A Deep Dive into State-Specific Native American Home Loan Assistance: An In-Depth Review

Homeownership has long been heralded as a cornerstone of the American Dream, a pathway to financial stability, generational wealth, and community building. Yet, for many Native Americans, this dream remains disproportionately out of reach, a legacy of historical injustices, economic disparities, and unique challenges related to land tenure and access to conventional financing. While federal programs like HUD Section 184 and VA Native American Direct Loans (NADL) address some of these hurdles, a lesser-known but equally vital "product" in the housing landscape is state-specific Native American home loan assistance.

This article provides an in-depth review of these state-level initiatives, analyzing their features, benefits, drawbacks, and offering a comprehensive recommendation for potential users. Viewing these programs through the lens of a "product review" allows us to dissect their utility, efficiency, and overall value proposition for Native American homebuyers.

Understanding the "Product": What is State-Specific Native American Home Loan Assistance?

Unlike direct federal loan programs, state-specific Native American home loan assistance is not a single, monolithic entity. Instead, it represents a diverse collection of initiatives, grants, down payment assistance programs, and partnerships enacted and funded at the individual state level. These programs are often designed to complement federal offerings or address gaps not fully covered by national policies, tailoring solutions to the unique demographics, tribal communities, and economic conditions within a particular state.

The "product" in question is not a standalone mortgage loan in most cases. Instead, it typically functions as an enhancement or supplement to existing mortgage options, whether federal (like Section 184 or NADL), conventional, or FHA/VA loans. These state-level initiatives might include:

- Down Payment Assistance (DPA): Often structured as grants or zero/low-interest deferred loans to help cover the upfront cost of a down payment, a significant barrier for many first-time homebuyers.

- Closing Cost Assistance: Financial aid to help cover the various fees associated with closing a mortgage, such as appraisal fees, title insurance, and loan origination fees.

- Reduced Interest Rate Programs: Some states partner with lenders to offer slightly lower interest rates to eligible Native American homebuyers, making monthly payments more affordable.

- Homebuyer Education and Counseling: Mandated or strongly encouraged courses designed to prepare homebuyers for the responsibilities of homeownership, financial management, and navigating the mortgage process.

- Property Rehabilitation Programs: Assistance for purchasing and renovating homes, particularly in rural or tribal areas where housing stock may be older or require significant repairs.

- Partnerships with Tribal Housing Authorities: State programs often collaborate directly with tribal governments or their housing authorities to administer funds, provide culturally relevant support, and address specific tribal housing needs.

The primary goal of these varied state-level "products" is to increase homeownership rates among Native Americans, foster economic development within tribal communities, and address historical inequities in housing access.

Features and Functionality: How These Programs Work

The operational mechanics of state-specific programs vary significantly by state. However, common threads include:

- Eligibility Criteria: Applicants are almost universally required to be enrolled members of a federally recognized Native American tribe. Beyond that, states typically impose income limits (often tied to Area Median Income – AMI), residency requirements (e.g., living or intending to live in the state, or within a specific tribal jurisdiction), and often first-time homebuyer status.

- Application Process: This usually involves applying through a participating lender, a state Housing Finance Agency (HFA), or a tribal housing authority. The process often requires extensive documentation, including tribal enrollment verification, income statements, and property details.

- Integration with Primary Mortgages: State assistance is rarely a standalone loan. It’s almost always layered on top of a primary mortgage (e.g., a HUD Section 184 loan, an FHA loan, or a conventional loan). This means applicants must qualify for the underlying mortgage first.

- Land Tenure Considerations: A critical feature, particularly for Native Americans, is how these programs address homes on trust land versus fee simple land. While many programs primarily target fee simple properties, some states have specific provisions or partnerships with tribes to facilitate homeownership on trust lands, navigating the unique legal and financial complexities involved.

- Funding Mechanisms: State programs are typically funded through state appropriations, bond issues, federal grants passed through to states (like HOME Investment Partnerships Program funds), or partnerships with private lenders. This funding can fluctuate annually, impacting program availability and scope.

The Pros: Advantages of This "Product"

When evaluating state-specific Native American home loan assistance, several compelling advantages emerge, making it a valuable tool for eligible individuals:

- Tailored Solutions for Specific Needs: Unlike federal programs that operate on a broad national scale, state initiatives can be meticulously crafted to address the unique economic realities, cultural contexts, and housing challenges prevalent within that particular state’s tribal communities. This can mean more relevant income limits, specific geographic targeting, or culturally sensitive homebuyer education.

