing older homes or properties that have not been well-maintained.

-

Less Flexible for Non-Traditional Credit: While more lenient than conventional loans, FHA still prefers traditional credit scores. It may be less flexible than HUD 184 in considering truly non-traditional credit histories.

-

No Specific Expertise for Tribal Land: While FHA loans can technically be used on tribal lands, lenders offering FHA loans may not have the specialized knowledge or experience with tribal land tenure systems that HUD 184 lenders possess. This can lead to additional hurdles or a lack of understanding regarding the unique legal and administrative processes involved.

Direct Comparison: HUD 184 vs. FHA for Native Americans

To facilitate a clearer understanding, let’s compare these two loan programs side-by-side, focusing on the most critical aspects for Native American borrowers:

| Feature | HUD Section 184 Indian Home Loan Guarantee Program | FHA Loan Program |

|---|---|---|

| Eligibility | Enrolled member of a federally recognized tribe | Any credit-qualified individual |

| Down Payment | 1.25% (loans ≤ $50K), 2.25% (loans > $50K) | 3.5% (FICO ≥ 580), 10% (FICO 500-579) |

| Mortgage Insurance | One-time 1.5% upfront guarantee fee (can be financed). NO monthly MIP. | 1.75% UFMIP (upfront), plus annual MIP (paid monthly) for life of loan (for low DP loans). |

| Credit Flexibility | Very flexible; considers non-traditional credit | Lenient but prefers traditional credit; less flexible than 184 for non-traditional. |

| Interest Rates | Competitive, fixed rates | Competitive, fixed rates |

| Property Location | Tribal trust land, fee simple land, approved off-reservation areas | Anywhere in the U.S. that meets FHA standards |

| Understanding Tribal Land | High; lenders are often specialized in tribal land transactions | Low; general real estate knowledge, less specific to tribal tenure |

| Processing Time | Potentially longer, especially on tribal lands due to approvals | Generally standard, can be faster |

| Loan Limits | Based on FHA county limits for the property location | Specific FHA county limits apply |

| Overall Cost | Lower long-term cost due to no monthly MIP | Higher long-term cost due to mandatory monthly MIP |

Key Considerations for Native American Borrowers

Choosing between a HUD 184 and an FHA loan involves more than just comparing interest rates. Native American borrowers should carefully consider their individual circumstances:

-

Tribal Affiliation: This is the most critical determining factor. If you are an enrolled member of a federally recognized tribe, you are eligible for the HUD 184 loan. If not, FHA (or conventional) is your primary government-backed option.

-

Property Location:

- On Tribal Trust Land: The HUD 184 loan is almost always the superior choice here. Its framework is built to navigate the unique legal and administrative structures of tribal lands, including leasing, title, and tribal government approvals. FHA loans, while technically possible, often face significant hurdles and a lack of lender expertise in this domain.

- Off-Reservation in an Approved Area: HUD 184 remains a strong contender due to its lower down payment and lack of monthly MIP.

- Off-Reservation in an Unapproved HUD 184 Area: If your desired home is in an area not covered by the HUD 184 program, an FHA loan becomes a viable and accessible option.

-

Credit History: If you have a limited or non-traditional credit history, the HUD 184’s flexibility in underwriting can be a game-changer. While FHA is more lenient than conventional, it still places more emphasis on traditional credit scores than HUD 184.

-

Long-Term Financial Planning: The absence of monthly mortgage insurance with HUD 184 can lead to significant savings over the life of the loan. While FHA’s annual MIP protects the lender, it adds a substantial recurring cost for the borrower, often for the entire loan term. Consider how this recurring cost impacts your long-term budget and ability to build equity.

-

Urgency of Purchase: If you need to close quickly, an FHA loan might offer a slightly faster path, especially if the property is straightforward and off-reservation. However, for tribal land purchases, the HUD 184 process, while potentially longer, is designed to successfully navigate those complexities.

-

Future Plans: If you anticipate staying in the home long-term, the savings from no monthly MIP with HUD 184 become even more pronounced. If you plan to move within a few years, the difference in total cost might be less dramatic, but still notable.

Purchase Recommendation

There is no one-size-fits-all answer, but based on the comprehensive analysis, here’s a recommendation:

Recommendation for HUD Section 184 Loan:

- Strongly Recommended If: You are an enrolled member of a federally recognized tribe, and your primary goal is to minimize long-term housing costs, you have a limited or non-traditional credit history, or you plan to purchase a home on tribal trust land. The unparalleled advantages of low down payment and, critically, no monthly mortgage insurance make it the superior choice in these scenarios. Even for off-reservation purchases in approved areas, the long-term savings are compelling.

Recommendation for FHA Loan:

- Recommended If: You are not an enrolled member of a federally recognized tribe (and thus not eligible for HUD 184), or if your desired property is located in an area not served by HUD 184 lenders. It is also a viable option if you need a widely available loan product with lenient credit requirements and a low down payment, and you are comfortable with the mandatory monthly mortgage insurance premium. If you anticipate refinancing into a conventional loan later to remove PMI, FHA can serve as an excellent stepping stone.

When to Consult a Professional:

Regardless of your initial leaning, it is imperative to consult with a mortgage lender specializing in both HUD 184 and FHA loans. An experienced loan officer can assess your specific financial situation, credit history, tribal affiliation, and desired property location to provide personalized guidance. They can help you compare precise interest rates, closing costs, and total long-term expenses for both options. Additionally, seek advice from tribal housing authorities or HUD’s Office of Native American Programs for resources specific to your community.

Conclusion

The journey to homeownership is a significant milestone, and for Native Americans, the HUD Section 184 and FHA loan programs offer distinct pathways to achieving this dream. While the FHA loan provides broad accessibility and flexible credit terms for the general public, the HUD Section 184 loan stands out as a powerful and uniquely tailored tool for enrolled members of federally recognized tribes. Its low down payment, lack of monthly mortgage insurance, and specialized understanding of tribal land issues often make it the more advantageous choice, particularly for those looking to build equity and stability within their communities.

By carefully weighing the advantages and disadvantages of each program against personal circumstances and long-term financial goals, Native American families can confidently choose the mortgage product that best serves their needs, laying a solid foundation for generations to come. The dream of homeownership is within reach, and with the right information and professional guidance, it can become a tangible reality.