- Enhanced Financial Accessibility: The most direct and impactful benefit is the provision of down payment and closing cost assistance. These upfront costs are often the biggest barriers to homeownership, especially for lower and moderate-income families. Grants or deferred loans can significantly reduce the cash needed at closing, making homeownership a tangible reality.

- Increased Homeownership Rates: By lowering financial hurdles, these programs directly contribute to a rise in Native American homeownership. This, in turn, fosters greater stability for families, improves educational outcomes for children, and strengthens tribal communities.

- Wealth Creation and Economic Empowerment: Homeownership is a primary driver of intergenerational wealth. By facilitating property acquisition, state programs help Native American families build equity, which can be leveraged for future investments, education, or retirement, slowly addressing historical economic disparities.

- Community Stability and Cultural Preservation: Many Native Americans seek to remain on or near ancestral lands. State programs, particularly those designed with tribal input, can help facilitate homeownership in these areas, strengthening tribal governance, maintaining cultural ties, and preventing outward migration due to lack of affordable housing.

- Fills Gaps in Federal Programs: While federal programs are vital, they don’t always meet every need. State assistance can complement these, providing additional layers of support that make a critical difference. For instance, a state DPA program could be paired with a HUD Section 184 loan to provide an even more comprehensive financial package.

- Local Expertise and Support: State HFAs and tribal housing authorities often possess deep local knowledge and established relationships within the community. This can translate into more personalized guidance, better understanding of local housing markets, and more effective navigation of the application process.

The Cons: Disadvantages and Challenges of This "Product"

Despite their significant advantages, state-specific Native American home loan assistance programs are not without their limitations and challenges:

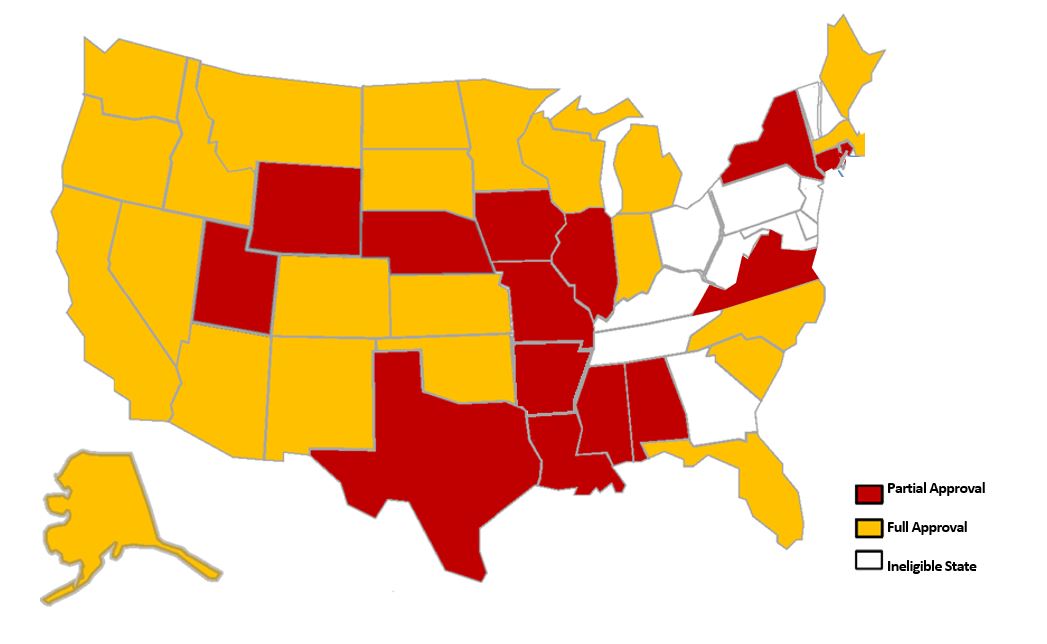

- Limited Geographic Availability and Inconsistency: This is perhaps the most significant drawback. These programs only exist in certain states, and even within those states, their availability can be limited to specific regions or tribal jurisdictions. Funding is often inconsistent, making programs susceptible to budget cuts or temporary suspensions, creating an unpredictable landscape for potential homebuyers.

- Complex and Varied Eligibility Requirements: While tailored solutions are a pro, the sheer variety of eligibility criteria across different states and even within different programs in the same state can be incredibly confusing. Navigating income limits, tribal enrollment verification, residency requirements, and specific property criteria requires diligent research and can be a significant hurdle.

- Funding Constraints and Sustainability: State budgets are often tight, and housing assistance can be among the first areas to see cuts during economic downturns. This reliance on fluctuating state appropriations makes the long-term sustainability and consistent availability of these programs a concern. It also means that even if a program exists, funds might run out quickly each year.

- Lack of Awareness and Outreach: Many eligible Native Americans are simply unaware that these state-specific programs exist. States often lack the robust marketing and outreach budgets of federal agencies, leading to missed opportunities for those who could benefit most. Information can be siloed, difficult to find, or not readily accessible in tribal communities.

- Bureaucratic Hurdles and Processing Times: The application process can be lengthy and complex, involving multiple agencies (state HFA, tribal housing, lenders). Coordinating between these entities can lead to extended processing times, which can be frustrating and even jeopardize a home purchase in a competitive market.

- Coordination Challenges: When state programs attempt to work in conjunction with federal programs or tribal housing initiatives, coordination can be difficult. Different regulations, reporting requirements, and timelines can create friction and inefficiency, leading to a less streamlined experience for the homebuyer.

- Perpetuates a "Patchwork" Approach: While states have the flexibility to innovate, the fragmented nature of these programs means there’s no cohesive national strategy for addressing Native American housing needs. This "patchwork" approach can create inequities, where access to vital assistance depends entirely on the state an individual happens to reside in.

- Land Tenure Complexity (Still a Factor): While some state programs attempt to address trust land issues, the fundamental complexities of mortgaging homes on tribally owned trust land remain. State laws and regulations often don’t fully align with federal trust responsibilities, and securing conventional financing on trust land is inherently more challenging, limiting the applicability of some state-level assistance.

Recommendation for Engagement: Is This "Product" Worth It?

For eligible Native Americans seeking homeownership within their state, engaging with state-specific home loan assistance programs is overwhelmingly recommended, but with a critical caveat: thorough due diligence is paramount.

Who should consider this "product"?

- First-time Native American homebuyers: Especially those struggling with down payment and closing costs.

- Native Americans seeking to purchase or rehabilitate homes within their state: Particularly in areas where conventional financing is difficult or expensive.

- Individuals already pursuing federal programs (e.g., HUD Section 184): State assistance can often be layered on top to provide additional financial relief.

- Members of tribes with strong state-level partnerships: These often indicate more robust and accessible programs.

How to "purchase" or engage with this "product":

- Start with Your Tribe: Contact your tribal housing authority or tribal government. They are often the best first point of contact, as they may administer state funds directly or have strong partnerships with state agencies and lenders familiar with these programs. They can also provide culturally relevant guidance.

- Contact Your State Housing Finance Agency (HFA): Every state has an HFA (e.g., Housing Finance Agency). Their websites are excellent resources for discovering available programs, eligibility criteria, and lists of participating lenders.

- Seek Lenders Experienced with Native American Programs: Look for mortgage lenders who specifically advertise expertise in HUD Section 184 loans, VA NADL, and state-specific Native American housing programs. These lenders are more likely to understand the nuances and be able to help you navigate the process efficiently.

- Utilize Homebuyer Education: Even if not mandated, participating in homebuyer education workshops (often free or low-cost) can provide invaluable information about the homebuying process, financial management, and available assistance programs.

- Be Persistent and Patient: Given the potential for bureaucratic hurdles and funding limitations, a degree of persistence and patience is often required. Keep meticulous records of all communications and documents.

The "purchase" decision hinges on individual circumstances and the specific state in question. While the benefits of financial relief, tailored support, and increased access to homeownership are significant, potential users must be prepared for varying levels of availability, complex eligibility, and the need for proactive research.

Conclusion

State-specific Native American home loan assistance programs represent a crucial, albeit often fragmented, component of the housing ecosystem designed to empower Native American families to achieve homeownership. As a "product," it offers powerful features like down payment and closing cost assistance, tailored solutions, and the potential for significant wealth creation and community stability.

However, its "performance" is heavily influenced by factors such as state funding consistency, program awareness, and the inherent complexities of tribal land tenure. While not a perfect solution, and often a supplement rather than a primary loan, these state-level initiatives are indispensable tools for addressing historical inequities and fostering self-sufficiency within Native American communities.

Ultimately, for eligible individuals, these programs are a highly valuable resource that warrants thorough investigation and engagement. Their existence underscores a growing recognition of the unique housing challenges faced by Native Americans and the ongoing commitment, at various governmental levels, to building a more equitable and prosperous future. Continued advocacy for consistent funding, streamlined processes, and enhanced outreach will be vital to maximize the potential of this essential "product" for all who can benefit.